Everything you should know about Bitcoin before the Halving

Will the Bitcoin network sleep as other ecosystems develop? What impact will the awakening giant have on the entire crypto market?

When the giant wakes up

Since its launch, Bitcoin has always been the representative face of the crypto market. BTC is the coin with the largest market capitalization and is considered "digital gold". But with an application just for storing, sending and receiving, it limits Bitcoin within its own circle. The giant seemed to have fallen asleep while other ecosystems developed rapidly and people began to believe that Bitcoin would lose its leading position in the market.

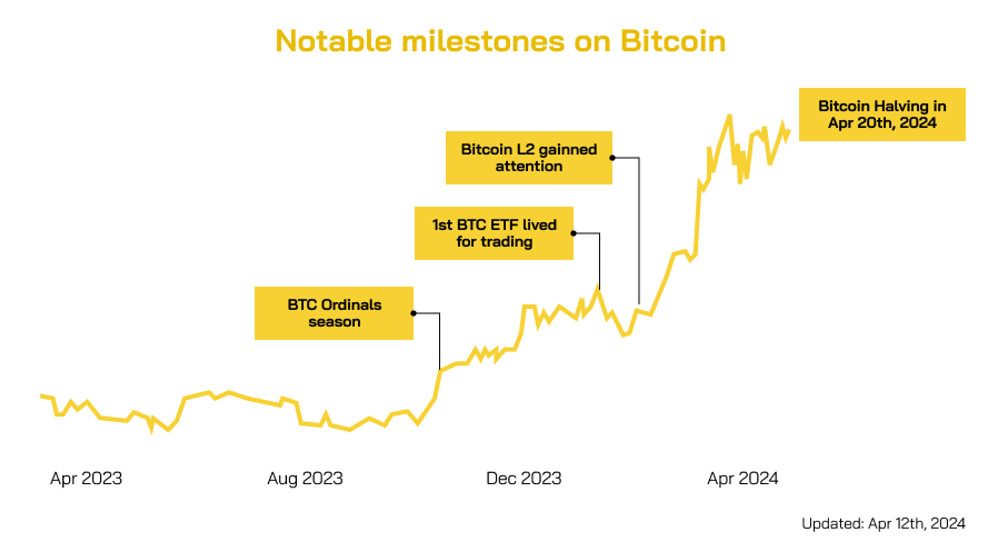

However, when the giant woke up, Bitcoin showed the whole market its influence. Every time BTC fluctuates, it affects other tokens. With the largest capitalization and liquidity, BTC is always the number one choice of financial institutions when wanting to participate in the crypto market. Investment tools that help attract large cash flows such as Bitcoin ETF are gradually being approved. The ecosystem itself also has many developers testing solutions to bring new life to the network.

Notable milestones on the Bitcoin network

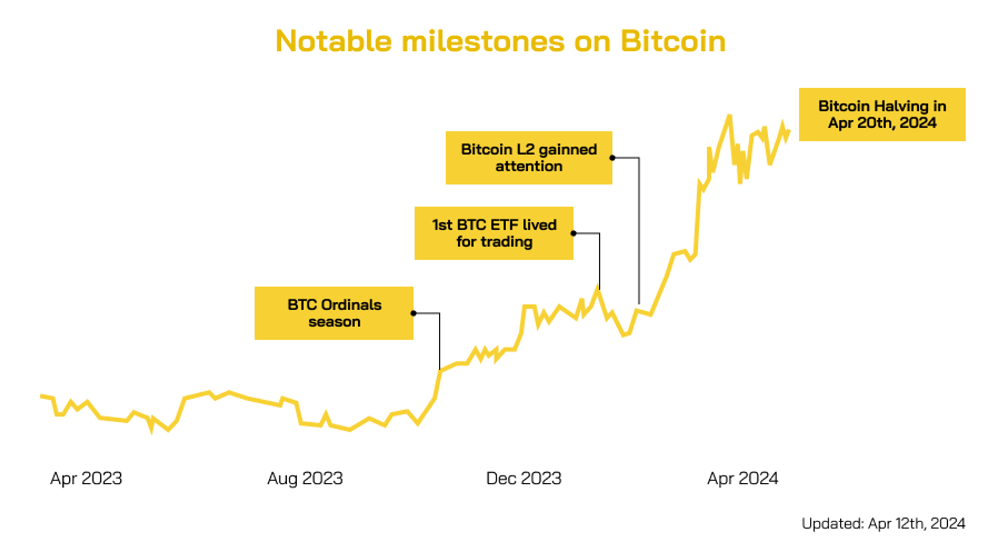

The image below summarizes what Bitcoin is all about. In the content below, let's go deeper with Coin98 Insights into each of its main areas.

Top choice of cash flow

The crypto market is growing rapidly with widespread acceptance by the masses. Digital assets are gradually receiving more attention. Many major financial institutions have been openly supportive of crypto and encourage their clients to dedicate a certain percentage of their asset portfolios to crypto.

