The Impact of Cryptocurrencies on Global Trade

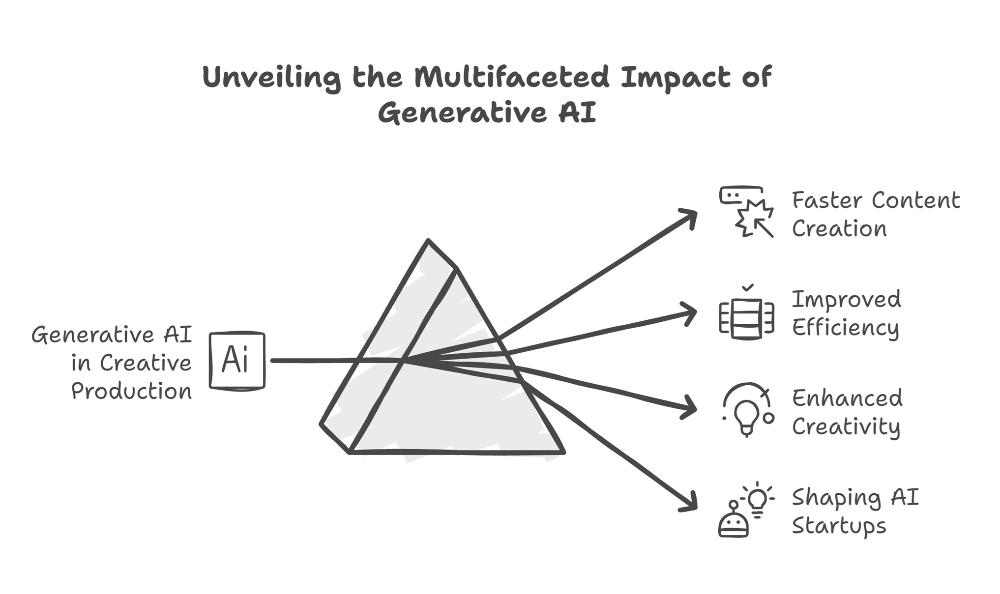

Faster and more efficient transactions

Cryptocurrencies can facilitate faster and more streamlined transactions compared to traditional banking systems. They eliminate the need for intermediaries and enable peer-to-peer transfers, reducing transaction delays and costs associated with cross-border trade.

