Bitcoin soars above $66k, poised for historic ATH before halving

Bitcoin (BTC) continues to forge a new path in the lead-up to its April halving as the top crypto climbed above $66,000 in early trading on Monday and is now less than 4% from its all-time high of $69,000.

The real story is the fact that King Crypto has never hit a new ATH prior to its quadrennial halving, but stands poised to do so currently as the halving is still roughly 48 days away while BTC has put on weekly gains of 8%, 14%, and 22% over the past month.

Data provided by TradingView shows that Bitcoin bulls started to push the price action in the early hours of Sunday, methodically stair-stepping its price higher and leaving bears with little defense as relentless demand from spot BTC ETFs has diminished the available supply on cryptocurrency exchanges.

At the time of writing, BTC trades at $66,490, an increase of 6.8% on the 24-hour chart.

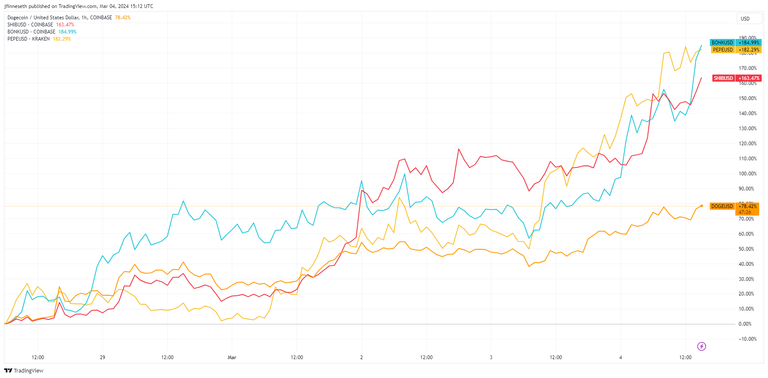

And it’s not just Bitcoin that is exciting traders to start the week as the broader altcoin market is also rallying, led by meme coins including Dogecoin (DOGE), Shiba Inu (SHIB), Bonk (BONK), and Pepe (PEPE), which have thus far seen their prices increase 19.8%, 27.1%, 58%, and 46.4%, respectively.  DOGE vs. SHIB vs BONK vs PEPE 1-hour chart. Source: TradingView

DOGE vs. SHIB vs BONK vs PEPE 1-hour chart. Source: TradingView

Meme tokens continue to enjoy a growing level of popularity among the crypto crowd and have thus far been one of the top-performing sectors of the market. Even presidential candidates have grown to appreciate the fun-loving sector, with Robert Kennedy Jr. recently endorsing Shiba Inu’s slogan, “It’s Not A Meme, It’s A Movement,” while speaking at an event at ETHDenver 2024.

BTC ETF demand accelerates

“The BTC Spot ETFs continue to exhibit strong momentum, with a cumulative net inflow of approximately $1.7 billion recorded last week, bringing the total net inflow since inception to about $7.4 billion,” said Matteo Greco, Research Analyst Fineqia International. “Leading the race is the Blackrock Bitcoin ETF (IBIT), which surpassed $10 billion in assets under management (AUM) last week, setting a record as the fastest ETF in history to achieve this AUM milestone.”

He noted that the trading volumes for the BTC Spot ETFs “saw a significant surge during the week, totaling $22.3 billion, with an average daily trading volume of almost $4.5 billion. This marked a remarkable 265% increase from the average daily trading volume of $1.7 billion recorded since inception. The cumulative trading volume now exceeds $73.9 billion, with the daily average volume surpassing $2 billion, currently standing at $2.1 billion.”

Trading volumes on centralized cryptocurrency exchanges have also increased, he said, “reaching a cumulative trading volume of $73.4 billion for the week. This represents an 80% increase from the previous week's volume of $40.7 billion and marks the highest weekly trading volume recorded since May 2022. The data underscores the recent price appreciation accompanied by robust trading activity.”

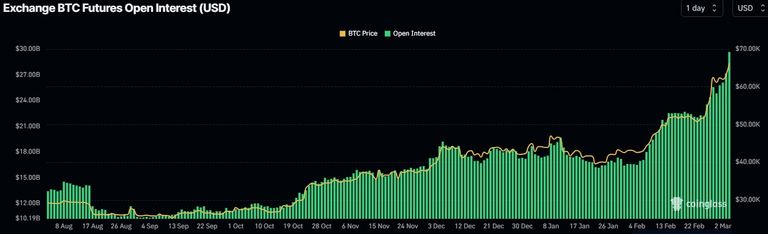

“The rise in open interest, which represents the total number of outstanding derivative contracts for an asset that have not been settled, is observed both for BTC and the digital assets market in general, across both centralized digital assets exchanges (e.g., Binance, Coinbase, ByBit, etc.) and traditional finance investors’ platforms (e.g., CME),” Greco said. “This indicates heightened activity from both digital assets native and traditional finance investors. BTC futures open interest. Source: CoinGlass

BTC futures open interest. Source: CoinGlass

He said the momentum shown by Bitcoin has extended to the broader market and helped push the total cryptocurrency market cap above $2.5 trillion, and the metric is now approaching its all-time high of $3 trillion.

“Notably, the Total3 metric, which excludes Bitcoin and Ethereum (ETH) and represents the market cap of the top 125 capitalized digital assets, has surged to $660 billion, reflecting a 19.3% growth week-on-week and a 31.5% year-to-date increase,” he said. “This underscores the broad impact of BTC Spot ETFs on market momentum beyond BTC's price action.” Total3 4-hour chart. Source: TradingView

Total3 4-hour chart. Source: TradingView

“Examining the total stablecoin supply also provides insights into heightened demand,” he said. “During periods of low demand, the supply of stablecoins typically decreases as investors exchange them for fiat currencies like USD, GBP, or EUR, thereby reducing the overall circulating supply.”

“Conversely, during phases of increased liquidity injection into the market, the supply of stablecoins tends to expand,” he added. “Presently, the total stablecoin supply stands at approximately $145 billion, reflecting a continuous uptrend from around $129 billion noted at the end of September 2023. This confirms sustained strong investor demand observed throughout Q4 2023 and into Q1 2024.”

Information

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)