Arbitrage: How Arbitraging Works in Investing, With Examples

:max_bytes(150000):strip_icc():format(webp)/arbitrage-4201467-1-705aa79c9d6f4128b8eb7b9588403849.jpg)

What Is Arbitrage?

Arbitrage is the simultaneous purchase and sale of the same or similar asset in different markets in order to profit from tiny differences in the asset’s listed price. It exploits short-lived variations in the price of identical or similar financial instruments in different markets or in different forms.

Arbitrage exists as a result of market inefficiencies, and it both exploits those inefficiencies and resolves them.

KEY TAKEAWAYS

- Arbitrage is the simultaneous purchase and sale of an asset in different markets to exploit tiny differences in their prices.

- Arbitrage trades are made in stocks, commodities, and currencies.

- Arbitrage takes advantage of the inevitable inefficiencies in markets.

- By exploiting market inefficiencies, however, the act of arbitraging brings markets closer to efficiency.

Understanding Arbitrage

Arbitrage can be used whenever any stock, commodity, or currency may be purchased in one market at a given price and simultaneously sold in another market at a higher price. The situation creates an opportunity for a risk-free profit for the trader.

Arbitrage provides a mechanism to ensure that prices do not deviate substantially from fair value for long periods of time. With advancements in technology, it has become extremely difficult to profit from pricing errors in the market. Many traders have computerized trading systems set to monitor fluctuations in similar financial instruments. Any inefficient pricing setups are usually acted upon quickly, and the opportunity is eliminated, often in a matter of seconds.

Examples of Arbitrage

As a straightforward example of arbitrage, consider the following: The stock of Company X is trading at $20 on the New York Stock Exchange (NYSE), while, at the same moment, it is trading for $20.05 on the London Stock Exchange (LSE).

A trader can buy the stock on the NYSE and immediately sell the same shares on the LSE, earning a profit of 5 cents per share.

The trader can continue to exploit this arbitrage until the specialists on the NYSE run out of inventory of Company X’s stock, or until the specialists on the NYSE or the LSE adjust their prices to wipe out the opportunity.

Types of arbitrage include risk, retail, convertible, negative, statistical, and triangular, among others.

