Best Crypto to Buy Now in March 2024

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

As the crypto market heats up, many retail and institutional investors are wondering which coins will deliver the biggest gains over 2024 and beyond. With hundreds of mega-cap tokens and thousands of emerging cryptos to choose from, it can be hard to decide what crypto to buy today.

We’ve evaluated hundreds of crypto projects to make your decision easier. In this guide, we’ll highlight 20 of the best crypto to buy now, including Bitcoin, Ethereum, XRP, and more. We’ll also cover new cryptos like Green Bitcoin , Scotty AI, Smog, Frog Wif Hat and Sponge V2 that have the potential to explode this year.

Keep reading to find our top picks for March 2024. Remember that you should always do your own research before you make any kind of investment.

Best Crypto to Buy Now

We’ll start our list of the best cryptocrurrencies to buy now with 10 large-cap tokens that we think could deliver market-beating returns over the next crypto bull market.

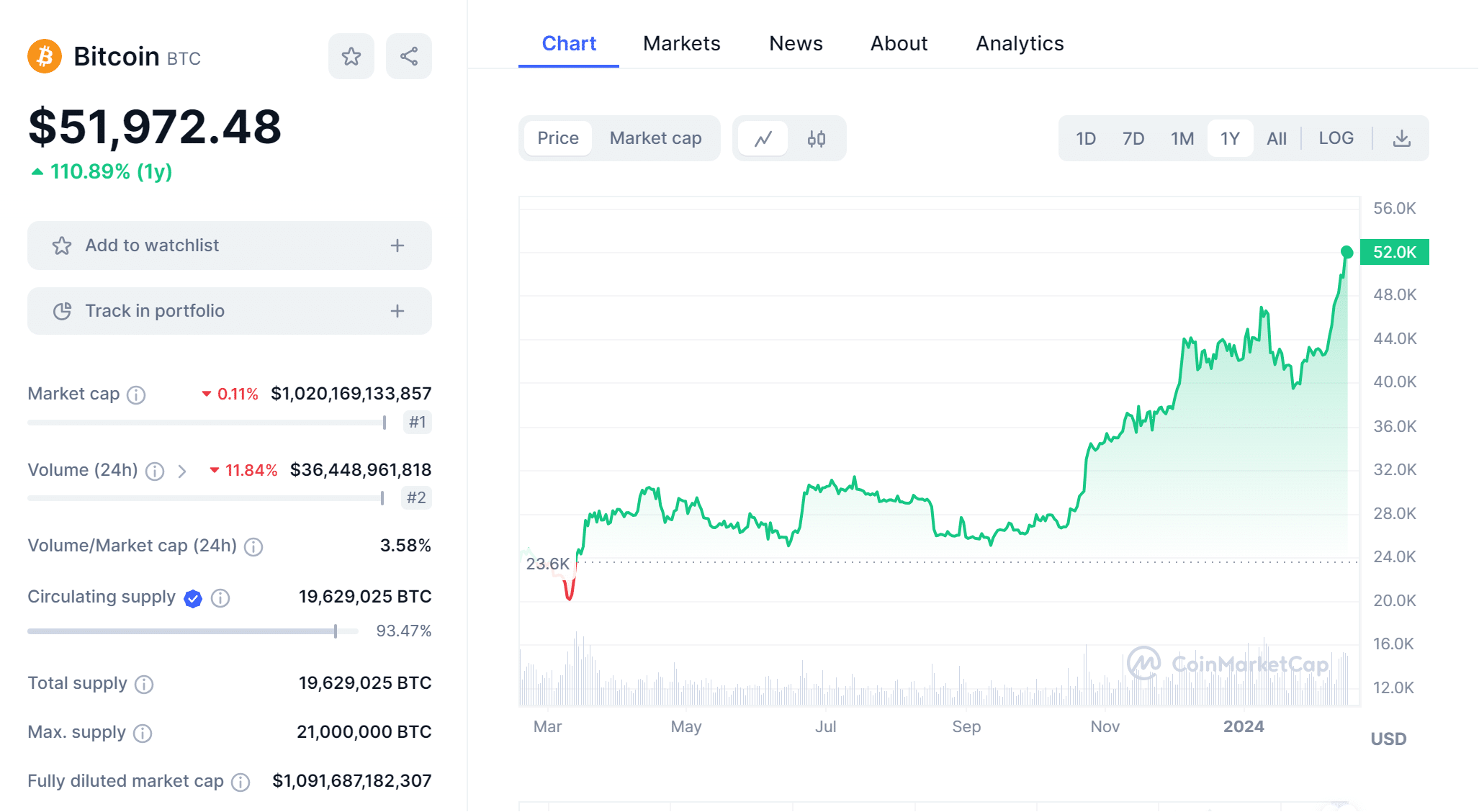

1. Bitcoin

Bitcoin is the world’s oldest cryptocurrency and the largest crypto by market cap by a wide margin. It’s the only cryptocurrency that’s officially recognized by many major governments, including the US, and it’s used as legal tender in countries like El Salvador. Recently, the first spot Bitcoin ETFs began trading on US stock exchanges.

Market cap: $1.01 trillion

12-month return: 110.80%

Why Bitcoin made it onto our list:

Bitcoin has been driving the crypto bull market for much of the past year. It’s more than doubled in value in the past 12 months, vastly outperforming major altcoins like Ethereum.

BTC is now trading over $50,000, well over the key $42,000 price benchmark set during the 2020-21 crypto bull run. That provides a major psychological boost that’s likely to provide BTC with important momentum over the coming months.

Bitcoin could see even more gains thanks to the launch of spot Bitcoin ETF trading in the US. As more brokers and investment managers offer these ETFs to clients, demand for Bitcoin is expected to soar.

