Daily bridge volume to Solana increased 335% over the week

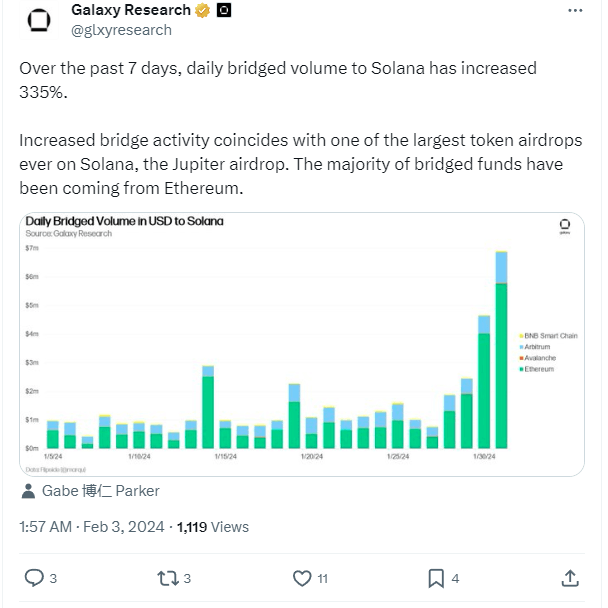

Galaxy Research highlights an intriguing trend on the Solana blockchain: Daily bridge volume to Solana has increased 335% in the past seven days.

According to Galaxy Research, the increased demand activity corresponds to one of Solana's largest token airdrops ever, the Jupiter airdrop. The majority of the bridging funds come from Ethereum.

On Wednesday, Jupiter, the network's major DEX aggregator, distributed its largest airdrop on Solana to date. One billion tokens, equivalent to 10% of the entire supply, have been airdropped to Jupiter users before November 2, 2023.

The airdrop was a huge stress test for the Solana network, with doubts about its ability to handle such a large number of transactions. A total of 40% of the supply will be made available to users in the next three phases next year.

An additional 10% is reserved for community contributors and sponsors. The remaining 50% of supply will be allocated to Jupiter team members, strategic reserves and liquidity terms, subject to various lockups and vesting.

Lockup (token lockup period or vesting period) is a period of time, usually after a token sale, during which token holders of a cryptocurrency project are not allowed to sell their tokens. The lock-in period will help initiatives avoid liquidity issues while new projects are still building their support base.

Vesting is the activity of locking tokens for a period of time for teams, partners, advisors and those who are contributing to the development of the project. Vesting is often used to show that the team is very interested in the project and will stick with the development of that project for a long time.

Jupiter's airdrop was a major milestone in Solana's comeback over the past year and a great barometer of the network's progress.

Looking ahead, planned improvements to Solana's scheduler as part of version 1.18 will continue to reduce “scheduling jitter,” which encourages users to flood the network with spam while there is a state of dispute.

At the time of writing, SOL price was down 1.2% in 24 hours to $97.90.

According to The TIE, monthly unlocks of Alameda-linked SOL tokens are scheduled for February 7 and 11. These monthly unlocks represent approximately 2% of Solana's average trading volume and are expected to will continue until September 2027 and January 2028, corresponding to the massive 7.5 million SOL unlock scheduled for March 1, 2025.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)