DEFI and the World Bank: Struggles and Future Collaborations

Decentralized Finance (DeFi) and the World Bank, two seemingly contrasting entities, find themselves unexpectedly intertwined in the tapestry of financial evolution. DeFi, with its blockchain-powered, peer-to-peer financial services, disrupts traditional institutions like the World Bank, known for centralized, traditional finance in developing economies.

Struggles: Where DeFi and the World Bank Clash

- Regulatory uncertainty: DeFi operates in a grey area, lacking clear regulations. This raises concerns for the World Bank, focused on stability and risk mitigation.

- Financial inclusion: While DeFi aims for inclusivity, its technical complexity creates barriers for the underbanked populations the World Bank serves.

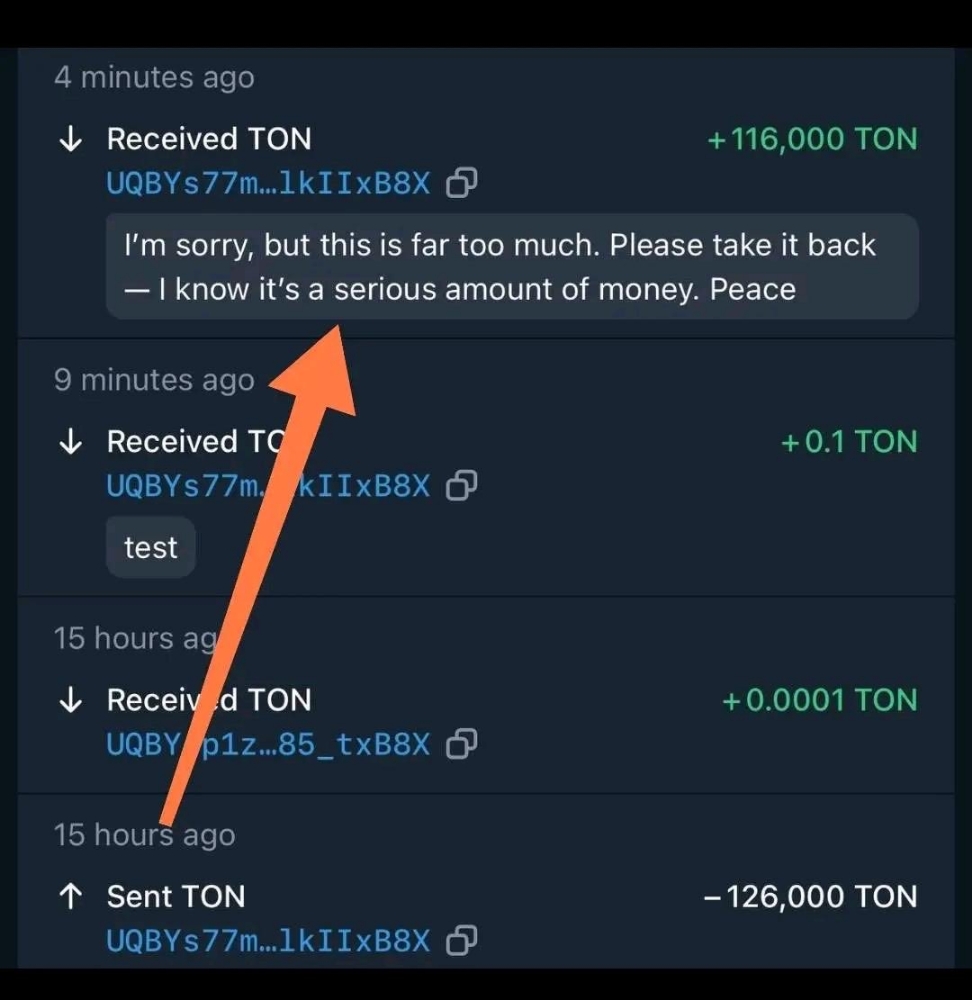

- Security and scams: DeFi's open nature exposes users to scams and hacks, contradicting the World Bank's emphasis on secure financial systems.

- Scalability and infrastructure: DeFi currently faces scalability issues, unable to handle large transaction volumes, potentially hindering its wider adoption.

Potential Collaborations: Finding Common Ground

Despite the struggles, opportunities for collaboration exist:

- Financial literacy and education: The World Bank's expertise in financial education can empower users to navigate DeFi platforms safely and responsibly.

- Identity and KYC solutions: Collaborations can develop blockchain-based identity solutions for secure and inclusive access to DeFi services.

- Cross-border payments: Exploring DeFi's potential for faster, cheaper cross-border payments could benefit developing economies.

- Microfinance and SME lending: DeFi protocols can offer alternative lending options for microfinance and small businesses, reaching the underserved.

The Future: Navigating the Uncertain Path

The future of DeFi and the World Bank's relationship remains uncertain. Regulatory clarity, improved infrastructure, and user education are crucial for DeFi's wider adoption. The World Bank, with its experience and resources, can play a vital role in facilitating this evolution.

Here are some key points to consider for a very good writeup:

- Balance both perspectives: Give equal weight to the challenges and opportunities for collaboration.

- Provide specific examples: Showcase concrete initiatives or pilot projects where DeFi and the World Bank are already collaborating.

- Consider the ethical implications: Discuss the potential impact of DeFi on financial stability, data privacy, and social equity.

- Offer a nuanced conclusion: Avoid overly optimistic or pessimistic predictions, acknowledging the uncertainties and complexities involved.

- Maintain a clear and concise style: Aim for a reader-friendly tone, explaining technical concepts in easy-to-understand language.

By addressing these points, you can create a well-rounded and insightful analysis of the potential collaboration between DeFi and the World Bank, shaping the future of finance for developing economies.

THANKS FOR READING....