These Four Cryptocurrency Exchanges Officially Became Members of the Indonesian

These Four Cryptocurrency Exchanges Officially Became Members of the Indonesian Cryptocurrency Exchange

PT Bursa Komoditi Nusantara, also known as CFX, a regulated cryptocurrency exchange in Indonesia, is urging Prospective Physical Asset Crypto Traders (CPFAK) to expedite the registration process to become Physical Asset Crypto Traders (PFAK).

CFX views the registration as PFAK as a commitment from CPFAK to provide services in line with industry standards and comply with government regulations. It is also an effort to promote safe and orderly growth of the cryptocurrency industry in Indonesia.

"We understand the importance of strong regulations for the future of the cryptocurrency industry in Indonesia. Therefore, CFX is fully committed to collaborating with Bappebti and other stakeholders in creating a safe, transparent, and reliable cryptocurrency asset trading environment. We support Bappebti in this regard in line with our role as an exchange for consumer security," said Subani, CEO of CFX, in a statement released on April 7, 2024.

Currently, out of the 35 CPFAK and 1 Non-CPFAK registered with Bappebti, 4 CPFAK namely PT Pintu Kemana Saja (PINTU), PT Bumi Santosa Cemerlang (PLUANG), PT Kripto Maksima Koin (Kripto Maksima – GOTO Group), and PT Aset Digital Berkat (TOKOCRYPTO) have obtained SPAB from CFX.

In a recent interview with Coinvestasi, Subani mentioned that the deadline to meet the requirements to become Physical Asset Crypto Traders (PFAK) on CFX is June 2024.

PINTU Officially Becomes the First PFAK

Separately, PINTU, as the first cryptocurrency exchange to obtain PFAK status, expressed its appreciation to CFX.

"We highly appreciate CFX for placing full trust in PINTU as the first cryptocurrency company in Indonesia to obtain SPAB. We always strive to be at the forefront not only in providing innovative features but also in complying with regulations. Everything we do is to provide security for cryptocurrency investors and fully support the cryptocurrency ecosystem in Indonesia," said Malikulkusno (Dimas) Utomo, General Counsel of PINTU.

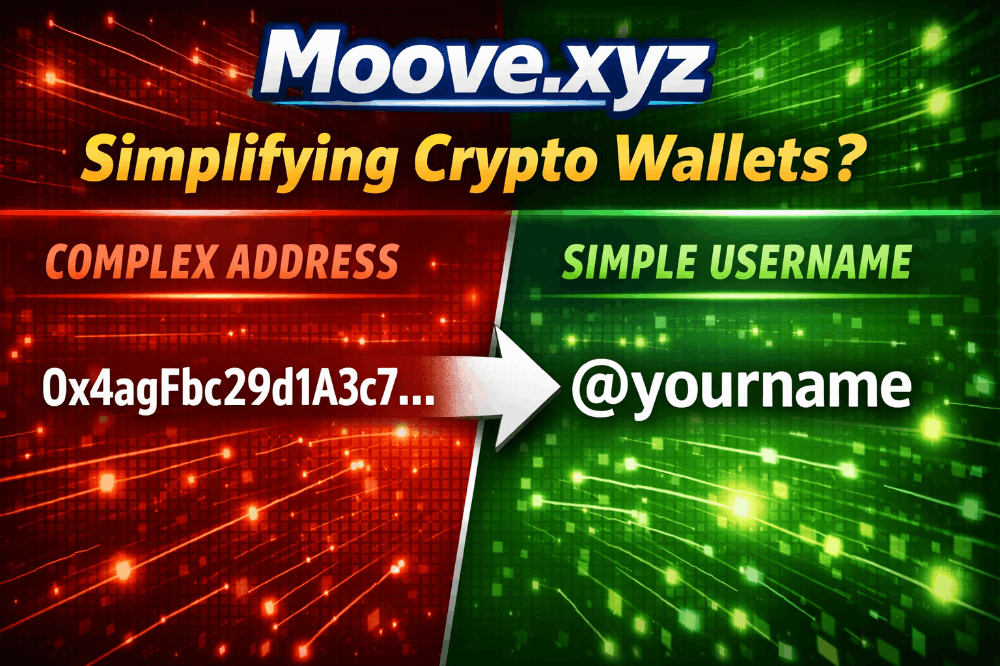

Steps to Become PFAK in the Indonesian Cryptocurrency Exchange

For information, to obtain permission to become a Physical Asset Crypto Trader (PFAK) from the Commodity Futures Trading Regulatory Agency (Bappebti), cryptocurrency companies with the status of Prospective Physical Asset Crypto Traders (CFPAK) or Non-CPFAK must obtain SPAB issued by CFX and a letter of recommendation from CFX.

The requirements to obtain SPAB and a letter of recommendation involve registering as a Member of the Exchange and being able to meet the administrative and technical document requirements set by the exchange.

Once all requirements are met, CFX will issue SPAB and a letter of recommendation. Exchange members who have obtained SPAB and a letter of recommendation will proceed with the process at Bappebti, fulfilling other requirements including the Fit and Proper Test to obtain approval as PFAK.

CFX will periodically update the announcement of the SPAB status of each CPFAK and non-CPFAK on www.cfx.co.id.

Conclusion

the recent integration of four cryptocurrency exchanges as members of the Indonesian Cryptocurrency Exchange, facilitated by PT Bursa Komoditi Nusantara (CFX), marks a significant step towards the regulated growth of the cryptocurrency industry in Indonesia.

This move reflects a commitment to industry standards and government regulations, fostering a safe and transparent environment for crypto asset trading. With CFX's emphasis on collaboration with regulatory bodies like Bappebti and its role in ensuring consumer security, the exchanges aim to promote orderly growth in the Indonesian cryptocurrency ecosystem.

The successful registration of PT Pintu Kemana Saja (PINTU) as the first Physical Asset Crypto Trader (PFAK) underscores the dedication of these exchanges to compliance and investor security. As the deadline approaches for prospective traders to meet the requirements set by CFX, the industry is poised for further development within a regulated framework. Through ongoing updates and adherence to exchange protocols, CFX aims to streamline the process for prospective traders, ensuring the integrity and legitimacy of the cryptocurrency market in Indonesia.

Read Too : Bitcoin Cash (BCH) Price Rally After Second Halving

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.