Is it worth it to create multi-accounts for airdrops?

Crypto projects often do airdrops and give away their tokens for free.

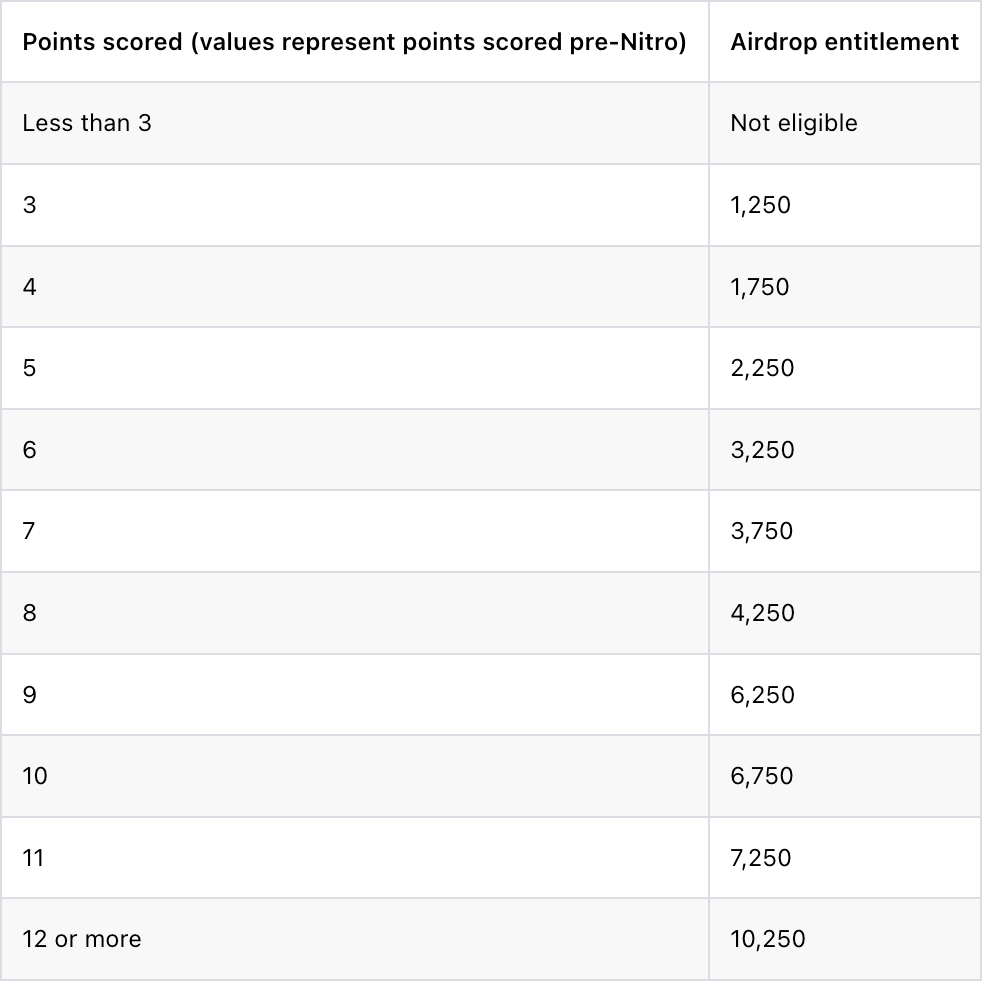

Sometimes they give away thousands of dollars per wallet. For example, Arbitrum airdropped from 1,250 to 10,250 tokens to 625,000 users, and now $ARB is trading at ~1$ per token.

If you’re considering this form of investment, you’ll probably think:

Why don’t I just create multiple wallets and get 10x more reward?

That was exactly what I thought for myself.

I started digging into that and figured out, that some projects will ban you for multi-accs. Not great.

In this article, I will cover:

- When is it worth it to create multi-accounts for airdrops

- Why multi-accs are good for an ecosystem

- How multi-accs might get detected and how to avoid it

Let’s dive in!

Is it worth it to create multi-accounts for airdrops?

Multi-accounts are not always profitable.

There are two types of airdrops:

- Task-based

- Wallet-based

If the project airdrops you tokens for X interactions, there’s no point in creating multiple accounts. You can simply do all your tasks on a single wallet and get the same amount of money.