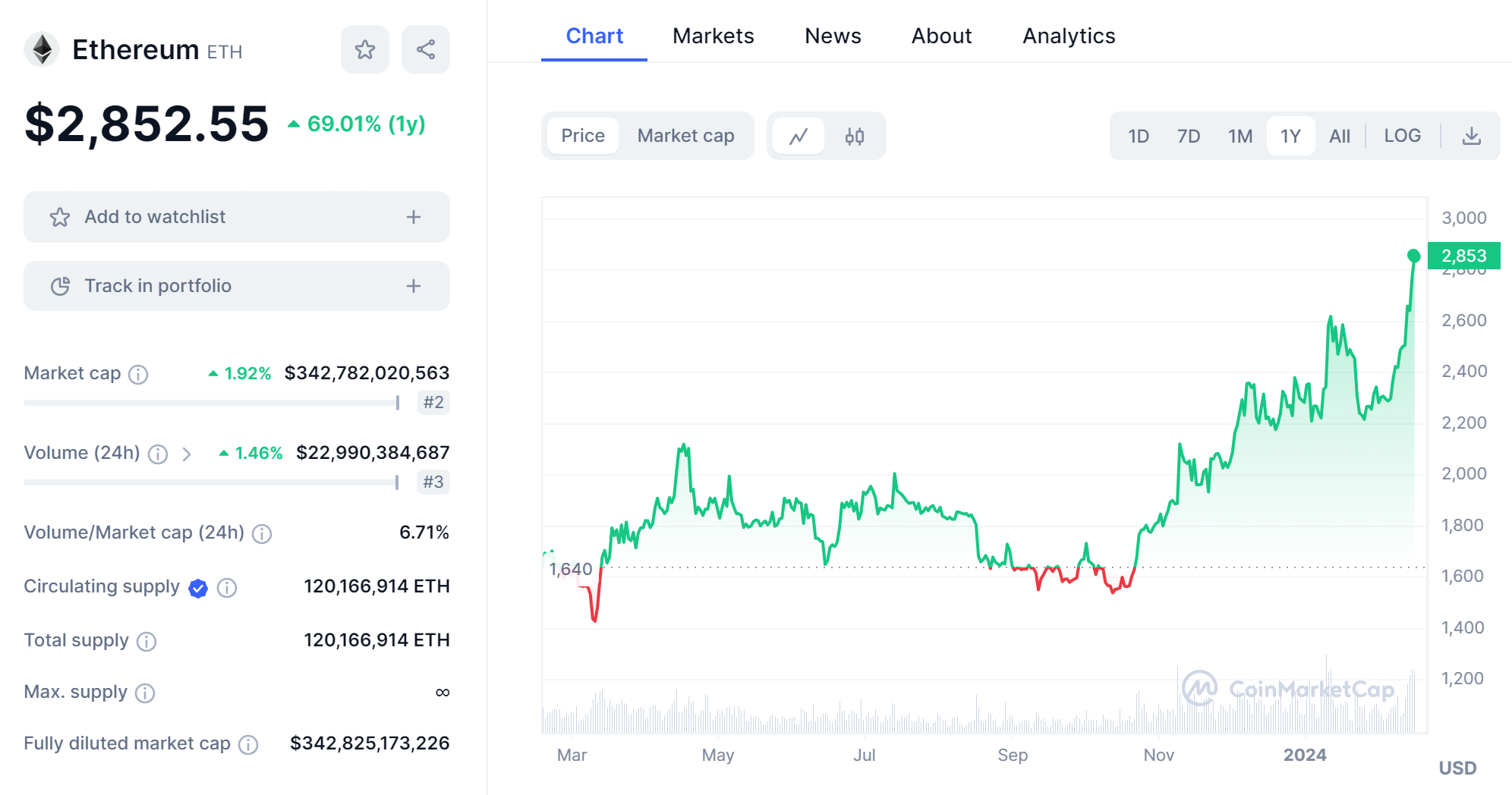

2. Ethereum

Ethereum is the world’s second-largest crypto by cap and the most widely used blockchain network for dApp development. The project was the first to introduce smart contracts when it launched in 2015. Ethereum successfully transitioned from a proof-of-work validation mechanism to a proof-of-stake mechanism in 2022.

Market cap: $342.8 billion

12-month return: 68.98%

Why Ethereum made it onto our list:

Ethereum remains by far the most popular blockchain network for developers. It’s where most of the action in the crypto world is happening, including new launches, new play-to-earn crypto games, and advances in DeFi.

There’s a flywheel effect at play here. As Ethereum gets bigger, more developers will build on it and encourage even more users to join. All the while, demand for ETH will grow and its value will go up.

Ethereum successfully fended off challenger blockchains like Cardano and Solana during the last crypto bull market. Now, the focus is on Layer-2 solutions that improve the speed of the Ethereum network and boost Ethereum’s value rather than on building new blockchains to try to knock down the smart contract king.

