Introducing Ethena Labs

// Ethena Labs: Enabling the Internet Bond_

Ethena has been built to address the largest and most obvious immediate need within crypto. DeFi aims to create a parallel financial system, yet the sector’s most important financial instrument – stablecoins – are completely tethered to, and reliant upon, traditional banking infrastructure. It is time to provide a scalable crypto-native form of money to enable a truly decentralized financial system.

{Introduction}:

Ethena Labs is a decentralized protocol built on Ethereum that will provide a crypto-native solution for money not reliant on traditional banking system infrastructure, alongside a globally accessible and permissionless dollar denominated savings instrument - the 'Internet Bond'.

Ethena’s synthetic dollar, USDe, will provide the first censorship resistant, scalable and stable crypto-native solution for money by delta-hedging staked Ethereum collateral. USDe will be fully collateralized transparently onchain and free to compose throughout DeFi.

The ‘Internet Bond’ is built upon USDe and will combine yield derived from staked Ethereum as well as the basis in both perpetual swap and futures markets, to create the first onchain bond that can function as dollar denominated savings instrument for users worldwide.

{The Problems}:

// Crypto can no longer depend on traditional infrastructure for stablecoins_

For any functional truly decentralized financial system to work at scale, a stable asset not reliant on legacy banking infrastructure is required for both transactional money as well providing the core collateral for funding. Without a censorship resistant and stable reserve asset, both centralized orderbooks and decentralized applications are inherently fragile.

Centralized exchanges are in desperate need of a reliable and transparent stablecoin for their order books, and DeFi faces ongoing existential risk by relying on USDC with a centralized kill-switch. Reducing reliance on the existing banking system for crypto infrastructure is, in our view, the single most important issue facing the industry today.

// Eight billion people have no access to a dollar denominated savings instrument_

Whilst US citizens have access to their own $30 trillion treasury market, individuals in the rest of the world do not have permissionless access or an ability to generate a yield on a dollar denominated savings instrument.

User demand for existing stablecoins is already provable and enormous at $130 billion+ despite their “return-free risk” profile. We view an equivalent product that provides a permissionless savings return as the largest market opportunity that crypto can provide for individuals all over the world.

Even larger than either a volatile store of value, or stablecoins as they currently exist.

We fundamentally believe everyone in the world should have access to the most basic and important financial instrument - a dollar denominated savings tool.

{Existing Stablecoin Landscape}:

Stablecoins are the single most important instrument in crypto. All major trading pairs are denominated in stablecoins across spot and futures markets on both centralized and decentralized venues, with 70% of trading pairs and volumes often exceeding BTC and ETH. $8 trillion of stablecoin settlement took place on Ethereum in the last year, and stablecoins account for ~15% of total crypto market cap, 2 out of the 5 of the largest assets, >40% of TVL in DeFi, and are by far the most utilized assets on decentralized money markets and exchanges.

Stablecoins are not only the foundation of the entire industry, they are also arguably the only asset to have found true product market fit globally with more than 100 million users, the largest addressable market and the highest potential for revenue generation Last quarter Tether recorded $1.4 billion in net profit: more than Blackrock - the largest asset manager in the world.

Centralized Stablecoins

However, existing fiat based stablecoins carry significant unhedgeable custodial and regulatory risk as their design necessitates holding censorable bonds in regulated bank accounts as was evident with Paxos and Silicon Valley Bank earlier this year.

These products also fully externalize their risk of depegs onto users, whilst internalizing their return to issuers, providing stablecoin holders with “return-free risk”. We view this construct as not only wholly unsustainable as a user proposition, but also as a demonstration of the unquestionable product market fit and demand for stable digital dollars.

And yet despite their importance, the space has not found a crypto-native solution which can operate independent from the inherent fragility of the existing banking system. Current decentralized stablecoins either struggle with scalability or centralization of collateral assets, or both.

