Understanding Cryptocurrencies: A Brief OverviewIntroduction

Cryptocurrencies have become a prominent topic in the financial world, revolutionizing traditional concepts of currency and finance. Born out of the desire for decentralized and secure transactions, cryptocurrencies leverage blockchain technology to redefine the way we think about money. In this article, we will explore the fundamentals of cryptocurrencies, their underlying technology, and their impact on the global economy.

What are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on a decentralized network of computers. Unlike traditional currencies issued by governments and central banks, cryptocurrencies rely on blockchain technology to ensure transparency, security, and immutability of transactions. Bitcoin, created in 2009, was the first and remains the most well-known cryptocurrency, but thousands of others, commonly referred to as altcoins, have since emerged.

Blockchain Technology:

At the heart of cryptocurrencies lies blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers. Each transaction, or block, is linked to the previous one through a cryptographic hash, creating a chain of blocks. This decentralized and tamper-resistant structure ensures that once a block is added to the chain, it cannot be altered retroactively. This feature provides transparency and security, making blockchain a groundbreaking innovation with applications beyond finance.

Key Cryptocurrencies:

While Bitcoin remains the flagship cryptocurrency, numerous others have gained prominence. Ethereum, for example, introduced smart contracts, self-executing contracts with the terms of the agreement directly written into code. Ripple focuses on facilitating fast and low-cost international money transfers, while Litecoin and Bitcoin Cash aim to improve upon Bitcoin's limitations, such as transaction speed and scalability.

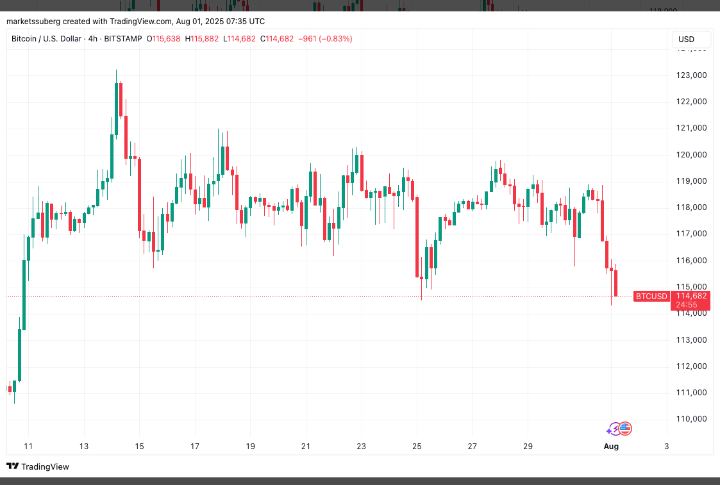

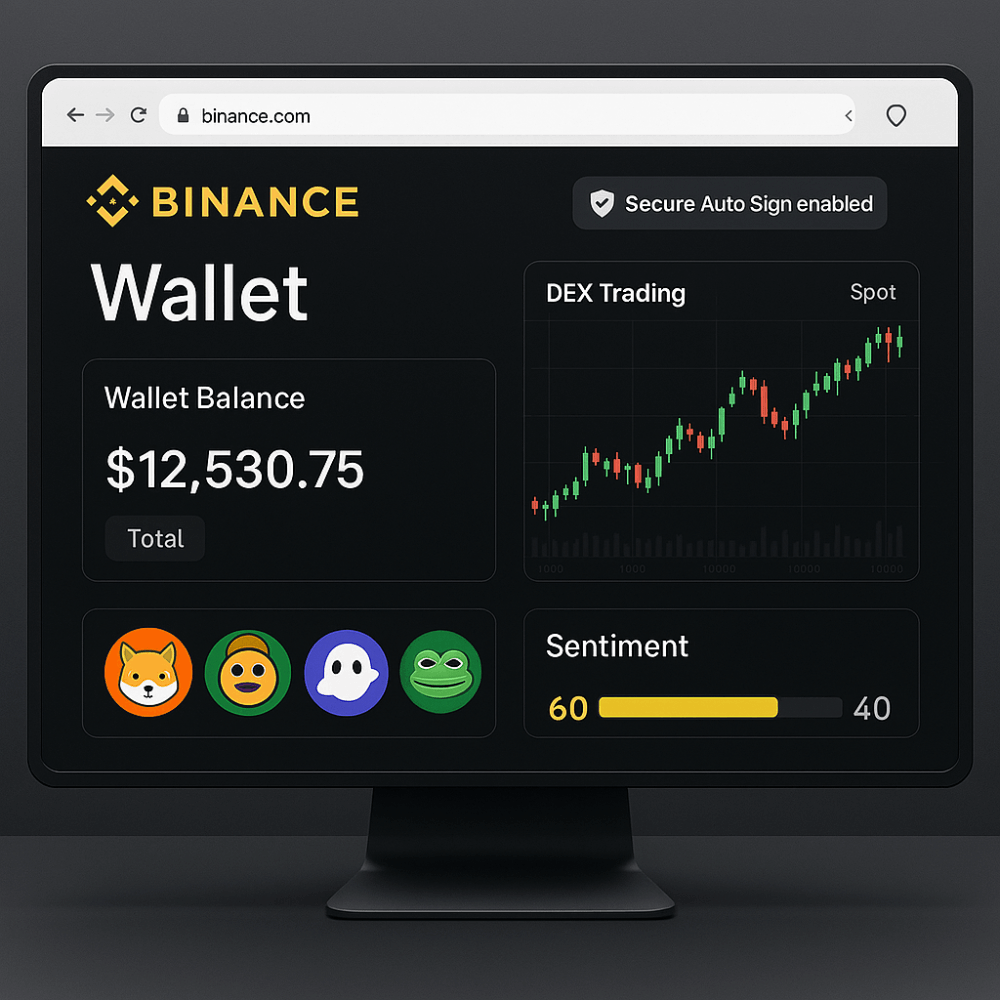

Investing and Risks:

Cryptocurrencies have attracted significant attention as investment assets. The volatile nature of their value, however, poses risks for investors. Prices can experience rapid fluctuations, influenced by factors such as market sentiment, regulatory developments, and technological advancements. It is crucial for investors to conduct thorough research and exercise caution when navigating the cryptocurrency market.

Regulatory Landscape:

Governments and regulatory bodies worldwide are grappling with the challenge of adapting existing frameworks to accommodate cryptocurrencies. Some countries embrace them as legitimate forms of currency, while others impose restrictions or outright bans. The evolving regulatory landscape adds an additional layer of complexity to the cryptocurrency ecosystem.

Conclusion:

Cryptocurrencies represent a transformative force in the financial world, challenging traditional notions of currency and finance. While the technology holds great promise, it also presents unique challenges and uncertainties. As the cryptocurrency landscape continues to evolve, staying informed and exercising caution are essential for anyone considering involvement in this dynamic and rapidly changing market.