An Overview of NFT Collections specific tokens by Flooring Protocol

A Bitcoin Rock Ordinal and Ethereum Rock NFT were sold for over $100K this morning. This particular sale occurred after a long gap, reminiscent of the time when the Ethereum Rock initiated a massive NFT bull run. Now, you may wonder about the chances of another NFT bull run this time. I would suggest checking out NFT sales data from the past two months. When you do, you'll be surprised to find that NFTs have started recovering, with some specific gaming NFTs experiencing significant gains in recent weeks.

Early onchain traction favor the possibility of the next NFT bull cycle. If that cycle occurs, it could be much bigger than the last one, with better price liquidity, more market participants, and much-improved NFT collections. I believe the next NFT bull run will be led by art collectibles and gaming assets.

NFTs have failed to capture the attention of token traders in the previous cycle, as traders are not really interested in JPEGs and need a tradable asset with deep liquidity to make life-changing money.

A couple of protocols have attempted to create liquidity in NFT collections by fractionalizing them and issuing ERC20 tokens against them. NFTX is one such marketplace that gained early traction in the last bull market.

Flooring Protocol

While the NFT market has been in decline for a long time, innovations are emerging to solve existing liquidity issues in NFTs. Flooring Protocol is one such platform that introduced a novel way to issue ERC20 tokens against the fractionalization of NFTs.

https://x.com/waleswoosh/status/1714257050534900134?s=20

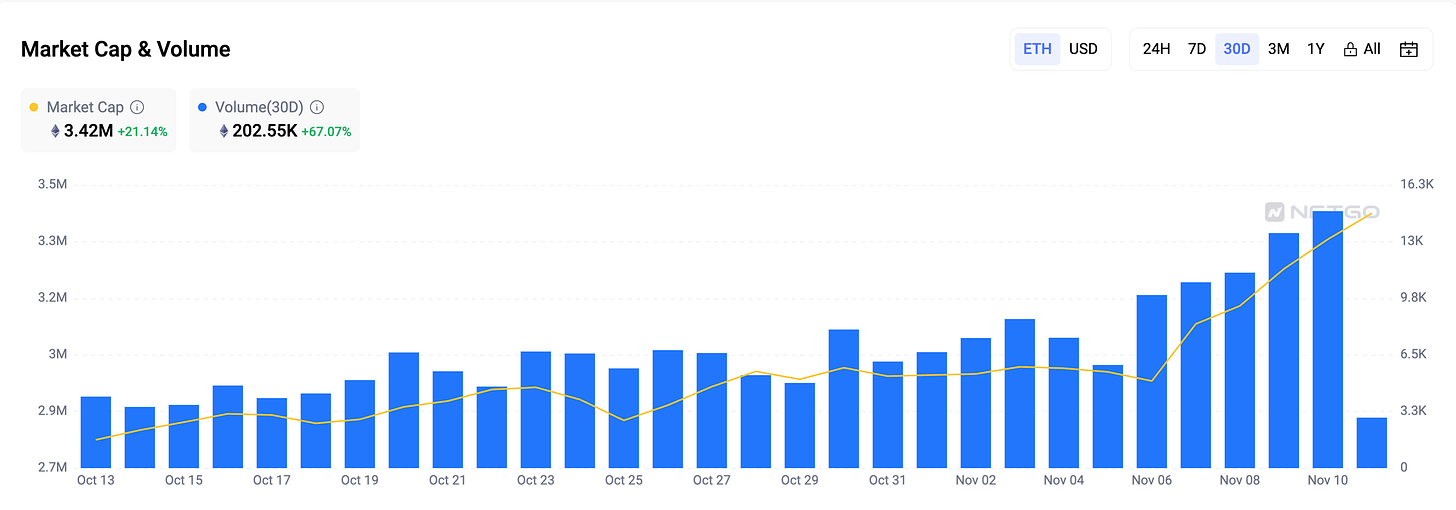

The Flooring Protocol managed to capture 25% of the daily Ethereum NFT volume within a month since its launch.

