SushiSwap

DeFi is the only place where unicorns and sushi cartoons face off in a liquidity war. Uniswap is one of the most successful DeFi protocols for exchanging tokens on Ethereum. It was created by a small team of passionate developers who designed the code to be open source and forkable by anyone. SushiSwap did just that!

With the development of the Decentralized Finance (DeFi) world, more and more new financial platforms are also emerging. We are witnessing how investors are taking advantage of new concepts such as flash loans and yield farming (liquidity mining) to make money . Uniswap has also solidified its place as one of the most fundamental DeFi protocols with the highest transaction volume. However, although it has a decentralized approach and is largely based on smart contracts, users are not given much say in Uniswap when it comes to the direction of development. SushiSwap, one of the new projects in this space, promises to change this. The fact that more than $1 billion worth of value was locked in the protocol in just a few days after its launch shows that many people are interested in this change. In this article, we will talk about SushiSwap, which took the crypto world by storm by forking from Uniswap.

What is SushiSwap?

SushiSwap was launched in September 2020 by anonymous developers Chef Nomi and 0xMaki. It is one of the most popular Decentralized Applications (DApp) on the Ethereum blockchain. SushiSwap uses the automatic market maker (AMM) model for its decentralized exchange (DEX) protocol . In other words, SushiSwap does not have an order book . Instead, the buying and selling of cryptos is done through smart contracts. SushiSwap started off by forking from Uniswap. It used Uniswap's code to form its foundation, but also made some significant changes, such as distributing rewards as SUSHI tokens. Liquidity providers on SushiSwap are rewarded with its native token, SUSHI, which is also the governance token of the protocol. Unlike Uniswap (UNI), SUSHI holders can continue to earn rewards even after they stop providing liquidity. SushiSwap has incentivized liquidity providers to stake their liquidity pool (LP) tokens on Uniswap by offering extra SUSHI rewards with high returns at market launch .

SushiSwap attracted over 1 billion USD of liquidity within a week, and the total value locked on the platform exceeded 150 million USD. The staked LP tokens were moved from Uniswap to SushiSwap two weeks later. This means that all Uniswap LP tokens staked on SushiSwap are bought back from Uniswap in exchange for the tokens they represent. With these tokens, new liquidity pools were created in SushiSwap, thus the SushiSwap exchange was established. In the second quarter of 2021, the SushiSwap ecosystem announced a unique token (NFT) platform called Shoyu as its latest innovation . The idea to establish this platform actually came from a SUSHI governance member who put forward the proposal to create Shoyu as an easy-to-use NFT platform. Shoyu aims to overcome issues encountered in today's NFT marketplaces, such as limited file format options, limited image size, and high transaction fees on Ethereum.

What is SUSHI?

SUSHI is the native token of SushiSwap. It is an ERC-20 token distributed via liquidity mining to liquidity providers on SushiSwap . SUSHI's maximum supply is 250 million tokens. SUSHI supply depends on block rate. As of November 2021, 100 tokens are created per block and the circulating supply has reached approximately 50% of the total supply with 127 million tokens. SUSHI offers token holders governance rights and a portion of the fees paid to the protocol. Simply put, it is possible to say that the owner of the protocol is the SUSHI community. So why has this situation attracted so much attention? Because community governance is closely related to the perspective of DeFi. The increasing use of liquidity mining (yield farming) as a valid method for distributing tokens has led to the launch of many new tokens. These fair token launch models aim to make the conditions equal for everyone. In this model, there is often no pre-mining, a special share is not allocated to the founders, and an equal distribution is made according to the amount of funds offered by each user. Distributed tokens often offer

governance rights to token holders. So what can token holders do with these governance rights? On SushiSwap, anyone can submit a SushiSwap Improvement Proposal (SIP), and these suggestions are then voted on by SUSHI owners. These may be suggestions for small or even major changes to the SushiSwap protocol. The development of SushiSwap is in the hands of SUSHI token holders rather than a more traditional team like at Uniswap. A strong community can be an important source of strength for any token project, but this is especially true for a DeFi protocol. For example, MISO, or Minimal Initial SushiSwap Offering, is a product based on a governance proposition. It is a token issuance platform within the SushiSwap ecosystem and is designed to meet the expectations of the SUSHI community. MISO allows individuals and communities to issue new project tokens through the SushiSwap platform.

How does SushiSwap work?

As we mentioned before, SushiSwap is an automated market maker (AMM) that operates as a decentralized exchange. There is no order book or central authority. Cryptocurrency trading on SushiSwap is done through smart contracts in liquidity pools. The liquidity pool is where SushiSwap users become liquidity providers (LPs) by locking their crypto assets. Anyone can become a liquidity provider on SushiSwap and earn rewards proportional to their share of the pool. To do this, it is necessary to deposit two tokens of equal value into the pool. Pools act like a market that users can use to buy and sell tokens.

