Why Do Funding Fees Matter in Crypto?

Cryptocurrency markets have revolutionized the financial landscape, offering innovative trading instruments that challenge traditional paradigms. Among these, perpetual futures contracts have emerged as a popular choice for traders seeking leveraged exposure to digital assets. At the heart of these contracts lies a crucial mechanism known as funding fees, a concept that plays a pivotal role in maintaining market equilibrium and influencing trading strategies.

Funding fees, often overlooked by novice traders, are a sophisticated balancing act that keeps the price of perpetual futures tethered to their underlying spot markets. This article delves into the intricacies of funding fees, exploring their significance, mechanics, and far-reaching implications for traders navigating the volatile waters of cryptocurrency markets.

As we unravel the complexities of funding fees, we'll discover how this seemingly technical aspect of crypto trading can significantly impact profitability, risk management, and overall market dynamics.

Whether you're a seasoned trader or a curious observer, understanding funding fees is essential for anyone looking to grasp the full picture of cryptocurrency trading in the modern era.

The Mechanics of Funding Fees

At its core, the concept of funding fees is elegantly simple, yet its implementation and effects are profoundly complex. To truly appreciate the role of funding fees in the crypto ecosystem, we must first understand their fundamental mechanics.

Perpetual Futures: A Balancing Act

Perpetual futures contracts, unlike their traditional counterparts, have no expiration date. This unique characteristic necessitates a mechanism to keep their prices aligned with the spot market. Enter funding fees:

• Periodic payments exchanged between long and short position holders

• Determined by the difference between perpetual and spot prices

• Aims to incentivize market participants to converge prices

The Formula Behind the Fees

The calculation of funding fees involves a delicate interplay of market forces:

Funding Rate = Premium Index + Interest Rate

Where:

- Premium Index reflects the deviation of the perpetual contract from the spot price

- Interest Rate is typically set close to the risk-free rate in traditional finance

This formula ensures that when perpetual prices deviate significantly from spot prices, traders are incentivized to bring them back in line through arbitrage opportunities.

Impact on Trading Strategies

Understanding funding fees is not merely an academic exercise; it has tangible implications for trading strategies across the spectrum of market participants.

The Long and Short of It

Funding fees directly affect the profitability of positions:

• Long positions pay funding fees when rates are positive

• Short positions pay when rates are negative

• The magnitude of fees can significantly impact returns, especially for leveraged positions

Savvy traders incorporate funding fee projections into their decision-making process, sometimes entering or exiting positions based on anticipated fee directions.