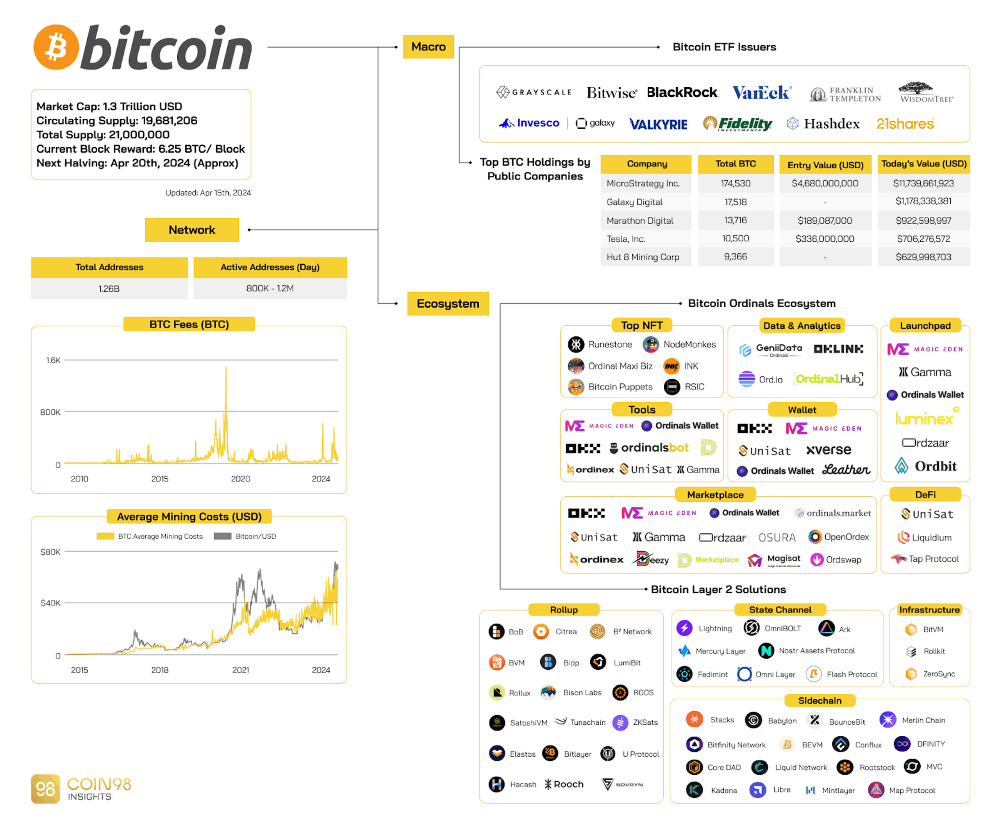

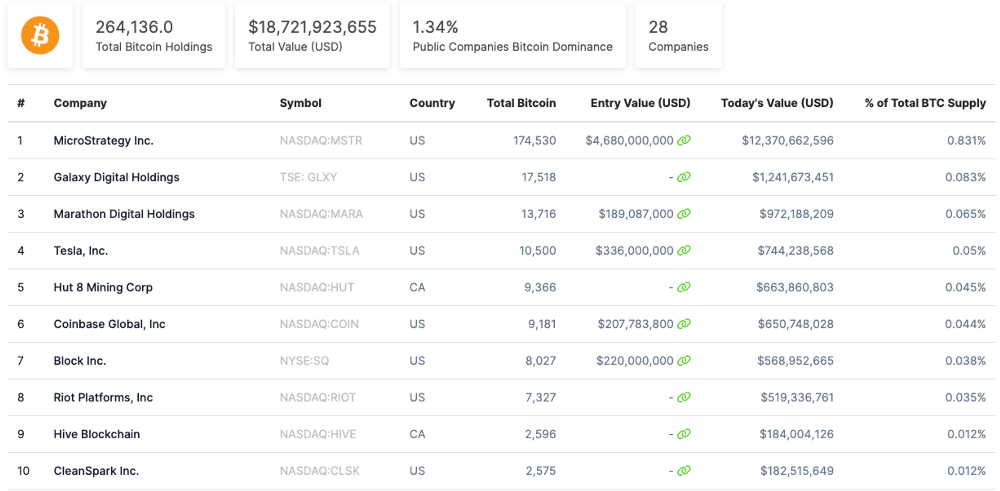

How much Bitcoin do large companies hold?

BTC, accounting for more than 50% of the crypto market capitalization, is always the top choice for financial institutions with huge amounts of money and customer files. Currently, there are 28 companies publicly announcing their ownership of BTC with a total of 264,136 BTC, approximately 17 billion USD at the current exchange rate (1 BTC = 65,000 USD). Companies investing in BTC are all profitable, including companies with very high profit values such as Micro Strategy with more than 7 billion USD.

In addition to public companies, there have been many private companies, organizations and even countries adding BTC to their asset portfolio. A typical example is the country of El Salvador with 2,301 BTC purchased at an average price of 44,189 USD, up to now this country has profited more than 52 million USD. This is the driving force for more names to join in holding BTC in general and other crypto assets in particular to diversify their asset portfolio.

Bitcoin ETF - The key to opening the door to large cash flows

To help traditional investors feel comfortable and hassle-free when investing in BTC, Bitcoin ETF has been developed and can currently be traded on many major stock exchanges.

Bitcoin ETF is a group of assets related to Bitcoin or Bitcoin price offered on traditional stock exchanges by brokerage companies, traded in the form of fund certificates (ETF).

Bitcoin ETFs use a similar structure to traditional ETFs to enable trading. The price of the ETF will closely follow the price of Bitcoin. As the value of Bitcoin increases and decreases, the value of the ETF will increase and decrease accordingly.