Native yield derived from proof-of-stake Ethereum alongside a deep Ethereum derivative market presents the first opportunity to utilize derivative infrastructure at scale to create decentralized money, for a global, decentralized financial settlement layer.

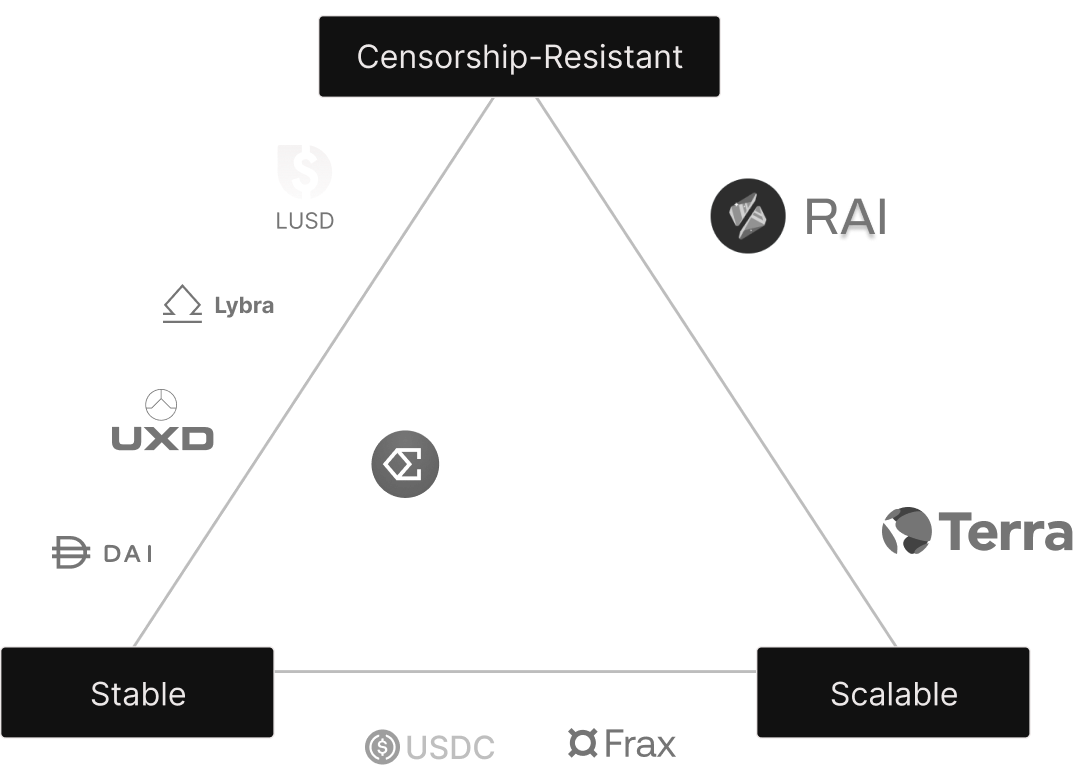

The Onchain Stablecoin Trilemma

The stablecoin trilemma refers to the trade-off all stablecoins to this point have made, forced to sacrifice one of:

- Censorship Resistance

- Scalability

- Stability

Overcollateralized stablecoins have historically experienced issues with scalability as their growth was inexorably tied to the on-chain growth in leverage demand for Ethereum. In order to scale these designs, the stablecoins eventually morphed into wrappers for USDC, which we believe defeats the core value proposition they intended to provide - censorship resistance. When onchain stablecoins carry the same custodial risk as the USDC backing them, they do not provide uncorrelated risk profiles alongside a worse liquidity profile than USDC or USDT.

Algorithmic stablecoins like UST faced obvious challenges with their mechanism design which were found to be inherently fragile and unstable. We do not view these designs as sustainably scalable.

More recent attempts to create a delta-neutral synthetic dollar failed to scale with an over-reliance on decentralized futures venues. Decentralized perpetual futures exchanges are insufficiently mature to offer the liquidity to grow this product alone. Delta neutral synthetic dollars have also suffered from a lack of native embedded yield on the collateral asset to act as a margin of safety for periods of negative funding.

