Are we in crypto bull market?

It may seem like we are, but in reality, many people are still in disbelief. I still see $21-23K price targets for Bitcoin on my feed every day. The majority of folks have completely missed the recent Bitcoin move from $27K to $35K as they were expecting a dip below $20K. If you ask what changed fundamentally that caused this rally, well, nothing so notable.

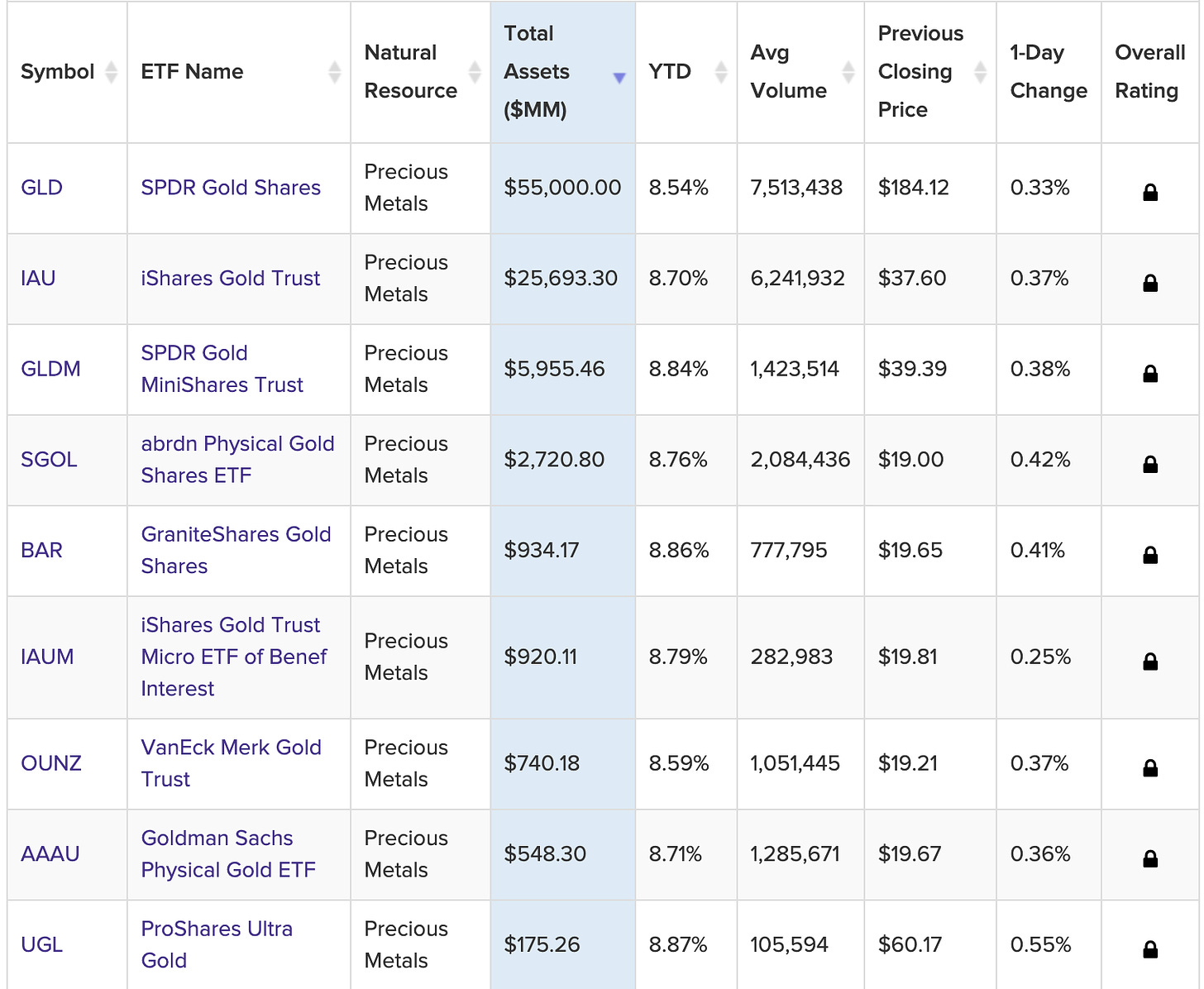

But yes, the Bitcoin ETF hype is peaking up, and we've almost come to believe that a spot ETF in the United States is coming, either by Grayscale or BlackRock, with other companies likely to follow once the first approval hits the market. Retail investors think Bitcoin ETFs will send the Bitcoin price to $1M, but in reality, if we compare it with Gold ETFs, the price of gold rallied by 4x after the first Gold ETF was approved in the USA.

