The state of the Gen AI ecosystem

The state of the Gen AI ecosystem

Why we are more excited than ever! Over the past few months, the field of generative AI has gained substantial traction as startups and incumbents alike are harnessing the technology to bolster productivity across the board.

Over the past few months, the field of generative AI has gained substantial traction as startups and incumbents alike are harnessing the technology to bolster productivity across the board.

From 2014 to 2017 major scientific AI papers (GAN, Diffusion, Transformers, etc.) were released, providing the mathematical foundations that enabled OpenAI, Stability AI, etc. to launch some of the fastest-growing consumer applications (ChatGPT reached 1M users in just 5 days). These companies trained their models (GPT, Stable Diffusion, etc.) on gargantuan datasets, yielding game changing results, and then made them available for the world, through simple user interfaces (chat) or simple APIs.

Until recently, putting an AI into production required to have a team of trained (and often expensive) data scientists, large datasets and a mountain of graphics cards for training. With genAI models available through simple API, the barriers of entry for using AI models have dropped significantly. Developers with no prior AI knowledge can now easily integrate AI features into their products. Furthermore, fine-tuning of models does not require as much data anymore, as new foundational models have become remarkably good at generalization.

With a paradigm shift such as this one, new oceans of opportunity open up, but they come with their own risks and pitfalls. While we are certain that immense value will be created in the coming years, we are less certain as to whom in the AI value chain will be able to sustainably capture that value. It is with that key question in mind that have been scouring the startup ecosystem for opportunities, and here’s what we’ve observed:

- As expected, there’s been an explosion in the number of AI startups created in the last few months as the top talent in the tech ecosystem has flocked towards this exciting opportunity.

- Everyone is eager to play with and implement generative AI to see if the tech lives up to its promises. Early traction for GenAI products can be explosive and we are seeing many startups with strong revenue growth (Synthesia, Jasper, Copy.ai, all these startups went from 0 to $10m ARR extremely fast).

- However, users have high expectations and, as it’s still early days, the tools currently pushed to market aren’t always up to standard. This, coupled with high competitive intensity, means that we sometimes see high levels of churn as well.

- The open vs closed source debate is raging and dividing the genAI community. On the one hand, the most intelligent language model to date by far — GPT4 — is a complete blackbox. This pushes some to argue that the largest and highest performing models can only come from centralized, closed-source players like OpenAI, that have the economical resources and incentives to burn hundreds of millions of dollars on training. On the other hand, rich ecosystems have developed around open-source models such as Stable Diffusion, the invention of highly effective low resource fine-tuning algorithms like LoRA and the emergence of performant “small” models, which seem to support the thesis that decentralized, open and grass-routes initiatives could prevail.

- At the application layer, SaaS incumbents are surfing the wave, launching genAI features (see what Notion, Intercom are doing for example), while new startups are creating new products with Gen AI at their core. Today, given the low barrier to entry to integrate GPT or other LLMs in production, there is a question as to whether Gen AI will most benefit incumbents or new entrants. The bet newcomers (and VCs backing them) are taking, is that leveraging the full potential of GenAI requires a complete overhaul of products and workflows, which incumbents cannot do.

- Looking at the infrastructure layer, we believe there are many opportunities in providing the picks and shovels for the gen AI rush whether it is in data preparation, LLM deployment orchestration or monitoring. This is a category that we know well through previous investments made by the team and that we remain very bullish about. We’re still working on our thesis as to the future structure of the market. Will falling model training costs (70% YoY according to Ark Invest) cause models to become commoditized? Will the mounting costs of building ever larger models to compete crowd out smaller players? How much bigger can large models become before we start to see diminishing returns in model performance? Will actors with access to proprietary datasets (c.f. Google’s new privacy agreement) outcompete the rest? Put simply, will the foundational model market be a winner-takes-all market?

Do you have insights on this point? Please reach out, we’d love to chat.

