Liquid Staking Tokens on Solana

The advent of Liquid Staking Tokens (LSTs) on the Solana blockchain represents a significant advancement in the realm of decentralized finance (DeFi).

By merging traditional staking benefits with liquidity, LSTs offer users the opportunity to participate in network security while maintaining the flexibility to engage in other DeFi activities.

This article explores the mechanics, benefits, and platforms associated with LSTs on Solana, and provides insights into how users can navigate this innovative landscape.

Understanding Liquid Staking Tokens (LSTs)

The Concept of Liquid Staking

Staking, in the context of blockchain technology, involves locking up a certain amount of cryptocurrency to support the operations of a proof-of-stake network.

This process helps secure the network and validate transactions. Traditionally, staked assets are locked and illiquid, meaning they cannot be used for other purposes until they are unstaked.

Liquid Staking Tokens revolutionize this model by issuing tokens that represent the value of the staked assets. These tokens are designed to maintain the staking benefits while being tradable and usable within the DeFi ecosystem. This means that while users' original assets remain staked, they can use LSTs to participate in various financial activities.

The Emergence of LSTs on Solana

In the first half of 2024, Solana saw a surge in the launch of Liquid Staking Tokens, marking a new phase in its DeFi evolution. Solana's high throughput and low transaction fees make it an ideal candidate for LSTs, which can leverage the blockchain's scalability to offer both staking rewards and liquidity.

Key Benefits of Liquid Staking Tokens

Enhanced Liquidity

One of the primary advantages of LSTs is the provision of unlocked liquidity. Unlike traditional staking, where assets are locked and inaccessible, LSTs allow users to retain liquidity.

This means that users can engage in other DeFi activities while their assets continue to support network security.

For example, holding LSTs like Helius Staked SOL (hSOL) allows users to participate in decentralized exchanges (DEXs), yield farming, and liquidity provision without sacrificing their staking benefits.

Increased Network Participation

LSTs facilitate broader participation in the network. By enabling users to stake SOL and receive LSTs in return, Solana encourages more individuals to engage in staking activities. This increased participation helps bolster network security and decentralization, enhancing the overall robustness of the Solana blockchain.

Additional Yield Opportunities

LSTs also create opportunities for additional yield generation. Users can deploy their LSTs across various DeFi platforms to earn extra returns. For instance, LSTs can be used to provide liquidity on platforms such as Meteora or Kamino, or traded on DEXs for potential profits. This multifaceted utility enhances the overall return on staked assets.

Platforms and Transactions

Sanctum: A Hub for LSTs

Sanctum is a prominent platform within the Solana ecosystem that facilitates the acquisition and management of LSTs. It serves as a launchpad for various LSTs, allowing users to search for and interact with different tokens.

Sanctum also offers a multi-LST pool, known as the Infinity Pool, which enables users to swap between various LSTs using their native Infinity (INF) token. This platform simplifies the process of managing LSTs and accessing diverse DeFi opportunities.

