Unraveling the March Surge: Cryptocurrency Spot Volume Insights

Today, we’re diving deep into the thrilling world of cryptocurrency trading, specifically focusing on the jaw-dropping surge in spot volume that occurred in March. Brace yourselves for an exhilarating ride as we unravel the mysteries behind this unprecedented milestone of reaching $2.5 trillion in spot volume.

March Madness: A Surge in Crypto Spot Volume

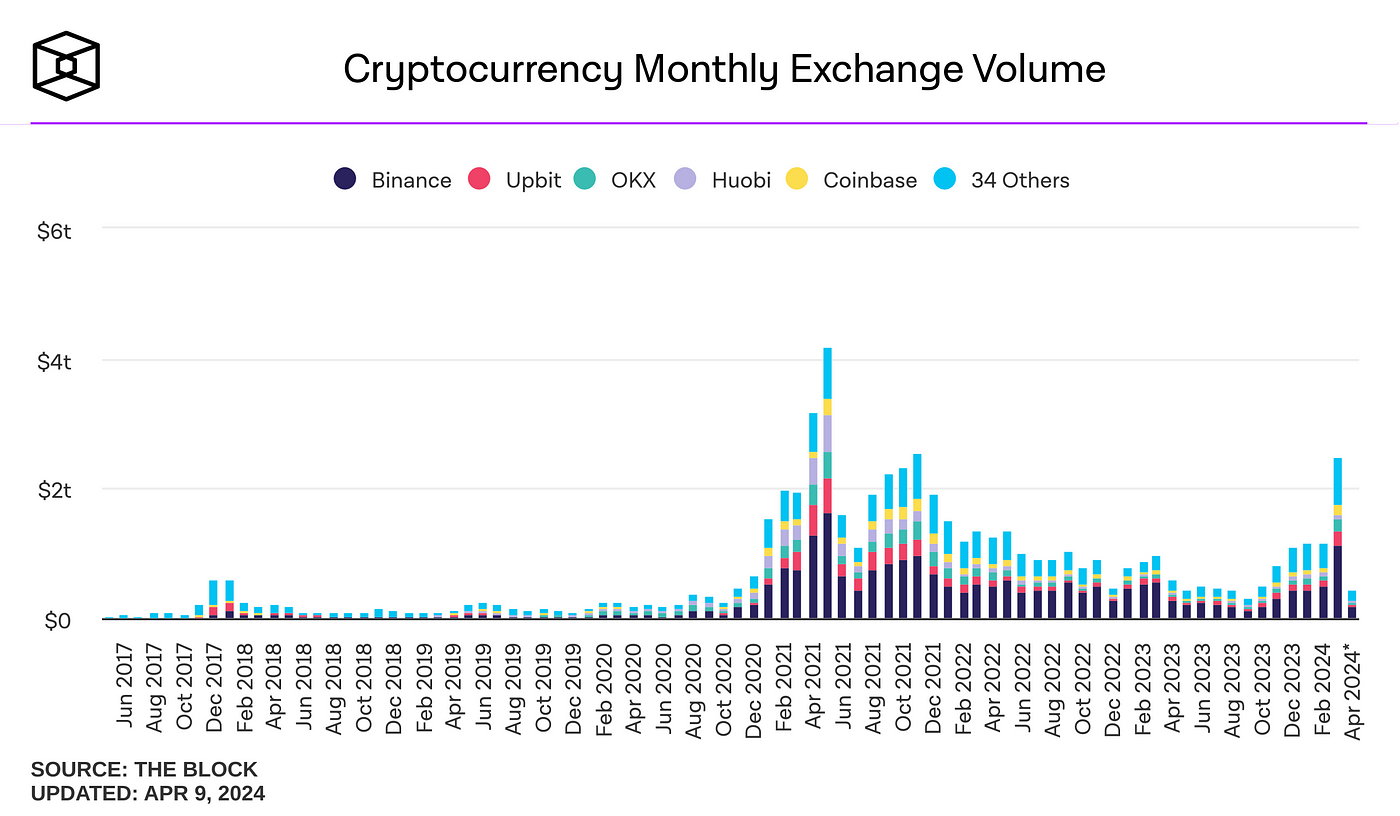

