Diving into the Crypto Wave: Unraveling the Magic of Liquidity Pools

In the ever-evolving world of cryptocurrency, new terms and concepts pop up like mushrooms after the rain. One such term that has been making waves (pun intended) is "liquidity pools." If you're scratching your head, wondering what this buzz is all about, fear not – we're here to break it down for you in a language that won't make your brain do somersaults.

What's the Fuss about Liquidity Pools?

So, what's the big deal with liquidity pools? Imagine a bustling marketplace where buyers and sellers come together to trade goods. In the cryptocurrency realm, these goods are tokens. Liquidity pools are essentially the lifeblood of these markets, ensuring that trading can happen seamlessly.

In simpler terms, a liquidity pool is a stash of tokens locked in a smart contract. These tokens are made available for trading, allowing users to swap between different assets without relying on a centralized exchange. It's like a communal piggy bank for traders, ensuring there's always enough in the pot for transactions to take place.

How Do Liquidity Pools Work?

Let's break it down further. In a liquidity pool, you'll find pairs of tokens – for example, Ethereum and a stablecoin like USDC. These pairs create a balanced pool with a certain value assigned to each token. This balance is crucial for ensuring that the pool remains, well, liquid.

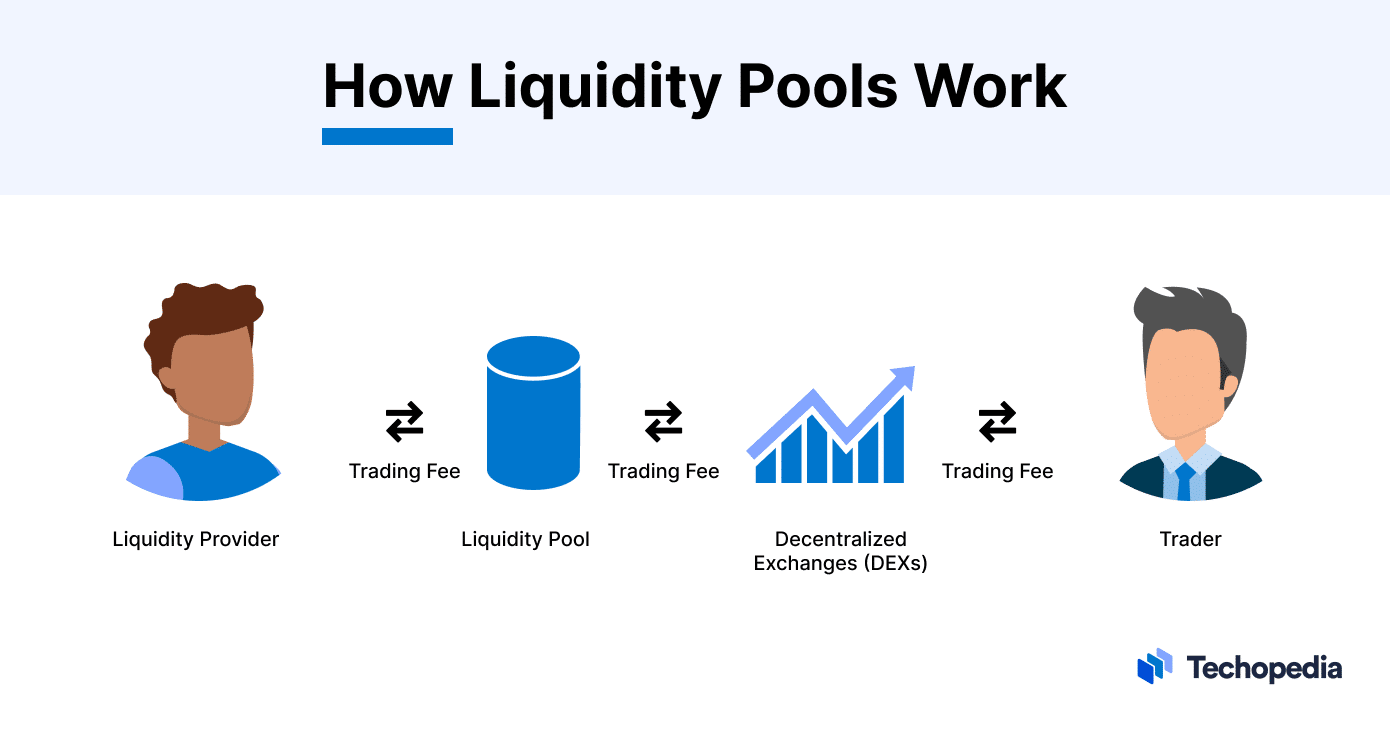

When a trader wants to make a swap, they contribute an equal value of both tokens to the pool. In return, they receive liquidity pool tokens representing their share in the pool. The smart contract calculates this exchange, ensuring that the overall value of the pool remains stable. Now, here's where it gets interesting. Traders are incentivized to provide liquidity to these pools by earning fees on transactions. Whenever someone swaps tokens, a small fee is charged, and this fee is distributed among the liquidity providers based on their share in the pool. It's like getting a little kickback for helping keep the trading ecosystem running smoothly.

Now, here's where it gets interesting. Traders are incentivized to provide liquidity to these pools by earning fees on transactions. Whenever someone swaps tokens, a small fee is charged, and this fee is distributed among the liquidity providers based on their share in the pool. It's like getting a little kickback for helping keep the trading ecosystem running smoothly.