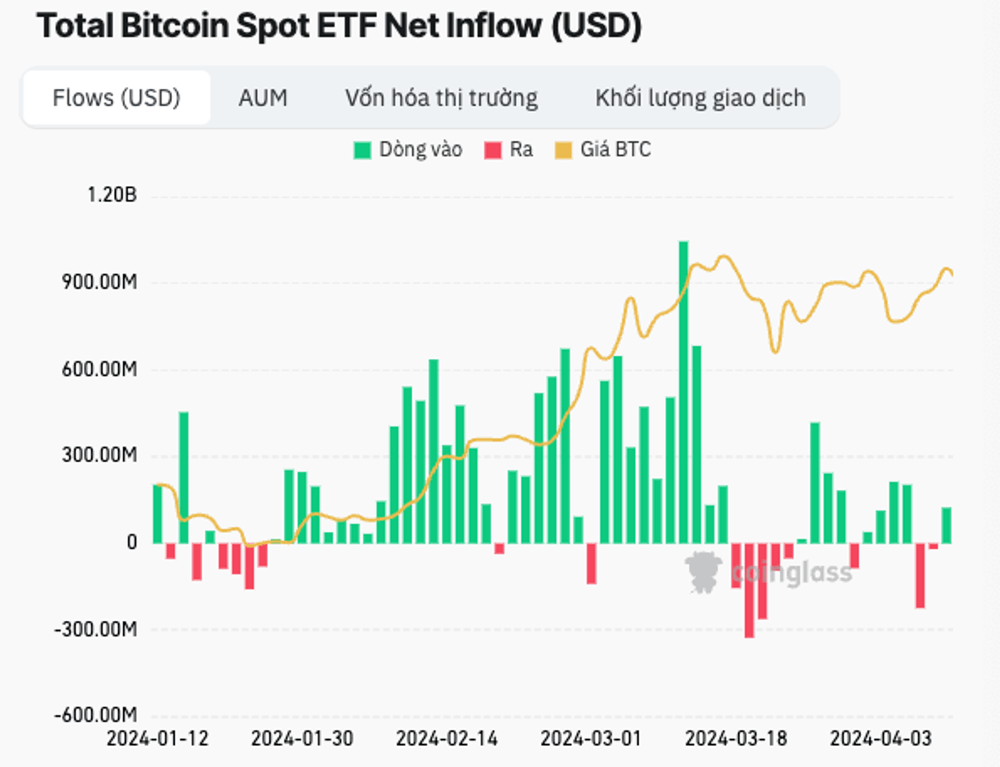

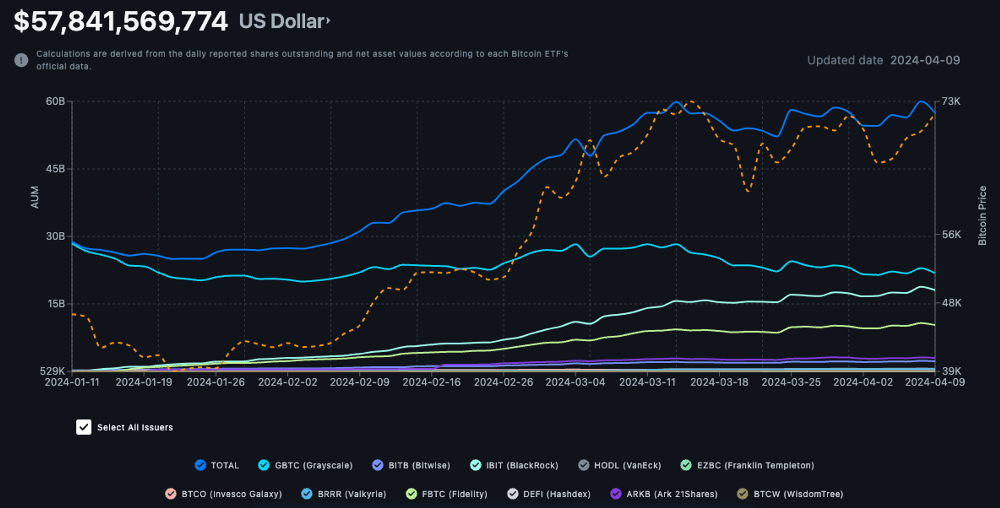

Since it began trading, Bitcoin ETF cash flows have been largely positive with total assets under management (AUM) reaching more than $57 billion. Looking at the chart, we can see the correlation between BTC price and Bitcoin ETF cash flow.

Among managed assets, a large share of value is being managed by large financial institutions such as Grayscale, Bitwise, BlackRock. This acts as a guarantee for Bitcoin to help increase investor confidence.

With the rapid increase of money flowing into ETF funds, there are gradually more big names wanting to divide this pie. In early April, Morgan Stanley and UBS announced the provision of Bitcoin ETF services to customers. Many financial institutions in China also announced they will launch Bitcoin ETFs.

Old but new story

Every 4 years following the Bitcoin halving event, familiar topics such as BTC's price reaction and stories related to miners are discussed. The story may be old, but the context in each cycle contains many fluctuations that each investor should not ignore.

