The Future Of Cryptocurrency

Crypto: Entering a New Era of Growth and Scrutiny

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite their name, cryptocurrencies are not considered to be currencies in the traditional sense, and while varying treatments have been applied to them, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[10] Though, the cryptographic keys of the wallets are largely centralized in a few exchanges. When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[11]

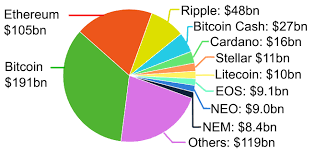

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.[12] Throughout their existence, cryptocurrencies have been involved in criminal activities and multi-billion-dollar fraud schemes. Some economists and investors, such as Warren Buffett, considered cryptocurrencies to be a speculative bubble.

The cryptocurrency market has experienced a whirlwind journey in recent years. From the dizzying highs of 2021 to the sobering correction in 2022, cryptocurrencies have captured the imagination of investors and spark global debates. As we move through 2024, experts are looking ahead to see what the future holds for this digital asset class.

Growth and Maturation

Furthermore, the industry is poised to enter a new phase of development. We can expect to see a heightened focus on security measures, with exchanges and blockchain projects prioritizing robust infrastructure to safeguard user assets. This focus on security will be crucial for building trust among both institutional and retail investors.

Regulation in Focus

Addressing Challenges

Despite the positive outlook, there are still challenges that need to be addressed. The environmental impact of certain cryptocurrencies, like Bitcoin, remains a concern. Developers are actively exploring solutions for more sustainable mining practices. Additionally, the crypto market's volatility is a hurdle to wider acceptance. Innovations like stablecoins, cryptocurrencies pegged to real-world assets, could offer some stability.

The Road Ahead

The future of cryptocurrency is likely to be shaped by the collective efforts of developers, regulators, and stakeholders. By addressing challenges, fostering innovation, and establishing clear regulations, the crypto industry can pave the way for a more interconnected, efficient, and inclusive financial ecosystem.

conclusion

Cryptocurrency is here to stay, and its future looks bright. However, its success will depend on its ability to overcome hurdles, gain regulatory clarity, and deliver on its promise of a more accessible and efficient financial system.

References

- ^ Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- ^ Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

- ^ Jump up to:

- a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3 May 2016.

- ^ Pernice, Ingolf G. A.; Scott, Brett (20 May 2021). "Cryptocurrency". Internet Policy Review. 10 (2). doi:10.14763/2021.2.1561. ISSN 2197-6775. Archived from the original on 23 October 2021. Retrieved 23 October 2021.

- ^ "Bitcoin not a currency says Japan government". BBC News. 7 March 2014. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)