Bitcoin vs Gold: Peter Brandt Asks Peter Schiff to Put Things in Broader Perspective

Veteran trader and renowned chartist Peter Brandt has urged gold bug Peter Schiff to “put things in a broader perspective” when comparing gold to bitcoin. Schiff ramped up his criticism of the crypto this week as the price of gold rose and bitcoin dipped slightly. “I expect gold’s rise and bitcoin’s fall to accelerate. Don’t say I didn’t warn you,” Schiff wrote.

Peter Brandt, Peter Schiff Weigh in on Bitcoin vs Gold

Gold advocate Peter Schiff seized on last week’s market movements to criticize bitcoin and promote gold, with gold prices experiencing a stronger-than-anticipated rise.

Schiff highlighted in a post on X Friday that gold gained 4%, silver surged 10%, and gold mining ETFs (GDX and GDXJ) rose 7% and 8% respectively, while bitcoin exchange-traded funds (ETFs) fell 5% and Microstrategy’s stock (MSTR) plummeted 16%. “This likely represents a major shift. I expect gold’s rise and bitcoin’s fall to accelerate. Don’t say I didn’t warn you!” he emphasized.

Commenting on Schiff’s post, veteran trader Peter Brandt wrote:

Come on Peter, put things in a broader perspective. I like gold too — I am long a bunch — but which race horse has done better since BTC’s inception?

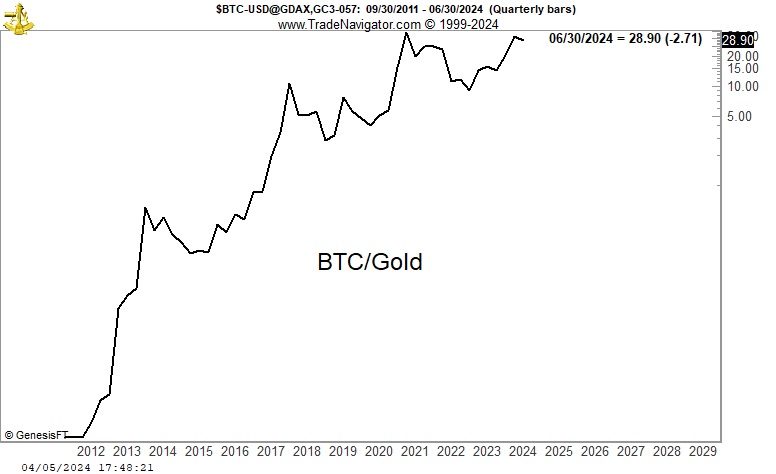

Brandt also included a chart that “represents the number of oz. of gold to purchase one bitcoin,” the veteran trader explained. “In the past 50 years, gold price has increased at CAGR of 5.2%, barely exceeding the U.S. Consumer Price Index,” Brandt noted. Chart showing the number of oz. of gold needed to purchase one bitcoin. Source: Peter Brandt

Chart showing the number of oz. of gold needed to purchase one bitcoin. Source: Peter Brandt

A vocal bitcoin proponent, Brandt believes that BTC is vying to replace fiat currency as the primary store of value. In February, he raised his bitcoin price target for the current bull market cycle to $200K.

On Saturday, Schiff touted gold’s outperformance compared to bitcoin in a follow-up post on X: “On Oct. 21, 2021, it took 37 ounces of gold to buy one bitcoin. Today it takes only 29. That’s a 22% decline, an official bear market.” He insisted that BTC “has underperformed gold for the past 2.5 years.”

The gold bug defended his analysis after many users accused him of cherry-picking the time frame to favor gold, stating: “I’m not cherry picking. You have to measure an asset relative to its all-time high.” Schiff further opined:

Bitcoin is far more likely to lose 90% of its current market cap than to amass another 90% of gold’s market cap.

He further detailed: “From 2000 to 2011 the gold price rose from below $400 to above $1,900. That was a 5x move. A similar move from the $2K breakout will send gold to $10,000. Given the far weaker fiscal position of the U.S. now and potential for larger QE, the next move should happen much quicker.”

What are your thoughts on Peter Schiff’s arguments? Do you think he will consider Peter Brandt’s suggestion to take a wider view when evaluating bitcoin vs gold? Let us know in the comments section below.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)