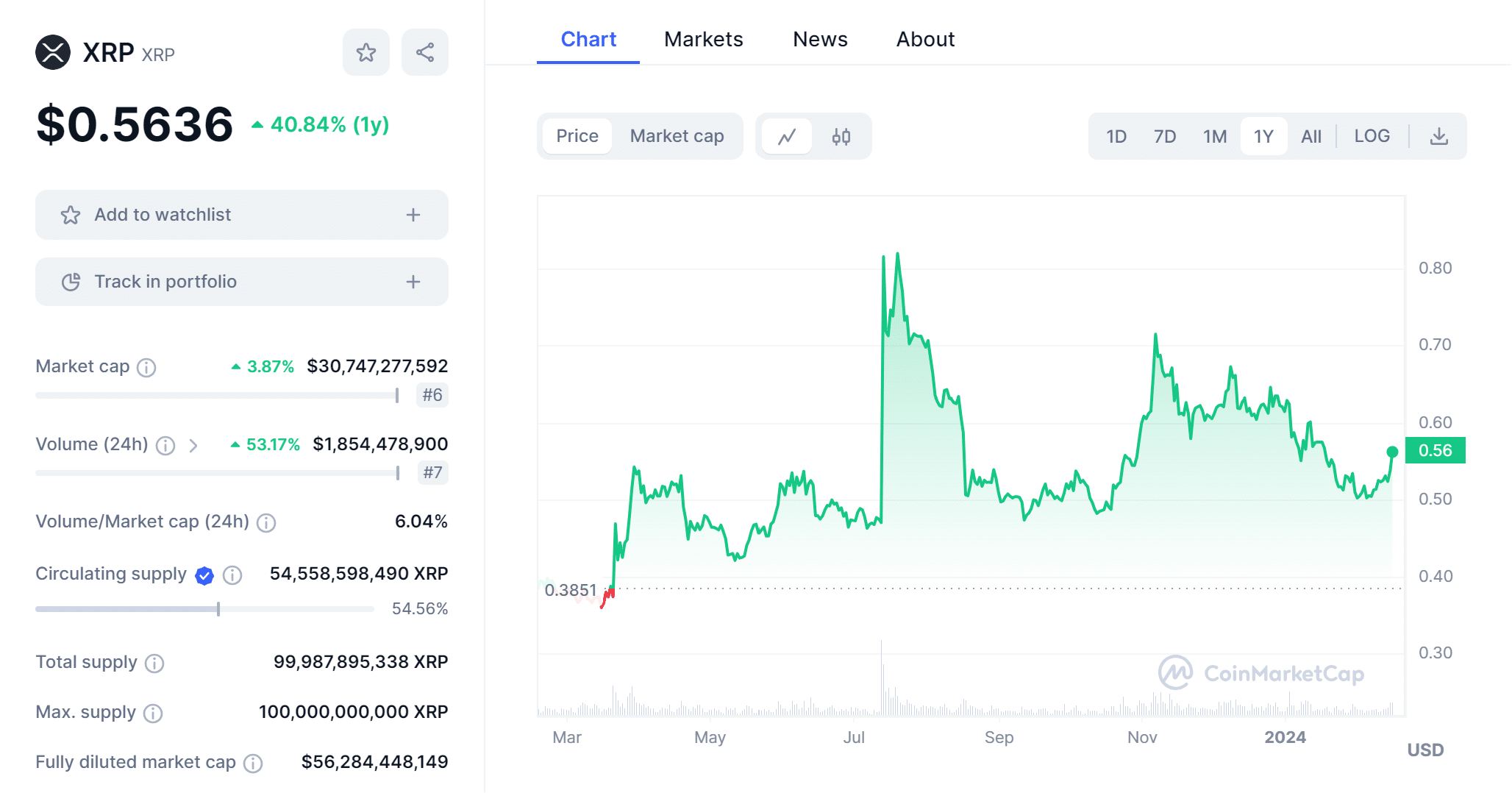

3. XRP

XRP is the official crypto token of the Ripple payment network, which was built to make international payments faster and cheaper. The project is coming off a win against the SEC, which alleged that XRP was an unregistered security. XRP is now the 6th largest crypto by cap.

Market cap: $30.7 billion

12-month return: 40.85%

Why XRP made it onto our list:

XRP has been held back for years by uncertainty over whether it would be classified as a security in the US. Now, thanks to its court victory over the SEC, that uncertainty is gone.

That has cleared the way for major banks to try out Ripple’s payment network using XRP. The project has brought on major partners like Bank of America, PNC Bank, Santander Bank, and more.

XRP is up only slightly since its court victory last summer, leading many analysts to think that it is undervalued. More interest in using XRP for international payments during the upcoming crypto bull market could send its price skyrocketing.

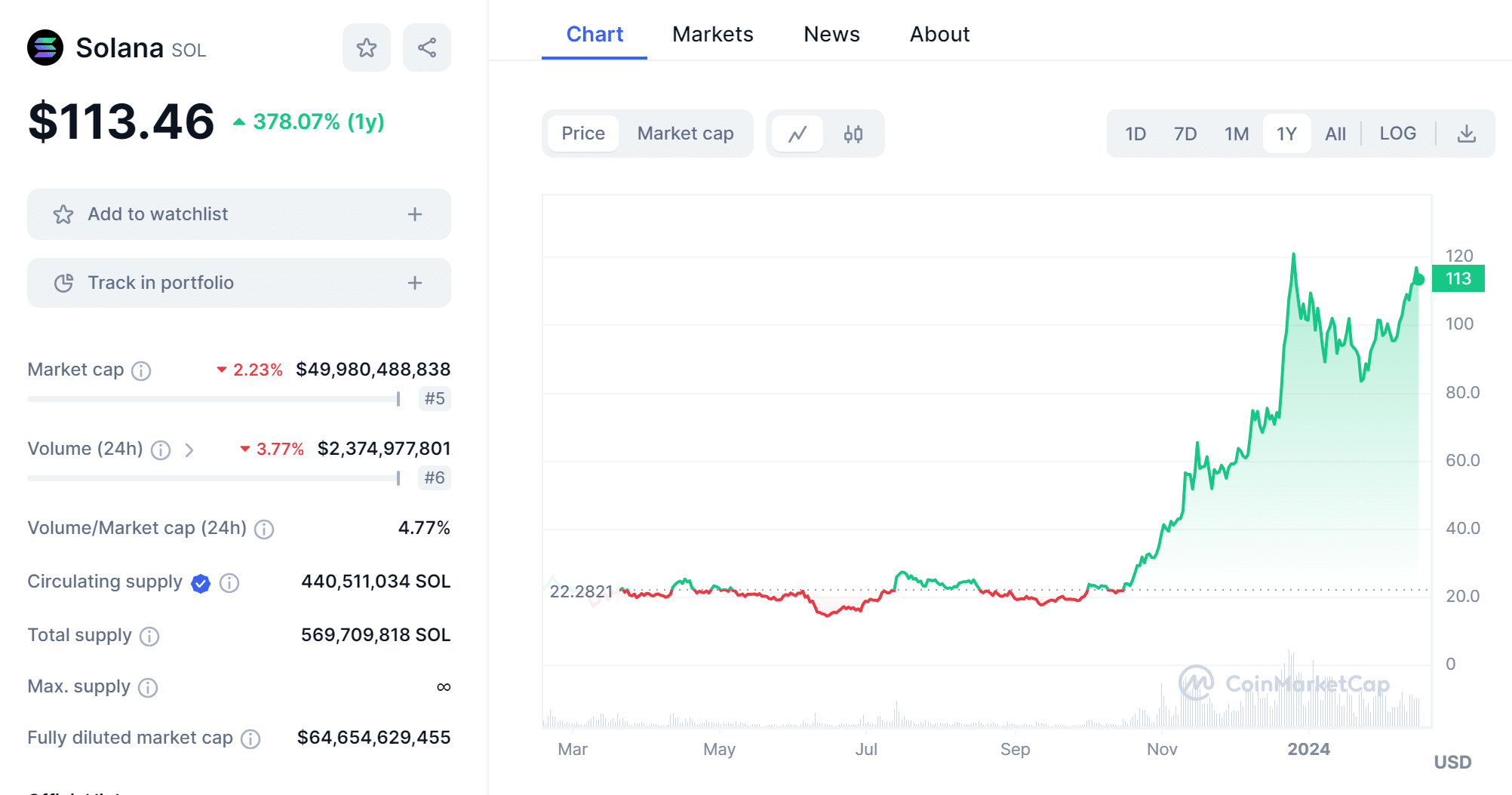

4. Solana

Solana is a fast and cheap blockchain created as a challenger to Ethereum. It’s been one of the most successful crypto tokens of the resurgent crypto bull market, gaining more than 300% between October 2023 and February 2024. Solana is now the 5th-largest crypto by cap.

Market cap: $49.8 billion

12-month return: 376.99%

Why Solana made it onto our list:

No cryptocurrency has as much momentum as Solana does right now. It has been on an uninterrupted winning streak for the past several months, gaining nearly 5x in value and experiencing a surge in developer interest.