How can we provide a censorship-resistant, scalable and stable asset which is both independent of the banking system and passes through the economic return to users?

{The Solution: USDe as the Internet Bond}:

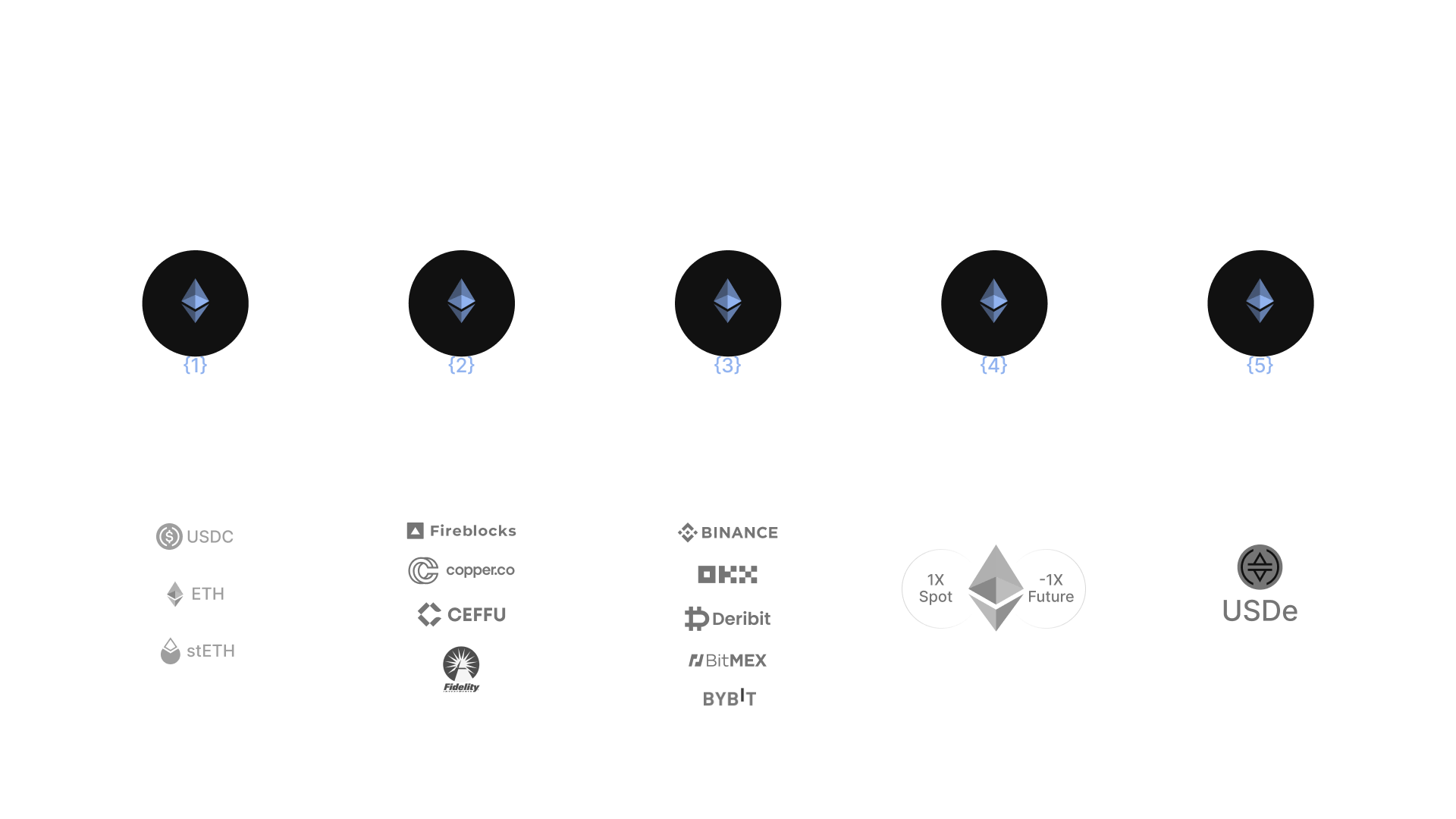

USDe is created via a variety of delta-neutral derivative positions against liquid staked Ethereum collateral across both centralized and decentralized venues.

