Understanding Bitcoin's Latest All-Time High: Why $72,700 Doesn't Guarantee Eternal Highs.

Introduction:

Bitcoin, the world's premier cryptocurrency, has captured headlines once again as it soared to a new all-time high of $72,700. For seasoned investors and crypto enthusiasts, such milestones may be exhilarating, yet it's essential to maintain a sober perspective. While the surge in Bitcoin's value may seem promising, it's crucial to analyze the factors behind this rally and understand that high prices aren't necessarily here to stay forever.

In this article, we'll delve into the reasons behind Bitcoin's latest peak, examine the dynamics influencing its price movements, and explore why caution should temper the euphoria surrounding astronomical valuations.

https://finance.yahoo.com/news/bitcoin-newest-time-high-72-162804250.html

Understanding Bitcoin's Price Movements

Bitcoin's price is notorious for its volatility, characterized by rapid fluctuations that can see its value skyrocket or plummet within short periods. While volatility is inherent to many financial assets, Bitcoin's decentralized nature, limited supply, and speculative trading exacerbate this phenomenon.

https://bitcoinmagazine.com/guides/bitcoin-price-history

Market Sentiment and Speculation

Sentiment plays a significant role in Bitcoin's price movements. Positive news such as institutional adoption, regulatory clarity, or macroeconomic uncertainty can fuel bullish sentiment, leading to increased demand and higher prices. Conversely, negative news or regulatory crackdowns can trigger selloffs and price corrections.

https://www.lehnerinvestments.com/en/sentiment-analysis-stock-market-sentiment/.png?alt=media)

Supply and Demand Dynamics

Bitcoin's supply is capped at 21 million coins, creating scarcity akin to precious metals like gold. As demand for Bitcoin increases, driven by factors like institutional interest or retail adoption, its price tends to rise. Conversely, if demand wanes or supply increases due to factors like mining rewards, prices can decline.

https://www.researchgate.net/figure/Supply-and-Demand-of-Bitcoin-Case-of-a-Vertical-Supply-Curve_fig1_314406810

Institutional Adoption

Institutional investors have increasingly embraced Bitcoin as a store of value and hedge against inflation. Companies like MicroStrategy and Tesla allocating portions of their treasury reserves to Bitcoin, along with the emergence of Bitcoin futures and ETFs, have boosted institutional confidence and liquidity in the market.

https://www.coindesk.com/markets/2015/07/27/8-banking-giants-embracing-bitcoin-and-blockchain-tech/

Regulatory Environment

Regulatory developments can significantly impact Bitcoin's price trajectory. Clarity and favorable regulations can attract institutional investors and mainstream adoption, while uncertainty or hostile regulations can spook investors and lead to selloffs.

Technological Innovations and Upgrades

Bitcoin's protocol and network upgrades, such as the implementation of the Lightning Network for faster transactions or improvements in scalability and security, can enhance its utility and value proposition, influencing price movements.

The Importance of Skepticism and Risk Management

While Bitcoin's latest all-time high may inspire optimism and excitement, it's crucial for investors to approach the market with caution and skepticism. High prices aren't synonymous with guaranteed returns, and the crypto market's volatility can lead to substantial losses if not managed prudently.

