elegant twist turtle cinnamon manual comfort loop habit chair chat bla

EN

BTC

BTC- 2.61%

ETH

ETH- 1.09%

USDT

USDT- -0.03%

SOL

SOL- 8.68%

BNB

BNB- -2.66%

XRP

XRP- 0.94%

USDC

USDC- -0.02%

ADA

ADA- -0.38%

AVAX

AVAX- 13.14%

DOGE

DOGE- 3.85%

BTC

BTC- 2.61%

ETH

ETH- 1.09%

USDT

USDT- -0.03%

SOL

SOL- 8.68%

BNB

BNB- -2.66%

XRP

XRP- 0.94%

USDC

USDC- -0.02%

ADA

ADA- -0.38%

AVAX

AVAX- 13.14%

DOGE

DOGE- 3.85%

Home > News

Published: 18/03/2024

-

Author: Leexim

Solana DeFi TVL Skyrockets by 80% in One Month

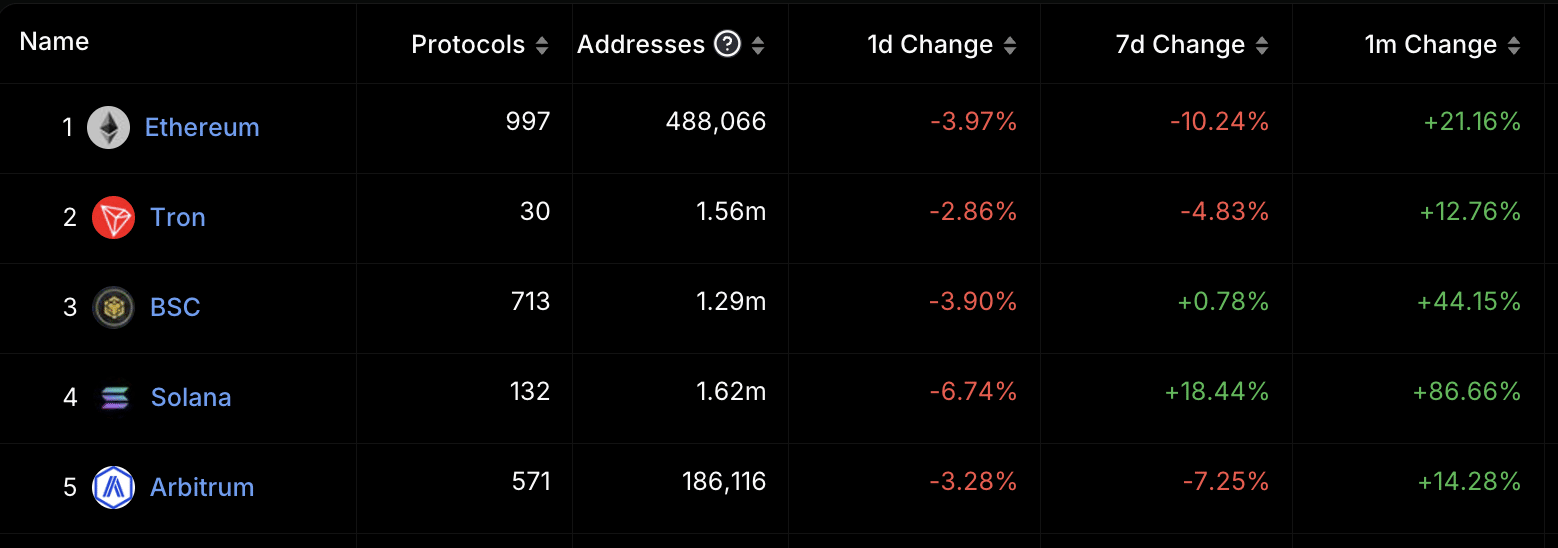

Despite the overall market downturn, demand for SOL remained resilient, driving Solana's DeFi TVL to soar by more than 80% in the past month. The DefiLlama data reveals a remarkable surge of over 80% in the Total Value Locked (TVL) of Solana’s decentralized finance (DeFi) ecosystem over the past month. This impressive growth has propelled Solana’s DeFi TVL to its highest point in two years, currently standing at $3.8 billion. Among the top 5 DeFi networks by TVL, Solana ranks as the blockchain with the highest growth rate in the past month.

