Could Solana (SOL) price rise above $100 after launching “token extension”?

Solana (SOL) price has been trending down since the beginning of 2024, down more than 30%.

SOL fell below the horizontal support zone and faced a short-term descending resistance line.

Solana fell sharply after its yearly high

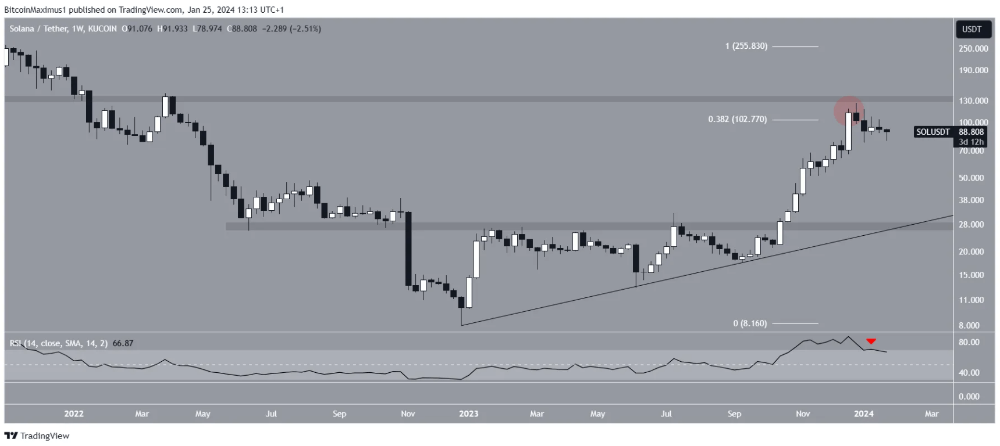

SOL price has been rising along with the ascending support line since the beginning of 2023. The price bounced off the support line in September (green symbol) and accelerated its rise thereafter.

The uptrend led to a yearly high of $126 in the last week of the year. The high was made just above the 0.382 Fib retracement resistance level. However, SOL prices have dropped since then. It creates a deviation above the Fib resistance mentioned above (red circle).

Today, Solana introduced the token extension utility. They will empower developers to build custom tokens to meet their business needs. Solana's token extension will include anonymous trading, token swap fee customization, and metadata.

The weekly relative strength index (RSI) is trending down. RSI is a momentum indicator that traders use to evaluate whether the market is overbought or oversold and whether to accumulate or sell an asset.

A reading above 50 and sloping up shows that the bulls still have the advantage, while a reading below 50 shows the opposite. The weekly RSI is trending down and fell below 70 this week (red symbol).

SOL price prediction: Slight decrease or reversal?

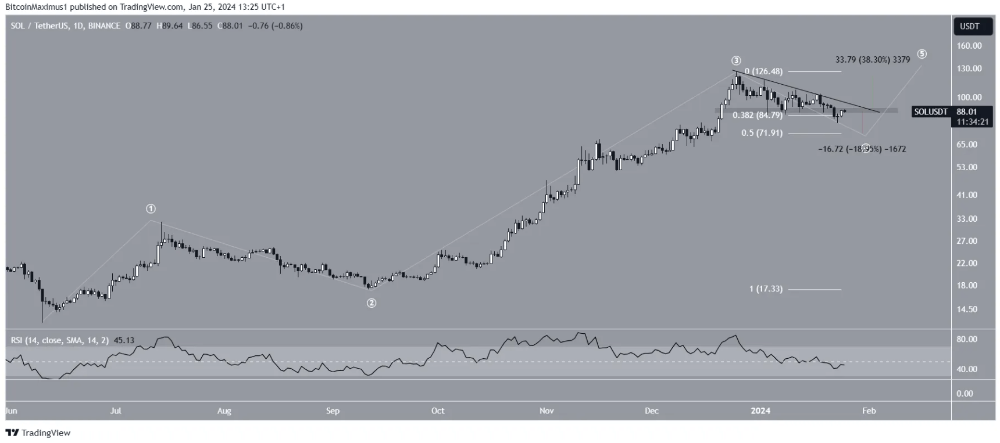

A closer look at the daily time frame shows that SOL is still correcting. This is due to price action, wave count and RSI.

Price action shows SOL broke below the $90 horizontal zone and confirmed it as resistance. Additionally, the daily RSI is falling below 50, a sign of a downtrend.

Altcoin Sherpa believes that SOL price will decrease in the short term. He declared:

“I think DCA at the 0.382 and 0.50 Fib levels are both good long-term holds for #Solana. Don't expect things to progress quickly but be patient...".

This is consistent with the wave count as it shows that SOL is in wave four of a five-wave upward movement.

Technical analysts use Elliott Wave theory to identify long-term price patterns and investor psychology, helping them determine the direction of trends.

If the wave count is correct, SOL will complete wave four at the 0.5 Fib retracement support at $72, a 20% drop from the current price.

Despite this bearish prediction, reclaiming the $90 area and breaking above the descending resistance line would mean that the price has bottomed. SOL could then rally at least 40% to its 2023 high at $126.

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)