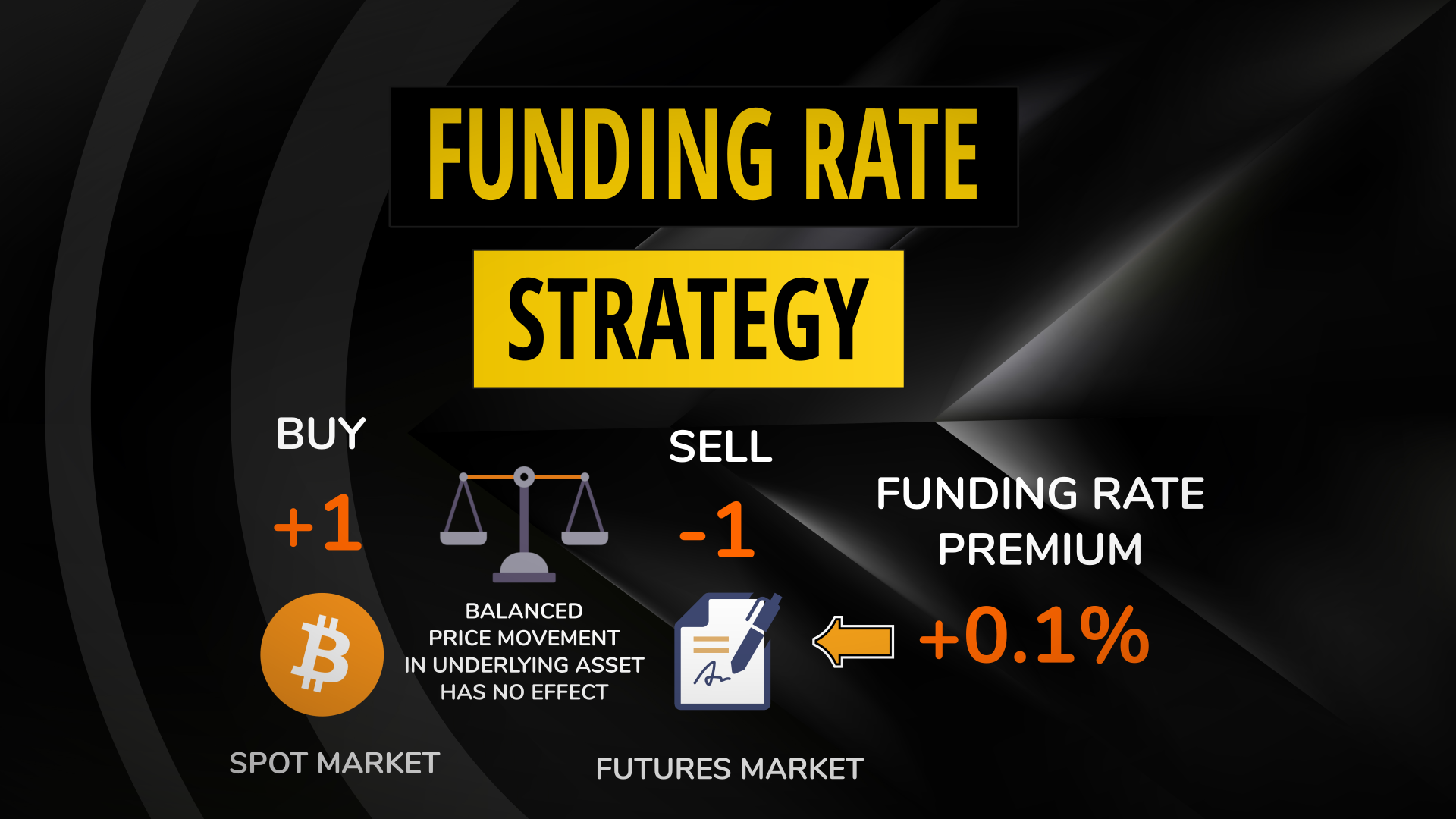

Arbitrage Opportunities

The funding fee mechanism creates unique arbitrage opportunities:

• Traders can profit from price discrepancies between perpetual and spot markets

• Strategies may involve simultaneously holding spot and futures positions

• These activities contribute to overall market efficiency and liquidity

However, executing these strategies requires a deep understanding of market dynamics and careful risk management.

Market Dynamics and Sentiment Indicators

Beyond their direct impact on individual traders, funding fees serve as a window into broader market dynamics and sentiment.

Gauging Market Sentiment

Funding rates can be a powerful indicator of market sentiment:

• Consistently positive rates suggest bullish sentiment

• Negative rates often indicate bearish outlook

• Extreme rates in either direction may signal potential market reversals

Traders and analysts closely monitor funding rate trends to gain insights into market psychology and potential future price movements.

Volatility and Liquidity Effects

Funding fees play a role in market volatility and liquidity:

• High absolute funding rates can lead to increased volatility as traders adjust positions

• The mechanism encourages liquidity provision by incentivizing arbitrage

• During extreme market conditions, funding rates can exacerbate price movements

Understanding these effects is crucial for risk management and market analysis.

Navigating the Funding Fee Landscape

As with any sophisticated trading concept, mastering the nuances of funding fees requires both theoretical knowledge and practical experience.

Strategies for Mitigating Funding Fee Impact

Traders can employ various strategies to manage funding fee exposure:

• Timing entries and exits around funding fee periods

• Utilizing delta-neutral strategies to balance exposure

• Considering funding fees in overall position sizing and risk calculations

Advanced traders may even develop strategies that specifically capitalize on funding fee dynamics.

Tools and Resources

Several tools and platforms provide valuable insights into funding fees:

• Exchange-provided funding rate calculators

• Third-party analytics platforms offering historical and real-time data

• Community-driven resources for strategy discussion and analysis

Leveraging these resources can significantly enhance a trader's ability to navigate the complex world of crypto derivatives.

Conclusion

Funding fees, while often overlooked, are a critical component of the cryptocurrency trading ecosystem. They serve as a linchpin in the delicate balance between perpetual futures and spot markets, influencing everything from individual trade profitability to broader market dynamics.

As the cryptocurrency market continues to mature, understanding concepts like funding fees becomes increasingly important for traders, investors, and market observers alike. These mechanisms not only shape the strategies of individual market participants but also contribute to the overall efficiency and stability of crypto markets.

In navigating the complex landscape of cryptocurrency trading, knowledge of funding fees serves as a powerful tool. It allows traders to make more informed decisions, manage risks more effectively, and potentially uncover profitable opportunities that others might miss. As we look to the future of digital asset trading, it's clear that a deep understanding of these foundational concepts will be essential for success in this dynamic and evolving market.

References

- Understanding Cryptocurrency Perpetual Futures

- The Role of Funding Rates in Crypto Derivatives

- Crypto Derivatives: A Comprehensive Guide

- Funding Rate Arbitrage in Cryptocurrency Markets

- The Impact of Funding Rates on Crypto Market Volatility

- Perpetual Swap Funding Rate Explained

- Crypto Derivatives Trading: Advanced Strategies and Techniques

- The Future of Crypto Derivatives Markets

- Funding Rate Dynamics in Cryptocurrency Perpetual Futures

- Risk Management in Crypto Trading: Best Practices