Solana’s performance is even more impressive considering where the project was a year ago. It was favored project of disgraced FTX founder Sam Bankman-Fried, and many analysts thought Solana would simply disappear after FTX collapsed.

Solana has demonstrated that it’s highly resilient. While we don’t think Solana will challenge Ethereum for dApp dominance, it could earn enough market share to see $SOL become quite valuable.

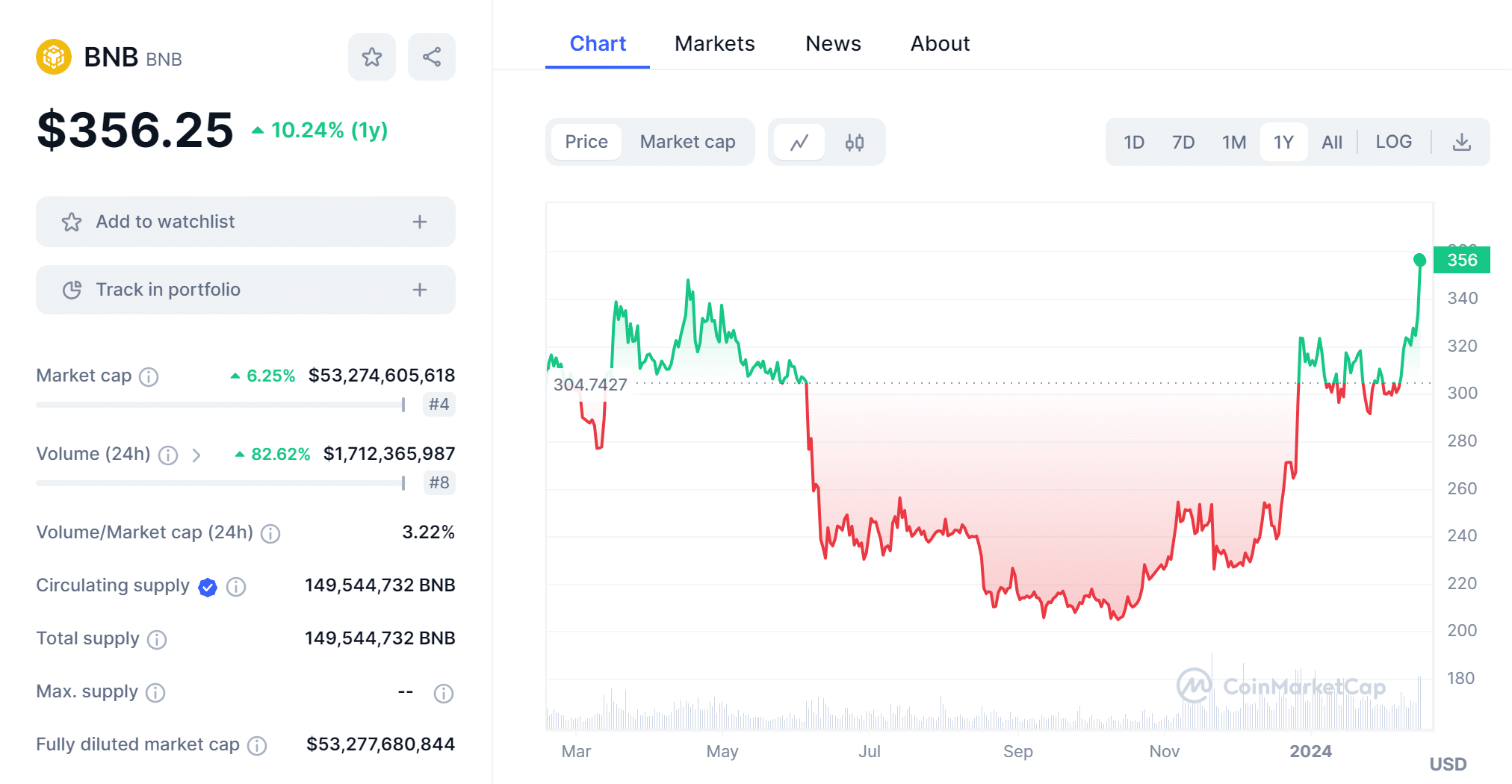

5. BNB

BNB is the official cryptocurrency of Binance, the world’s largest crypto exchange. It offers discounts on trading and benefits like early access to new crypto launches on Binance. It’s the 4th-largest crypto by cap.

Market cap: $53.3 billion

12-month return: 9.60%

Why BNB made it onto our list:

BNB’s performance over the past year hasn’t been impressive. For much of the year, it was actually down because of a US prosecution of Binance and its founder, Changpeng Zhao, for violating anti-money laundering and sanctions requirements.

Binance has now settled that lawsuit and its business has hardly suffered. More important, an investigation into Binance turned up no evidence of fraud—dispelling rumors that Binance could follow the fate of FTX. In other words, the US government determined that the exchange’s financial undergirding is solid.

It might take time for BNB’s price to reflect this good news, but we think Binance is a great business at the center of the crypto world. It’s likely to see continued long-term growth.