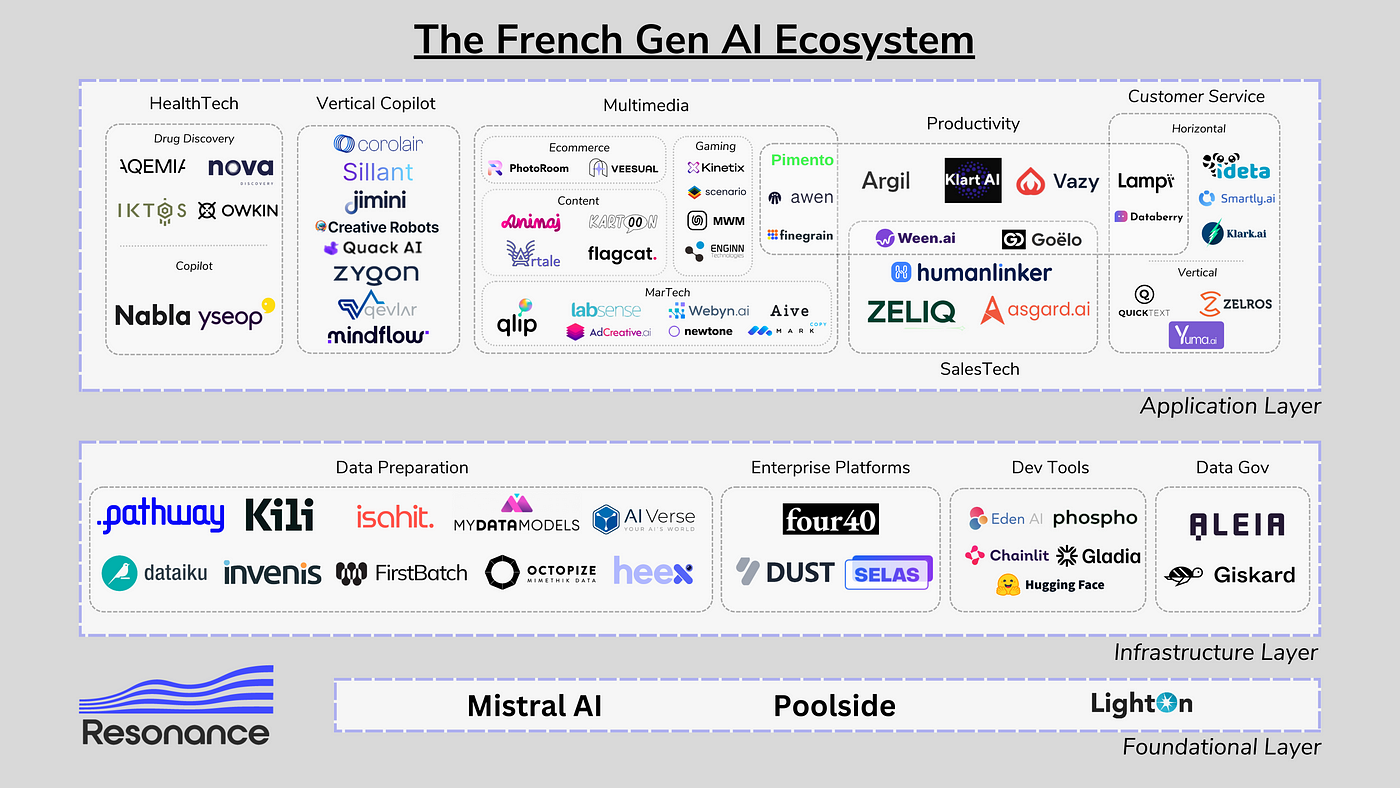

Furthermore, we’ve mapped all the French startups that we’ve identified as leveraging genAI to drive innovation (see below) and listed some of the spaces we’re paying particular attention to:

- Pharmaceutical research process: in this sector, time = lives saved and GenAI has immense potential to have an impact on drug time-to-market. From drug discovery, to AI-generated regulatory submissions there are numerous ways that this technology will help streamline the historically tedious drug approval process.

- Customer support and sales: especially as context windows grow larger, GenAI-boosted SaaS platforms will enable client-facing employees to personalize and automate the customer experience they provide, at a scale never seen before.

- Vertical tools: as mentioned previously, low barriers to entry are a double edged sword. And so, we are particularly on the lookout for founders building vertical tools for which they will be able to ship persona/industry specific features, fine-tune models for their use-case, etc. Building their moat that way.

- Content marketing: as synthetic content quality increases and the marginal costs of content creation take a dive, it is becoming possible to use AI to create highly specialized content at scale, and target even the smallest niche audiences. This will drive engagement, conversation rate and value creation.

- Infra layer: as previously mentioned, the streams of companies building in the GenAI space will need specific tools to develop better products and faster. We’re very interested in data tools that help with fine-tuning and reinforcement learning use-cases, which are central to unlocking the full potential of GenAI models.

- Foundational models: we’re very excited to see what will come of the two new, highly funded, French challengers that will be competing at the foundational layer (Mistral & Poolside).

The preceding notes and mapping, are a snapshot of the Gen AI landscape in France as of Q2 2023. It will quickly become outdated as new players enter the scene every day. Furthermore, we’re sure we’ll have missed quite a few, if you know of any please reach out!