Binance Labs invests in the Renzo liquidity restaking protocol.

Binance Labs, the venture capital arm and incubator branch of the $10 billion USD-valued Binance exchange, has invested an undisclosed amount in Renzo, an Ethereum liquidity restaking protocol based on EigenLayer.

Binance Labs' investment in Renzo comes shortly after the startup raised $3.2 million in a seed funding round with a valuation of $25 million last month. Lucas Kozinski, co-founder of Renzo, stated that Binance Labs' investment has a structure similar to the seed round, meaning ownership comes with token warrants at a 1:1 ratio.

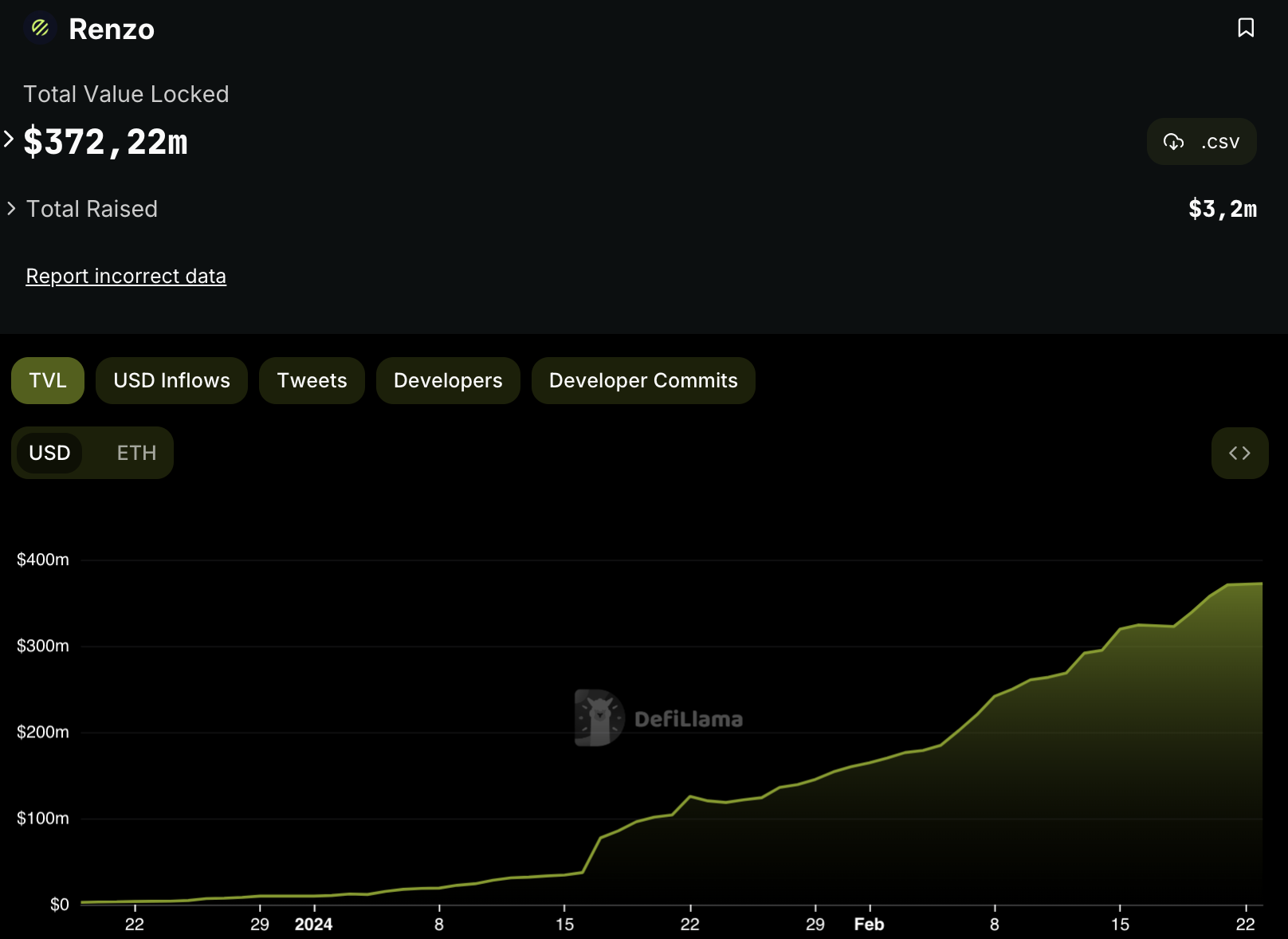

Renzo marks Binance Labs' second recent investment in the Ethereum restaking space. The company invested in Puffer Finance last month, a protocol that rapidly grew to become the second-largest liquidity restaking protocol since its launch on February 1st. Puffer has over $1 billion locked in its platform, while Renzo is the fourth-largest restaking protocol with over $372 million locked, according to DeFiLlama.

Ethereum liquidity restaking is currently one of the hottest sectors in the cryptocurrency space, with billions of dollars pouring into the industry. This trend began with the launch of EigenLayer, a company that introduced a restaking system for Ethereum in June last year. EigenLayer currently boasts a total locked value of $7.9 billion, as shown by DeFiLlama. Protocols built on EigenLayer, including Renzo and Puffer, have accumulated total assets worth over $3.5 billion.

Yi He, co-founder of Binance and leader of Binance Labs, declared that liquidity restaking protocols 'play a crucial role in unlocking liquidity and maximizing capital efficiency while eliminating technical complexity for users.

Native ETH restaking on BNB Chain

With new funding from Binance Labs, Renzo plans to deploy native ETH restaking on BNB Chain through a recent partnership with the crosschain protocol Connext, Kozinski stated. This means that BNB Chain users will be able to directly restake ETH to earn ezETH, Renzo's liquidity restaking token, without the need for bridging and receive rewards in EigenLayer points and Renzo's ezpoints. Points are designed to incentivize participation without direct monetary value or can be traded directly.

Renzo has also started accepting deposits of wBETH (Binance's liquidity staking token) for restaking. Kozinski added that the protocol remains focused on building new restaking integrations for BNB Chain users.

Kozinski noted that alongside wBETH, Renzo also accepts stETH – Lido's liquidity staking token representing staked ETH – for restaking.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)