Should I invest in new coins or old coins?

The crypto market has made surprising changes. In 2020, there were more than 8,100 coins on the market. The majority of these were short-lived, especially the memecoins. By 2023, nearly 23,000 coins will be developed, with market capitalization reaching more than 1.1 trillion USD, according to CoinMarketCap.

Too many coins on the market make investors confused in making investment decisions, especially new ones. One of the biggest questions often asked is whether to invest in:

· Old coin: Released a long time ago, there is little pressure to sell because most of the tokens have been unlocked, but the "story" is old, the product is not suitable for current market trends.

· New Coin: Newly released, providing products that the market is in demand, but also under high selling pressure.

To answer this question, let's consider with Coin98 Insights the opportunities and risks of these two asset types.

What are old coins and new coins?

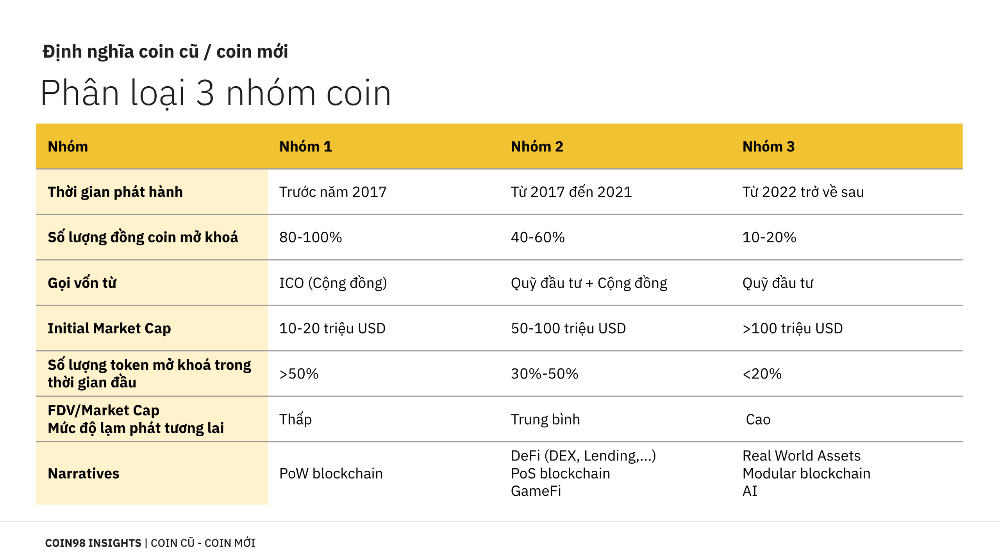

After the advent of blockchain and Bitcoin, many new coins have been developed. If we divide them by release time, we have the following groups:

Group 1:

Released before 2017.

Unlocked from 80-100%, low inflation rate and selling pressure.

Crowdfunding through ICO, less affected by investment funds (Venture Capital) or Market Maker.

Low initial market capitalization from $10 to $20 million. Currently, for projects that are still operating, their capitalization can reach billions of USD due to increased market capitalization.

Products tend to serve past market trends.

Group 2:

Issued from 2017 to 2021, this is the period when investment funds begin to participate.

Coins are unlocked from 40-60%.

The project calls for capital from two groups, including investment funds and the community.

Market capitalization increased to $50 million to $100 million. This is due to the surge in new money entering the market when Bitcoin peaked in 2017.

Group 3:

Released from 2022 onwards.

Unlocked from 10-20%, inflation rate and selling pressure are high in the later stages, low in the early stages.

Calling capital from investment funds for legal reasons and supply control. Subject to many impacts from investment funds and market makers.

The initial market capitalization is high, over 100 million USD, so it is difficult to increase prices as strongly as group 1. To bring profits to investment funds, the initial total supply needs to be low for easy control.

Products consistent with current market trends.

In the lower part of the article, the definition of old coin and new coin is described as follows:

· Old Coin: Tokens are almost unlocked, low inflation rate, low selling pressure.

· New coin: Tokens are unlocked rarely, have high inflation rate, and are subject to high selling pressure.

Old coin, low selling pressure, will price increase sharply?

Case study 1: Injective (INJ)

Injective (INJ) is Layer 1 on the Cosmos SDK, launched on Binance Launchpad in October 2020. In May 2021, INJ price increased from 1 USD to 24 USD. Project capitalization also increased from 10 million USD to 600 million USD, 60 times.

By the downtrend season of 2022, the project unlocked more tokens, the supply increased, the price of INJ decreased 20 times to only 1 USD in June 2022, a decrease of 3 times the capitalization of Injective. This scared most retail investors and sold INJ.

At this time, INJ's circulating supply on the market is 88%. In August 2022, Injective successfully called for capital from some of the market's leading venture capital funds Jump Crypto and BH Digital with an amount of 40 million USD.

This is a 34-fold growth in just less than 1 year. However, do old coins with low selling pressure have the same results?

Case study 2: Mithril (MITH), Augur (REP), Tellor (TRB)

Not every project has a large increase in unlocked tokens like Injective. It is not difficult to find some projects belonging to the old coin group. This group, after unlocking most of the tokens for the team, investors, and community, was unable to keep up with current trends and did not have enough potential to continue developing.

Therefore, many development teams have left the project and are sparsely active on social channels. Funds investing in these projects also sell tokens, recovering capital to find newer deals. This causes the project's coin price to tend to decrease. Some projects were even delisted on Binance.

Mithril (MITH) is a project with 100% unlocked supply, operating on sparse social channels, MITH's price tends to decrease continuously after launching in early 2018. By the end of 2022, MITH was delisting on Binance.