https://x.com/eekeyguy_eth/status/1722939725248622653?s=20

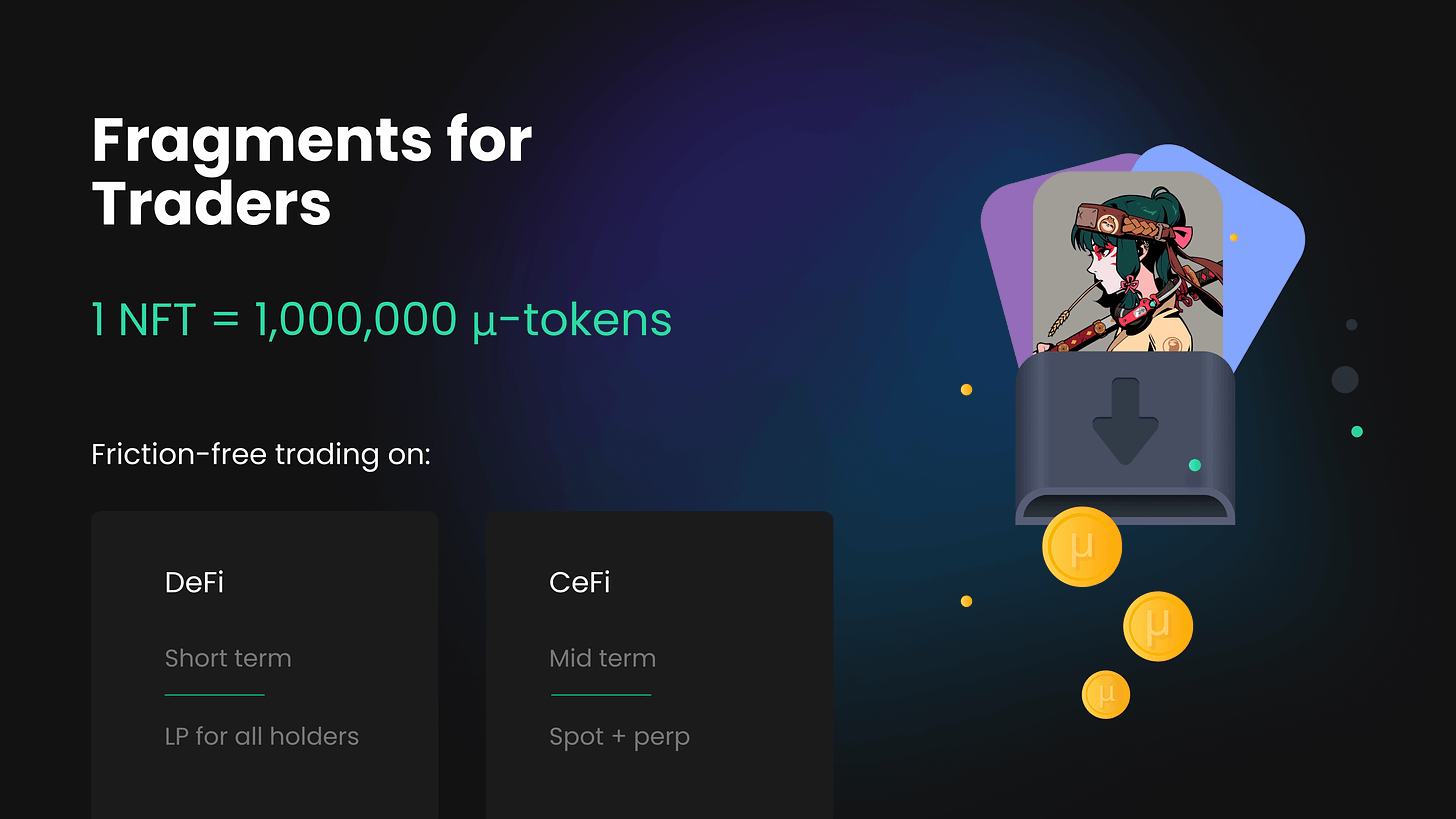

NFT holders can deposit their NFTs in the Flooring Protocol smart contract and mint 1M µ-Tokens against their NFT. µ-Token is an ERC20 token representing a particular NFT collection.

Flooring Protocol also provides a DEX to trade these tokens; you can even trade them on UniSwap V3. Liquidity can also be provided to these pairs on the Flooring Protocol to generate attractive yields.

