8 Ethereum Spot ETFs to be Traded in the US

8 Ethereum Spot ETFs to be Traded in the US

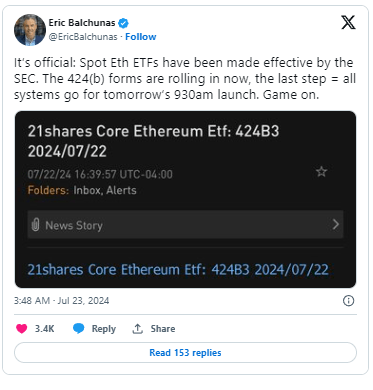

Exchange-Traded Fund (ETF) Ethereum spot can now be traded in the United States after receiving final approval from the U.S. Securities and Exchange Commission (SEC).

On Monday evening (July 22, 2024), the SEC reportedly approved the necessary S-1 forms for the launch of these ETFs on their respective stock exchanges. Eight Ethereum spot ETFs will soon be available in the US, including products from BlackRock, Fidelity, VanEck, Bitwise, 21Shares, Franklin Templeton, Invesco Galaxy, and Grayscale.

Mixed Performance Predictions for Ethereum ETFs

With this approval, Ether becomes the second cryptocurrency to have an ETF in the US, alongside Bitcoin. The market is currently hopeful that Ether will replicate the success of the Bitcoin spot ETF launched in January 2024. In March, Bitcoin's price reached an all-time high of $73,737.

However, analysts have varied predictions about Ether’s future performance. For instance, analysts from K33 Research predict that Ethereum ETFs will absorb between 0.75% to 1% of the total circulating supply of Ether within the first five months of their market launch. These ETFs are also expected to be a strong catalyst for the price performance of the second-largest cryptocurrency throughout the US summer.

Conversely, analysts from JPMorgan note that the Ethereum spot ETF may not experience the same inflow of funds that the Bitcoin spot ETF did at its launch. Reasons include the lack of major drivers to boost Ether demand, the absence of staking features that offer yields, and lower liquidity and assets under management (AUM), making the ETH spot ETF less attractive to institutional investors compared to Bitcoin.

At the time of writing, Ether’s price appears unreactive, even declining by 1% to around $3,478.

Future Expectations for Altcoin ETFs

Conclusion

The approval of eight Ethereum spot ETFs by the SEC marks a significant milestone for the cryptocurrency market in the United States, establishing Ether as the second cryptocurrency to gain such recognition after Bitcoin. This development is expected to enhance Ether’s accessibility and appeal to investors, potentially driving more mainstream adoption and interest in cryptocurrency investments. The inclusion of major financial players like BlackRock, Fidelity, and Grayscale further underscores the growing legitimacy and acceptance of Ethereum in traditional financial markets.

Despite the optimism surrounding the Ethereum spot ETFs, the market remains cautious about their immediate impact. Analysts offer mixed predictions, with some forecasting a substantial absorption of Ether's circulating supply and a positive influence on its price performance, while others highlight potential challenges such as the lack of staking features and lower institutional interest compared to Bitcoin. These differing perspectives reflect the uncertainties inherent in the rapidly evolving cryptocurrency landscape and the various factors influencing market dynamics.

Looking ahead, the successful launch of Ethereum spot ETFs could pave the way for additional cryptocurrency ETFs, including those based on other altcoins like Solana. This expansion could further diversify investment options and stimulate the growth of the crypto market. However, the response of institutional investors and the broader market will be crucial in determining the long-term success and stability of these new financial products. As the industry continues to mature, ongoing regulatory developments and market performance will play pivotal roles in shaping the future of cryptocurrency investments.

Read too : Trump's Campaign Raises Rp53.2 Billion in Crypto Donations

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)