Task-based airdrop example: Blur

Blur is an NFT marketplace that announced “Farming seasons” to encourage people to do more NFT bids, listings, and lending activity.

The more activity and volume you made, the more tokens you would receive.

Someone got $8.4m in Blur during that airdrop on his single wallet.

So it’s pretty simple — focus on activity on a single account and get bigger rewards.

Wallet-based airdrop example: Arbitrum

Arbitrum, on the other hand, airdropped its tokens to a fixed amount of wallets — 625,000.

Of course, particular conditions increased the amount of tokens you could get in your wallet. But those conditions grow unevenly compared to the reward.

Arbitrum used a points system, where 1 point would give you ~500 extra tokens.

Let’s say you created your account early. You already farmed 3 points and want to get some more:

- To get one more, you would need to bridge $10k of assets

- To get the second one, you needed to bridge $50k of assets

- The third one would require you to bridge $250k of assets

The crazy $240k difference in assets would only give you 1000 more tokens. https://docs.arbitrum.foundation/airdrop-eligibility-distribution

https://docs.arbitrum.foundation/airdrop-eligibility-distribution

But what if you would use those $240k to get 1 point for 24 other accounts?

It would grant you 500 * 24 = 12.000 tokens, which is 12x more profitable.

That works for many projects and many types of activity. It’s generally better to have 10 accounts with 50 transactions each than to have 1 account with 500 transactions.

No surprise, conditions like that stimulate users to create multiple accounts.

Are multi-accs bad for an ecosystem?

Yes and no.

Some projects say this is an abuse and a form of “Sybil attack”.

A Sybil attack is a type of attack in which an attacker creates a large number of identities and uses them to gain a unfairly large influence.

In the context of airdrops, Sybils are the users who interact with the blockchain to get the maximum reward.

Why is it “bad”?

Every project wants to have as many users as possible.

And if there’s a choice between having 100 users with one wallet and having 1 user with 100 wallets, they would want 100 users.

Plus it feels better to publicly say that most of your users are real people, and not just multi-accs.

However, the real impact of multi-access on the blockchain is rather positive, and that’s why:

Multi-acc users bring more value to the blockchain than regular users

Do you know what’s better than 100 users with one wallet each?

— 100 users with 1000 wallets, each generating transactions and bringing more liquidity to the ecosystem.

What matters for Arbitrum, Starknet, ZkSync, and others?

— Liquidity, interactions, and developers.

What brings more developers?

— Customers that pay money.

Developers don’t care if you spend $10k from one wallet or $1k from 10 different wallets.

Multi-acc users are more interested in projects

Multi-acc users are not just users. They’re investors, who bring money to the project, hoping to get good returns.

That means they will follow your social media and keep an eye on the latest updates. They will use multiple DEX and sponsor their developers. They will bring liquidity to the market and buy NFTs.

They’re 100x users for the project.

The only reason they’re doing all that activity from 100 wallets, and not from a single one — because projects made it more profitable by introducing wallet-based rewards.

Remember the Blur guy who made $8.4m during the farming season?

Wouldn’t that be stupid if Blur punished him for doing so much activity?

Because that’s exactly what many projects do, or at least say they do.

There are exceptions, though. Starknet Ecosystem Lead said during the interview, that 90% of transactions in the network are made by bots, and they’re okay with that.

How multi-accs are detected?

Blockchain makes it much harder to track users’ interactions:

- It’s not possible to track the IP address of the particular wallet

- It’s not possible to get the user’s browser or operating system based on his blockchain activity

- You can’t use cookie files for tracking

However, there are still a few ways to detect multi-accs users.