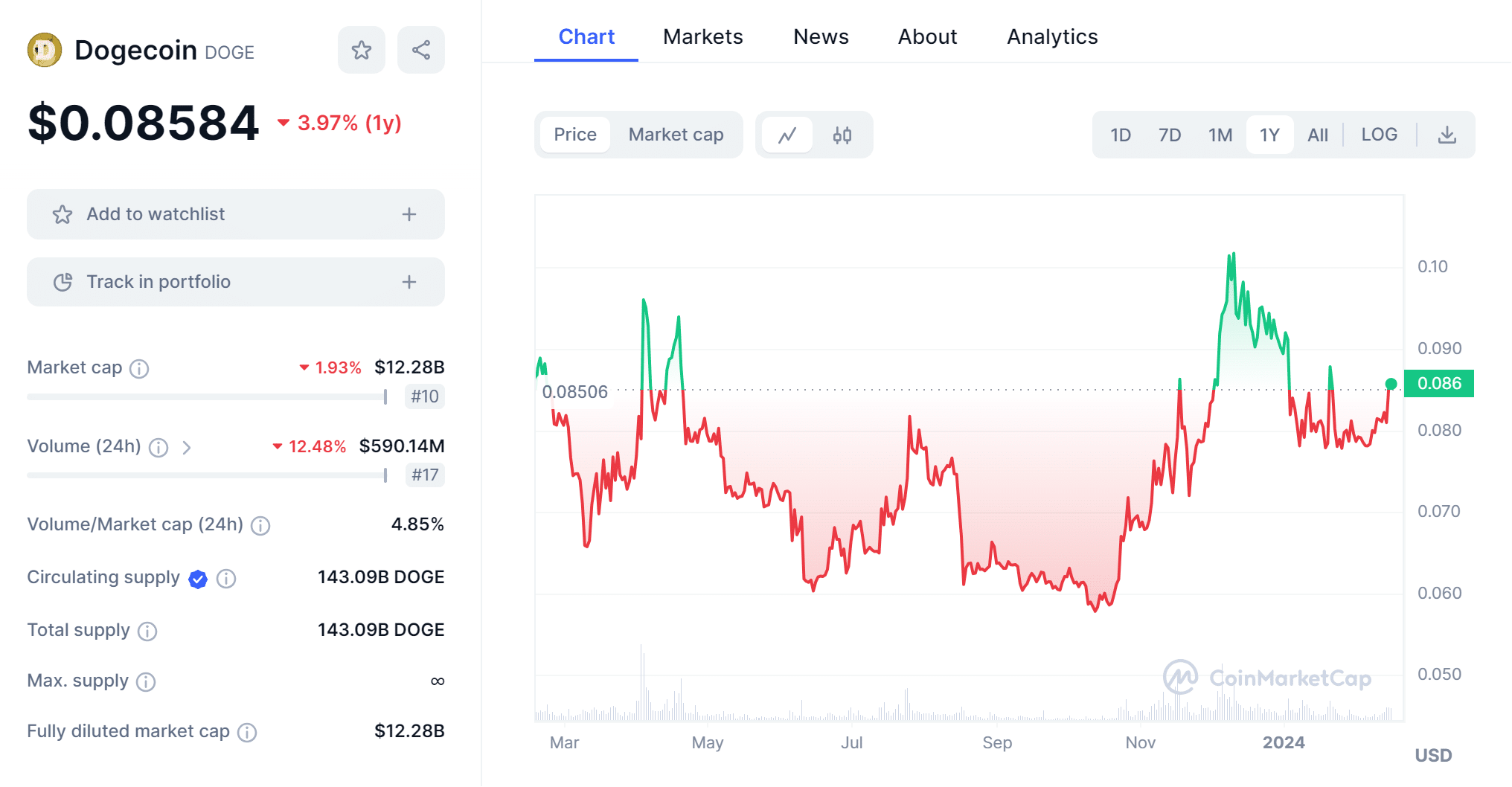

6. Dogecoin

Dogecoin is the original meme coin, launched in 2013. It was mostly unheard of until 2020-21, when it gained the attention of major celebrities including Tesla founder Elon Musk. Since Dogecoin’s explosive gain during the last bull market, it’s inspired thousands of copycat meme coins—including highly successful ones like Shiba Inu.

Market cap: $12.3 billion

12-month return: -4.89%

Why Dogecoin made it onto our list:

Although Dogecoin is down over the past 12 months, we think it’s poised for a comeback. Meme coins have always fared well when the crypto market is hot, and it is heating up right now.

In addition, Dogecoin is at this point more than just a meme coin. It’s widely accepted for payments in the crypto world, and increasingly in the real world as well. Dogecoin has proven that it can fend off challengers like Shiba Inu and Pepe, giving us confidence this meme coin is here to stay.

While likely still far off, it’s even possible that Dogecoin could get its own ETF one day. If that happens, look for the price of $DOGE to head to the moon.

