Bitcoin Price Prediction as ETF Decision Approaches – Buy the Rumors, Sell the News?

In the ever-shifting landscape of cryptocurrency, Bitcoin (BTC/USD) stands at a crucial juncture, currently trading at $42,279 with a modest increase of 0.28% on Monday.

In the ever-shifting landscape of cryptocurrency, Bitcoin (BTC/USD) stands at a crucial juncture, currently trading at $42,279 with a modest increase of 0.28% on Monday.

As the market eagerly anticipates the decision on the debut of a Bitcoin ETF, a development that might initially seem underwhelming yet holds the potential to attract trillions of dollars in the long run.

This anticipation comes at a time when Bitcoin is experiencing soaring onchain fees, leading to a record mining revenue of $1.51 billion in December 2023.

The sentiment of ‘buy the rumors, sell the news’ looms over Bitcoin’s future, suggesting that the outcome of the ETF decision could significantly sway its market trajectory.

Bitcoin ETF’s Potential: Despite Slow Start, Trillions Await

The debut of spot Bitcoin exchange-traded funds (ETFs) might initially see modest inflows, around $100 million, primarily from institutional investors, according to VanEck adviser Gabor Gurbacs. However, Gurbacs foresees a significant long-term impact.

He draws parallels with the gold market, noting that after the launch of gold ETFs in 2004, gold prices tripled in eight years, boosting its market cap from $2 trillion to $10 trillion.

Given Bitcoin’s fixed supply and scarcity, particularly due to halving events, it could experience a similar, albeit quicker, growth trajectory.

Many may be disappointed by the “initial impact” of a spot Bitcoin ETF, says VanEck adviser @gaborgurbacs. However, if gold ETFs are any indication, there’s no need to worry. https://t.co/ngXvD2EQDT

— Cointelegraph (@Cointelegraph) January 1, 2024

The key lies in Bitcoin ETFs’ ability to legitimize the cryptocurrency for institutional investors and nation-states. Bloomberg ETF specialists Eric Balchunas and James Seyffart also underscore the importance of considering the long-term effects rather than short-term metrics.

This development has sparked discussions on whether the anticipated ETF approval will lead to both immediate and sustained increases in Bitcoin prices, or if it will culminate in a “sell the news” scenario.

December 2023: Bitcoin’s Record $1.51B Mining Revenue Amid Rising Fees

In a remarkable achievement, Bitcoin miners secured a record revenue of $1.51 billion in December 2023, surpassing the previous high set in May by 64.27%. This included an unprecedented $324.83 million from onchain transaction fees.

On December 31, 2023, the average fee stood at 231 satoshis per virtual byte, equating to $20.86 per transaction, with a median fee of $9.60. Notably, fees soared to $40 per transaction on December 17, marking the year’s highest on-chain fees.

Simultaneously, the hash price of Bitcoin reached its peak for the year at $133.62 per petahash per second (PH/s). Despite these elevated fees, the network experienced a backlog of about 496,000 unconfirmed transactions, leading to 430 blocks of congestion.

This impressive financial performance of miners in December underscores their resilience and could positively impact the overall growth trajectory of Bitcoin prices.

Bitcoin Price Prediction

As the New Year unfolds, Bitcoin embarks on a pivotal journey, trading at $42,000, experiencing a +1.08% upswing.