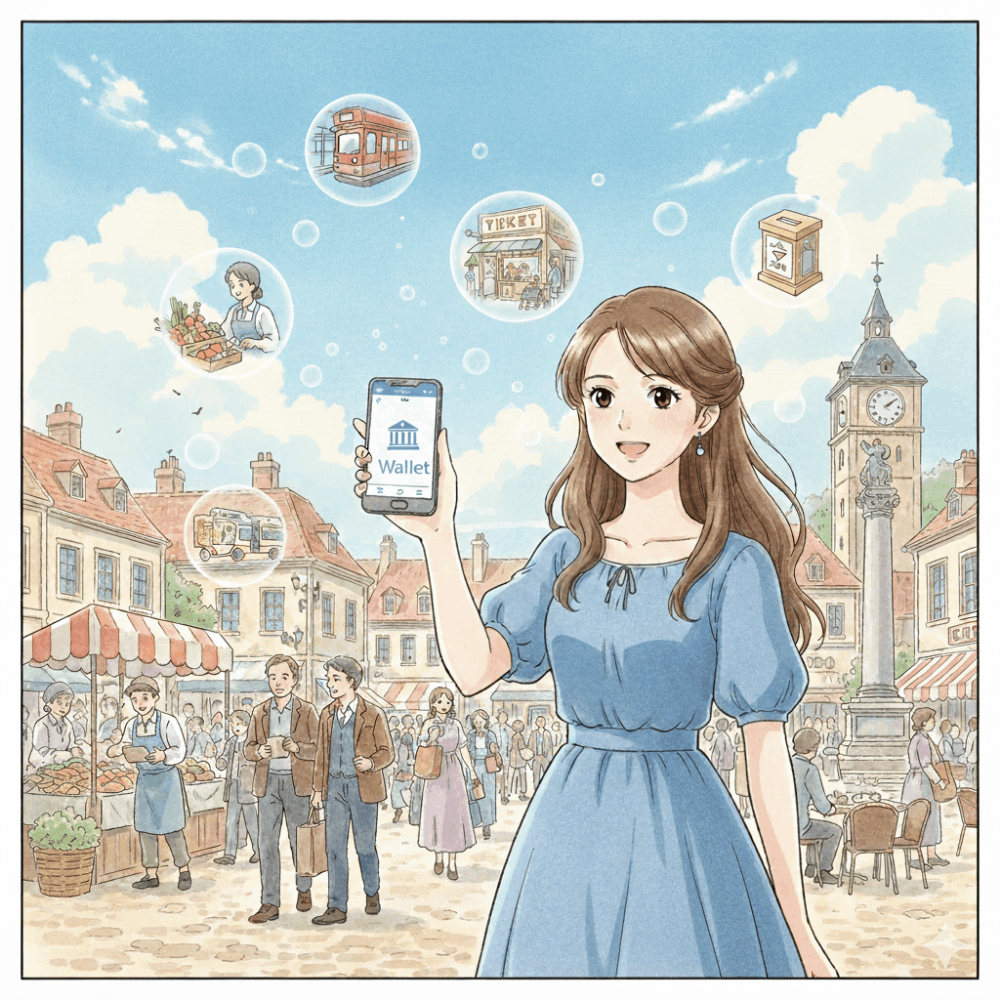

Improved accessibility

Cryptocurrencies can improve financial inclusion, especially in regions with limited access to traditional banking services. It promotes economic opportunity and lowers barriers to entry by enabling individuals and businesses to participate in global trade even without a bank account.

Reduced fees and currency conversion costs

Cryptocurrencies can reduce transaction fees and currency conversion costs by eliminating the need for intermediaries such as banks and payment processors. This can be particularly advantageous for small businesses involved in international trade as it allows them to save on costly banking services.

Increased security and trust

Cryptocurrencies use advanced cryptographic techniques to secure transactions, making them resistant to fraud and counterfeiting. Blockchain technology, which underpins many cryptocurrencies, increases trust and reduces the risk of disputes in global trade by providing transparent and tamper-proof transaction records.

Weaknesses of the Impact of Cryptocurrencies on Global Trade

Volatility and price fluctuations

Cryptocurrencies are known for their price volatility. The value of cryptocurrencies can fluctuate significantly over short periods of time, introducing uncertainty and risk for businesses engaged in global trade. This volatility can lead to price instability and affect the profitability of transactions, making it difficult for businesses to plan and budget effectively.

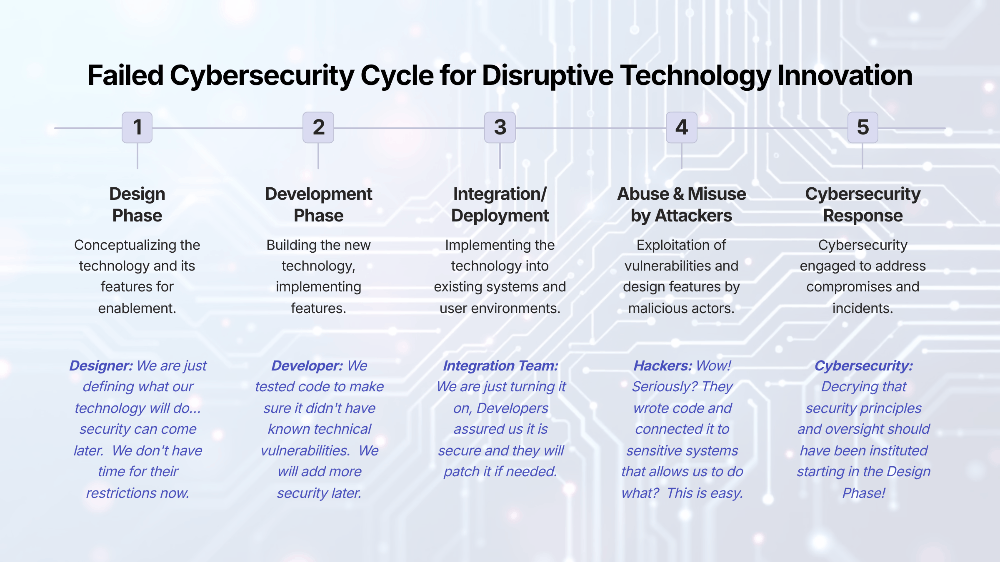

Regulatory challenges

The regulatory environment surrounding cryptocurrencies is still evolving in many countries. The lack of clear and consistent regulations can create uncertainty for businesses engaged in global trade, hindering their desire to accept cryptocurrencies as a form of payment or integrate them into their operations.

Scalability and technical limitations

Some cryptocurrencies face scalability issues, meaning they may struggle to handle large volumes of transactions quickly and efficiently. Low transaction speeds and high network fees can pose challenges in the context of global commerce where high transaction volumes are common.

Lack of widespread adoption

While the popularity and acceptance of cryptocurrencies has increased in recent years, they are still not universally recognized or adopted by businesses and governments. Limited acceptance as a medium of exchange in global trade may limit their impact and usefulness in facilitating cross-border transactions.

Although there is uncertainty about cryptocurrencies, their integration into global commerce represents a paradigm shift that offers exciting possibilities for individuals, businesses and economies around the world.