Top 10 Bitcoin Holders: Who Owns the Most BTC? (2024

Even if you are unfamiliar with the extensive world of cryptocurrencies, chances are you are familiar with Bitcoin (BTC), the original cryptocurrency and the largest by market capitalization.

While it is known for its decentralization, there are still some giant whales out there — individuals or organizations who own a significant amount in the vast sea of cryptocurrency.

So, who are the biggest BTC owners and why should we care about them? This article delves into who the key players are, highlighting institutional investors, celebrities, and even countries adopting the token as a legal tender.

Key Takeaways

- As Bitcoin finds its largest market cap yet — making 2024 another winning year for BTC — we look at the top 10 holders as of March 2024.

- The top Bitcoin holder is still believed to be Satoshi Nakamoto, the anonymous creator of Bitcoin, who reportedly holds around 1.1 million BTC across many wallets.

- Despite this large holding, the top 10 holders collectively only possess about 5.5% of the total Bitcoin supply.

- Major exchanges like Binance and Bitfinex also hold significant amounts of Bitcoin, with wallet addresses associated with these exchanges appearing in the top 10 list. These addresses hold billions of dollars’ worth of BTC.

- Celebrity Bitcoin holders include Brian Armstrong, CEO of Coinbase, Michael Saylor, CEO of MicroStrategy, Tech billionaire Tim Draper, and the Winklevoss Twins.

FAQs

Table of Contents

Who Are Bitcoin Whales?