Talking numbers

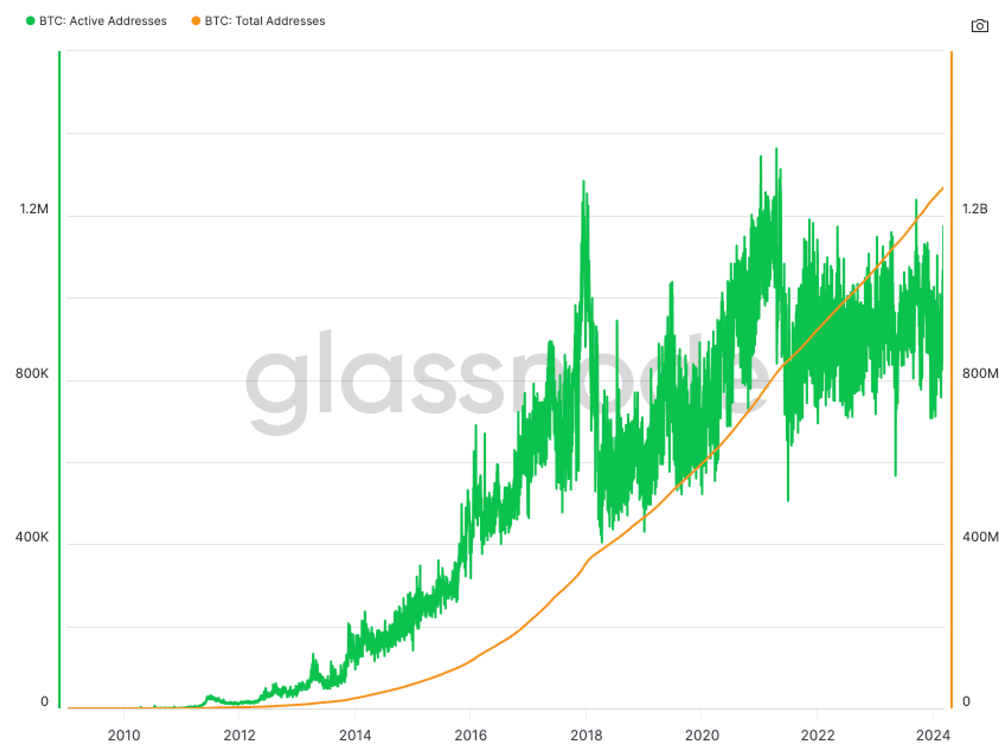

The number of Bitcoin wallet addresses continues to increase, and active wallet addresses fluctuate between 800k and 1.2 million wallet addresses daily.

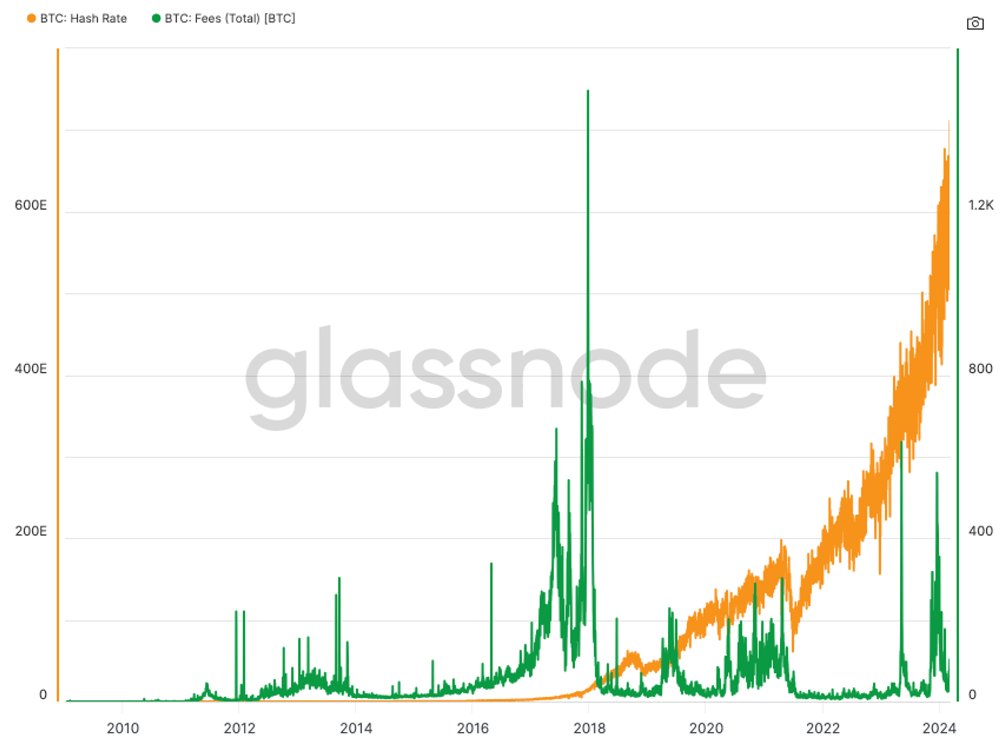

Bitcoin Hash Rate, the rate related to mining difficulty, has only increased, demonstrating the increasingly fierce competition between miners in the network. However, the amount of fees generated on the Bitcoin network is not too much. It can be seen that miners' current revenue mainly comes from block rewards.

Bitcoin Halving - Will history repeat itself?

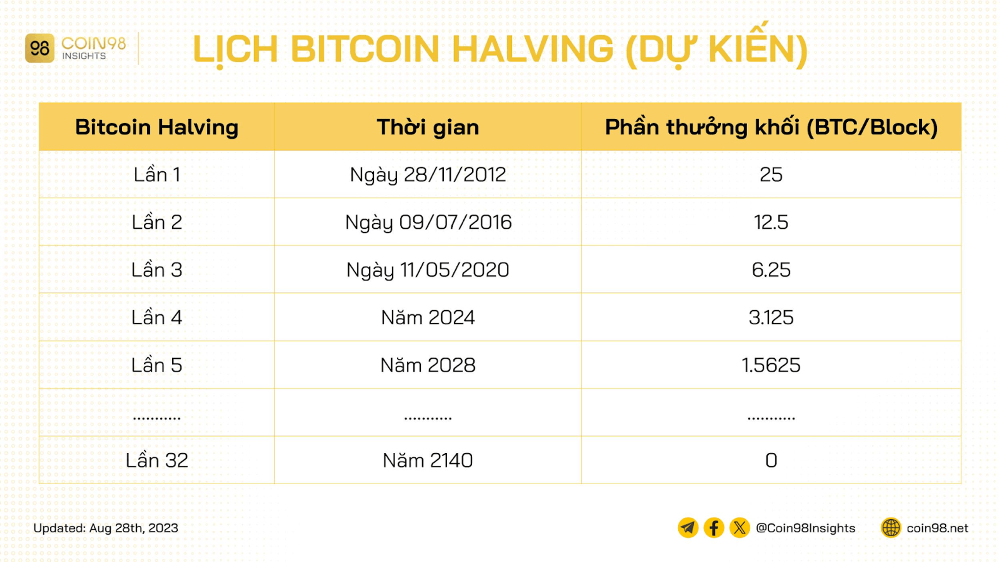

Bitcoin halving is an event that reduces the block reward by half (halving) for Bitcoin miners, taking place about every 4 years. The goal of this is to control the amount of new Bitcoin created, help increase mining difficulty, limit the maximum supply of Bitcoin and fight inflation.