Augur (REP) is another 100% unlocked supply project, last active on its X in November 2021. From then until now, REP's price has continuously decreased and was finally delisted from Binance at the end of 2022.

Some similar projects, which have unlocked most of the supply, operate on sparse social channels, are delisted on famous platforms such as Bitcoin Standard Hashrate Token price (BTCST), Bitcoin Diamond (BCD) , Bitcoin Gold (BTG)...

Some investors see this as an opportunity to short these coins, but this is highly risky. Some coins can experience short-squeeze, or price manipulation, such as Tellor (TRB).

TRB is a nearly 100% unlocked coin. On December 31, 2023, TRB price increased sharply from 260 USD to over 500 USD in 1 day, before plummeting 80% in just a few hours, and falling 500% in the following 4 days. This caused nearly 74 million USD to be liquidated in the derivatives market.

Lookonchain has presented evidence that whale wallets holding large amounts of TRB have had notable activity during periods of high price fluctuations for TRB. In particular, a large amount of TRB was sent to the exchange after the price of TRB increased sharply above 500 USD.

New coin, high selling pressure but price will decrease?

Newly launched projects have high inflation and selling pressure because they haven't been unlocked much yet, and will low circulation supply cause prices to drop sharply?

Case Study 1: Solana (SOL)

Before January 11, 2021, Solana had a circulating supply of about 150 million SOL, a capitalization of 850 million USD and a 24-hour trading volume of 70 million USD.

After this date, Solana will be unlocked 320 million SOL, causing the circulating supply of SOL to increase to 470 million SOL, equivalent to an increase of 213%. The total unlocked SOL value is even many times higher than the current 24h trading volume.

If capitalization remains unchanged, increased circulating supply could cause SOL price to decrease from 3 USD previously to 1.8 USD (Capitalization 850 million USD/ supply 470 million SOL).

In fact, after being unlocked, the SOL price did not decrease but increased sharply to 240 USD in November 2021, a profit of about 80 times. This is considered one of the best profitable investments at the moment.

Case Study 2: Serum (SRM)

In September 2021, Serum's total circulating supply was only 1%, capitalization reached 1.2 billion USD and Serum's FDV reached 121 billion USD.

When the market entered the downtrend season, Serum's capitalization decreased 75 times from 1.2 billion USD to 16 million USD. The supply of Serum was unlocked, increasing from 1% to 2.6%, the price of Serum did not decrease 75 times as capitalization but decreased 200 times from 12 USD to 0.06 USD.

Thus, after the new coins were unlocked, Serum's price plummeted more than 200 times, not increasing 80 times like Solana.

What should we pay attention to when analyzing old coins and new coins?

There is no investment formula for new coins with high inflation and old coins with low inflation. Both types of assets have the same ability to grow or decrease in price. Instead, investors need to consider four important factors:

· Does the project still have momentum to develop?

· If coin prices increase, who benefits the most?

· Bitcoin price movement trend.

· Development motivation of the project

If the project has been launched for a long time but continuously has changes and product improvements in line with market trends, and even receives larger cash flow than competitors in the same industry, this group can be considered as "new" projects, e.g.:

Although BNB was launched in 2017, it is backed by Binance and still keeps up with market trends through Launchpool and Launchpad events.

The Chainlink project once dominated the crypto market with its Oracle segment in the 2020s, and now continues to make a splash with its CCIP segment.

Even though Ethereum was born in 2015, it still has the ability to create trends through Dencun, Layer 2, Liquid Staking...

For newly launched projects, it is necessary to see whether their products are suitable for market tastes at that time, whether the project team is good, whether there is a long-term development plan... In addition, it is necessary to Compared with other projects in the industry, which project is receiving the most attention from the community?

Circulating supply of coins

Investors also need to research factors such as circulating supply, inflation rate, and wallet addresses with large holdings to know if coin prices increase sharply and who will benefit the most.

For projects with low real circulating supply (not nominal circulating supply - tokenomics) outside the market, most are in the hands of some entity such as market maker, development team, exchange, price. Coins can increase unusually strongly to serve a number of needs such as:

Increase sharply to attract attention from the community

Increase strongly before major coin unlocks to keep the support price range from being breached.

Strong increase in advance of activities that require the use of that coin to participate.

This could happen with projects like Celestia (TIA) or Injective (INJ).

In the beginning, Celestia only unlocked 15% of the total supply, although the nominal capitalization was high, but the real capitalization was low. This facilitates MM activities.

For Injective, although it has been around for a long time and has unlocked 88% of the total supply, most investors are discouraged and cut losses. After this period, the project raised capital from Jump Capital. This can be considered the first step for future activities related to Market Maker of the two parties.

In addition, another important factor to consider when choosing the time to invest (both for new or old coins) is the trend of Bitcoin and the crypto market. In particular, you should avoid buying when the market is too hot because if Bitcoin increases sharply, the price of altcoins usually only goes sideways. Altcoin prices only increase when Bitcoin goes sideways and will plummet 15% to 20% if Bitcoin collapses just 5%.

Combining technical analysis and on-chain data when investing is also necessary to find good price zones and reduce risks. If you buy when the market increases sharply and then decreases, it will take a long time for investors to return to the breakeven mark.

summary

Choosing newly launched projects with low supply and products suitable for the market will be somewhat less risky. This is similar to project groups that have been released for a long time but have new products that catch up with the trend.

Both old and new projects have the same ability to grow and decline. Investors need to consider many other factors instead of just paying attention to their launch time.