Navigating LST Transactions

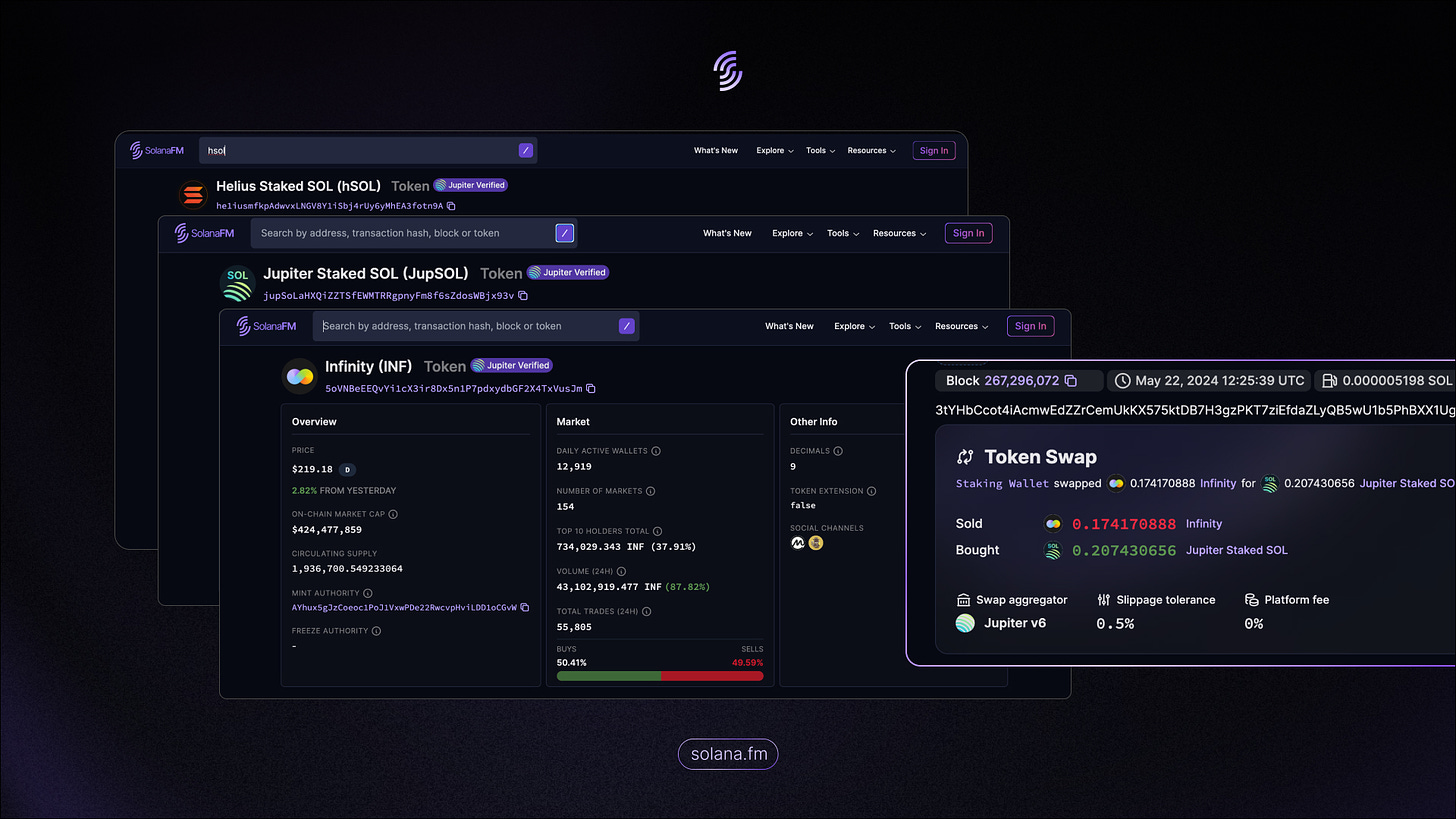

Understanding LST transactions involves recognizing how these tokens function on-chain. For example, when staking SOL and receiving Helius Staked SOL (hSOL), users engage in a token swap.

This process is visible on the SolanaFM Explorer, where users can track transaction details and verify the legitimacy of LSTs. By analyzing on-chain data, users can make informed decisions about their LST holdings and associated activities.

Exploring and Verifying LSTs

Using SolanaFM for LST Exploration

SolanaFM provides a comprehensive tool for exploring and verifying LSTs on Solana. Users can access the SolanaFM Token Page to view verified LSTs, ensuring they interact with legitimate tokens.

The platform offers key metrics such as market cap, circulating supply, and trading volume, which are essential for evaluating LSTs.

Some notable LSTs on Solana include:

- BlazeStake Staked SOL (bSOL)

- Bonk SOL (bonkSOL)

- CogentSOL (cgntSOL)

- Compass SOL (compassSOL)

- Helius Staked SOL (hSOL)

By referencing these resources, users can verify the authenticity of LSTs and ensure they are participating in a secure and productive manner.

Conclusion

Liquid Staking Tokens on Solana represent a significant advancement in the DeFi space, offering users enhanced liquidity, increased network participation, and additional yield opportunities. Platforms like Sanctum and tools like SolanaFM play a crucial role in managing and verifying LSTs, enabling users to navigate this innovative landscape effectively.

As the LST ecosystem continues to evolve, staying informed and leveraging available resources will be key to maximizing the benefits of these tokens. By understanding the dynamics of LSTs and utilizing platforms and tools, users can enhance their DeFi experiences and contribute to the growth of the Solana blockchain.

References

- SolanaFM: Liquid Staking Tokens Overview

- Sanctum: Liquid Staking Tokens on Solana

- Helius Staked SOL (hSOL) Token Information

- BlazeStake Staked SOL (bSOL) Token Information

- Bonk SOL (bonkSOL) Token Information

- CogentSOL (cgntSOL) Token Information

- Compass SOL (compassSOL) Token Information

- Marinade Staked SOL (mSOL) Token Information

- Jupiter Staked SOL (JupSOL) Token Information

- Liquid Staking Token by MarginFi (LST) Token Information

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)