It is expected that the upcoming 4th halving will take place in April 2024. After this halving, the block reward for miners on each block will only be 3,125 BTC compared to 6.25 BTC at the present time, leading to a decrease in supply. Bitcoin's annual issuance is only 0.9%.

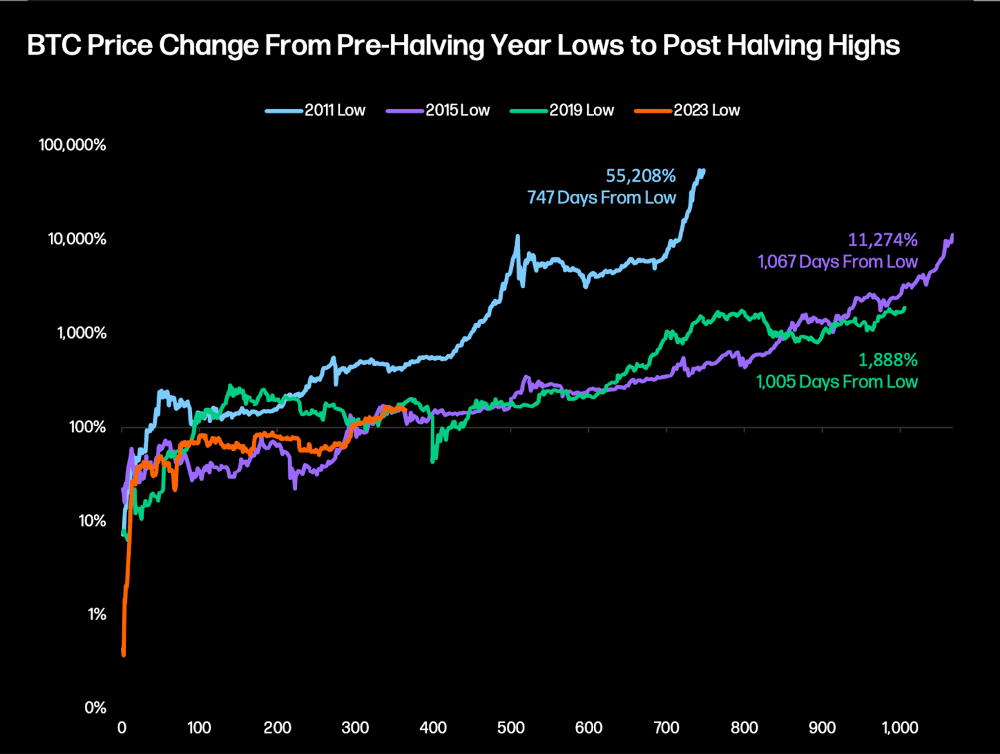

In previous Halvings, Bitcoin prices would often increase sharply after Halvings with the main story revolving around the issue of supply cuts. Specifically:

· Halving 2012: price increased by 55,208% since the bottom of 2011.

· Halving 2016: price increased by 11,274% since the bottom of 2015.

· Halving 2020: price increased by 1,888% since the bottom of 2019.

· Pre-Halving 2024: price increases 332% since the 2022 bottom (as of April 15, 2024).

It can be seen that BTC price often reacts positively to Bitcoin halving events. However, a sample of only 3 times in the past does not tell everything. The main factor helping this asset class grow comes mainly from the market's demand and perspective on Bitcoin. Will BTC price continue to grow during the 2024 halving cycle?

Will miners' reduced revenue affect the network?

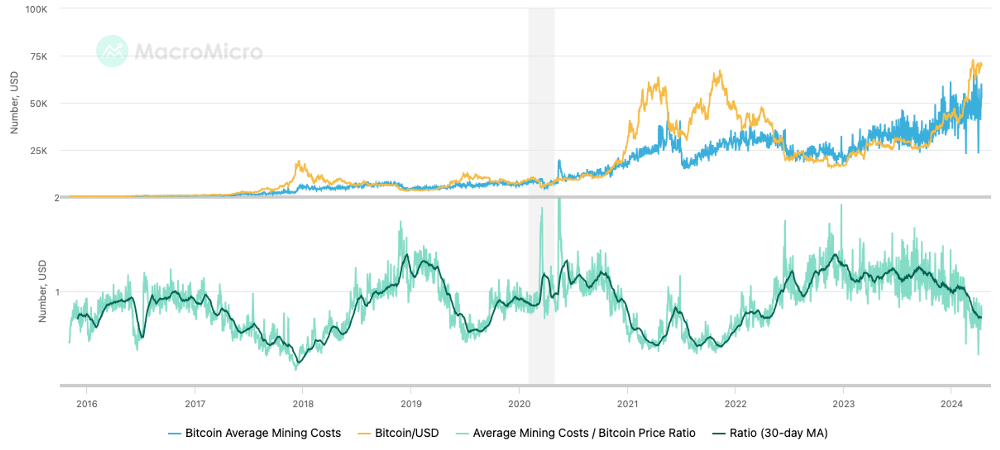

The Bitcoin Halving event not only affects the supply and demand of Bitcoin but also affects miners. To balance costs and profits, miners can make large Bitcoin sales when necessary, or incur losses for certain periods of time.