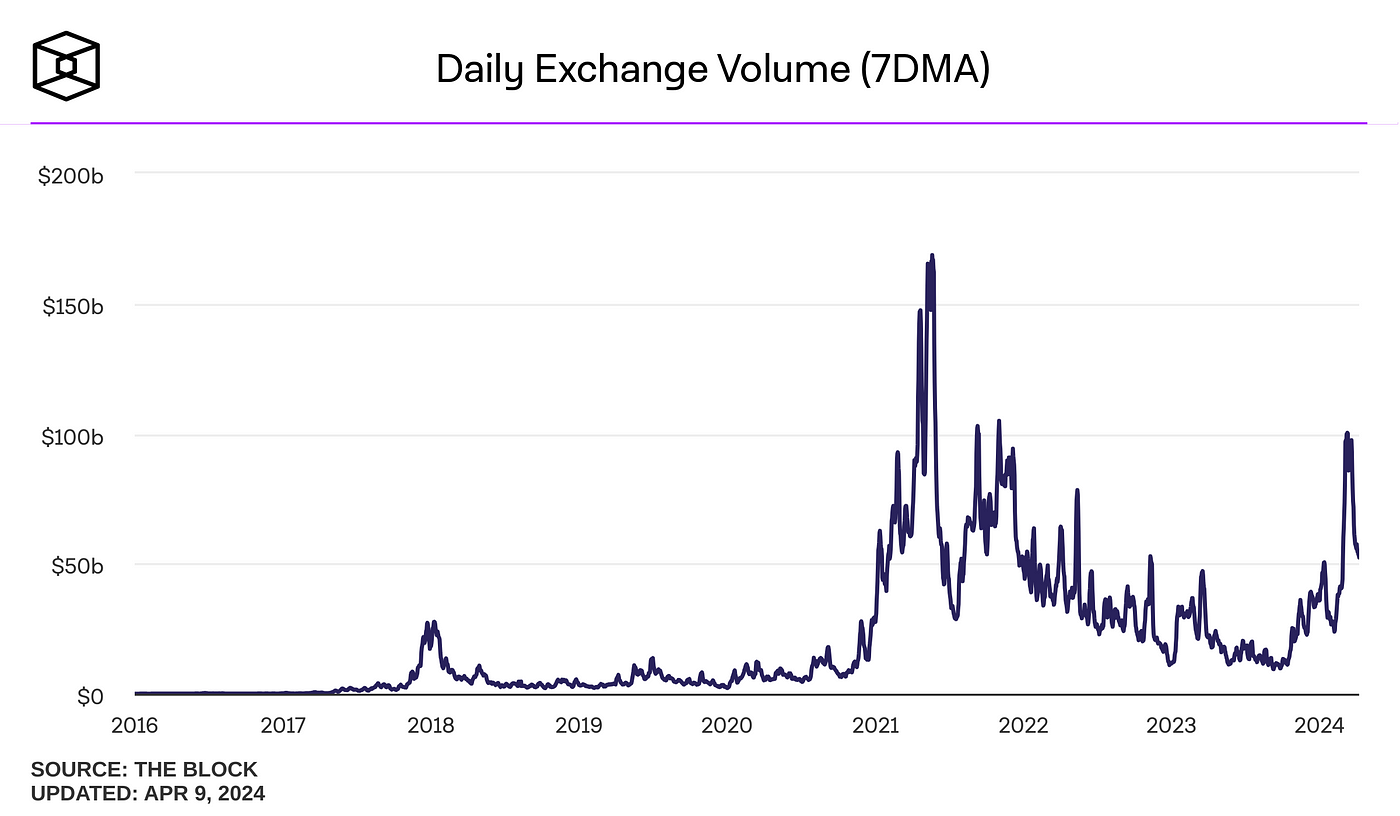

March wasn’t just another month in the crypto realm; it was a whirlwind of activity that left traders and analysts alike buzzing with excitement. Picture this: the monthly spot volume on centralized crypto exchanges soared to unimaginable heights, more than doubling compared to previous months. It’s like witnessing a rocket launch, except this time, it’s the crypto market shooting for the stars.

