Crypto Market in Concerted Decline, Rp15 Trillion Liquidated

Crypto Market in Concerted Decline, Rp15 Trillion Liquidated

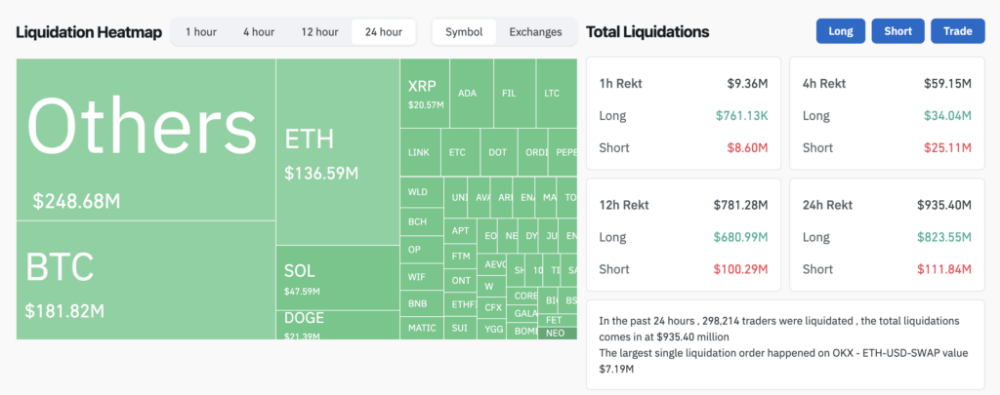

The crypto market has experienced liquidation of over US$935 million or roughly Rp15 trillion in the past 24 hours (April 13), according to data from Coinglass. LONG positions in the derivatives market saw the most liquidations at US$823 million or around Rp13.2 trillion.

This liquidation was caused by the majority of crypto prices turning red. The price of Bitcoin briefly dropped to the level of US$65,800 before rising back to US$67,000, marking a decrease of over 4% in the past 24 hours.

ETH, the second largest crypto by market capitalization, followed Bitcoin's lead, dropping by 8.56% in the past 24 hours and trading at US$3,200. DOGE and SOL, among the top 10 crypto assets by market capitalization, experienced the steepest declines, dropping by -12% and -11% respectively.

Decline Amidst Iran Attack Concerns

This decline occurred amidst concerns about retaliatory attacks from Iran against Israel. It began when Israel attacked the Iranian consulate in Syria on April 1. In response to the situation, countries like France, India, Russia, and the UK have issued warnings to their citizens against traveling to Israel.

The crypto market decline also coincided with a drop in the US stock market during US trading sessions, a few days after new data showed that inflation had increased for three consecutive months.

Higher-than-expected CPI data further dashed hopes for a Fed interest rate cut this year amid concerns that progress may be hindered in controlling price hikes.

JPMorgan Chase CEO Jamie Dimon, as reported by Cointelegraph, warned on April 12 that "sustained" inflation, geopolitical tensions, and The Fed's quantitative tightening efforts threaten positive economic prospects.

"We have never truly felt the full impact of quantitative tightening on this scale," Dimon said.

He also emphasized that the market is likely to remain burdened by inflation pressures that are likely to persist.

Conclusion

the recent sharp decline in the crypto market, resulting in the liquidation of significant amounts of assets, reflects a broader concern about geopolitical tensions, particularly in the wake of escalating tensions between Iran and Israel.

This decline also aligns with a broader economic context marked by inflationary pressures and uncertainty surrounding the Federal Reserve's monetary policy.

The warning from JPMorgan Chase CEO Jamie Dimon underscores the ongoing challenges facing the global economy, highlighting the need for careful monitoring and proactive measures to navigate these turbulent times.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)