The DefiLlama data reveals a remarkable surge of over 80% in the Total Value Locked (TVL) of Solana’s decentralized finance (DeFi) ecosystem over the past month. This impressive growth has propelled Solana’s DeFi TVL to its highest point in two years, currently standing at $3.8 billion. Among the top 5 DeFi networks by TVL, Solana ranks as the blockchain with the highest growth rate in the past month.

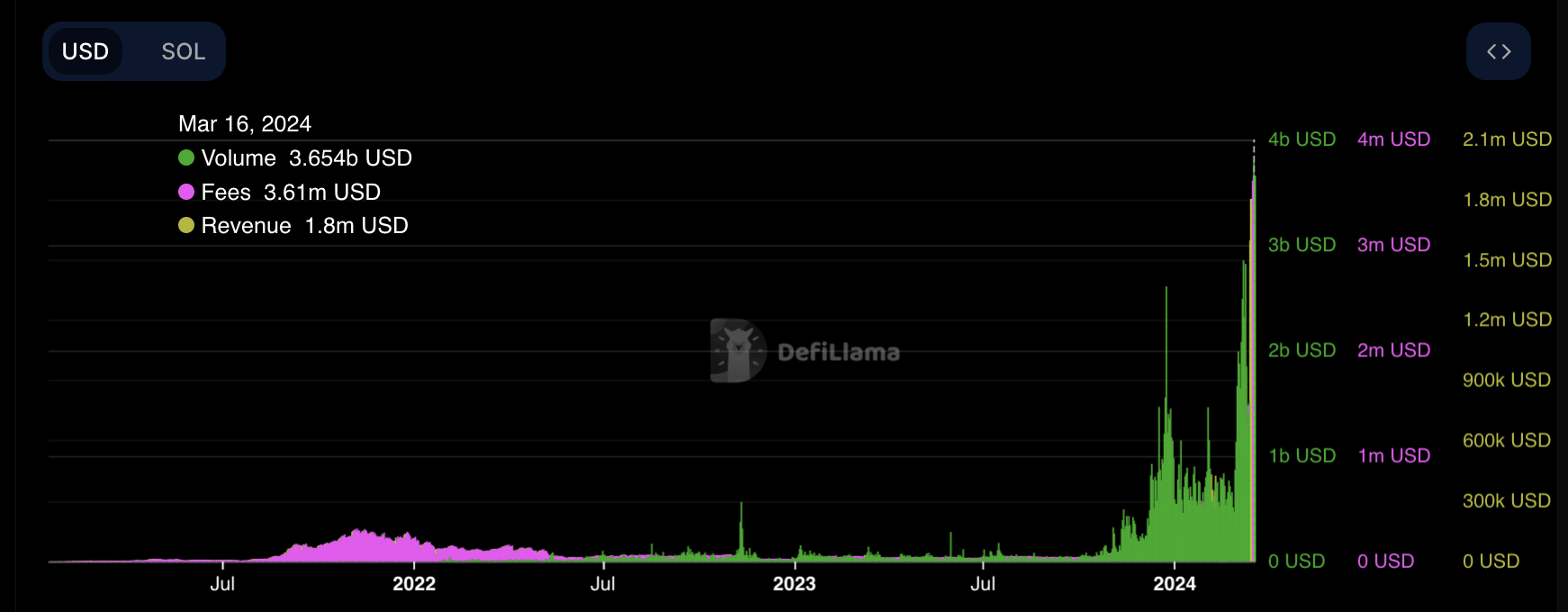

The surge in Solana’s TVL over the past month can be attributed to a significant increase in trading volume on Layer 1 (L1) DeFi protocols within the network. Since the beginning of the month, the total daily trading volume recorded on these protocols has surged by 125%. In fact, on March 15th, trading volume on Solana’s DeFi reached its highest level in years at $3.7 billion.