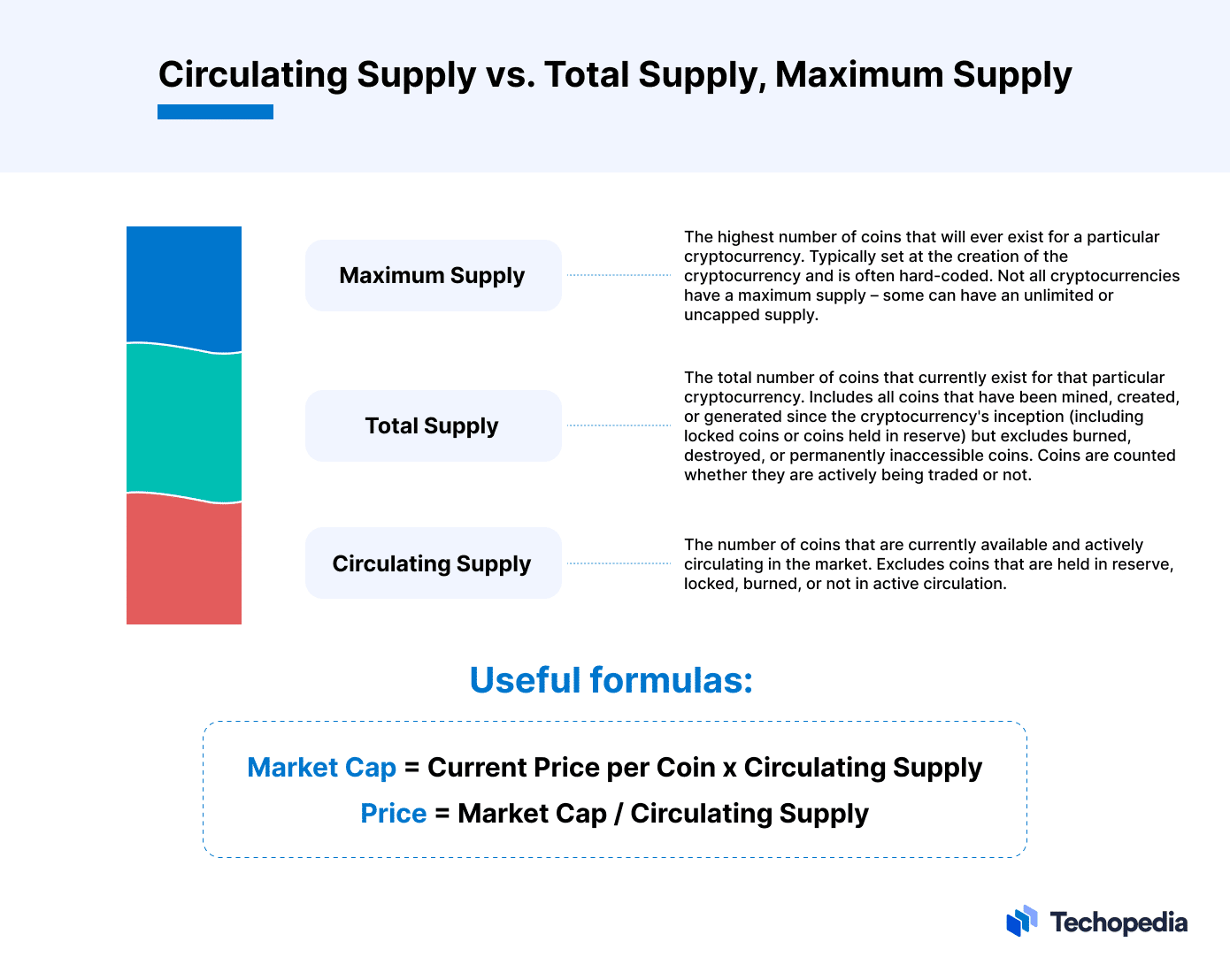

The total supply of BTC in circulation is limited (a circulating supply of around ~19.5m and a max supply of 21m BTC), which is why many investors are curious to know who owns large amounts. Crypto whales are individuals or organizations that own the most amount of a particular cryptocurrency. Their importance in crypto markets is crucial since they can highly influence the prices of certain cryptocurrencies.

Crypto whales are individuals or organizations that own the most amount of a particular cryptocurrency. Their importance in crypto markets is crucial since they can highly influence the prices of certain cryptocurrencies.

Amer Vohora, the CEO of SwissFortress, told Techopedia: “The common perception in crypto is that it is essential to track whales, those that own large amounts of coins, because, from their trades, we can infer price trends.”

Advertisements

“With the low volume compared to more traditional financial markets, inferring what “whales” would do is a way to second guess the direction of the market.

The non-private nature of traditional wallets, with their receiving public addresses, has essentially allowed this to prevail in the market.”

In addition, whales are also vital for BTC’s liquidity, which denotes the ease with which one can buy or sell Bitcoin without causing significant price fluctuations.

Top BTC holders deepen the market by placing substantial buy and sell orders, providing more trading options, and reducing price volatility. Nikita Buzov, the CEO and Founder of Solace, added:

“Understanding the flow of liquidity and its positioning allows one to gauge the sentiment, predict price moves, and know of any major liquidations ahead of time.”

Who Owns the Most BTC?

So, who are the top holders of BTC? According to the Bitcoin research and analysis firm River Intelligence, Satoshi Nakamoto, the anonymous creator behind Bitcoin, is listed as the top BTC holder as of 2024. The company notes that Satoshi Nakamoto holds about 1.1m BTC tokens in about 22,000 different addresses.

In a refreshing change from many alts, CoinCarp says the top 10 holders only hold 5.5% of the BTC supply.

Meanwhile, BitInfoCharts, a website tracking Bitcoin billionaire and millionaire wallets, found that most of the top 10 wallet addresses are linked to the Binance and Bitfinex crypto exchanges. According to the website, an extensive list of the top 10 Bitcoin wallets as of March 2024 looks like this:

- 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo

- Balance – 248,597 BTC

- A wallet address linked to Binance holding about $16.9bn worth of BTC (as of March 5, 2024) amounts to about 1.27% of the entire coins in circulation.

- bc1qgdjqv0av3q56jvd82tkdjpy7gdp9ut8tlqmgrpmv24sq90ecnvqqjwvw97

- Balance – 204,010 BTC

- A wallet linked to Bitfinex holding about $13.9bn worth of BTC, amounting to 1.1% of the entire coins in circulation.

- bc1ql49ydapnjafl5t2cp9zqpjwe6pdgmxy98859v2

- Balance – 131,945 BTC

- An anonymous wallet holding over $9.0bn worth of BTC tokens (0.6% of entire coins in circulation).

- 39884E3j6KZj82FK4vcCrkUvWYL5MQaS3v

- Balance – 115,177 BTC

- A Binance-linked wallet also holds $7.8bn worth of BTC.

- bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt Balance – 94,643 BTC

- An anonymous wallet holding $6.45n worth of BTC.

- 37XuVSEpWW4trkfmvWzegTHQt7BdktSKUs

- Balance – 94,505 BTC

- An anonymous wallet also holds $6.4bn worth of BTC.

- 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF

- Balance – 79,957 BTC

- An anonymous wallet holding $5.4bn worth of BTC.

- bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6

- Balance – 63,370 BTC

- An anonymous wallet holding $4.3bn worth of BTC.

- 3LYJfcfHPXYJreMsASk2jkn69LWEYKzexb

- Balance – 68,200 BTC

- A wallet linked to a Binance BTC reserve holding about $5.6bn worth of BTC tokens.

- bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4

- Balance – 66,465 BTC

- A wallet linked to stablecoin provider Tether held about $4.5bn worth of BTC.

While wallet addresses are public and can be easily accessed by the public, their holders’ names remain anonymous unless voluntarily disclosed by the owner themselves.

This makes knowing exactly who the biggest Bitcoin owners are a little more challenging. However, some names in higher leagues of the BTC Whale Hall of Fame include:

- Brian Armstrong, CEO of Coinbase

- Michael Saylor, entrepreneur and CEO of MicroStrategy, reportedly owns at least 17,000 BTC (and MicroStrategy owns around 193,000 BTC)

- Binance CEO Changpeng “CZ” Zhao

- Tech billionaire Tim Draper famously purchased 30,000 BTC at a discount when the U.S. Marshalls Service auctioned them off after seizing them from the Silk Road black market

- The Winklevoss Twins, of Facebook fame, bet heavily on BTC in 2012/2013.

