Kamino Finance: Understanding De-Fi Risk

The Risk Dashboard is a great tool for assessing your level of exposure.

Cryptocurrency can be risky due to market volatility and lack of regulation. Use reputable platforms, avoid emotional trading, and only invest what you can afford to lose. Be cautious and remember, not your keys, not your crypto.

In previous articles, we’ve taken a look at some of the products offered by Kamino Finance and looked at ways to earn and maximise points while doing so. While there are certainly plenty of useful ways to engage with the platform, you don’t have to be a professional day trader to leverage some of Kamino’s other resources.

One of the best things about the platform is the lengths they’ve gone to in an attempt to build something that’s truly user-friendly. And while we’d typically think of liquidity pools or other trading resources, today things are going in a different direction entirely.

Aiming to bring De-Fi into everyday life, Kamino has built trust in the platform right from the start. One of the ways it does this is by providing the community with a broad range of resources to help educate people on what exactly the platform has to offer. It’s those resources that we’ll be breaking down for you in today's article.

A Word On Auditing

Like many big tech companies, the Kamino platform has been audited for vulnerabilities. Due to the scope of De-Fi services though, it’s fair to say that auditing isn’t the only consideration here. To have true trust, we need a committed team and transparency around its products, potential for profit and possible risks to user funds.

Similar to the “security onion” approach which uses a layered defence strategy to provide protection, Kamino has played a reverse strategy and used similar methods to build trust within the community. It isn’t just relying on an audit to ensure integrity. It’s a core approach in how the team do business, meaning that being transparent about Risk is also a thing.

With transparency an ongoing issue with some Web 3 projects, it’s a refreshing change to see teams take the concept of trust seriously. Not only does it help to naturally build engagement within the community, but it also provides strong signals regarding long-term support and viability.

So, while an audit isn’t the only thing to consider when assessing a platform, it’s still a step in the right direction.

K-Lend Risk Dash

The K-Lend dashboard is a fantastic tool provided by Kamino that isn’t used enough. Able to provide a market snapshot at a glance, as well as tools to gauge risk due to market changes, it’s an extremely useful resource that you should spend some time with if you’re planning to carry out some de-fi activities While the market dashboard is particularly useful, there’s also a range of prediction tools you can use to help manage your portfolio in greater detail, helping to avoid the possibility of encountering a liquidation.

While the market dashboard is particularly useful, there’s also a range of prediction tools you can use to help manage your portfolio in greater detail, helping to avoid the possibility of encountering a liquidation.

The Price Shock tools, in particular, will be helpful to get an idea of what your position will be exposed to regarding unexpected price movements.

Check it out via this link

Risk Analysis

While the concept of De-Fi is pretty revolutionary stuff, in some ways it varies little from some of the issues that we’ll see in traditional finance as well. Kamino needs to manage risk to itself on a day-to-day basis as well, not just its users. This means that managing exposure to insolvency risk as well as ensuring minimal exposure to things like bad loans, are all part of the day-to-day process.

There’s no denying that this is probably the “fine print” that most people tend to hate reading, but within this is some great information that breaks down a lot of the technical concepts into simple, easy-to-understand chunks.

If you aren’t much for reading the fine print though, never fear. Kamino also has an active discord where you can get advice, as well as an ongoing community-led creator program where you can use articles like this to help get through the fine print. So, if you’ve got a problem, simply reach out to the community and chances are good that you’ll find some help.