Similar to other DEX protocols, you can exchange ERC-20 tokens on SushiSwap. For example, you can exchange stablecoins such as USDT and BUSD for cryptocurrencies such as bitcoin (BTC) and ether (ETH). In addition, you can benefit from different sushi-themed functions that allow you to earn passive income. For example, you can get xSUSHI by staking SUSHI on SushiBar. Staking xSUSHIs offer holders the chance to earn 0.05% of fees on all transactions across all liquidity pools. Upon Shoyu launch, SUSHI holders who stake their tokens for xSUSHI will also be eligible to receive 2.5% of all NFT trades on the NFT marketplace.

BentoBox is another feature for earning rewards on SushiSwap. It is an innovative safe that allows users to take advantage of all the available return-generating tools on SushiSwap. When you deposit your assets into BentoBox, you can automatically earn returns by lending to other users as well as staking on SushiBar. At the same time, xSUSHI holders can also earn rewards from transaction fees charged on BentoBox.

Uniswap and SushiSwap comparison

It is a well-known fact that crypto is based on the spirit of open source. Many people think that Bitcoin and the growing number of permissionless protocols act as a new kind of public good in the form of software. Since these projects can be copied quite easily and put into use again with minor changes, it is natural to see competition between similar projects. But we can assume that this ultimately leads to the best products for the end user.

There is no doubt that the DeFi world owes many important advances to the Uniswap team. But we can also see a future where both Uniswap and SushiSwap (or other forks) develop further. Uniswap can remain at the forefront of innovation in the AMM world, and SushiSwap can offer an alternative that focuses more on the features the community wants to see.

However, splitting liquidity between similar protocols is not an ideal situation. If you have read our Uniswap article, you know that the more liquidity in the pools, the better AMMs work. Splitting much of the liquidity in DeFi between different AMM protocols can result in a worse experience for the end user.

How to provide liquidity for SushiSwap?

If you have decided to stake your tokens to earn SUSHI, the first step will be to acquire these tokens. To do staking, you can buy cryptocurrencies from a centralized crypto exchange such as Binance or a decentralized exchange such as Uniswap and 1inch.

We will offer liquidity for BNB-ETH in this example, but you can also follow our guide using any other pair of your choice (provided, of course, that the LP tokens are available on SushiSwap).

1. Go to Sushi and click [Enter App] to enter SushiSwap.

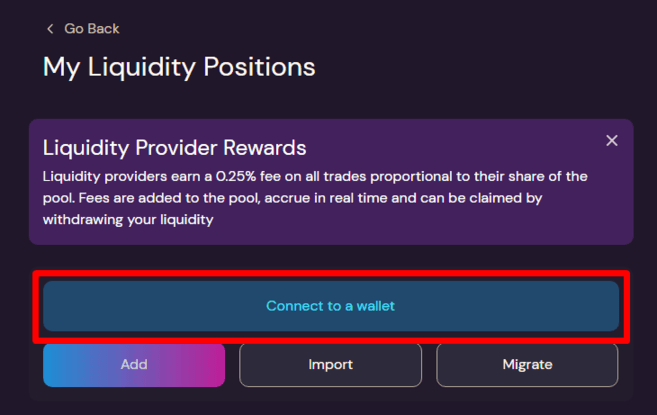

2. Select [Pool] from the navigation bar at the top. To get started, you will need to connect your wallet.You can use Binance wallet,MetaMask,Wallet connect or any other supported Ethereum wallet. In this example we will use Binance Wallet.

3. After clicking [Binance], a pop-up window will appear. Enter your password to unlock your wallet, or click [Create a new wallet] if you don't have a wallet.