i) Scalability is achieved by utilizing derivatives which allow for USDe to scale without significant overcollateralization, since the staked ETH collateral can be perfectly hedged with a short position of equivalent notional, the stablecoin only requires 1:1 collateralization.

ii) Stability is provided through unlevered short perpetual positions executed against the collateral immediately on issuance which ensures the position is delta-neutral and that USDe is never issued to users without the initial notional balance being perfectly hedged.

iii) Censorship Resistance by separating collateral from the banking system and storing trustless crypto collateral outside of centralized liquidity venues in onchain, transparent, 24/7 auditable, programmatic custody account solutions.

Connective Tissue Between DeFi and CeFi

Whilst traditional market structure separate custody from execution and settlement, centralized crypto exchanges have historically merged these functions into a single entity. In our view, market structure will begin to shift away from this model and Ethena hopes to pioneer a new approach by providing connective infrastructure between DeFi and CeFi.

Utilizing recent developments in "off-exchange" secured custody accounts we are able to access centralized liquidity while retaining the core value proposition of transparency and onchain custody within DeFi. In doing, so we are able to scale USDe into the billions with centralized exchange liquidity, whilst ensuring user collateral is never left on centralized exchange servers to reduce counterparty risk for our users.

More details on the custody infrastructure will be provided next week.

What Else is Uniquely Enabled by the Internet Bond?

Whilst the focus of the protocol is a crypto-native synthetic dollar, we expect USDe and our infrastructure to act as a compelling base layer for other products to compose with, and build products upon, which were not possible before.

USDe will provide the following properties as a base asset on which to build:

i) Stable Transactional Dollar: USDe as a censorship resistant, scalable and stable form of money to gradually replace fiat stablecoins in other onchain DeFi applications which rely on USDC for stablecoin backing or money market collateralization

ii) Floating and Fixed Rate Bonds: the use of dated or expiring futures instead of perpetual swaps allows for not only the issuance of floating rate bonds, but fixed rate tenured bonds over defined maturities.

iii) Crypto-Native Yield Curve and Risk Free Rate: with a fixed rate maturity curve built on staked ETH vs dated futures short positions, we will enable the emergence of the first scalable crypto-native yield curve and ultimately the crypto “risk free rate” which can act as a base layer for interest rate swap products to be built.

iv) Repo-Financing: much like the US Treasury exists on bank or insurance balance sheets, an asset with a stable principal an embedded yield is uniquely positioned to act as collateral in money markets throughout DeFi which will allow for attractive post-leveraged returns on the underlying Internet Bonds.

The Team

What’s Next

- We will be shortly releasing our technical documentation in Gitbook and a FAQ to help provide more detailed explanations on the mechanism design.

- Throughout the next quarter the Ethena Labs contributors will be running internal testing for the delta-neutral USDe with our investors and whitelisted capital partners. You can apply to join this testnet phase here.

- A capped public launch of delta-neutral USDe will follow in Q4.

- This staggered approach helps us ensure the launch of USDe is done in a controlled and secure manner whilst allowing our community to engage with the protocol throughout our launch process.

The Ethena Labs Data & Research team will continue to post longer form analysis here and you can expect more data-driven analysis on the various aspects of USDe and crypto-market structure to follow.

In the meantime, follow our Twitter and jump in our Discord & Telegram for some more early info on how to support Ethena and get involved as an early user.

// It’s time to leave the banking system, are you coming with us, anon?

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)