So, what exactly fueled this explosive growth in spot volume? Well, hold onto your seats as we delve into the factors that ignited this trading frenzy. From Bitcoin’s stellar performance to the introduction of spot Bitcoin ETFs, there were plenty of catalysts propelling the market forward. And boy, did it make waves!

Now, let’s talk numbers. March witnessed a monumental milestone as spot volume skyrocketed to a staggering $2.5 trillion. Yes, you read that right — trillion with a ‘T’. It’s a feat that hasn’t been achieved since 2021, marking a historic moment in the world of cryptocurrency trading. But what does this mean for the market as a whole? Join us as we dissect the implications of this monumental achievement and what it signifies for the future of crypto trading.

Creating a crypto exchange platform in today’s market presents a rewarding opportunity to capitalize on the surging demand for digital asset trading. With spot volume reaching record highs and the cryptocurrency market poised for continued growth, establishing an exchange offers the potential for substantial returns and industry influence.

Insights into the Doubling of Spot Volume

But wait, how did we get here? Let’s rewind and take a closer look at the journey leading up to this monumental surge in spot volume. From humble beginnings in September 2023 to steady growth throughout December and January, the stage was set for March to make its grand entrance.

It wasn’t just a sudden spike out of nowhere; it was a culmination of gradual progress and increasing momentum. Each month paved the way for the next, laying the groundwork for March to steal the spotlight. And boy, did it deliver!

Tracking the rise in spot volume is like watching a suspenseful thriller unfold. With each passing day, anticipation mounts as traders eagerly await the next twist in the plot. And when March finally arrived, it didn’t disappoint. The surge in spot volume was nothing short of exhilarating, leaving everyone on the edge of their seats.

Understanding the Significance of Reaching $2.5 Trillion in Spot Volume

Now, let’s talk turkey — or should I say, crypto? Reaching $2.5 trillion in spot volume isn’t just a number on a screen; it’s a testament to the resilience and vitality of the cryptocurrency market. It’s a symbol of the growing acceptance and adoption of digital assets on a global scale.

But beyond the numbers lies a deeper significance. It represents a milestone in the journey towards mainstream recognition and legitimacy for cryptocurrencies. It’s a signal to the world that the era of digital finance is here to stay, and it’s only just getting started.

Riding the Wave: Tracking the Rise in Monthly Spot Volume

Let’s take a journey through time, tracing the trajectory of monthly spot volume from humble beginnings in September 2023 to the explosive heights of March 2024. It’s like watching a seed grow into a towering tree, each month building upon the last to form a sturdy foundation for what was to come. From the lows of September, where spot volume languished around $324 billion, to the steady climb throughout December and January, the stage was set for March to steal the spotlight.

As the months passed, so did the anticipation, with traders eagerly awaiting the next twist in the plot. And when March finally arrived, it didn’t disappoint. The gradual increase in spot volume leading up to this monumental month was akin to a slow-burning fire, steadily gaining momentum until it erupted into a blazing inferno. It was a testament to the resilience and vitality of the cryptocurrency market, a sign that the era of digital finance was here to stay.

The March Momentum: Unveiling the Surge in Trading Volume March was no ordinary month in the world of cryptocurrency trading; it was a whirlwind of activity that left traders and analysts alike buzzing with excitement. The surge in trading volume during March was nothing short of exhilarating, propelled by a combination of factors that set the stage for a perfect storm. Bitcoin’s price movements played a pivotal role, with the leading cryptocurrency breaking past its previous cycle peak and setting off a chain reaction throughout the market.