4. Click [Connect].

5. You will be redirected to the SushiSwap pool again. Click [Add] to add liquidity.

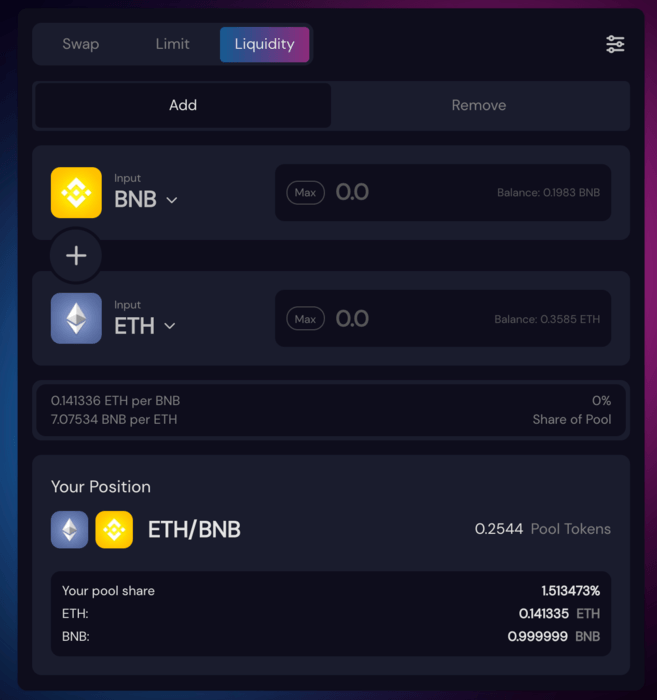

6. Click [Select a token] to find the cryptocurrency pair you want to offer liquidity to. Next, enter the amount for one of the tokens (e.g. 1 BNB). The system will automatically calculate how much of the other token is required.

It is also possible to see your share in the pool at the bottom. Click [Approve ETH] to confirm.

7. Another pop-up window will appear where you can see the transaction information and the gas fee for this transaction. Click [Confirm] to confirm or [Reject] to edit.

8. Click [Confirm Adding Liquidity] and then click [Confirm Supply] to add liquidity to the BNB-ETH pool.

Note: Due to temporary loss , the distribution of tokens you will receive when leaving the pool may be different from what you deposited when entering the pool. Please make sure you understand the risks before adding liquidity.

9. Confirm the transaction from the pop-up window in your wallet.

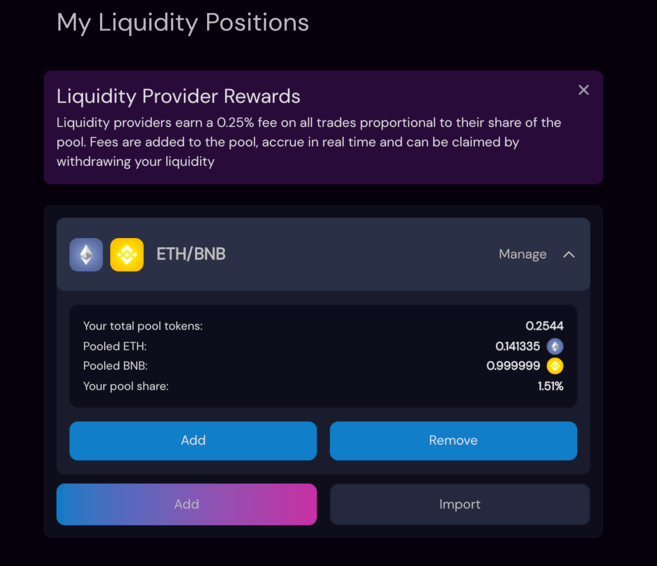

10. You have successfully added liquidity to the BNB-ETH pool. You can see your position and your share in the pool. This means that when users make BNB/ETH transactions, you will earn transaction fee rewards.

11. To manage your positions, go to the [Pool] tab from the navigation bar at the top of the page and click on your position to add or remove liquidity.

You will see that you have some SLP tokens in your wallet. SLP tokens are Sushiswap LP tokens and represent the funds you deposit into the pool. The tokens issued by all liquidity pools in SushiSwap are called SLP, but in fact these tokens represent different pools.

How to buy or sell SUSHI on Binance?

Apart from earning SUSHI from SushiSwap, you can also buy it from cryptocurrency exchanges such as Binance On the other hand, if you want to sell the SUSHI you earned from SushiSwap, you can transfer the tokens to your wallet and sell them on crypto exchanges such as Binance.

1. Log in to your Binance account and select the classic or advanced trading page from the [Buy - Sell] tab at the top of the page.

2. Type "SUSHI" in the search bar on the right side of the screen and the available trading pairs will appear. We will use the [SUSHI/BUSD] pair in this example. Click on [ SUSHI/BUSD ] pair to open the trading page .

3. Scroll down to the [Spot] box. You can buy or sell SUSHI here. Enter the amount of SUSHI you want to buy or sell. Then choose an order type for your order. In this example we will use a Market Order . Click [Buy SUSHI] or [Sell SUSHI] to confirm the order.

SushiSwap is an exciting experiment that challenges the competitive advantage of Uniswap, an already successful DeFi protocol. Although SushiSwap was forked from UniSwap, it has added new features to its protocol, especially community governance

Since its launch, SushiSwap has surpassed many other DeFi projects in terms of total value locked and can continue to grow in both popularity and number of users. SushiSwap shows that no product or service has an unrivaled advantage in the DeFi world, regardless of its ultimate success.

https://www.bulbapp.io/u/BYqeEQZZWzQn7MVpopges4zH3qe3yeNDunPVY9f3FixS/erendurden

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)