The network’s total fees reached $3.61 million on March 16th, marking the highest daily fee collection since its inception. Revenue generated from these fees amounted to $1.6 million, representing the network’s highest daily revenue.

Source: DefiLlama

Related: Ethereum and Solana Follow Bitcoin’s Trend

SOL Challenges Market Trajectory

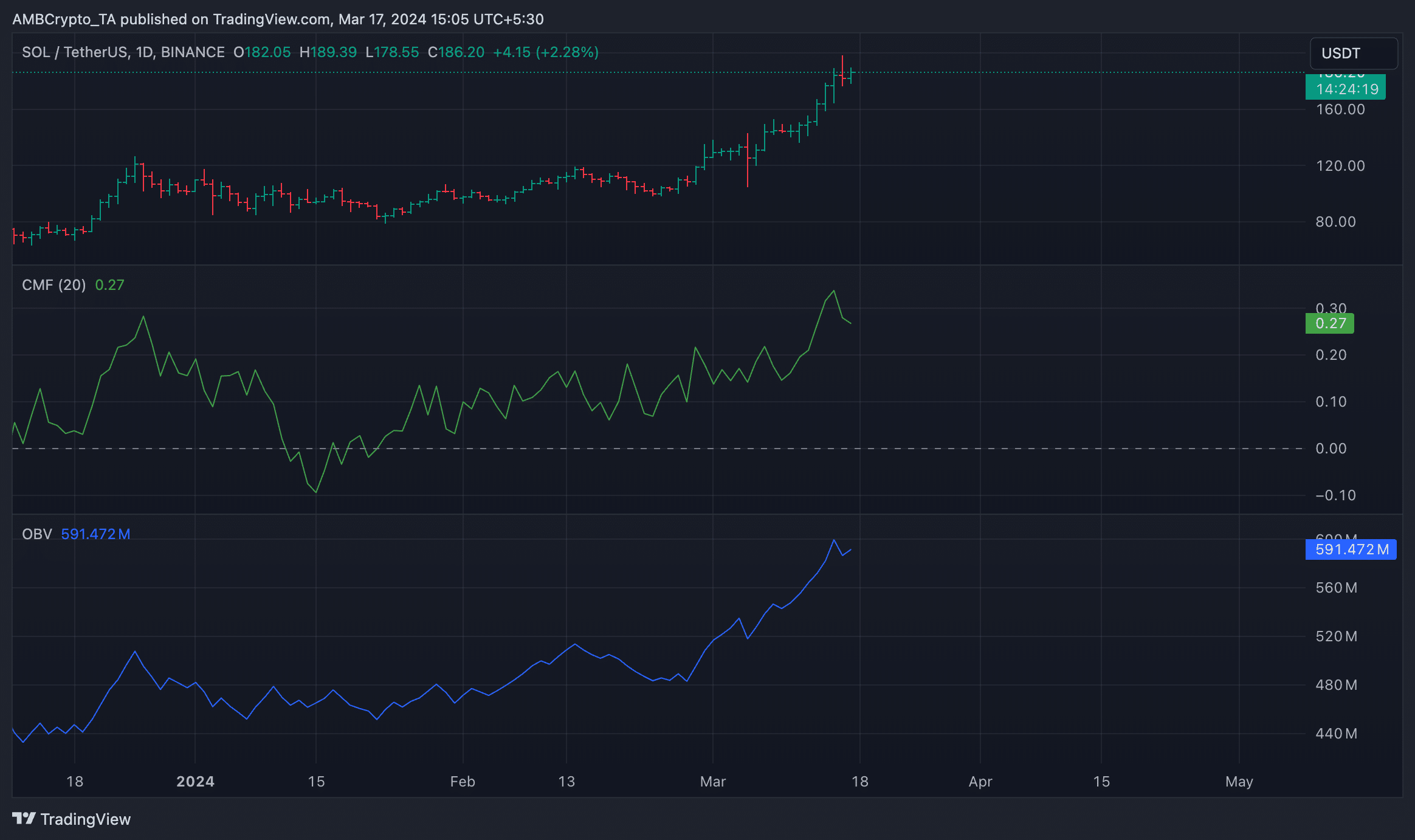

At the time of writing, SOL has traded hands at $187. According to CoinMarketCap data, the altcoin’s value has surged by 72% over the past month. While the rest of the market grapples with price reversals, SOL bucks the trend as optimism grows. Analysis of its daily chart movement indicates a stable increase in demand for SOL.

