Crypto Investment Inflows Reach US$2 Billion in May 2024

Crypto Investment Inflows Reach US$2 Billion in May 2024

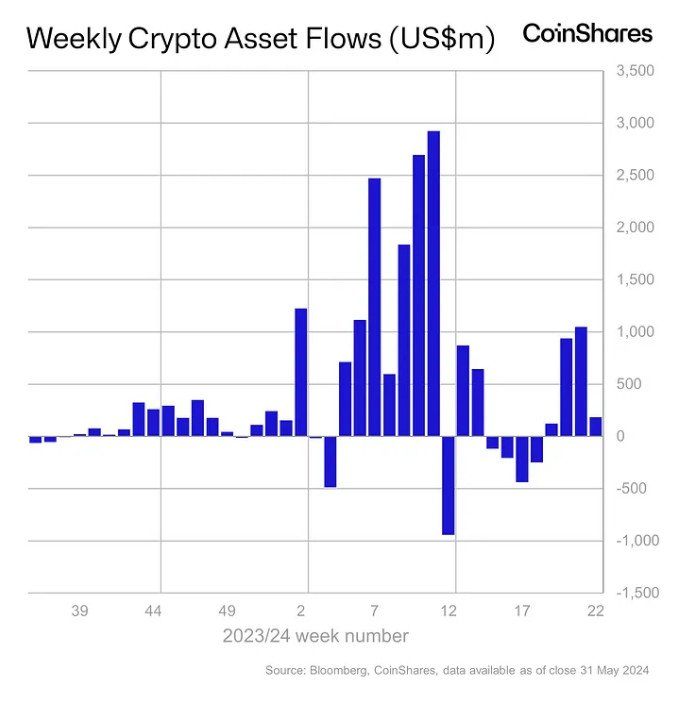

Global crypto investment products managed by various asset managers saw a significant increase, with net inflows reaching US$185 million as of May 28. This marks a positive trend for four consecutive weeks.

According to a report by CoinShares, this trend was further bolstered by inflows totaling US$2 billion in May, pushing the year-to-date (YTD) inflows to surpass US$15 billion for the first time in history.

However, trading volumes decreased to US$8 billion, compared to US$13 billion in the previous week.

Market Dominance of the United States

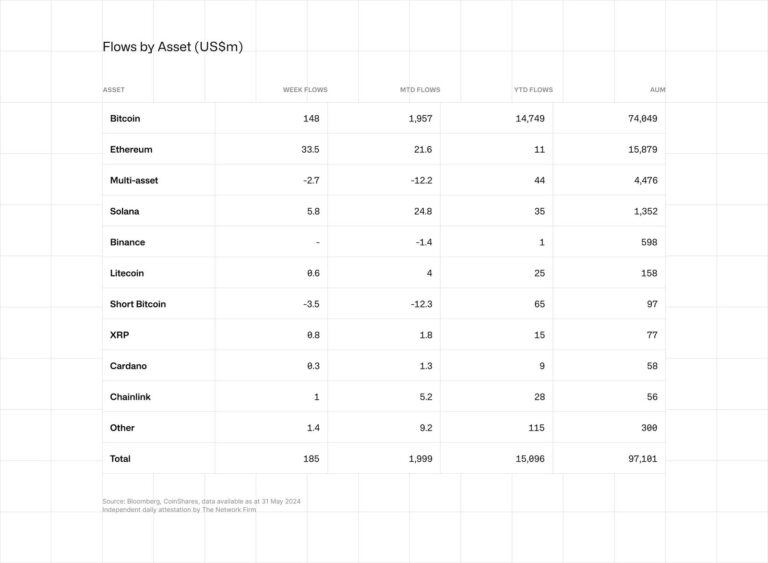

The report highlights that the United States was the primary source of these inflows, contributing a total of US$130 million. Switzerland recorded the second-largest inflow of the year at US$36 million, while Canada saw a turnaround with inflows of US$25 million, despite experiencing net outflows of US$39 million the previous month.

Additionally, Bitcoin-based ETFs generated global net inflows of US$148 million last week, indicating positive investor sentiment. Conversely, short Bitcoin products saw continued outflows totaling US$3.5 million.

Shifting Sentiment Towards Ether

Ether (ETH) witnessed its second consecutive week of inflows following the SEC's approval of an ETH spot ETF, with an expected launch in mid-July 2024. This marks a shift in investor sentiment towards Ether, which had experienced outflows for the previous 10 weeks, totaling US$200 million.

The positive news for Ethereum also benefited Solana (SOL), which saw further inflows of US$5.8 million last week. Other altcoins like XRP (XRP) and Cardano (ADA) recorded inflows of US$0.8 million and US$0.3 million, respectively.

Conclusion

The substantial inflows into global crypto investment products, reaching US$2 billion in May 2024, signal a robust and growing confidence among investors. This surge, particularly pronounced in the United States, underscores the market's increasing acceptance and optimism towards cryptocurrencies. The positive sentiment towards Bitcoin and Ether, fueled by regulatory approvals and new investment products, indicates a shifting landscape favoring digital assets. Despite a slight decline in trading volumes, the consistent inflows and renewed interest in altcoins like Solana, XRP, and Cardano highlight the evolving and dynamic nature of the cryptocurrency market. This trend suggests a promising outlook for the crypto investment sector, with potential for continued growth and diversification.

Read Too : Hong Kong Officially Bans Unlicensed Crypto Exchanges

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)