According to River Intelligence, while Satoshi Nakamoto is estimated to be the biggest BTC holder, the asset’s creator is thought to have not used any of the assets, apart from “a few test transactions.”

The Institutional Accumulation of BTC

Over the years, corporations, financial institutions, and alternative investment funds have accumulated bitcoin holdings due to its position as the leading cryptocurrency.

In early January 2024, Tether became the 10th largest holder of BTC after the stablecoin provider withdrew 8888.88 BTC tokens from a crypto exchange and put it safely in its corporate crypto wallet.

If you are wondering which other companies are betting big on Bitcoin, we can look at the financial statements of publicly listed companies that are obliged to disclose such investments.

According to a list compiled by CoinGecko, the top holders of Bitcoin among publicly listed companies as of March 2024 were:

CompanyTickerBTC holdingsBTC worthMicroStrategyMSTR193,000 tokens~ $13 billionMarathon Digital HoldingsMARA15,741 tokens~ $1 billionTeslaTSLA9,720 tokens~ $662 millionCoinbaseCOIN9,000 tokens~ $613.8 millionGalaxy DigitalGLXY8,100 tokens~ $551 million

Celebrity Bitcoin Owners

According to SwissFortress’s Vohora, celebrity accumulation of cryptocurrencies tends to normalize the holding of such assets amongst the public. Botanica School’s Zinin added that celebrity crypto investment could also play an “invaluable role in drawing attention” to the industry, “promoting wider adoption and understanding of cryptocurrencies”.

So, who are the top celebrity BTC holders? While data on who the most prominent celebrity Bitcoin holders are can only be found if those celebrities disclose that they own BTC, according to an article published by CoinMarketCap in 2021, the top three celebrity BTC holders were Elon Musk, Jack Dorsey, and Mike Tyson.

In 2021, Elon Musk disclosed that even though he was against the environmental impact imposed by Bitcoin mining, the entrepreneur himself held BTC during the B-Word conference. In addition, the Tesla and SpaceX CEO added that he was planning to hold BTC long-term.

“If the price of Bitcoin goes down, I lose money. I might pump, but I don’t dump. I definitely do not believe in getting the price high and selling or anything like that… I would like to see Bitcoin succeed.”

Jack Dorsey, the former Twitter CEO, is also known to owe BTC. In a Tweet published on February 6, 2019, Dorsey states that he “only” has BTC.

In addition, Dorsey’s digital payment company Square had also invested $50 million into a block of around 5,000 Bitcoins in 2020. Mike Tyson, the prominent boxer and social media personality, has been a BTC supporter since 2015.

Although no new articles about him owning the cryptocurrency have resurfaced since then, the athlete has partnered with Bitcoin Direct to launch a Bitcoin ATM in Las Vegas. Other stars, including Game of Thrones actress Maisie Williams, American rapper Snoop Dogg, and Kanye West, have also disclosed owning BTC.

Beyond Individuals: Countries and Bitcoin Reserves

Zinin explained:

“National BTC holdings, especially with countries like El Salvador and the Central African Republic adopting it as legal tender, can create infrastructural solutions that facilitate the integration of cryptocurrencies into the real economy.

This, in turn, can promote wider cryptocurrency distribution and usage, reducing concentration and fostering a more democratic ownership distribution.”

In 2021, El Salvador was the first country to make BTC a legal tender, making it mandatory for all local businesses to accept payments in BTC.

The Central African Republic followed El Salvador’s example and made Bitcoin a legal tender the following year, arguing that the cryptocurrency would help the country secure an independent financial future. Solace’s Buzov noted that national BTC holdings remain small, making asset concentration a minor issue.

However, the use of BTC as a legal tender has the potential to drive further adoption and infrastructure growth around the use of cryptocurrency, especially since the industry has faced much scrutiny in the last couple of years.

“For these lesser developed countries, it might be a strong driver to establish a vibrant ecosystem, offering valuable experience and leading international communities and other states around the globe along a similar path.”

The Bottom Line

Bitcoin’s ownership landscape is diverse, encompassing institutional investors, celebrities, and even nations adopting it as legal tender. Top BTC holders tend to influence the market and enhance its liquidity. This diverse ownership ecosystem and institutional and celebrity endorsements contribute to the cryptocurrency’s growth and acceptance.

As Bitcoin continues to evolve, its ownership patterns will play a pivotal role in shaping its future trajectory, affecting the cryptocurrency market and its integration into the global economy.

It’s essential to conduct in-depth research and invest solely within your financial comfort zone, acknowledging the possibility of total loss. This investment is high-risk, and you should be prepared for the absence of safeguards in adverse scenarios. our

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)