March was no ordinary month in the world of cryptocurrency trading; it was a whirlwind of activity that left traders and analysts alike buzzing with excitement. The surge in trading volume during March was nothing short of exhilarating, propelled by a combination of factors that set the stage for a perfect storm. Bitcoin’s price movements played a pivotal role, with the leading cryptocurrency breaking past its previous cycle peak and setting off a chain reaction throughout the market.

Market Leaders: Dominance in Spot Trading Volume

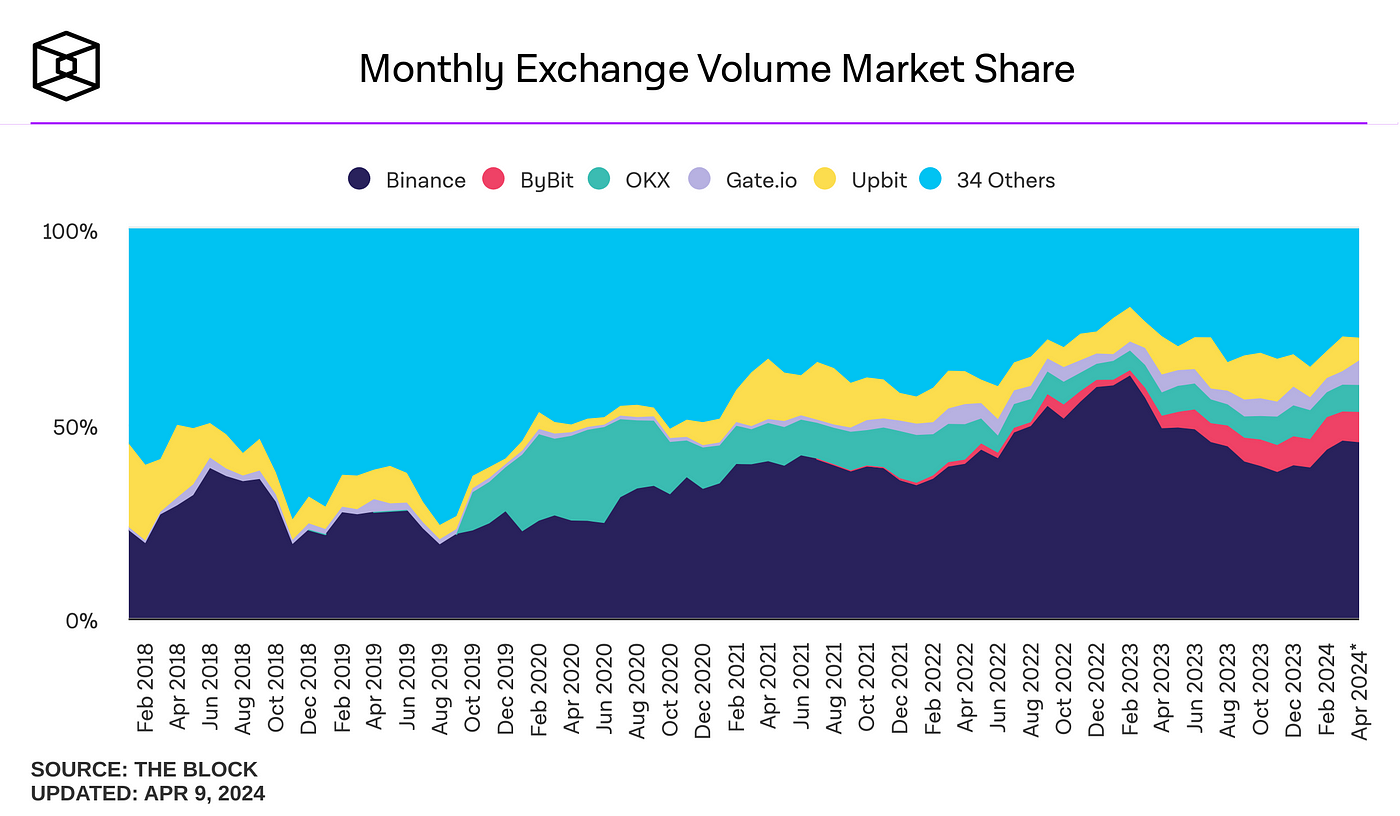

When it comes to the cryptocurrency market, there are some big players making waves, none more so than Binance. With a commanding market share of 45.5% and a staggering $1.1 trillion in monthly spot volume for March, Binance has firmly established itself as the leader in the realm of spot trading. But Binance isn’t alone in the spotlight; other exchanges have also made significant contributions to the surge in spot volume. From Upbit and Bybit to OKX and Coinbase, these exchanges have all played their part in shaping the landscape of crypto trading. Together, they represent the driving force behind the record-breaking $2.5 trillion spot volume seen in March, highlighting the diversity and dynamism of the cryptocurrency market.