Basically, Bitcoin mining costs are made up of 2 factors: Electricity costs + Operating costs (labor costs, investment and mining machine wear and tear). With the current BTC exchange rate, it can be seen that miners are gradually making a profit compared to operating costs. However, the profit rate is still quite low if we compare it with previous cycle peaks. After the upcoming halving event, the block reward will be halved, causing miners' revenue to continue to decrease.

According to analysis from the article on how to determine the bottom and top of Bitcoin with miners, most of the time miners will lose money. New miners often lose more when investing in old miners when Bitcoin prices increase, rewards are reduced after Bitcoin Halving and hashrate increases cause electricity costs to increase. In addition, the market going into a downtrend also makes many miners unprofitable and forced to leave mining activities.

The exodus of miners from the market has created concerns about maintaining the stability of the Bitcoin network. However, the halving cycle is like the screening process of the Bitcoin network when eliminating weak miners and retaining cost-optimized miners. As BTC prices increase, the network attracts new miners and the screening process continues.

New direction of value attraction for the Bitcoin network

With the goal of helping Bitcoin not be left behind, developers have tested many different solutions to bring new life to this network. The most prominent among them are Bitcoin Layer 2, Ordinals and the latest is Runes Protocol.

Bitcoin Ordinals - Store value directly on the Bitcoin blockchain

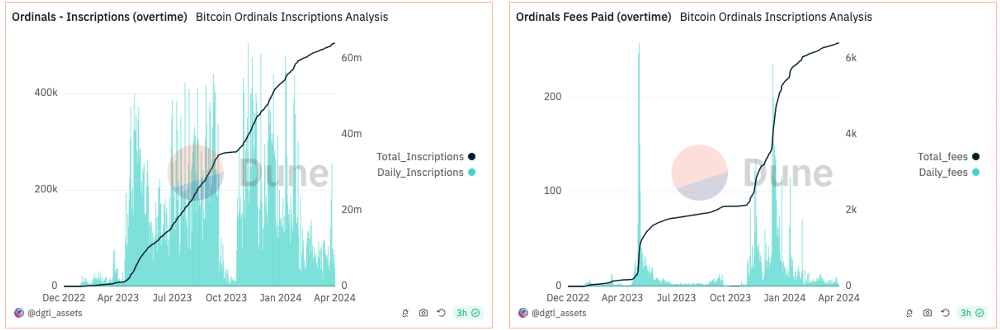

Ordinals helps inscribe data no larger than 4mb per SATS. The data here can be images, text/JSON/, even games or smart contracts,... The engraved data will become an inseparable part of sats and is stored directly and protected. confidential by the Bitcoin network. Thanks to this characteristic, Ordinals has opened the way to many new applications. The most prominent currently are Bitcoin NFT and BRC-20.

*1 BTC = 100 million sats

Since launch in January 2023, there have been over 64.1 million data engraved on sats and generated 6,434 BTC (~430 million USD) in fees. ORDI, the token of the Ordinals development team, also grew strongly.

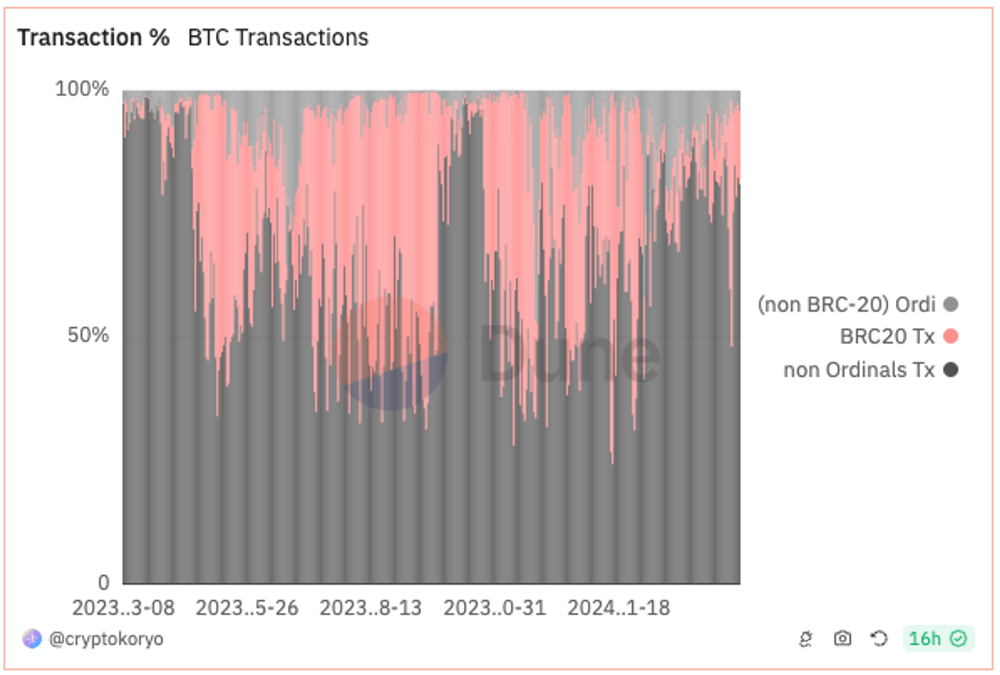

The number of transactions related to Ordinals is accounting for a significant proportion of the Bitcoin network. However, the above rate fluctuates greatly, sometimes only a few % but sometimes up to 30-40%. Proves that the current Ordinals market is unstable and somewhat speculative.

