Why A Cryptocurrency Dip is An Opportunity?

14

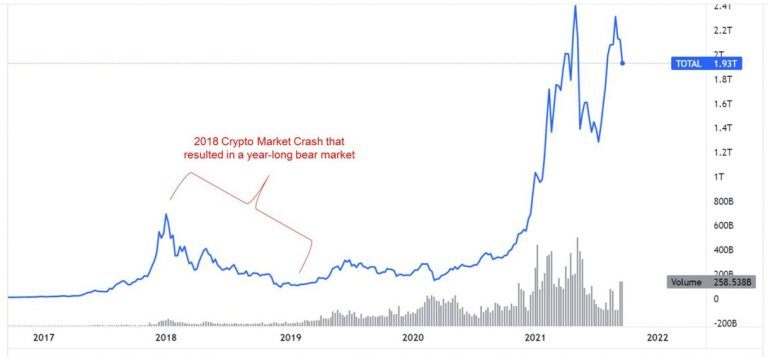

A cryptocurrency dip refers to a temporary decline in the prices of cryptocurrencies, resulting in a downward movement in the overall market. Dips can occur for various reasons, including market sentiment, regulatory developments, macroeconomic factors, or technical issues. During a dip, prices may experience a significant drop, leading to a decrease in the value of cryptocurrency holdings for investors and traders. However, dips are also considered a natural part of market cycles and can present buying opportunities for those looking to enter or add to their positions in cryptocurrencies at lower prices.

- *Buying at a Discount:* During a dip, cryptocurrency prices often drop significantly, presenting an opportunity to buy assets at lower prices than during peak periods. This can allow investors to acquire more coins or tokens for the same amount of investment capital.

- *Long-Term Investment:* If you believe in the long-term potential of a particular cryptocurrency project or the overall market, buying during a dip can be advantageous. History has shown that cryptocurrencies have experienced periods of volatility followed by significant growth over time.

- *Dollar-Cost Averaging (DCA):* DCA is a strategy where investors consistently invest a fixed amount of money at regular intervals, regardless of market conditions. During a dip, DCA allows investors to acquire more coins or tokens for the same investment amount, potentially lowering their average purchase price over time.

- *Market Corrections:* Dips are often part of the natural market cycle and can serve as healthy corrections after periods of rapid price appreciation. These corrections help to stabilize the market and weed out speculative excess, laying the groundwork for future growth.

- *Opportunity for Trading:* For active traders, cryptocurrency dips can present short-term trading opportunities to profit from ice fluctuations. By buying low and selling high, traders can capitalize on market volatility to generate returns.

- *Fundamental Analysis:* Dips provide an opportunity for investors to reassess the fundamental aspects of a cryptocurrency project, such as its technology, team, partnerships, and roadmap. Investing in projects with strong fundamentals during a dip can potentially yield significant returns when the market recovers.

However, it's essential to approach cryptocurrency investing with caution and conduct thorough research before making any investment decisions. Cryptocurrency markets are highly volatile and speculative, and investments should be made with careful consideration of one's risk tolerance and investment objectives.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)