A More Complicated Arbitrage Example

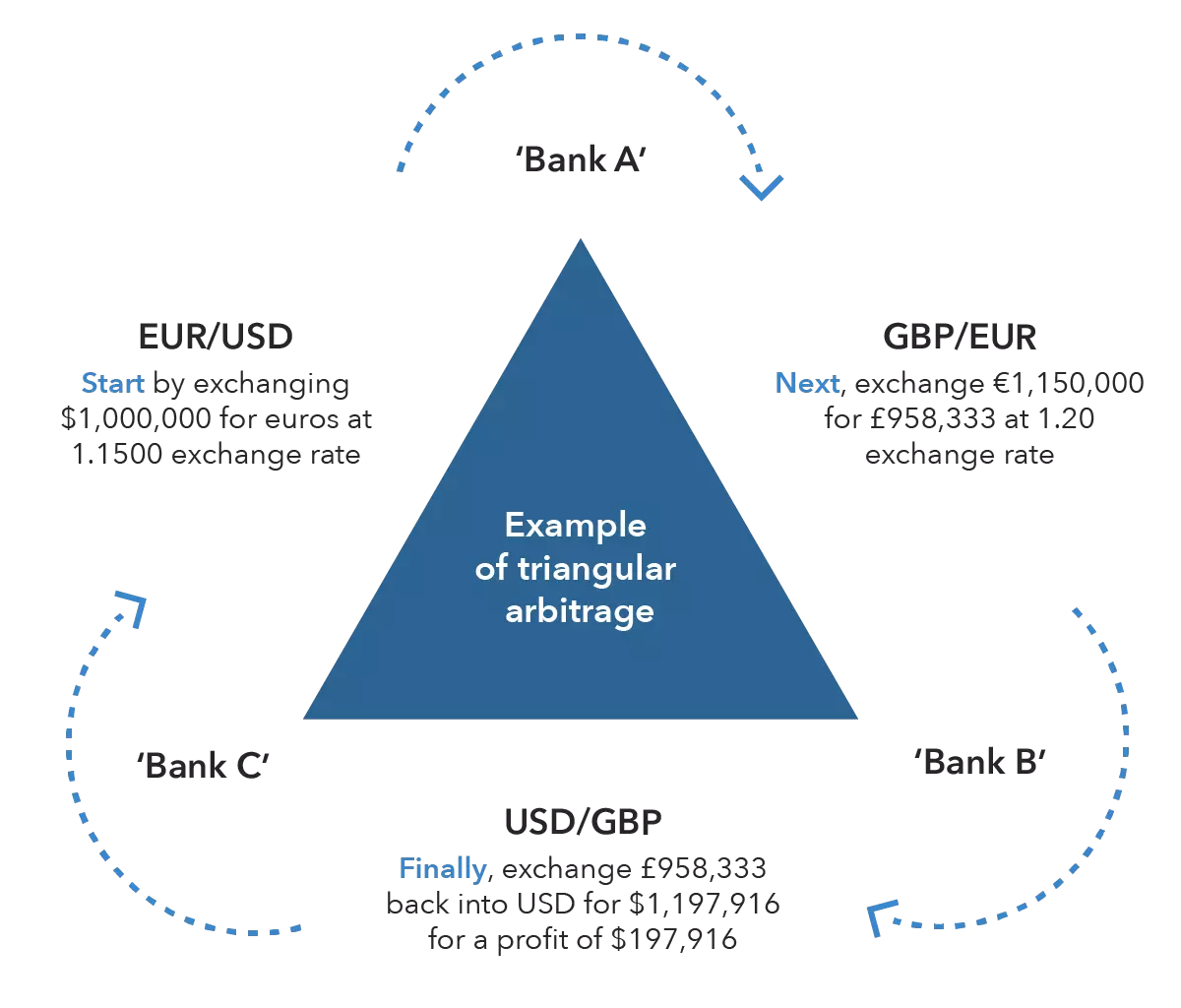

A trickier example can be found in Forex or currency markets using triangular arbitrage. In this case, the trader converts one currency to another, converts that second currency to a third bank, and finally converts the third currency back to the original currency.

Suppose you have $1 million and you are provided with the following exchange rates: USD/EUR = 1.1586, EUR/GBP = 1.4600, and USD/GBP = 1.6939.

With these exchange rates, there is an arbitrage opportunity:

- Sell dollars to buy euros: $1 million ÷ 1.1586 = €863,110

- Sell euros for pounds: €863,100 ÷ 1.4600 = £591,171

- Sell pounds for dollars: £591,171 × 1.6939 = $1,001,384

- Subtract the initial investment from the final amount: $1,001,384 – $1,000,000 = $1,384

From these transactions, you would receive an arbitrage profit of $1,384 (assuming no transaction costs or taxes).

How Does Arbitrage Work?

Arbitrage is trading that exploits the tiny differences in price between identical or similar assets in two or more markets. The arbitrage trader buys the asset in one market and sells it in the other market at the same time to pocket the difference between the two prices. There are more complicated variations in this scenario, but all depend on identifying market “inefficiencies.”

Arbitrageurs, as arbitrage traders are called, usually work on behalf of large financial institutions. It usually involves trading a substantial amount of money, and the split-second opportunities it offers can be identified and acted upon only with highly sophisticated software.

What Are Some Examples of Arbitrage?

The standard definition of arbitrage involves buying and selling shares of stock, commodities, or currencies on multiple markets to profit from inevitable differences in their prices from minute to minute.

However, the term “arbitrage” is also sometimes used to describe other trading activities. Merger arbitrage, which involves buying shares in companies prior to an announced or expected merger, is one strategy that is popular among hedge fund investors.

Why Is Arbitrage Important?

In the course of making a profit, arbitrage traders enhance the efficiency of the financial markets. As they buy and sell, the price differences between identical or similar assets narrow. The lower-priced assets are bid up, while the higher-priced assets are sold off. In this manner, arbitrage resolves inefficiencies in the market’s pricing and adds liquidity to the market.

In the course of making a profit, arbitrage traders enhance the efficiency of the financial markets. As they buy and sell, the price differences between identical or similar assets narrow. The lower-priced assets are bid up, while the higher-priced assets are sold off. In this manner, arbitrage resolves inefficiencies in the market’s pricing and adds liquidity to the market.