FIVE STEPS TO CRYPTOCURRENCY TRADING

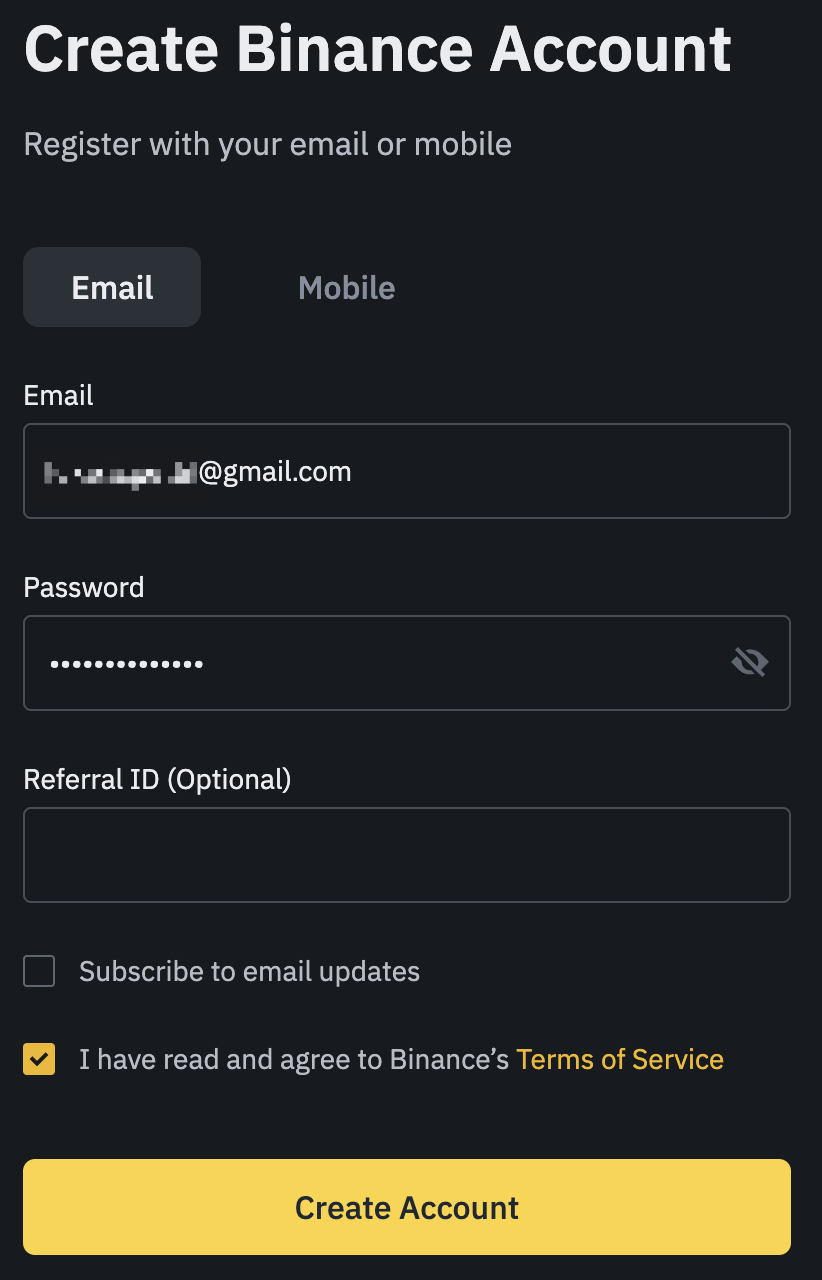

1. Create an Account on a Crypto Exchange:

To begin trading cryptocurrencies, you cannot just purchase them with money from your bank account. Opening a crypto exchange account is the first step in trading cryptocurrency.

A cryptocurrency exchange is a website where users may purchase and trade cryptocurrency. Binance and Coinbase are two of the top cryptocurrency brokerages available. You will need to provide certain personal details, like your email address, date of birth, personal address, and Social Security number (if you live in the US), in order to register a crypto exchange account.

2. Fund Your Account :

You will need to fund your cryptocurrency exchange account after it has been activated. Linking your bank account and trading account is the simplest method to accomplish this. Then, you have three options for transferring fiat money: wire transfers, debit cards, and bank deposits. Since wire transfers have minimal to no fees, they are usually the least expensive alternative for funding your account. You may check both Coinbase and Binance's transaction fees on their respective fee pages. Trading fees may differ.

3. Selecting a Cryptocurrency for Trading:

The two powerful coins that are readily available on the cryptocurrency market, Ethereum and Bitcoin, are the most well-liked among traders. However, there are thousands of additional cryptocurrencies that are expanding quickly. Numerous aspects, including market and technical analysis, market capitalization, and risk management, will play a role in selecting the best cryptocurrency for you.

The two powerful coins that are readily available on the cryptocurrency market, Ethereum and Bitcoin, are the most well-liked among traders. However, there are thousands of additional cryptocurrencies that are expanding quickly. Numerous aspects, including market and technical analysis, market capitalization, and risk management, will play a role in selecting the best cryptocurrency for you.

Due to their larger trading volume compared to lesser cryptocurrencies, the majority of traders favor trading Bitcoin and Ethereum. However, a lot of cryptocurrency traders invest some of their money in smaller cryptocurrencies. In this situation, you should make an independent decision about whether to stick with lesser altcoins or choose larger, more reliable cryptocurrencies.

4. Select a Plan:

Experienced traders understand the need for a strategy since, like stock trading, trading has risk and potential dangers. In this context, strategy refers to the plan or road map you will create to direct and reduce financial risk in all of your trading activities.

There are many different tactics available, and selecting the best one will rely on a number of aspects such as knowledge, experience, analytical abilities, patience, and discipline. There are two types of strategies: aggressive and passive.

Day trading, swing trading, trend trading, and scalping are examples of active trading strategies; these tactics call for extra care and ongoing supervision. However, passive investment strategies allow for a more hands-off approach and don't require much attention. HODL and index investing are two instances.

5.Start Trading:

It's time to get your hands dirty now that you have decided which cryptocurrency to trade and have created the best strategy based on your knowledge, abilities, and risk tolerance. Cryptocurrency trading is done in two ways: automatically and actively. Using trading bots to automate this procedure is the most efficient and straightforward method.

It's time to get your hands dirty now that you have decided which cryptocurrency to trade and have created the best strategy based on your knowledge, abilities, and risk tolerance. Cryptocurrency trading is done in two ways: automatically and actively. Using trading bots to automate this procedure is the most efficient and straightforward method.

In order to increase trading earnings, lower risks, diversify your portfolio, and provide you leverage over manual traders, these bots will automatically execute orders depending on your plan