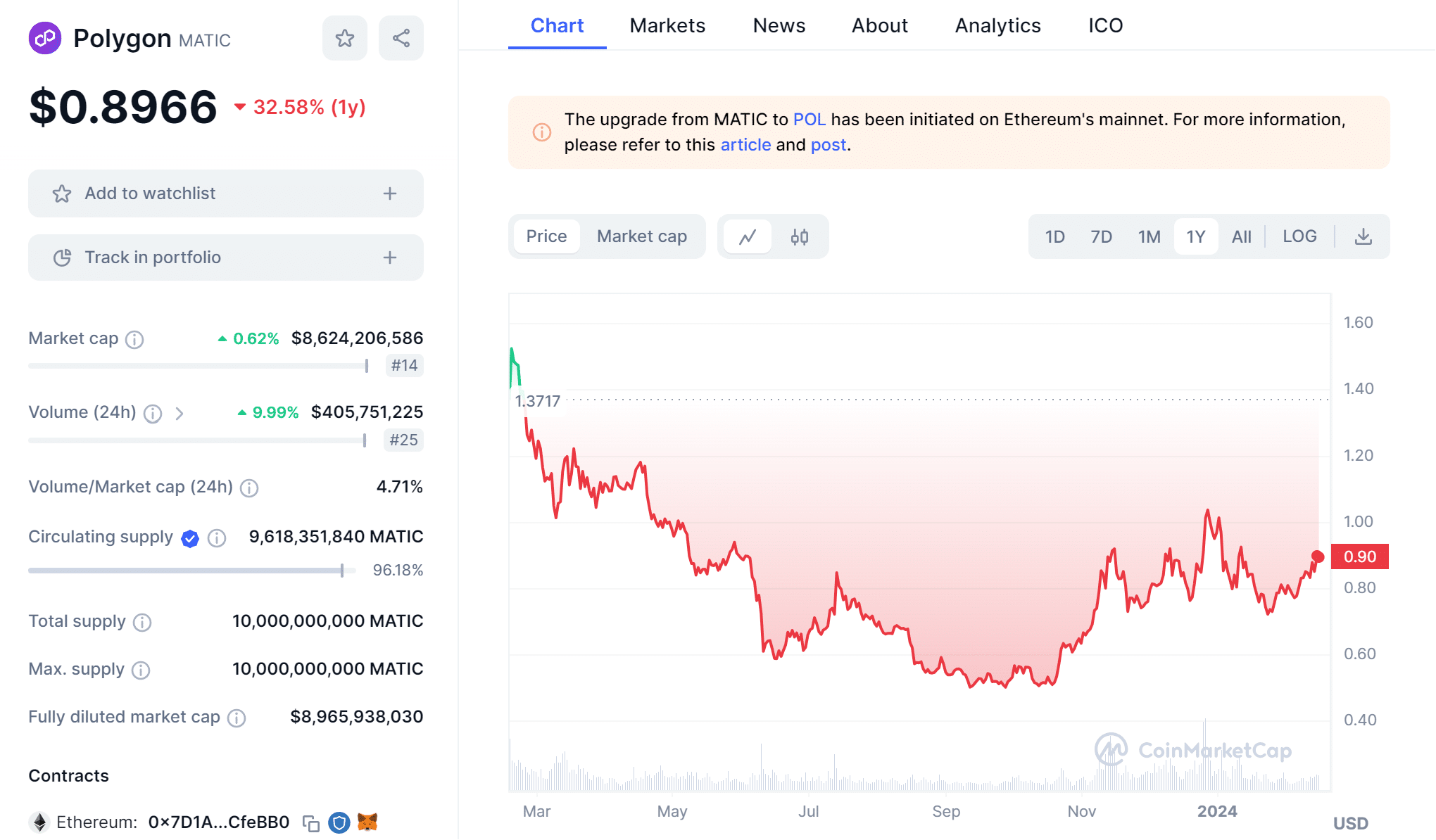

7. Polygon

Polygon is a Layer-2 solution for Ethereum that makes it faster and cheaper to run transactions on the Ethereum network. It recently announced a major upgrade to Polygon v2, which includes transitioning the $MATIC token to a new $POL token. $MATIC will be transferable to $POL at a 1:1 ratio.

Market cap: $8.6 billion

12-month return: -32.09%

Why Polygon made it onto our list:

Polygon suffered badly over the past two years as network activity on Ethereum dropped and competing Layer-2 solutions like Eigenlayer, Arbitrum, and Optimism gained traction. Polygon is responding with a massive development effort that includes retooling nearly every aspect of its network.

This effort involves transitioning from the $MATIC token, which is used to pay for transactions on Polygon, to a new $POL token that will offer increased staking rewards. While this transition hasn’t yet had a major impact on $MATIC’s price, we think gains will arrive as Polygon finishes the first milestones on its new roadmap.

On top of that, Polygon stands to benefit from Ethereum’s flywheel. As crypto rebounds and development on Ethereum spikes, transaction volume on Polygon should increase as well.

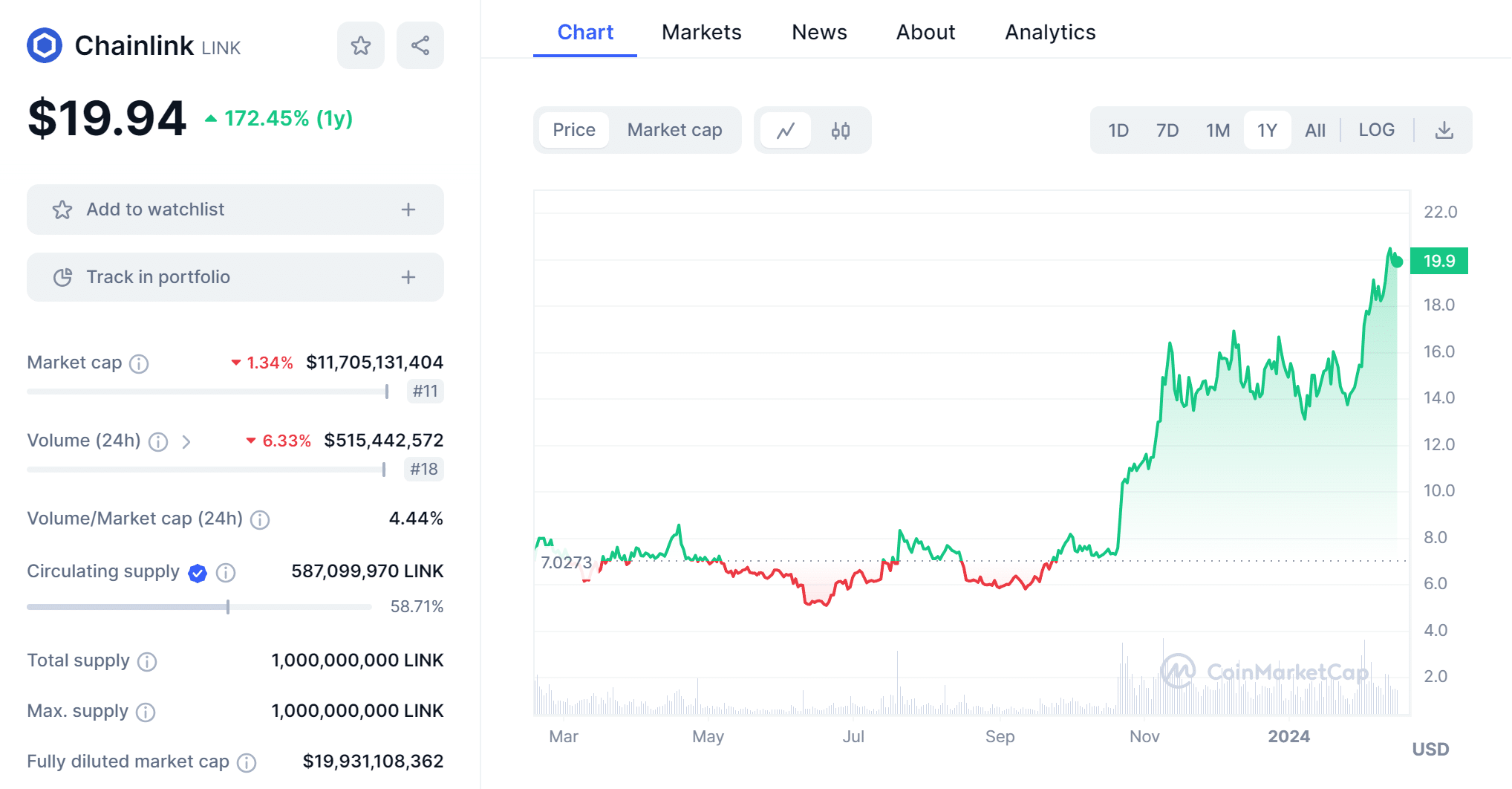

8. Chainlink

Chainlink is a blockchain oracle network. It enables blockchains like Ethereum to collect real-world data, such as stock prices, sports scores, and more. The project’s native token, $LINK, is used to pay for access to data and is the 12th-largest crypto by market cap

Market cap: $11.7 billion

12-month return: 172.48%

Why Chainlink made it onto our list:

Chainlink’s oracle services are crucial to the smooth functioning of the Ethereum network and the many thousands of dApps built on it. Thanks to Chainlink, smart contracts can collect real-world data required for decentralized finance, sports betting, Internet of Things applications, and more.

Chainlink stands to benefit from renewed development on Ethereum and increased interest in DeFi especially. The more dApps there are using Chainlink’s data, the more fees the network collects and the more the $LINK token gains value.