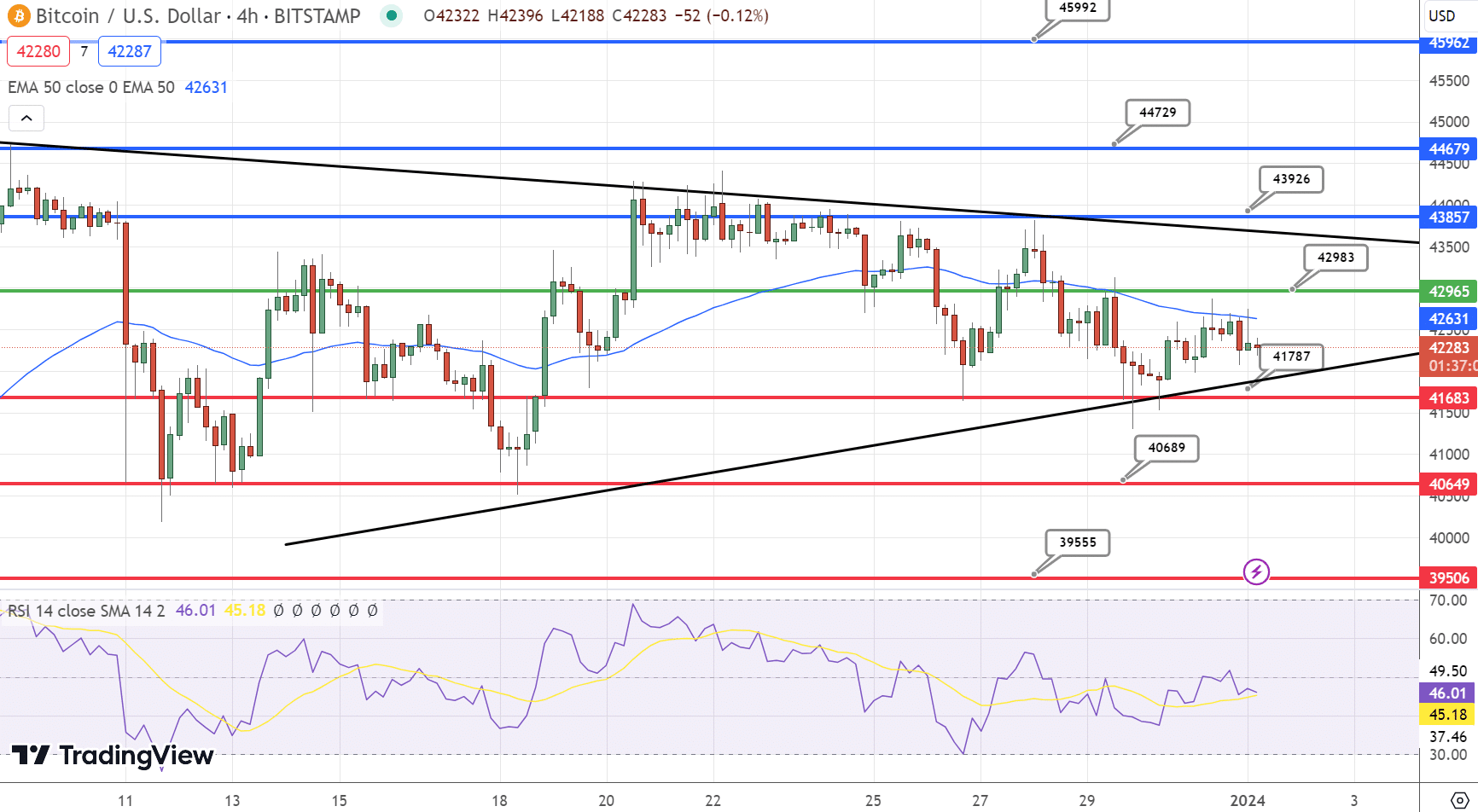

The cryptocurrency’s immediate fate hinges on the critical threshold of $42,965. It faces resistance at $43,857, $44,679, and $45,962, which could impede its ascent.

Key support levels are situated at $41,683, $40,649, and $39,506, integral in bolstering Bitcoin’s footing in the market.

The Relative Strength Index (RSI) currently reads 39, indicating bearish sentiment without reaching the oversold zone, suggesting cautious optimism in the trading community.

Bitcoin’s position below its 50-Day Exponential Moving Average (EMA) at $42,983 underscores a short-term bearish inclination. Bitcoin Price Chart – Source: Tradingview

Bitcoin Price Chart – Source: Tradingview

A bearish engulfing pattern near the 50 EMA, especially around $42,985, intimates a potential downward trend.

Nonetheless, an upward support trendline around $41,750 stands as a critical defense line against significant price drops.

Conclusively, Bitcoin’s market trajectory leans towards bearish under the $42,985 mark. Yet, it stands at vital junctures that could offer resistance against further price dips.

Market analysts and investors are keenly observing these key technical indicators to adeptly navigate the ever-changing landscape of the cryptocurrency market.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)