In Closing

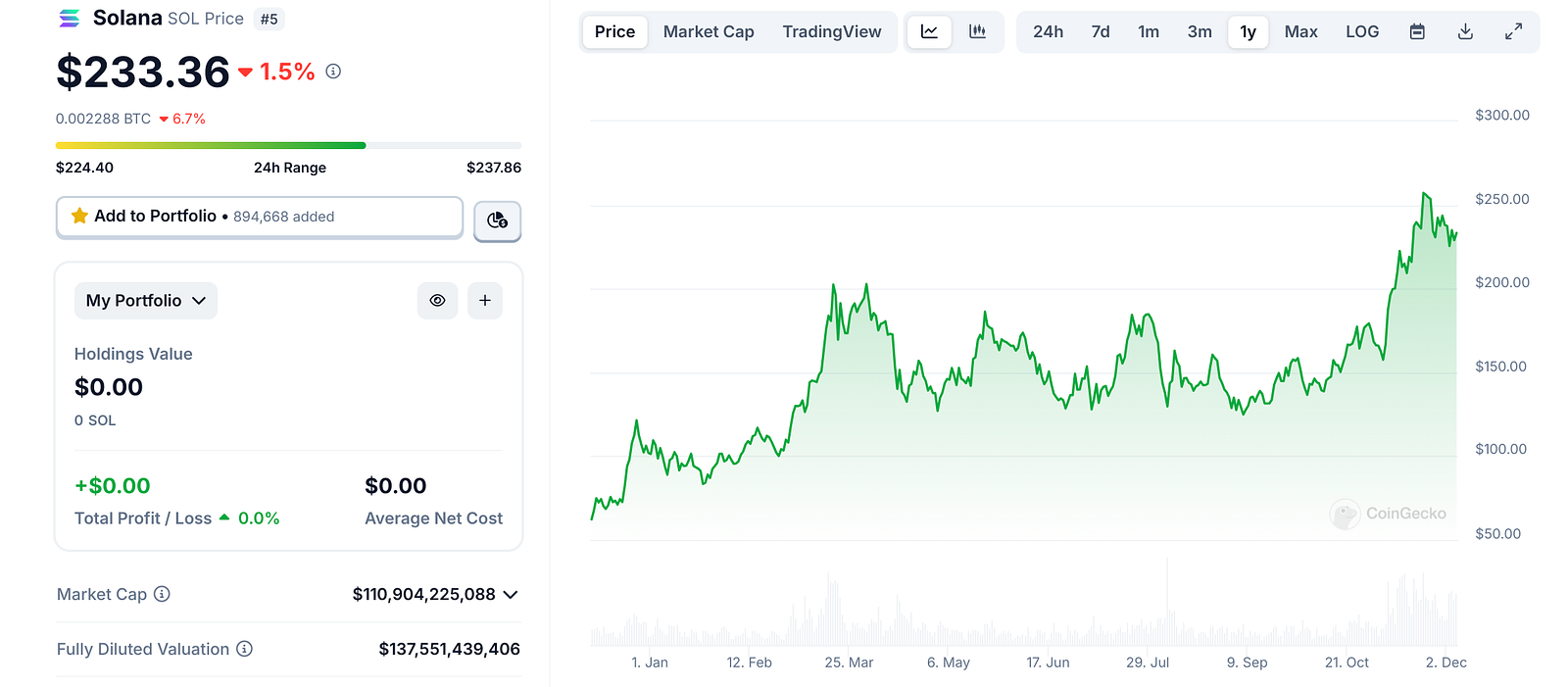

In recent months, there’s been strong interest in both Solana and its De-Fi ecosystem. As the token price has recovered, new money has flowed in and there’s been plenty of focus showing that the Solana community has been pretty passionate supporters of projects that have the potential to bring real change into the ecosystem.

We’ve also seen a real push towards onboarding new users as well. While a lot of us are here for the technology, the “normies” as we affectionately call them are here for a product that works and is easy to understand. While we have the patience to troubleshoot issues when they occur, to develop an ongoing market means a reliable, easy-to-use product is needed.

With products like Jupiter mobile offering users a one-stop shop to safely onboard into the Solana Ecosystem, we now have a way to bring new people into the fold.

And, projects like Kamino that have a strong community backing, provide a unique, long-term stability to the Solana ecosystem by providing the next steps in that onboarding journey.