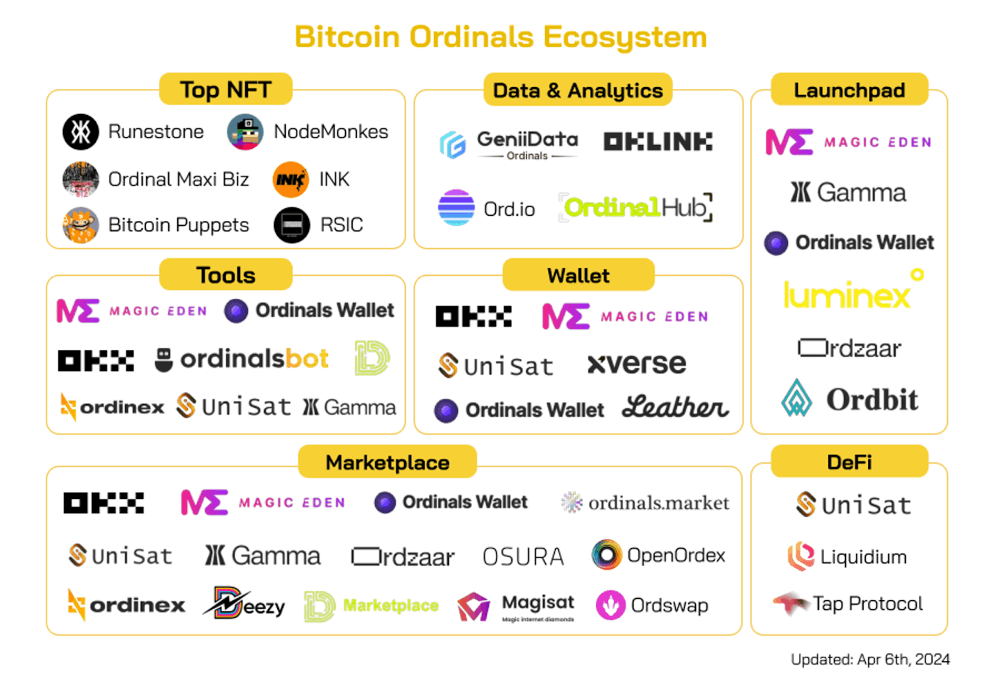

In less than a year, the Ordinals ecosystem has made significant progress with many product launches.

Bitcoin Ordinals ecosystem

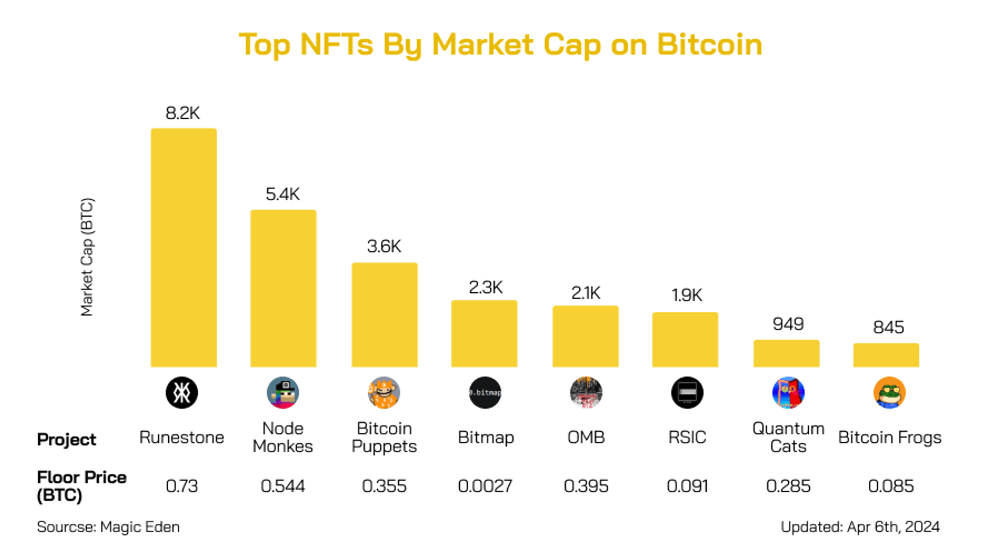

The top NFT collections on Bitcoin are currently large in value. Each collection has its own special features such as Ordinal Maxi Biz, Bitcoin Frogs engraved on rare sats, NodeMonkes running Bitcoin nodes, Runestone developed from the Ordinals team. Runestones alone is rising to become the NFT Collections with the second largest capitalization, reaching 540 million USD, just after CryptoPunks.