Chainlink has more than doubled in value in the last year and has a lot of momentum heading into the latest bull run. We expect to see that momentum increase in 2024.

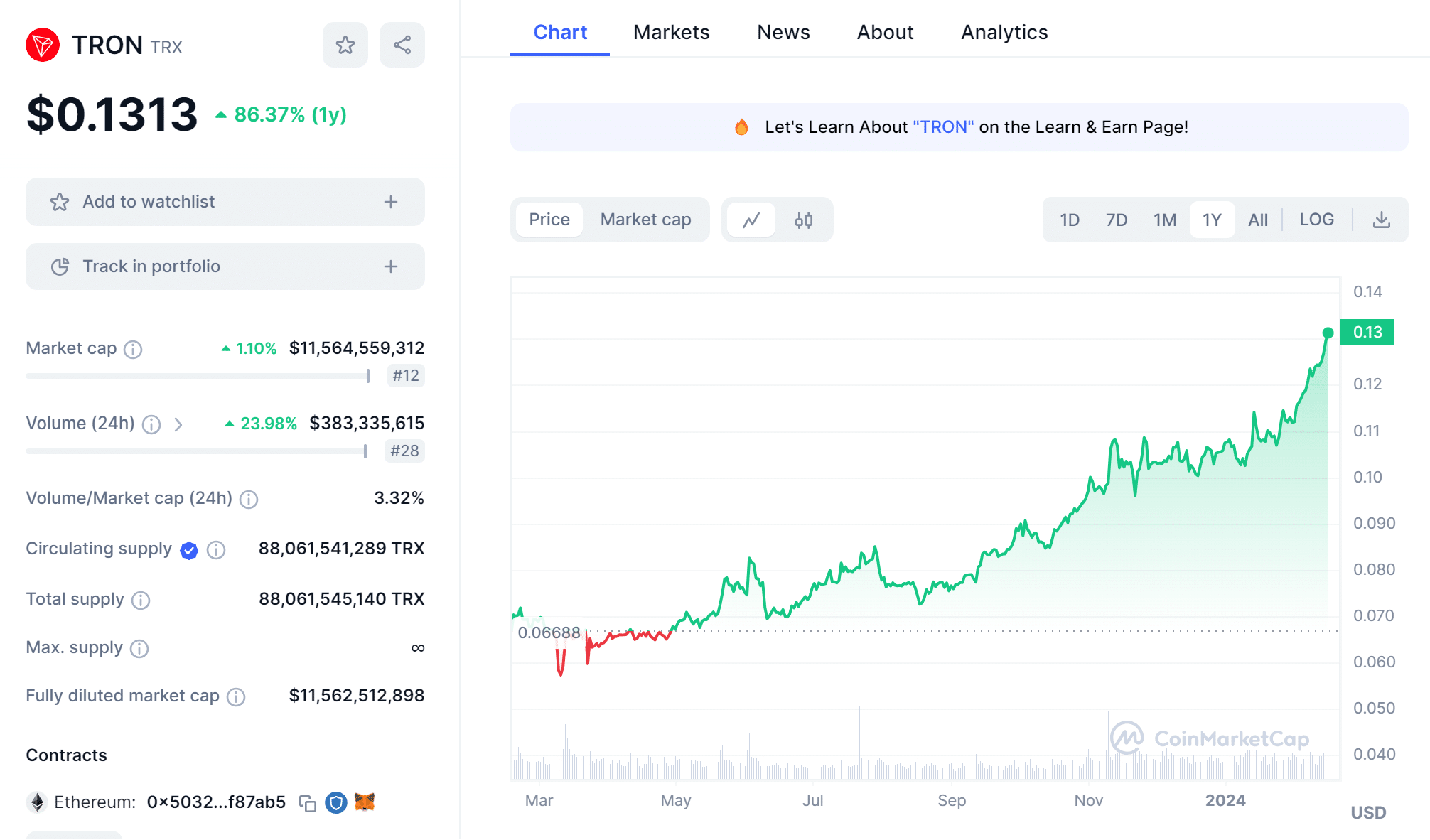

9. Tron

Tron is a blockchain launched in 2017 with the goal of democratizing media consumption and eliminating middlemen on the internet. It’s since morphed into an Ethereum competitor, taking on roles in DeFi and general dApp development. However, Tron remains much smaller than Ethereum, with a market cap of around 1/30th that of Ethereum

Market cap: $11.5 billion

12-month return: 86.37%

Why Tron made it onto our list:

Tron is one of the fastest-growing blockchains and it’s increasingly important in the world of DeFi. It’s now home to the majority of USDT and USDC stablecoins, which are used for everything from crypto trading to lending to staking.

That has resulted in Tron becoming the second-largest blockchain for total value locked (TVL) behind Ethereum. TVL growth demonstrates a long-term commitment to the Tron blockchain that has translated into significant gains for $TRX.

On top of that, Tron could see massive growth if it achieves its original aim of becoming a hub for decentralized content. Media companies are in turmoil right now, which could present an opening for Tron to step into.