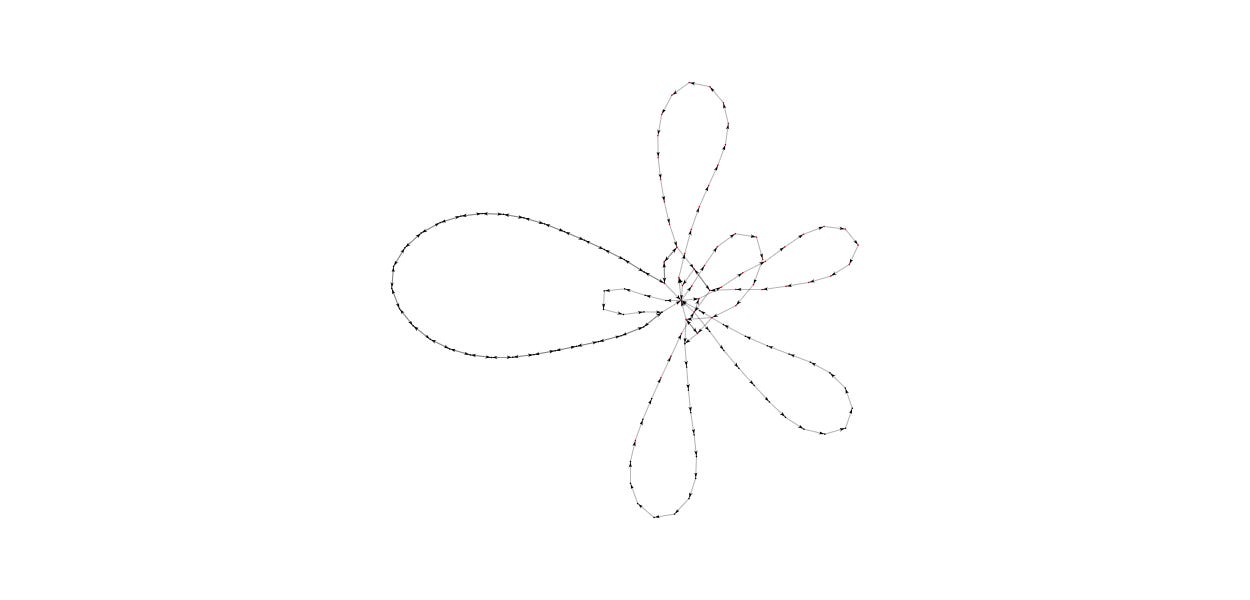

Transfer-based clustering

This one was used and described by Arbitrum.

How exactly does it detect sybils?

If you’re an owner of 100 accounts and you generate transactions and volume for them, you will need some amount of money.

Example #1:

- Add $100 to the Account #1

- Make 10 swaps with those $100 (or any other activity)

- Transfer the money to the Account #2

- Make another 10 swaps

- Transfer to the Account #3

- …

In this case, wallets transfer money between each other, which creates an obvious cluster. The creators of Arbitrum would consider that a Sybil attack.

You can see this “sequential” pattern in this image: Cluster 1544 with 56 eligible addresses. Source: Arbitrum

