Investigating a Whale Account Swapping 500k of $WIF: A Deep Dive with SolanaFM and Birdeye

Researching whale accounts, particularly those engaged in large-scale transactions of memecoins, can provide profound insights into market dynamics and trading strategies. With the integration of tools like Birdeye and SolanaFM, tracking these high-value accounts has become more accessible and informative.  This comprehensive guide will walk you through the process of using Birdeye to research whale accounts, highlighting the essential tools and techniques to gain valuable insights into their activities.

This comprehensive guide will walk you through the process of using Birdeye to research whale accounts, highlighting the essential tools and techniques to gain valuable insights into their activities.

Understanding Whale Accounts and Their Significance

Defining Whale Accounts

Whale accounts are cryptocurrency wallets that hold a significant amount of assets, typically exceeding $10,000. These accounts have the potential to influence market trends due to the large volumes of trades they can execute. By monitoring whale accounts, traders and analysts can gain insights into market movements and potential opportunities.

Importance of Monitoring Whale Accounts

Tracking the activities of whale accounts is crucial for several reasons:

- Market Sentiment: Whale trades can indicate market sentiment and potential price movements.

- Trading Strategies: Analyzing whale strategies can provide valuable lessons for optimizing your own trading approach.

- Risk Management: Understanding whale behavior helps in assessing market risks and making informed decisions.