Futures on Fire: Exploring the Rise in Bitcoin Futures Trading

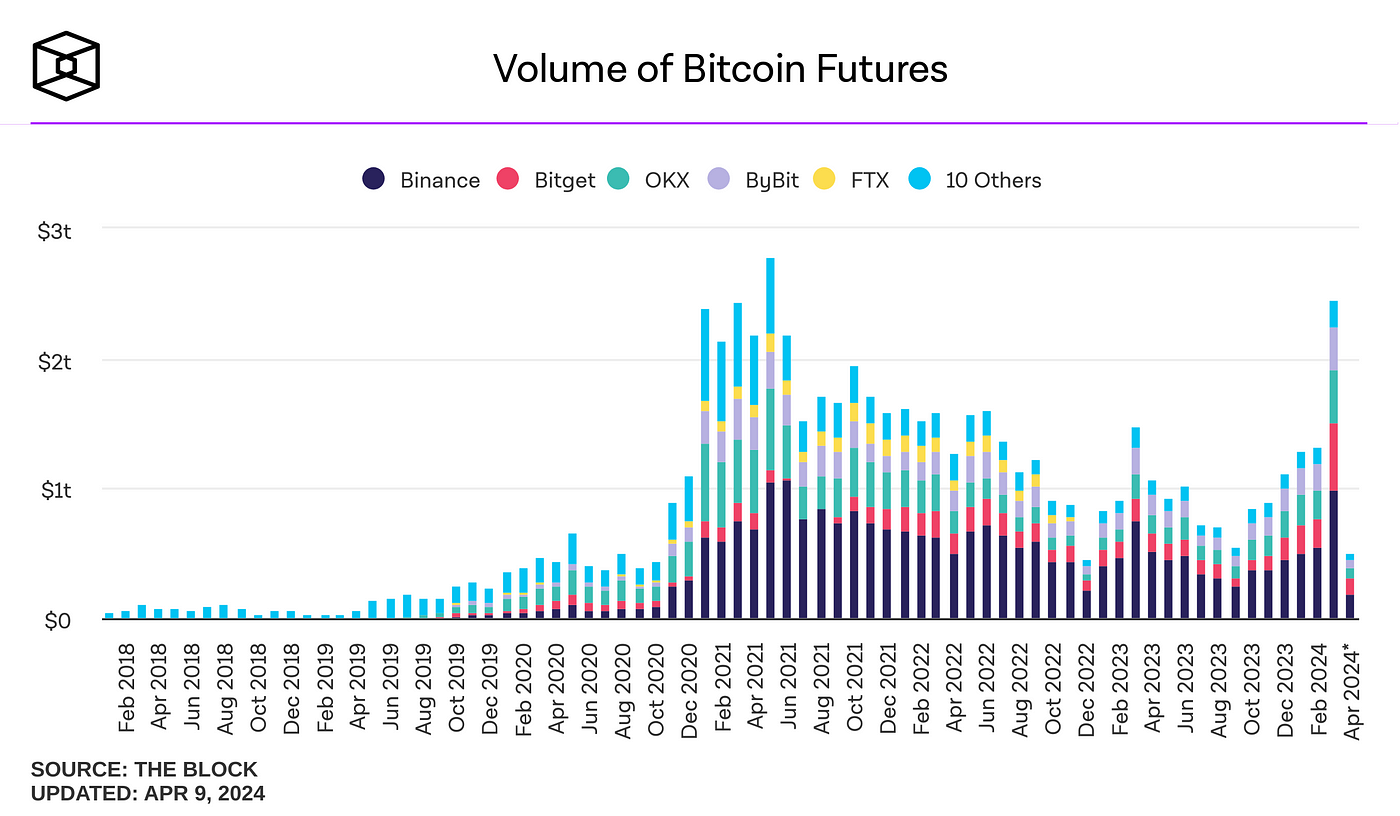

While spot trading may have stolen the show in March, let’s not forget about the explosive growth happening in the world of bitcoin futures trading. March witnessed a significant increase in monthly bitcoin futures volume, reaching nearly $2.5 trillion. This surge in futures trading volume is a clear indicator of the growing interest and confidence in bitcoin as an investment vehicle. But how does March’s figure compare to historical data? Well, it’s worth noting that March’s volume is the second-highest on record, surpassed only by the $2.8 trillion generated in May 2021. This highlights the resilience and enduring appeal of bitcoin futures as a key component of the cryptocurrency market. As we continue to ride the wave of crypto enthusiasm, it’s clear that both spot and futures trading are integral to the vibrant ecosystem of digital assets.

Binance Leads the Way: A Closer Look at Bitcoin Futures Volume When it comes to bitcoin futures trading, one name stands out above the rest: Binance. With a market share of 40% and a staggering $983 billion in bitcoin futures volume for March, Binance has solidified its position as the leader in this arena. But what sets Binance apart from the competition? Well, for starters, it boasts a user-friendly interface, robust security features, and a wide range of trading options, making it the go-to choice for both novice and experienced traders alike. But Binance isn’t the only player in town; other exchanges such as Bitget and OKX have also made significant contributions to the surge in bitcoin futures trading. Together, these exchanges form the backbone of the cryptocurrency market, driving innovation and shaping the future of digital asset trading.