It's been 20 years, and Gold ETFs still only manage to capture 1% of the total Gold market cap. Looking at a similar scenario, even if a Bitcoin ETF captures 5% of the total market cap of Bitcoin, we could end up with a $50B worth of demand shock if we set Bitcoin's market cap at $1T, and $50B is not huge in traditional finance.

You may not like it, but I'm going to say it loudly: a Bitcoin ETF is not going to send Bitcoin to $1M. The ultimate adoption of Bitcoin will only come when it is widely used as a payment method or when central banks start buying Bitcoin as an inflation hedge. Both alternative scenarios look like distant realities for now, so we will wait. I think Bitcoin will pump in the bull season, but I don't think it will go beyond $150K. I'm happy to be wrong.

Now, let's talk about possible reasons behind the recent surge

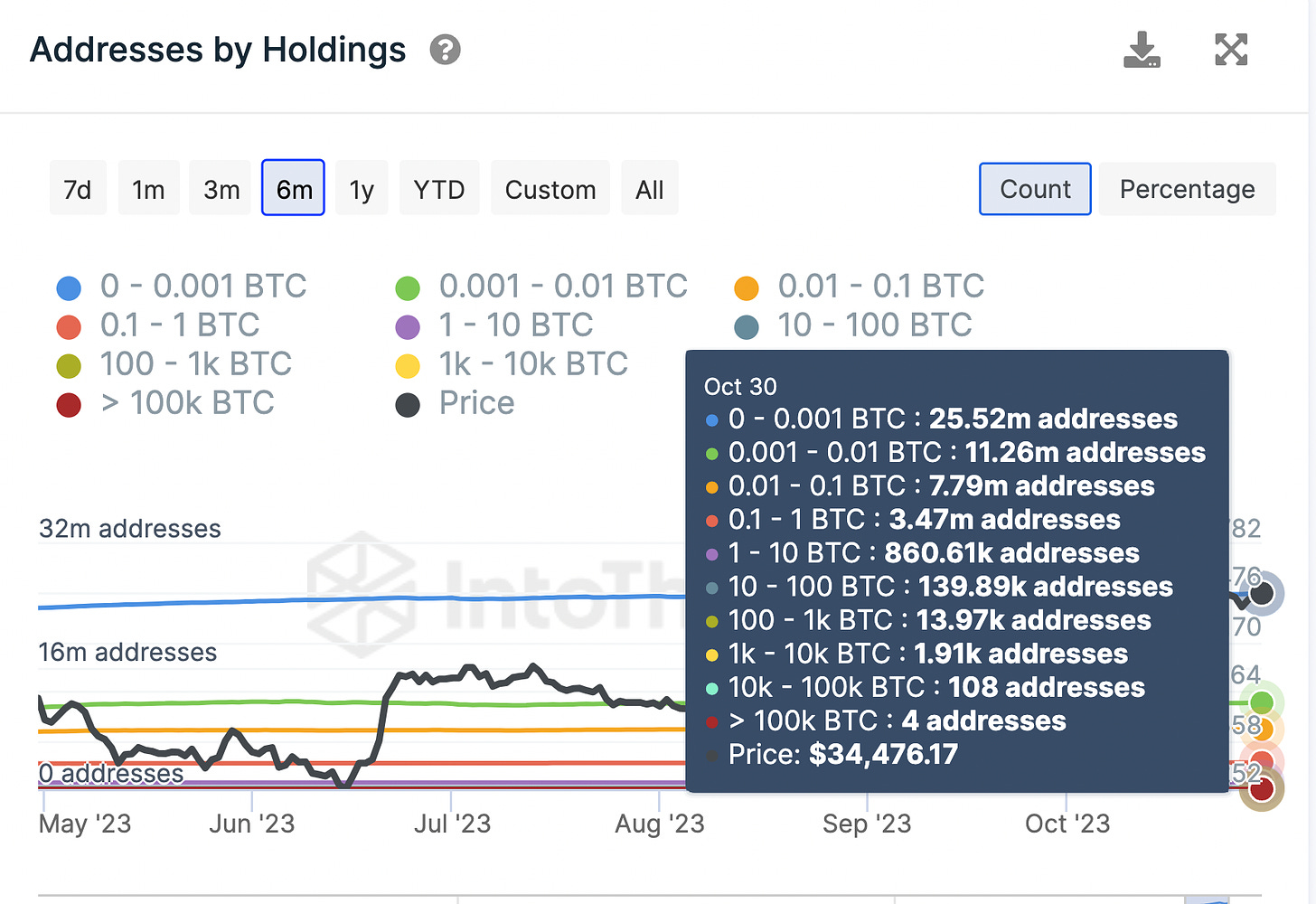

All I could find was impressive accumulation by some large accounts in the past few months. Bitcoin followed a tight price range of $25K to $32K for six months, from April to September. During this period, 7.5 million wallets bought Bitcoins in that range, making it the strongest support zone for Bitcoin.