Tools for Tracking Whale Accounts

Introduction to Birdeye

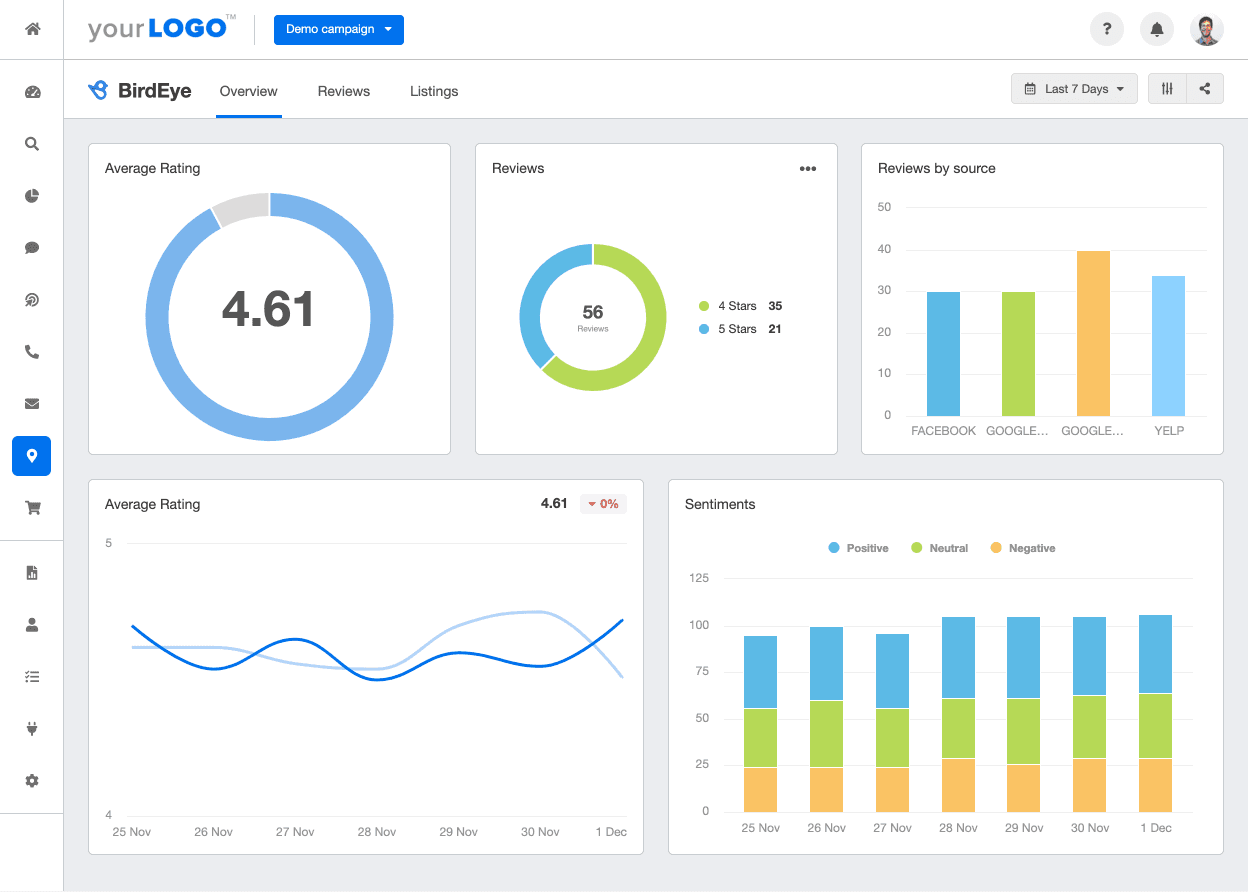

Birdeye is a powerful tool that enables users to monitor and analyze the trading activities of whale accounts. It provides detailed transaction histories and trading volumes, offering a comprehensive view of market activities. By integrating Birdeye with other blockchain explorers like SolanaFM, users can gain a deeper understanding of whale movements and strategies.

Using SolanaFM for Enhanced Insights

SolanaFM is a block explorer that allows users to track transactions on the Solana blockchain. By tagging and labeling accounts, SolanaFM makes it easier to identify and follow specific whale accounts. The combination of Birdeye and SolanaFM provides a robust framework for researching and understanding whale activities.

Step-by-Step Guide to Researching Whale Accounts with Birdeye

1. Setting Up Birdeye

To start tracking whale accounts, you need to set up an account on Birdeye. Follow these steps:

- Create an Account: Sign up on the Birdeye platform and log in to your account.

- Connect Wallets: Integrate your cryptocurrency wallets to access real-time data on your trades and holdings.

- Configure Alerts: Set up alerts for specific accounts or transactions to stay updated on whale activities.

2. Identifying Whale Accounts

Once your Birdeye account is set up, you can begin identifying whale accounts:

- Search for Accounts: Use the search feature to find accounts with significant trading volumes or asset holdings.

- Tag and Label: Assign custom tags and labels to easily identify and track these accounts over time.

3. Analyzing Transaction Histories

With identified whale accounts, delve into their transaction histories:

- View Trading Volumes: Check the trading volumes of the account over different time periods to identify patterns.

- Analyze Swaps and Transfers: Examine the types of tokens being swapped and transferred, and the platforms used for these transactions.

4. Utilizing SolanaFM for Detailed Analysis

Enhance your research with SolanaFM:

- Filter Transactions: Use SolanaFM’s filtering options to sort transactions by token or action, such as swaps.

- Examine Transaction Details: Look into the specifics of each transaction to understand the strategies employed by the whale account.

Practical Applications and Insights

Case Study: Memecoin Whale

Let’s explore a real-world example of a memecoin whale:

- Account Overview: The account traded over $500,000 worth of $WIF within a few hours, using platforms like Jupiter for swaps.

- Transaction Analysis: By analyzing the transaction history on Birdeye and SolanaFM, we observed a series of swaps involving $WIF, $SOL, USDC, and Tether. These swaps indicated strategic moves to capitalize on price disparities.

Leveraging Insights for Your Trading Strategy

By understanding whale strategies, you can enhance your trading approach:

- Identifying Opportunities: Spot potential buying or selling opportunities based on whale activities.

- Risk Management: Adjust your risk management strategies by anticipating market movements influenced by whales.

Conclusion

Researching whale accounts through tools like Birdeye and SolanaFM offers invaluable insights into market dynamics and trading strategies. By following the steps outlined in this guide, you can effectively monitor whale activities, gain a deeper understanding of their impact on the market, and optimize your own trading strategies. Leveraging these tools will empower you to navigate the volatile world of cryptocurrencies with greater confidence and precision.