When it comes to bitcoin futures trading, one name stands out above the rest: Binance. With a market share of 40% and a staggering $983 billion in bitcoin futures volume for March, Binance has solidified its position as the leader in this arena. But what sets Binance apart from the competition? Well, for starters, it boasts a user-friendly interface, robust security features, and a wide range of trading options, making it the go-to choice for both novice and experienced traders alike. But Binance isn’t the only player in town; other exchanges such as Bitget and OKX have also made significant contributions to the surge in bitcoin futures trading. Together, these exchanges form the backbone of the cryptocurrency market, driving innovation and shaping the future of digital asset trading.

Market Trends: Current Status of Cryptocurrency Prices

Now, let’s shift our focus to the current status of cryptocurrency prices. As of now, Bitcoin is trading at $66,112, marking a 2% increase over the past month. But what about the GMCI 30 index, representing a selection of the top 30 cryptocurrencies? Well, it gained over 15% in the past month, settling at 144.66. However, recent fluctuations in cryptocurrency prices have left investors on edge, with Bitcoin experiencing a 6% decrease over the last week. But fear not, fellow crypto enthusiasts, for volatility is the name of the game in this ever-changing market. As we navigate the ups and downs of cryptocurrency prices, it’s important to stay informed and keep a close eye on market trends. After all, knowledge is power when it comes to making informed investment decisions in the world of digital assets.

It’s Time to Create a Crypto Exchange Now

Are you ready to dive into the world of cryptocurrency and make your mark? Now is the perfect time to create your very own crypto exchange and ride the wave of the booming market. With spot volume doubling in March and reaching a staggering $2.5 trillion, the demand for crypto trading platforms has never been higher. But how can you seize this opportunity and capitalize on the surge in crypto trading?

