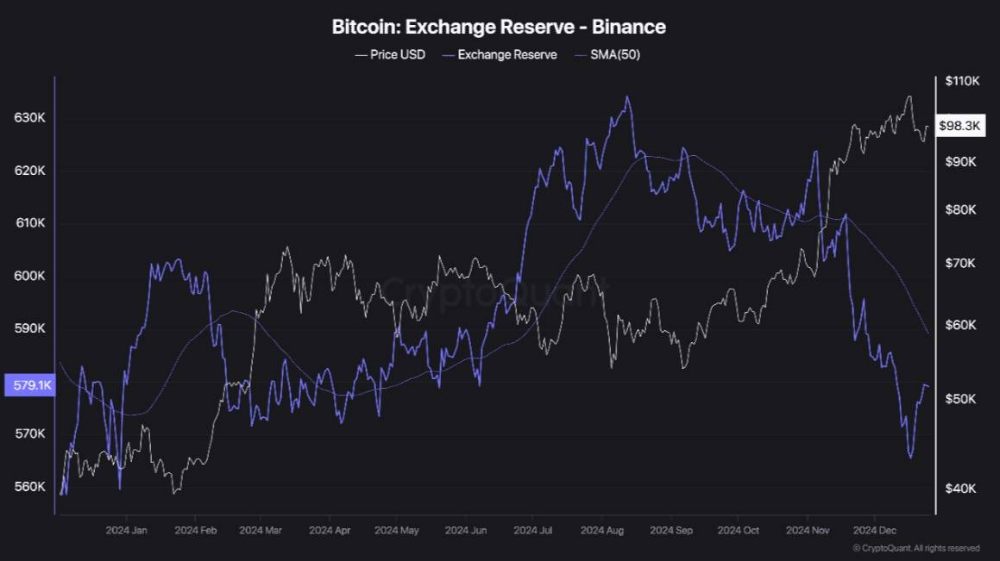

Binance Bitcoin Reserves Hit Yearly Low

Binance Bitcoin Reserves Hit Bottom

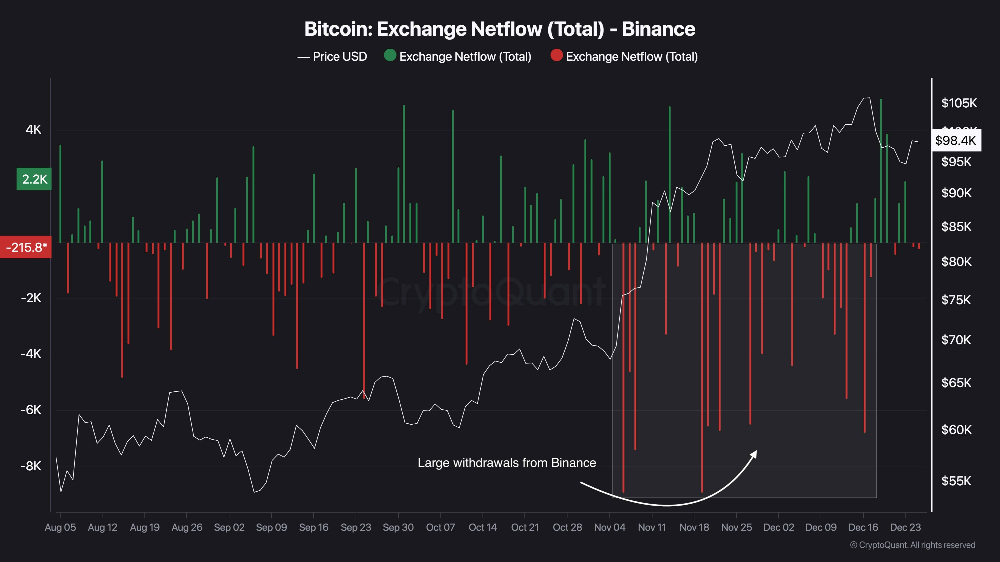

Binance saw a similar drop in reserves earlier this year, before Bitcoin surged to an all-time high of $73,679 on March 13. CryptoQuant analyst Darkfost said:

“Large BTC withdrawals are often a sign that the market is building positive momentum.”

Bitcoin Dominance Nears 60%

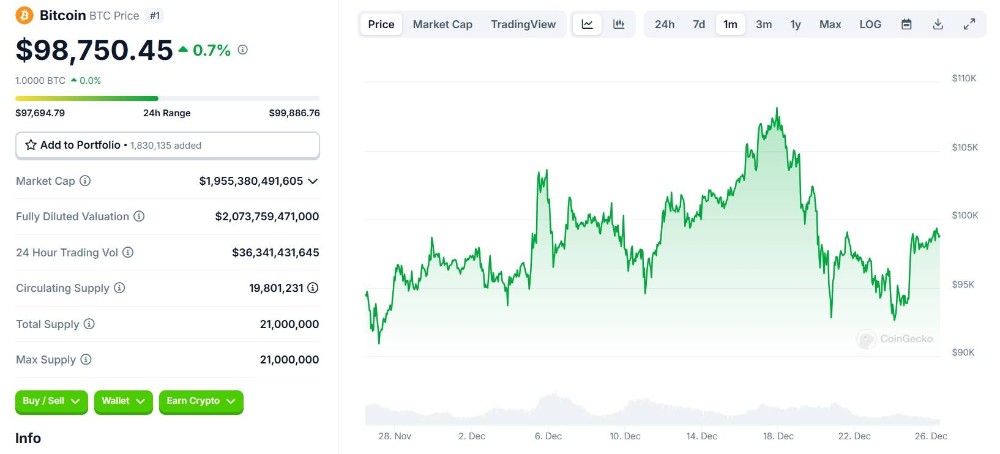

Bitcoin crossed the psychological $100,000 mark for the first time on December 5, but failed to maintain its upward momentum. The price has been falling below $100,000 since December 19, after hitting a new ATH of $108,353 on December 17.

Bitcoin’s monthly price action, screenshot from CoinGecko at 10:20 AM on December 26, 2024

“The market is usually more active after the holidays, as funds reposition capital into sectors that benefit from Trump’s inauguration.”

When looking at both reserve data, market dominance, and price trends, the analysis shows that Bitcoin is building positive momentum. If history repeats itself, Bitcoin prices could “take off” in the near future. However, investors need to keep an eye on other factors such as capital flows to altcoins and the impact of major economic events.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)