The Beauty of Decentralization

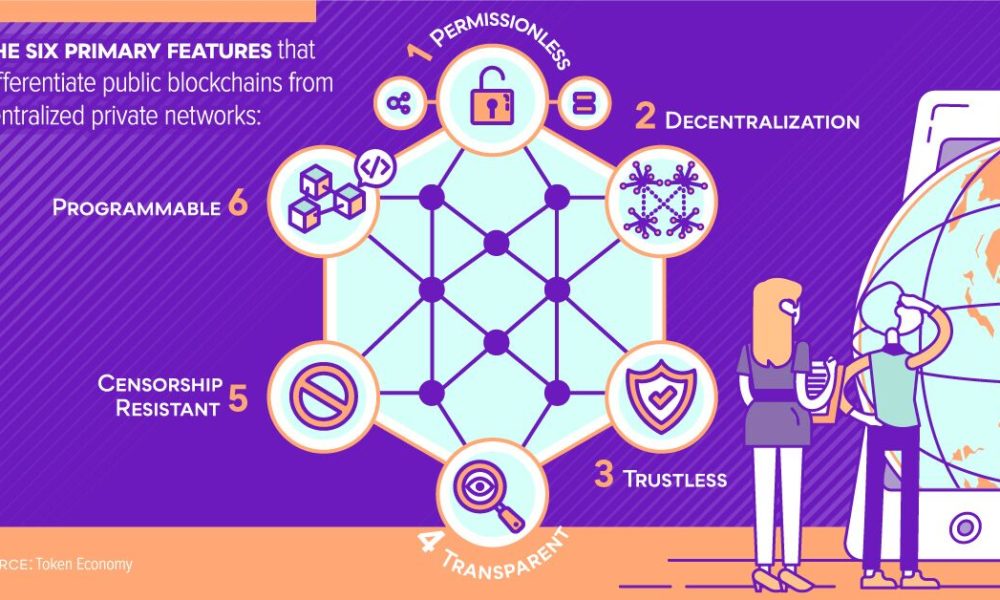

One of the key advantages of liquidity pools is decentralization. Unlike traditional exchanges where a central authority controls the trading process, liquidity pools operate on blockchain networks through smart contracts. This means that traders have more control over their assets, reducing the risk of hacking or fraud.

Decentralized finance (DeFi) has embraced liquidity pools with open arms, giving users the power to trade and provide liquidity without the need for a middleman. It's like taking the power back from the big financial institutions and handing it to the people – a concept that resonates with the core principles of cryptocurrency.

Challenges and Risks

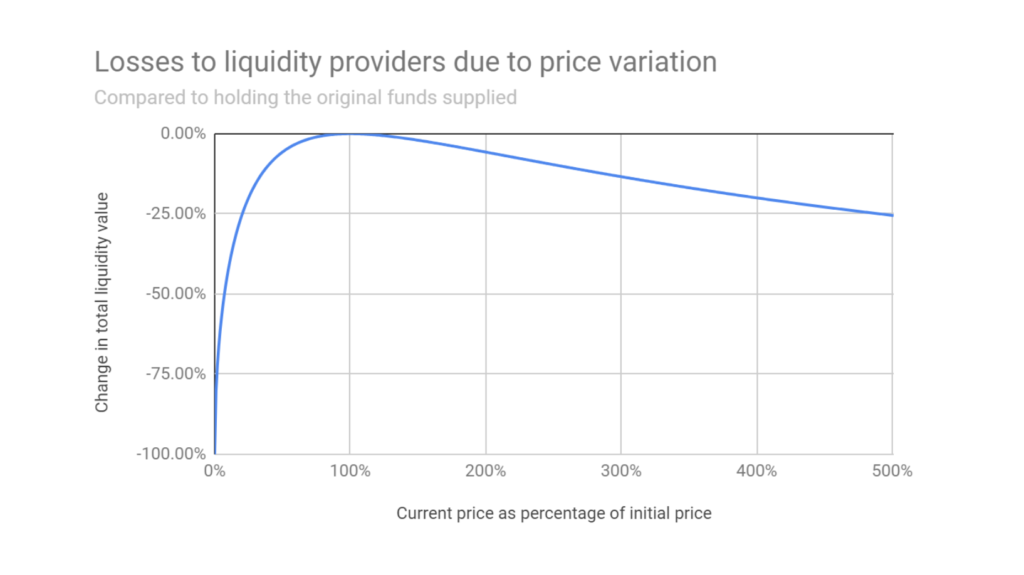

Of course, no system is perfect, and liquidity pools have their fair share of challenges. Impermanent loss, for instance, occurs when the value of the tokens in the pool changes compared to when they were initially added. Traders may end up with fewer assets than they initially contributed. Additionally, the smart contract code governing liquidity pools must be secure. Any vulnerabilities can be exploited, leading to potential losses for liquidity providers. It's crucial for participants to do their due diligence and choose reputable platforms for engaging in liquidity pools.

Additionally, the smart contract code governing liquidity pools must be secure. Any vulnerabilities can be exploited, leading to potential losses for liquidity providers. It's crucial for participants to do their due diligence and choose reputable platforms for engaging in liquidity pools.

In Conclusion

Crypto liquidity pools are like the beating heart of decentralized finance. They enable seamless trading, empower users, and provide a way for people to earn passive income through fees. As the cryptocurrency landscape continues to evolve, liquidity pools are likely to play an increasingly significant role in shaping the future of decentralized finance. So, buckle up – we're in for an exciting ride in the world of liquidity pools!

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)