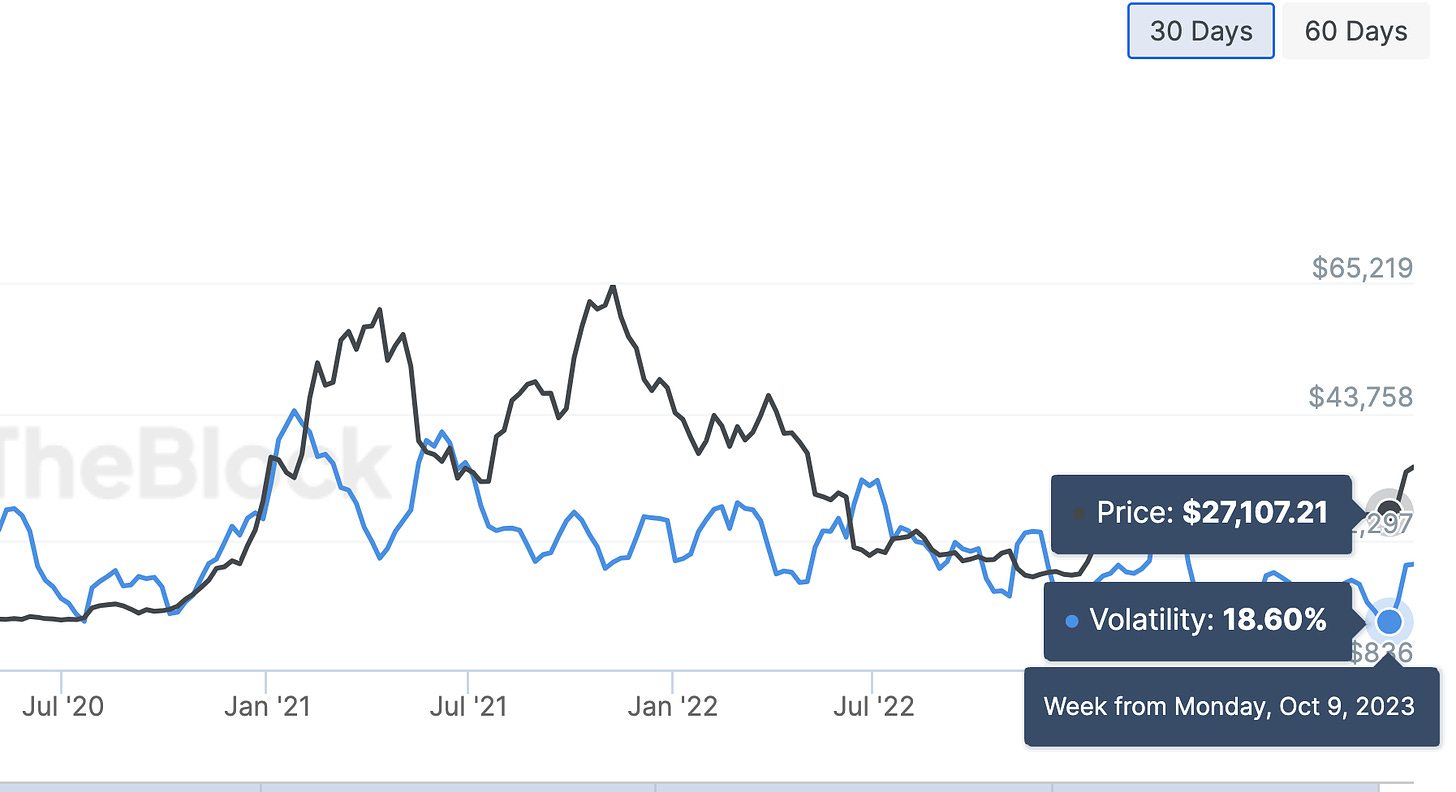

Additionally, wallets holding more than 1 BTC increased their Bitcoin holdings by 20% in that accumulation range. Bitcoin volatility also hit the lowest level since 2017, but now it's back up from 18% to 41% in the past few days, indicating that we've come out of the boring sideways movement, and the price could move further as the trend seems clear.

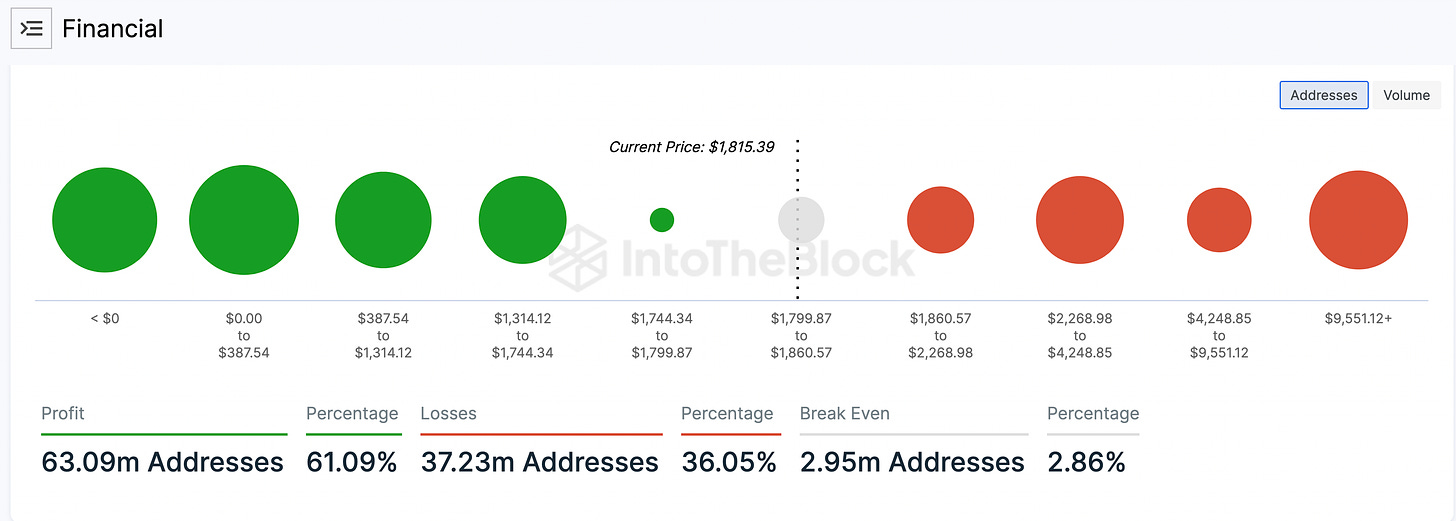

Right now, around 80% of wallets are holding Bitcoin at a profit, and that's the benchmark we could use for other altcoins to follow if they continue to rally for the next few months.

Based on the Bitcoin break-even price benchmark, here are some possible targets for ETH and LINK:

ETH:

Around 61% of wallets are holding ETH in profits. To reach the 80% profitable wallets benchmark, ETH needs to breach the $2.3K resistance.

LINK:

Around 51% of wallets are holding LINK in profits. To reach the 80% profitable wallets benchmark, LINK needs to breach the $16 resistance.

Ending Notes

I remain long on crypto, and I plan to buy major dips in BTC, ETH, and LINK. I believe Bitcoin can surpass $45K this month if it manages to stay above the $30K price level.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)