Cluster 1544 with 56 eligible addresses. Source: Arbitrum

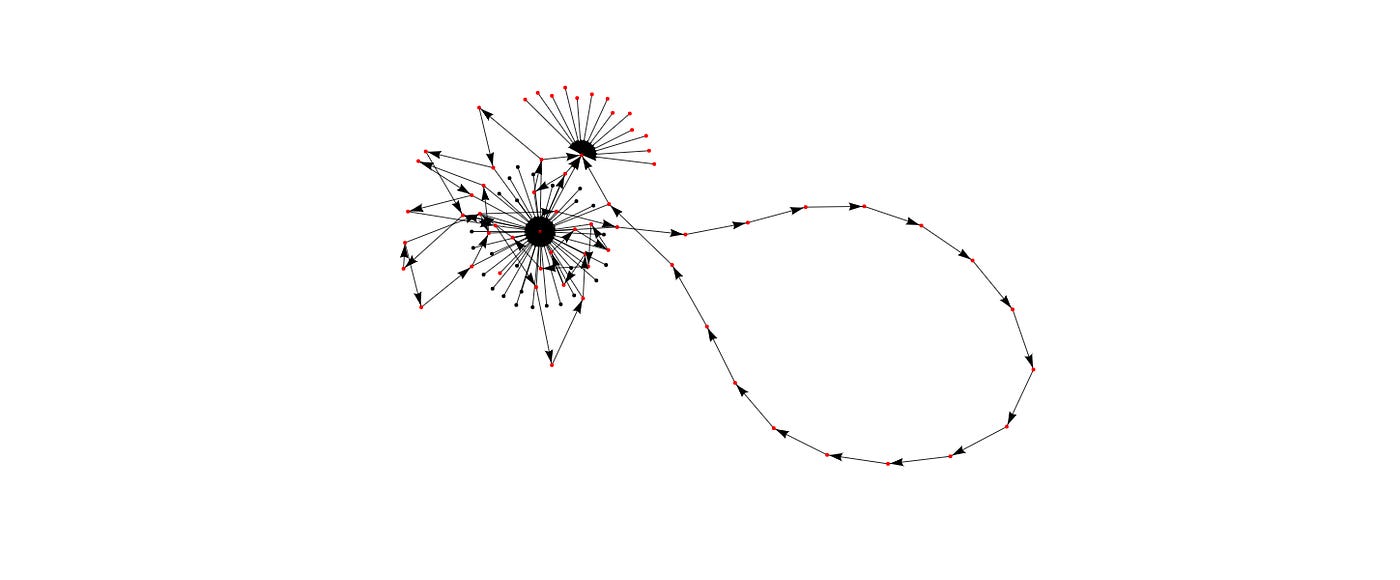

Example #2:

- Fund the main wallet with $10,000

- Send $100 to each of your 100 accounts

- Make 10 swaps on each of them

- Transfer money from all of these 100 accounts to the main one to have $10,000 again

This is another way to get detected because all wallets are connected through one wallet from step #1.

Here’s what this “parent-children” pattern would look like: Cluster 3316 with 65 eligible addresses. Source: Arbitrum

Cluster 3316 with 65 eligible addresses. Source: Arbitrum

How to avoid this type of clustering?

All you need is to avoid connections between your wallets. You can use crypto exchanges that provide multiple wallet addresses for funding. For example, OKX with its sub-accounts.

In that case, your activity would look like this:

- Deposit your $10,000 to the exchange balance

- Send $100 for each of your 100 accounts

- Make 10 swaps on each of them

- Create 100 unique deposit wallets that will point to your exchange account

- From each of your wallets, transfer $100 to the unique deposit wallet

- Safely withdraw $10,000 from your exchange balance anywhere you want

Activity-based clustering

If you have 100 wallets that interact with the same smart contracts in the same order with the same balance — it’s easy to get detected.

The simple solution is to make your interactions random and natural.

Instead of sending similar transactions, pick 10–15 different smart contracts and interact with them in different order.

IP, cookie, and browser tracking

Some airdrop farmers try to bypass classic web2 tracking, like IP address tracking or browser cookie files.

In most cases, this is just not possible. If a protocol is truly decentralized, it will never track your data. It just won’t appear on the blockchain.

However, some projects do a trick: they create some centralized entity (like a website) that collects users’ data, allowing owners to detect multi-acc owners.

This happened to the APTOS. They couldn’t track users’ activity on-chain, but they integrated a tracking system into the token-claiming process.

They announced that they would sort out the users who use multiple wallets from the same IP address.

The Aptos Foundation also used certain measures to try to eliminate bots or otherwise suspicious accounts. Users where the community platform account had over 20 wallets connected, or had an IP address that was shared with more than 20 other accounts, are not eligible for the airdrop.

So this is something to keep in mind, even if the chance is really low.

And when I automate airdrop farming, I always check that website actions are not tracked anyhow.

It’s a good practice to listen to the community as well since people often share when they find things like that.

Things to keep in mind

- Each project is unique and has its own rules. Listen to the community, do your research, and keep an eye on your project’s social media.

- Be careful sharing your account addresses. You don’t need this risk.

- Eligibility conditions are rarely disclosed before the airdrop. Use the experience of past projects and use best practices to create accounts that have activity as if it was real user.

- Time-sensitive airdrop announcements on Telegram — https://t.me/hashlight_crypto

- Project reviews and insights on Twitter — https://twitter.com/hashlight

Finance

Cryptocurrency

6 Read

4 Wow

0 Meh

Mint

14 May 2024

46

14 May 2024

40

14 May 2024

28

14 May 2024

44

14 May 2024

39

14 May 2024

67

14 May 2024

31

14 May 2024

61

14 May 2024

43

14 May 2024

38

14 May 2024

40

15 May 2024

38

14 May 2024

72

SkD

- •

14 May 2024

54

15 May 2024

108

14 May 2024

21

14 May 2024

46

14 May 2024

36

14 May 2024

62

maco

- •

14 May 2024

24

14 May 2024

41

14 May 2024

207

14 May 2024

38

14 May 2024

80

15 May 2024

60

14 May 2024

32

14 May 2024

42

14 May 2024

2

14 May 2024

40

14 May 2024

65

1 Comment

Most relevant

No comments yet.

Most relevant comments are displayed, so some may have been filtered out.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)