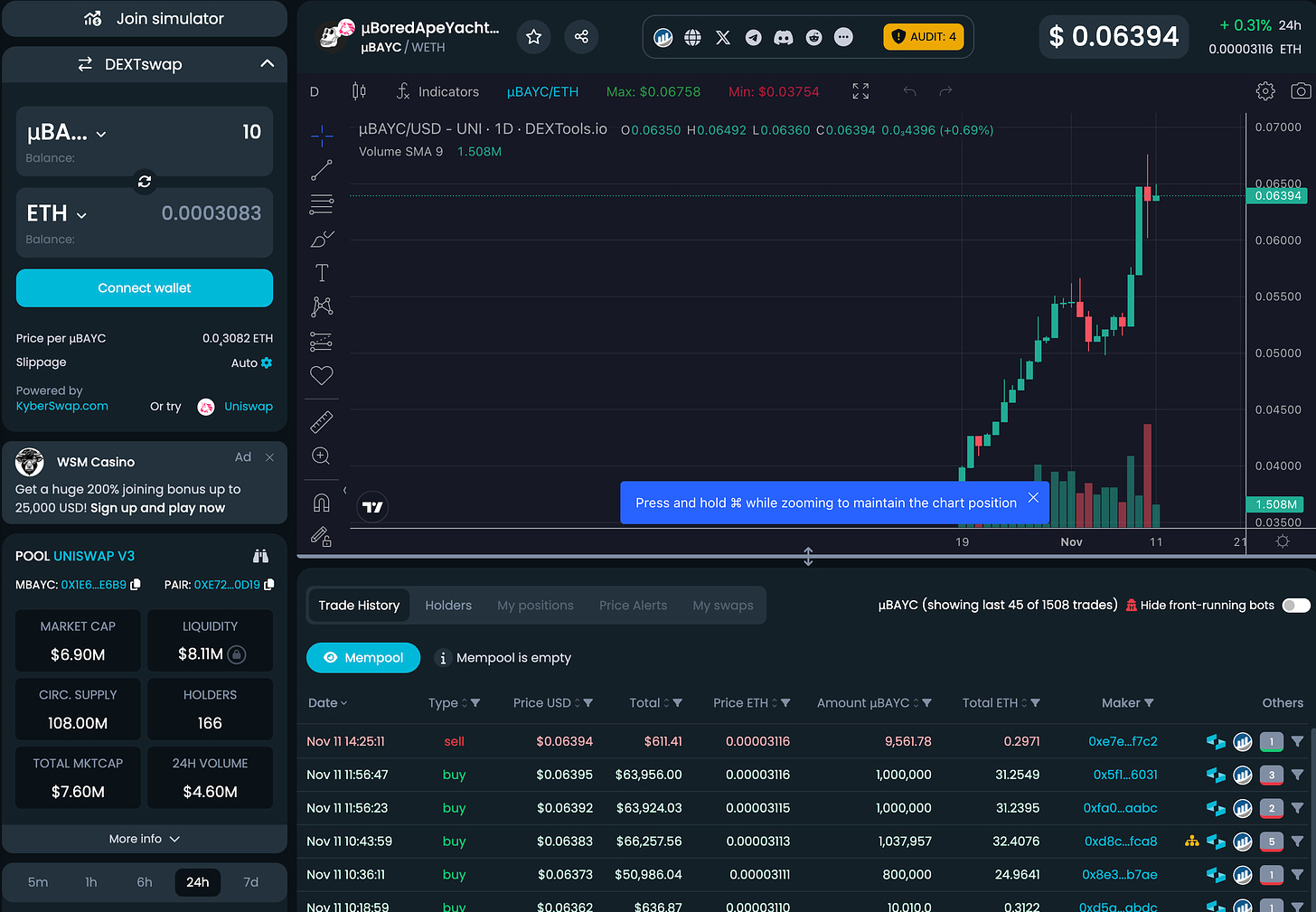

There are around 25 µ-Tokens listed on the Flooring Protocol, with µBayc representing BAYC as the most liquid asset with over $8M in TVL and $4.6M in 24-hour volume.