Risk of Corrections and Bear Markets

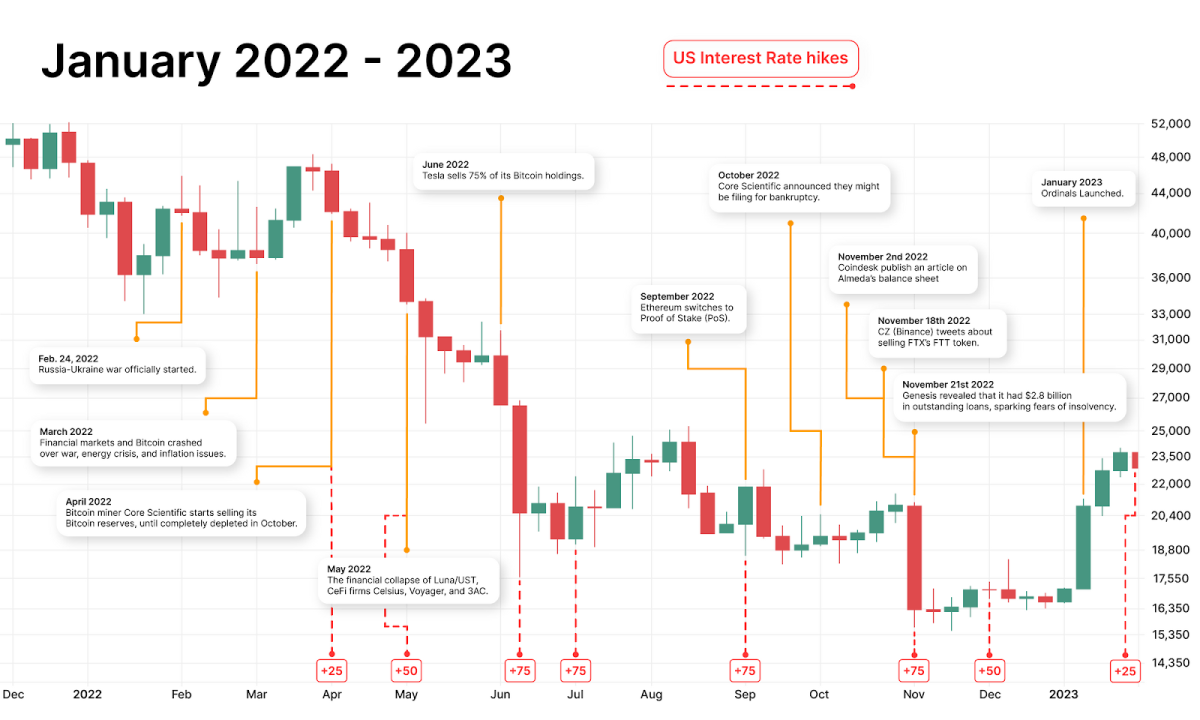

Bitcoin's price history is punctuated by periods of euphoria followed by sharp corrections and prolonged bear markets. The 2017 bull run, which saw Bitcoin reach nearly $20,000, was followed by a brutal bear market that lasted over a year. Similarly, the possibility of a market correction or prolonged consolidation looms large amidst current price levels.

Regulatory Uncertainty

Despite growing mainstream acceptance, Bitcoin remains subject to regulatory scrutiny and uncertainty. Regulatory crackdowns or unfavorable policies could disrupt the market and dampen investor confidence, leading to price declines and heightened volatility.

Security Risks and Custodial Concerns

The decentralized nature of Bitcoin offers security advantages, yet it also exposes investors to risks like hacking, fraud, and loss of funds. Custodial solutions like exchanges and wallets present single points of failure, necessitating robust security measures and adherence to best practices.

Psychological Factors and Investor Behavior

Investor psychology plays a significant role in shaping market dynamics. Greed and fear often drive irrational decision-making, leading to herd mentality, panic selling, or excessive risk-taking. Rationality, discipline, and a long-term perspective are essential for navigating volatile markets.

Conclusion

Bitcoin's latest all-time high of $72,700 exemplifies the cryptocurrency's remarkable journey from obscurity to mainstream recognition. While the surge may be fueled by institutional endorsement, inflation hedging narratives, and supply dynamics, it's imperative to approach the market with sobriety and caution.

High prices aren't guaranteed to persist indefinitely, and market volatility demands prudent risk management and skepticism. While Bitcoin holds immense potential as a revolutionary financial instrument and store of value, investors must exercise due diligence, diversification, and discipline to navigate the tumultuous waters of the crypto market.

As Bitcoin continues to redefine the financial landscape and challenge traditional paradigms, a nuanced understanding of its dynamics and an unwavering commitment to responsible investing will be indispensable for capitalizing on its potential while mitigating risks.

In the ever-evolving saga of Bitcoin, one thing remains certain: volatility is the price of admission to the future of finance.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)