The Problem of Printing Money and Bitcoin

In the realm of currency, a critical distinction emerges between the vulnerabilities of fiat money and the resilience of Bitcoin. Understanding the inherent flaws in traditional printed money sheds light on why an increasing number of individuals are turning to Bitcoin as a reliable alternative.

Fiat Money’s Fragility: A Dependency on Inflation

The primary flaw in fiat money lies in its dependence on the authorities’ ability to inflate the money supply. The soundness of printed money is intricately tied to the government’s capacity for inflation. Political constraints, however, impose limitations on this inflating power, providing a semblance of stability. The crucial point is that there are no inherent economic, physical, or natural limits on how much money a government can print.

Inevitable Devaluation and Wealth Transfer

In contrast to the resource-intensive production of silver and gold, the creation of government money merely necessitates a decree. The ever-expanding supply of fiat currency results in its continuous devaluation and depreciation. This ongoing erosion of value translates to a wealth transfer from savers to those vested with the authority to print money. Historical precedents emphasize the inevitability of governments succumbing to the temptation of inflating the money supply, perpetuating a cycle of devaluation.

Bitcoin’s Resilience: Scarce Supply as a Strength

In the realm of Bitcoin, a fundamental shift occurs. Unlike fiat currencies, Bitcoin operates in a landscape devoid of the relentless printing conundrum. Following the latest halving event, the daily production of Bitcoin has dwindled to 900 BTC, with projections indicating a further reduction to 450 BTC in 2024. This scarcity imbues Bitcoin with inherent value, serving as a stark contrast to the continuous devaluation experienced by traditional currencies.

The limited supply of Bitcoin transforms it into a valuable asset, a store of value that compensates for losses. While fiat currencies grapple with diminishing value, Bitcoin emerges as a resilient alternative, immune to the pitfalls of perpetual inflation.

Bitcoin’s Call: A Timely Alternative

Given the contrasting trajectories of fiat currencies and Bitcoin, a pertinent question arises: Is it not the opportune moment to gravitate towards Bitcoin? The inherent scarcity, coupled with its role as a safeguard against devaluation, positions Bitcoin as a viable choice for those seeking financial resilience.

As governments perpetuate the cycle of inflation, Bitcoin stands as a beacon of stability, offering an alternative path for individuals looking to preserve and grow their wealth. The trajectory of traditional currencies losing value while Bitcoin gains prominence underscores the shifting dynamics in the financial landscape. Perhaps, now more than ever, it is time to explore the transformative potential that Bitcoin holds in reshaping the future of currency and wealth preservation.

Mesut İnan

Bitcoin

Btc

Cryptocurrency

Crypto

Follow

Follow

Written by Dr. Mesut İnan

7 Followers

·

Writer for

Coinmonks

kriptokoin.com yazarı. #Bitcoin ve #altcoin sevdalısı. #AVAX hayranı.

More from Dr. Mesut İnan and Coinmonks

Dr. Mesut İnan

Dr. Mesut İnan

in

Coinmonks

Navigating Negativity: Empowering Perspectives in the Cryptocurrency Realm

In the realm of Bitcoin and cryptocurrency, negative indoctrination often casts a shadow, influencing decisions and potentially hindering…

2 min read

·

Jan 8

5

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

667

3

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

37K

995

Dr. Mesut İnan

Dr. Mesut İnan

Safeguarding Societies: Bitcoin’s Role in Combating Hyperinflation

In this article, we delve into the critical relationship between hyperinflation and Bitcoin. Astronomically high inflation poses a severe…

2 min read

·

2 days ago

Recommended from Medium

Crypto Passive LAB

Crypto Passive LAB

First Ever ROI Miner On Solona 🔥 — Earn $1160 By Staking Your Solana

We all know what we have acheived with the ROI dapps like Baked beans, ROI miner, Bean machine etc.. Those projects have made many people…

3 min read

·

4 days ago

179

1 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

423

10

Lists

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

622

saves

Financeable

Financeable

12 Side Hustles You Can Do From Your Phone ($600+ Per Day)

Let’s be honest, if you’re reading this article, you probably have a phone or a laptop. And with this thing, you can make as much as $600…

13 min read

·

Dec 25, 2023

5.7K

106

Max Yampolsky

Max Yampolsky

in

Coinmonks

Top 12 Web3 Trends In 2024 According To VCs

The biggest ideas in crypto, blockchain technology, and Web3 for 2024 according to some of the world’s most respected investors and finance…

·

22 min read

·

Jan 10

79

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.5K

116

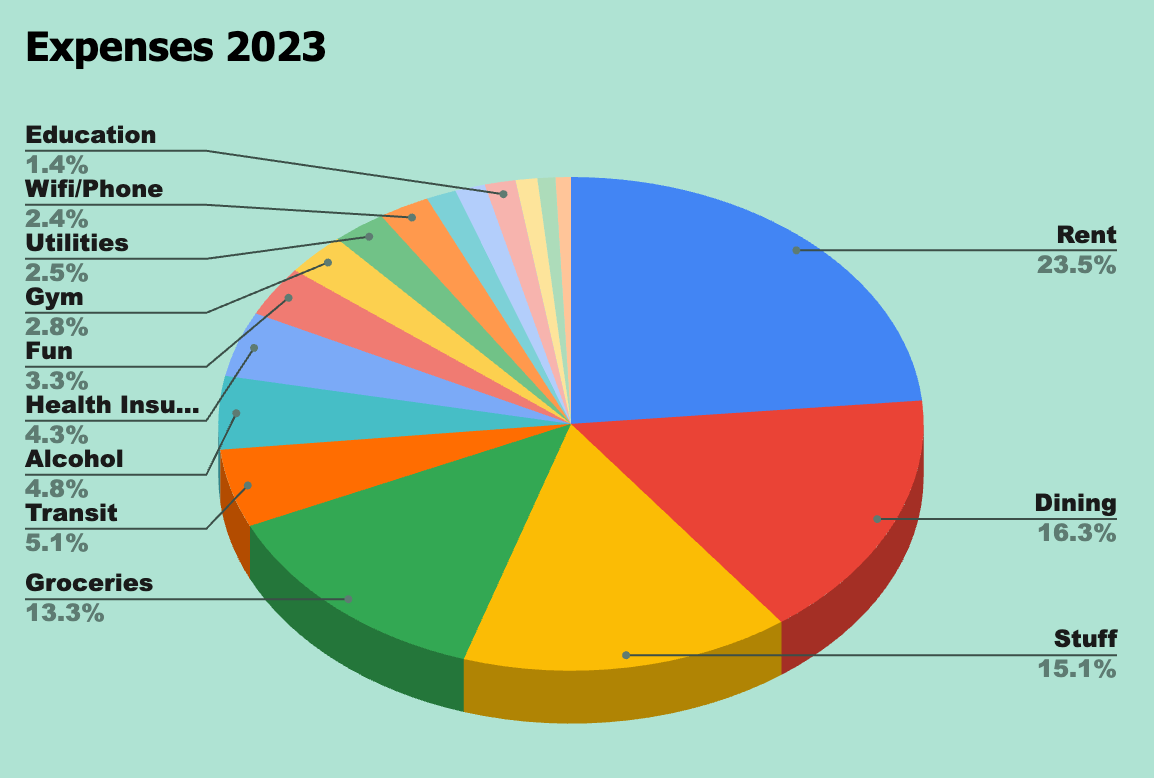

Shawn Forno

Shawn Forno

in

The Startup

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.6K

49