Seizing Opportunities: Capitalizing on the Surge in Crypto Trading

The surge in crypto trading volume presents a golden opportunity for new exchanges to enter the market and carve out their niche. With demand soaring and interest in cryptocurrencies at an all-time high, there’s never been a better time to launch a new exchange. But how can you make your exchange stand out in a crowded market? By leveraging the current market conditions and implementing innovative strategies, you can position your exchange for success.

Now, let’s talk strategy. One approach is to focus on user experience and interface design, ensuring that your platform is intuitive and easy to use for both novice and experienced traders. Another strategy is to offer unique features and functionalities that set your exchange apart from the competition. Whether it’s advanced trading tools, customizable dashboards, or innovative security features, finding ways to differentiate your exchange can attract users and drive growth.

Innovation in Action: Building a Unique Crypto Exchange Platform

Innovation is the name of the game in the world of cryptocurrency exchanges. With competition heating up and new exchanges entering the market every day, it’s essential to stay ahead of the curve and continually innovate. One way to do this is by focusing on technological advancements and incorporating cutting-edge solutions into your platform. Whether it’s integrating blockchain technology, implementing artificial intelligence algorithms, or enhancing security protocols, investing in innovation can set your exchange apart and attract users.

But innovation isn’t just about technology; it’s also about creativity and outside-the-box thinking. By thinking outside the box and exploring new ideas, you can uncover untapped opportunities and find unique ways to add value for your users. Whether it’s launching a new trading feature, partnering with other industry players, or exploring new markets, innovation is the key to success in the dynamic world of cryptocurrency exchanges.

Navigating Challenges: Overcoming Hurdles in Establishing an Exchange

Launching a crypto exchange may seem like an enticing venture, but it comes with its fair share of challenges. From navigating complex regulatory landscapes to building trust and credibility among users, there are numerous hurdles that new exchange startups must overcome. One common challenge is ensuring robust security measures to protect user funds and data from potential breaches and cyber attacks. Additionally, gaining liquidity and attracting users in a competitive market can be daunting tasks. However, by implementing thorough risk management strategies, adhering to regulatory compliance, and fostering transparent communication with users, these challenges can be effectively addressed.

Aspiring exchange entrepreneurs can take proactive steps to mitigate risks and increase the likelihood of success. Conducting comprehensive market research to identify niche opportunities and unmet needs can inform strategic decision-making and product development. Building strong partnerships with reputable financial institutions and regulatory bodies can also bolster credibility and facilitate growth. Moreover, investing in user education and support services can foster trust and loyalty, ultimately driving user acquisition and retention.

The Road Ahead: Embracing the Future of Crypto Trading

Looking ahead, the future of crypto trading holds immense promise and potential. As blockchain technology continues to evolve and mature, we can expect to see innovative solutions and advancements in the crypto exchange landscape. Decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and tokenization of assets are just a few areas poised for growth and disruption. However, alongside these opportunities come regulatory challenges and uncertainties.

Regulatory changes and enforcement actions are increasingly shaping the operating environment for crypto exchanges. From anti-money laundering (AML) and know your customer (KYC) requirements to tax regulations and licensing frameworks, compliance is paramount for long-term sustainability. Embracing regulatory compliance as an opportunity rather than a hindrance can position exchanges for legitimacy and trust in the eyes of users and regulators alike.

Conclusion

In conclusion, the surge in crypto exchange spot volume doubling to a monumental $2.5 trillion in March 2024 signifies not only the resilience and vitality of the cryptocurrency market but also the immense opportunities it presents for entrepreneurs and investors alike. While establishing a new exchange comes with its share of challenges, from regulatory compliance to market competition, proactive strategies and innovative approaches can pave the way for success. As we navigate the future of crypto trading, embracing technological advancements and regulatory changes will be key in shaping the landscape and ensuring the continued growth and evolution of the industry. With determination, strategic planning, and a commitment to excellence, the possibilities for innovation and advancement in the world of cryptocurrency are limitless.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)