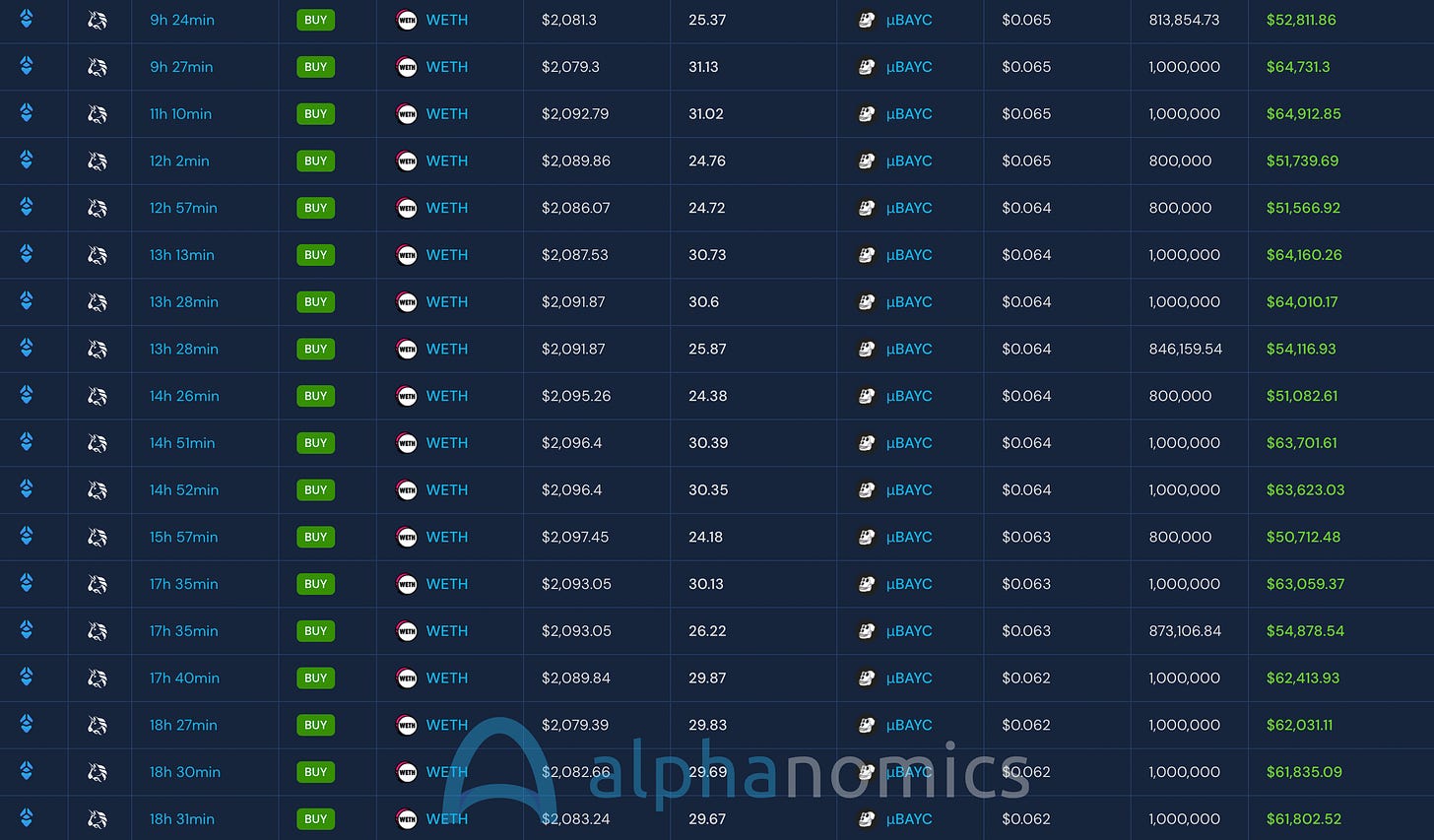

µBAYC has also been heavily accumulated by some whales in the past few days.

The price appreciation of these µ-Tokens is directly related to the floor price growth of related NFT collections. If the floor price of BAYC goes from 32ETH to 64ETH in the coming weeks, then the µBAYC price will also double.

Floor Protocol also has a native token: $FLC, which you can farm by providing liquidity in different pools on the Flooring Protocol. The $FLC token is the native currency that powers the Flooring Protocol ecosystem, unlocking and fueling customized platform utilities for all users.

Conclusion

The purpose of writing this blog on Flooring Protocol is to make you aware that NFTs will come back at some point in time, and now there is a new way of trading them like ERC20 tokens where you don't need to worry about liquidity problems. You can also take positions in µ-Tokens at the lowest cost possible, potentially making decent returns when NFT boom again.

![[LIVE] Engage2Earn: Dutton = MAGA](https://cdn.bulbapp.io/frontend/images/e12661b2-74fa-4cd8-b554-51be7f6fec4f/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)