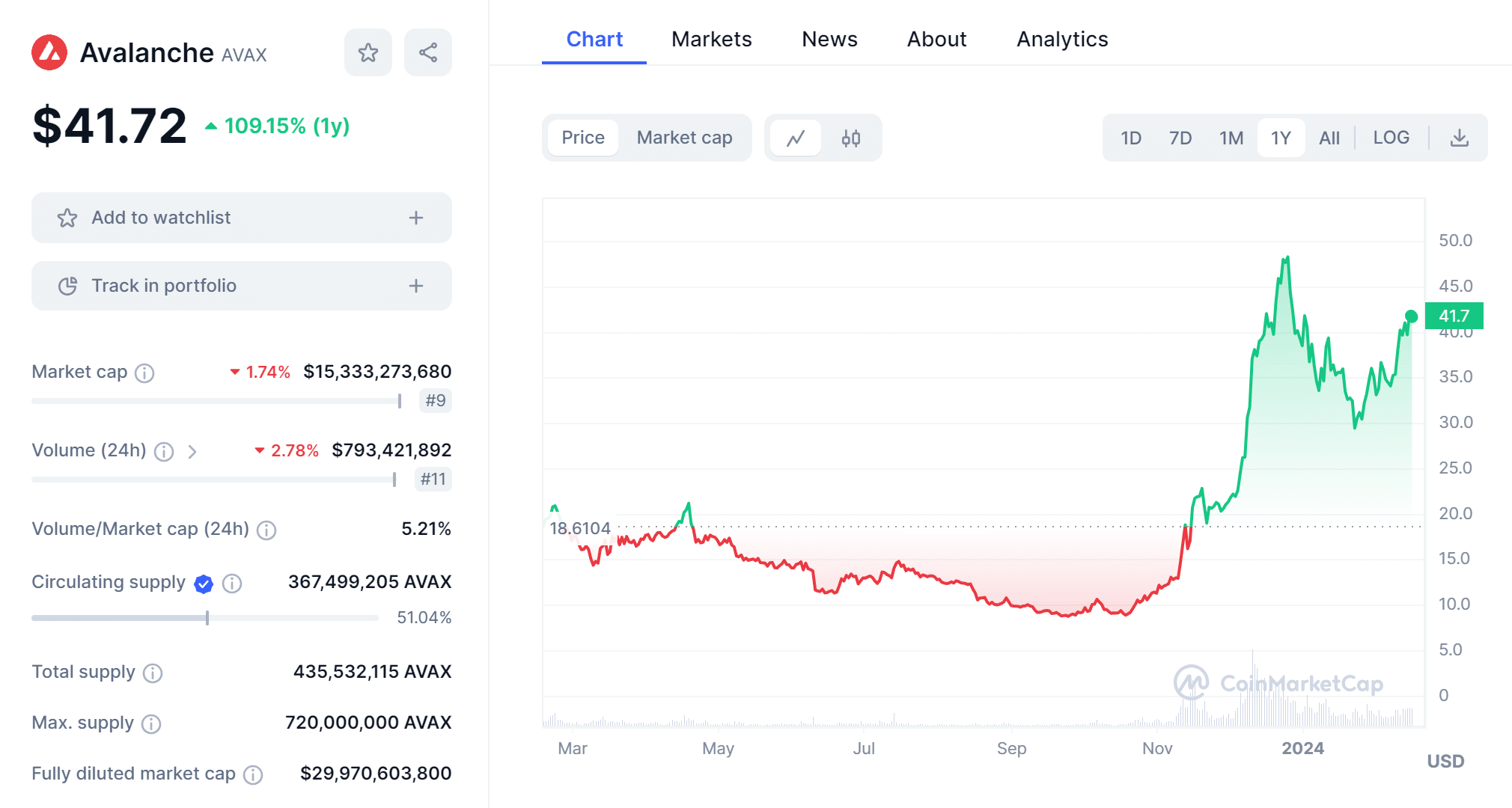

10. Avalanche

Avalanche is an ultra-fast blockchain and Ethereum competitor launched in 2020. It uses smart contracts and a proof-of-stake validation mechanism, similar to Ethereum, but offers more scalability for dApp developers. Avalanche’s $AVAX token is now the 9th-largest crypto by cap.

Market cap: $15.3 billion

12-month return: 109.15%

Why Avalanche made it onto our list:

Avalanche is a high-momentum project that’s nearly doubled in value in the past 5 months. That momentum shows no signs of slowing down now, which means that even bigger gains could be on the way for $AVAX.

The gains in Avalanche are being driven by strong fundamentals, including more developers flocking to this blockchain. It remains one of the strongest Ethereum competitors, expanding slowly and methodically rather than going through boom and bust cycles like Solana and Cardano.

Avalanche is focused on tokenizing real-world assets and GameFi, which are expected to be leading areas of development in the crypto sphere. So, look for $AVAX to be a standout token over the next 12 months.

How We Rated the Best Cryptos to Buy Now

To curate this list of the best cryptos to buy now we looked at various factors including historical performance, potential for growth and long-term potential, current price, utility, and security. For new projects currently on presale we also analyzed their teams, whitepaper, tokenomics, and roadmap to ensure they are legitimate projects that offer no risk of being a scam. Here’s how we weighted every aspect of the best cryptos to buy now.

Market Performance (25%)

- Recent Price Trend: We assessed the crypto’s price movement over the past three to six months, considering both short-term and long-term trends.

- Market Capitalization: We looked at the overall market value of the cryptocurrency, as it reflects its position and significance in the market.

Utility and Use Cases (20%)

- Practical Applications: We examined how the cryptocurrency is used in real-world scenarios, considering whether it has unique features or applications that set it apart.

- Technological Innovation: We evaluated the underlying technology and any recent innovations that contribute to the cryptocurrency’s usefulness.

Community and Adoption (15%)

- Community Engagement: We analyzed the level of activity on social media, forums, and community platforms as a colorful and engaged community often indicates strong support.

- Adoption Rate: Since higher adoption rates suggest a broader ecosystem, we looked at how widely the cryptocurrency is accepted by merchants, businesses, and other users.

Development Team (15%)

- Team Reputation: We investigated the track record and reputation of the development team. We don’t want to put down any crypto projects from newcomers, but we can all agree that experience and success in previous projects enhance credibility.

- Transparency: We assessed how transparent the team is in sharing project updates, development progress, and any challenges faced. The more the community knows about what’s going on, the more confident they can feel about their crypto purchase.

Security (15%)

- Network Security: We evaluated the security features of the underlying blockchain technology, considering factors like consensus mechanism and resistance to attacks.

- Past Security Incidents: We researched any historical security incidents or vulnerabilities, and analyze how well the team handled and mitigated them.

Regulatory Compliance (5%)

- Compliance with Regulations: We checked if the cryptocurrency complies with legal and regulatory frameworks in the regions where it operates – a crucial factor for long-term sustainability.

Roadmap and Future Plans (5%)

- Development Roadmap: A clear and well-defined roadmap can instill confidence in investors, so we also reviewed the crypto’s future plans, upcoming updates, and milestones outlined in its development roadmap.

Put together, the scores provided a comprehensive view of the cryptocurrency’s overall strength and potential, and allowed us to assign a percentage rating to each of the cryptos recommended on this page.

References

- CNBC: Bitcoin ETFs begin trading on U.S. exchanges

- TechCrunch: Ethereum switches to proof-of-stake consensus after completing The Merge

- Reuters: Ripple Labs notches landmark win in SEC case over XRP cryptocurrency

- Fortune: Once a Sam Bankman-Fried favorite, Solana has ‘moved beyond the FTX overhang’ and gained more than 300% this year

- US Department of Justice: Binance and CEO Plead Guilty to Federal Charges in $4B Resolution

- CoinDesk: POL Contracts Go Live on Ethereum Mainnet as Part of Polygon 2.0

- TheBlock: USDT Supply by Blockchain

- Reuters: Standard Chartered boosts 2024 bitcoin forecast to $120,000

- Fortune: The jobless turn to crypto video game for financial relief

- CNBC: AI frenzy puts Nvidia briefly ahead of Amazon in market value

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)