Bitcoin Just Dumped To $59K, is this a normal correction or the start of bigger crash

The cryptocurrency market witnessed a significant downturn on [DATE], with Bitcoin, the world's leading digital asset, plummeting to a three-month low of $59,000. This sharp drop has sent shockwaves through the crypto community, igniting a debate about whether this is a healthy correction or the harbinger of a more substantial crash.

The cryptocurrency market witnessed a significant downturn on [DATE], with Bitcoin, the world's leading digital asset, plummeting to a three-month low of $59,000. This sharp drop has sent shockwaves through the crypto community, igniting a debate about whether this is a healthy correction or the harbinger of a more substantial crash.

Corrections are a normal and expected part of any financial market, including cryptocurrencies. They represent periods where prices retrace after significant gains, allowing for a consolidation phase before potentially resuming their upward trajectory. These corrections help to eliminate excessive speculation and ensure long-term market stability.

Potential Causes of the Recent Bitcoin Dip

Several factors could be contributing to the recent Bitcoin price decline:

Profit-taking: After a stellar run that saw Bitcoin reach an all-time high of nearly $70,000 in November 2021, some investors might be cashing in on their profits, leading to a temporary sell-off.

Regulatory uncertainty: Regulatory scrutiny surrounding cryptocurrencies by various governments worldwide can create uncertainty in the market, prompting investors to adopt a wait-and-see approach.

Macroeconomic factors: Rising interest rates and potential inflation concerns can dampen investor sentiment towards riskier assets like Bitcoin.

Increased competition: The emergence of new cryptocurrencies and blockchain projects could be diverting some investment away from Bitcoin.

Is This the Start of a Bear Market?

While the recent price drop is undoubtedly concerning for some investors, it's crucial to maintain perspective. Here are some reasons why this might not be the start of a prolonged bear market:

Strong underlying fundamentals: Bitcoin's network fundamentals remain robust, with continued growth in hashrate (computing power dedicated to mining) and user adoption.

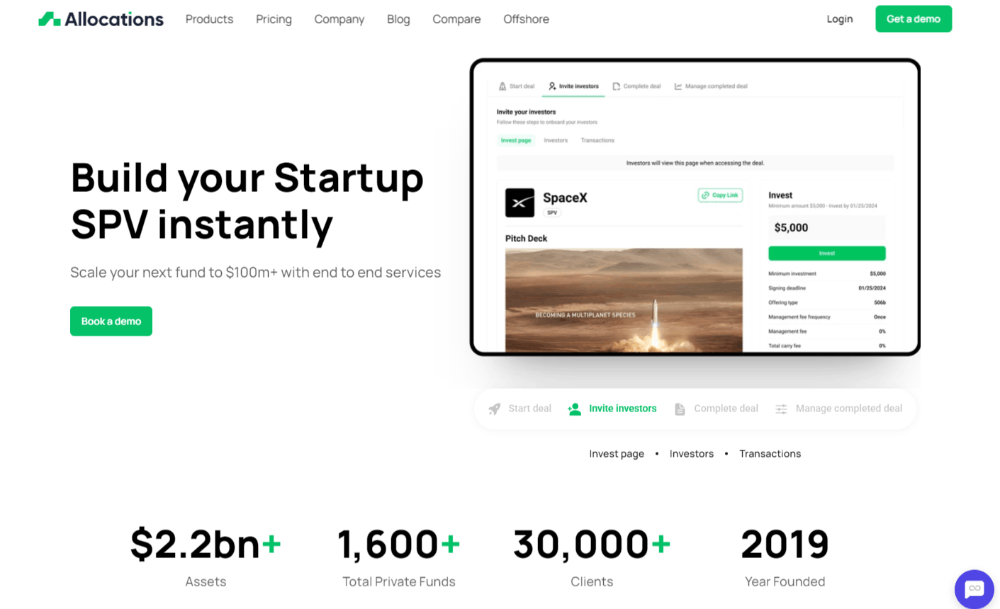

Institutional investment: The increasing involvement of institutional investors in the cryptocurrency space suggests a growing sense of legitimacy and long-term potential for Bitcoin.

Limited supply: With a capped supply of 21 million Bitcoins, scarcity remains a key driver of value.

What to Do During a Correction

Corrections can present an opportunity for long-term investors to accumulate Bitcoin at potentially lower prices. However, it's essential to approach such situations with caution and a well-defined investment strategy. Here are some tips for navigating a correction:

Stay informed: Keep yourself updated on relevant news and developments in the cryptocurrency space.

Do your own research (DYOR): Don't blindly follow investment advice. Understand the risks and potential rewards associated with Bitcoin before investing.

Invest what you can afford to lose: Cryptocurrencies are inherently volatile, so only invest what you're comfortable losing.

Focus on the long term: Don't get caught up in short-term price fluctuations. If you believe in Bitcoin's long-term potential, view corrections as buying opportunities.

Maintain a diversified portfolio: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to mitigate risk.

The Road Ahead for Bitcoin

The future trajectory of Bitcoin remains uncertain. The coming months will likely be crucial in determining whether this is a temporary correction or the beginning of a more prolonged decline. Here are some factors to keep an eye on:

Regulatory landscape: How governments approach cryptocurrency regulation will significantly impact market sentiment.

Institutional adoption: Continued involvement of institutional investors will be a positive sign for Bitcoin's long-term viability.

Macroeconomic environment: Global economic conditions, particularly interest rates and inflation, will influence investor risk appetite.

Technological advancements: Innovations in blockchain technology and the broader cryptocurrency ecosystem could unlock new use cases for Bitcoin.

Conclusion

The recent Bitcoin price dip serves as a reminder of the inherent volatility of the cryptocurrency market. While it's impossible to predict the future with certainty, understanding the potential causes of the correction and the underlying factors influencing Bitcoin's value can help investors make informed decisions. By staying informed, maintaining a long-term perspective, and managing risk effectively, investors can navigate both corrections and potential growth phases within the cryptocurrency market.

pen_spark

tuneshare

more_vert