Source: DefiLlama

For instance, the On-Balance Volume (OBV), which tracks buying and selling pressure of the coin, is showing an upward trend at press time. At 591.42 million at the time of reporting, SOL’s OBV has surged by 16% since the beginning of March. When a coin’s OBV witnesses such growth, it indicates increasing buying momentum.

Source: TradingView

The rising trend in SOL’s Chaikin Money Flow (CMF) further confirms this growth. This indicator measures the flow of money into and out of an asset. Currently standing at 0.27, up from 0, SOL’s CMF indicates a growing influx of liquidity into the market.

Read More

0.0/5

Love

Leave a Reply

Your email address will not be published. Required fields are marked *

Comment *

Twitter

Telegram

Name

Save my name, email, and website in this browser for the next time I comment.

LATEST News | Altcoin | Editor Choice | Research 18/03/2024

News | Altcoin | Editor Choice | Research 18/03/2024

What is Book Of Meme? Information about BOME Token?

Book of Meme - a memecoin project on Solana that caused a sensation by being listed on Binance within 3 days of its launch. So what is Book of Meme? Is the BOME Token worth investing in? Let's find out right away! News | Editor Choice | NFT 18/03/2024

News | Editor Choice | NFT 18/03/2024

Founder of NFT Collection Milady Targeted by Hacker Attack

Milady is said to have had many NFTs liquidated and lost 1 million USD transferred to another address. News | Altcoin | Editor Choice 18/03/2024

News | Altcoin | Editor Choice 18/03/2024

The ETH Supply Reaches Lowest Level Since August 2022

Ethereum's Dencun upgrade is proving to be highly successful, resulting in a substantial decrease in the supply of ether on the network. News | Altcoin | Bitcoin | Editor Choice 18/03/2024

News | Altcoin | Bitcoin | Editor Choice 18/03/2024

Crypto Weekly (11/03 – 17/03): Bitcoin Undergoes Significant Correction

The crypto market last week witnessed a significant correction in Bitcoin, while Ethereum successfully completed the Dencun upgrade. So, what were the highlights of the week? Let's recap together! News | Bitcoin | Editor Choice 18/03/2024

News | Bitcoin | Editor Choice 18/03/2024

Miners Exert Pressure Leading to Bitcoin Price Drop

Bitcoin experiences continuous corrections, dipping below the $66,000 mark, possibly influenced by miners' actions, exerting downward pressure on cryptocurrency prices.

Top views

- 1

- BingX Launches P2P Merchant Recruitment Program, Earn up to 215 USDT

- 2

- Receive BTC Airdrop on BingX

- 3

- Bitcoin to Continue Surging as Supply Nears Depletion

- 4

- Guide to Join io.net Airdrop

- 5

- Bitcoin Reaches All-Time High at $71,000

- 6

- Binance Announces Removal Of BNB & TUSD Spot Trading Pairs

- 7

- The Bitcoin Wallet Address of Elon Musk has been Revealed

- 8

- Telegram Shares 50% of Advertising Revenue, TON Increases Nearly 40%

- 9

- Receive Box Airdrop of TABOO on BingX

- 10

- What is Aevo? Information about AEVO Token?

About AZC.News

About Us

Contact Us

Privacy Policy

Terms of Services

Market

Analytics

Top Crypto Exchange

Top Cryptocurrency

Knowledge

Research

Glossary

Earn

Airdrop

Social Community

Copyright 2024 © AZ Coiner