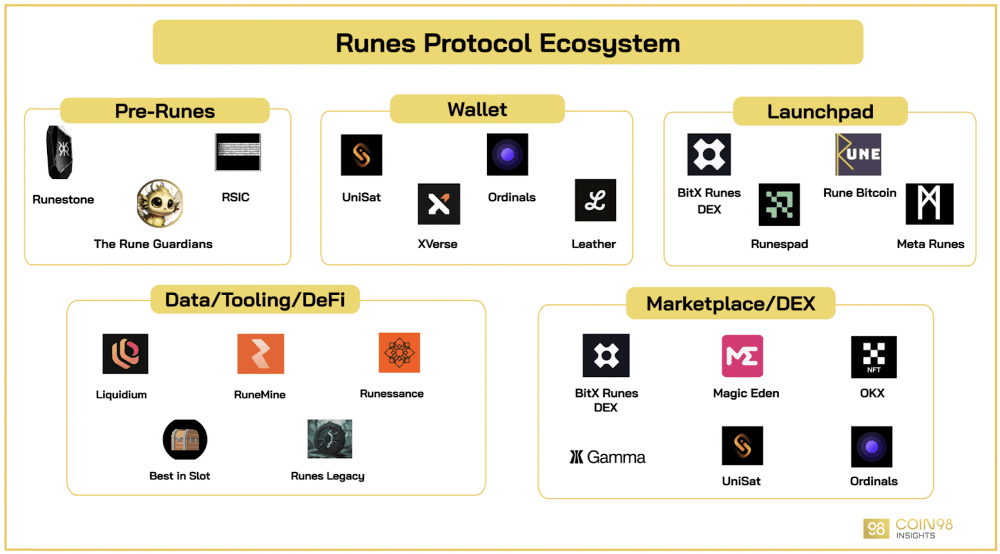

Runes Protocol ecosystem

There are many new applications being developed on Ordinals, notably Runes Protocol. Runes Protocol developed by the Ordinals team brings a new token standard to Bitcoin Ordinals, ARC-20. The project aims to solve the limitations of the BRC-20 standard, making transactions more convenient from the user's perspective.

Currently, pioneering exchanges supporting Bitcoin Ordinals such as Magic Eden and OKX have announced support for the Runes token standard. There have been projects launching tokens applying this new standard, but most of them are meme coins.

To attract more users to the Runes ecosystem, the Ordinals team has airdropped Runestone NFT to those who own more than 3 ordinals. 112,383 Runestone Ordinals were airdropped. Owning Runestone NFT will help users receive Runes Protocol's fungible token airdrop, expected to take place at Bitcoin Halving (April 20).

The first projects in the Runes ecosystem also quickly followed the Runes Protocol and announced airdrops for those holding NFT Runestone. This has caused NFT value to grow strongly in recent times. Learn about the Runes Protocol Ecosystem here.

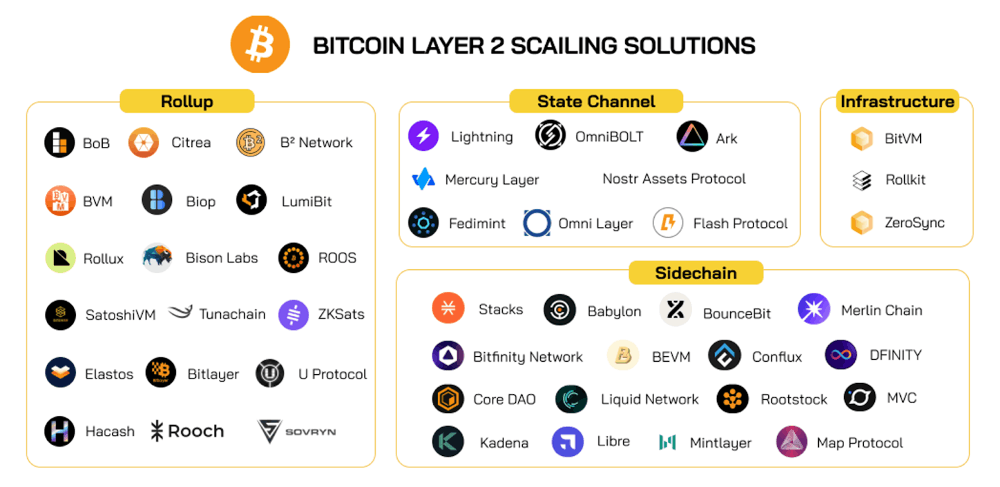

Bitcoin Layer 2 - Solve the expansion problem for the Bitcoin network

Bitcoin Layer 2 are networks built and developed on the Bitcoin blockchain, with the purpose of increasing scalability, transaction speed and reducing transaction fees for the Bitcoin network. Some solutions in the layer 2 branch will have additional smart contract interoperability capabilities to help solve the shortcomings of the Bitcoin network.

The development of layer 2 on Bitcoin is happening very actively. Bitcoin's advantage lies in the value of the network and community, which provides the opportunity to attract great value for projects developing on top of the network.

Bitcoin Layer 2 solutions include:

· Integration enhancement team: Bitcoin Virtual Machine (BitVM), Rollkit

· Scalability Enhancing Team: Lightning Network

· Sidechain solution group: Stacks, Liquid, RootStock

· Rollup solution group: B2 Network, Citrea, BoB

· The Bitcoin Layer 2 project team has appeared prominent names that have attracted attention from the community such as Merlin Chain or SatoshiEVM.

However, this group of projects has risks related to the decentralization of the bridge to Bitcoin. Besides, the majority of current Bitcoin Layer 2 projects still operate as an independent Layer 1 blockchain, not inheriting any security from Bitcoin. It can be said that most projects still use the term "Bitcoin Layer 2" to attract investors and is not completely technically correct.

Currently, the Bitcoin Layer 2 Rollup project team is still in the testing and development phase with the potential to become a true Layer 2 project team. This group of projects is expected to bring scalability while taking advantage of the security and decentralization capabilities of the Bitcoin base layer.

Conclusion

With the advantage of being the largest coin in the market and possessing a large community, BTC in particular and the Bitcoin network in general are always the focus of attracting cash flow and attention.

Bitcoin is not the fastest, most groundbreaking network, but any changes on the network have a big impact on the entire market. With the widespread acceptance of Bitcoin ETF, the upcoming halving event and a series of new products such as Bitcoin Ordinals, Runes, Bitcoin Layer 2, this will be an ecosystem that investors should not ignore.