The Profound Influence of Bitcoin ETFs on BTC Price: An In-Depth Analysis

Bitcoin, the world's first and most recognized cryptocurrency, has undergone significant evolution since its inception in 2009. While miners traditionally held substantial sway over Bitcoin's price through their control of supply, recent research highlights a new, potent influencer: Bitcoin Exchange-Traded Funds (ETFs).

According to a study by crypto investment firm Bitwise, Bitcoin ETFs have up to 4.8 times more influence on Bitcoin’s price than miners.

This article delves into the dynamics of Bitcoin ETFs, examining their impact on BTC prices, comparing their influence to that of miners, and exploring the broader implications for the cryptocurrency market.

Understanding Bitcoin ETFs

What Are Bitcoin ETFs?

Bitcoin ETFs are investment funds that track the price of Bitcoin and trade on traditional stock exchanges.

They allow investors to gain exposure to Bitcoin without the need to buy, store, or manage the cryptocurrency directly.

This makes Bitcoin ETFs an attractive option for institutional investors and those unfamiliar with the technicalities of handling digital assets.

The Appeal of Bitcoin ETFs

Bitcoin ETFs provide several advantages. They offer a regulated and familiar investment vehicle, reducing the perceived risk associated with direct cryptocurrency investments.

Additionally, ETFs can be included in tax-advantaged accounts like IRAs and 401(k)s, further enhancing their appeal. The ability to buy and sell ETFs through traditional brokerage accounts also simplifies the investment process.

Historical Context and Growth

The first Bitcoin ETF, the ProShares Bitcoin Strategy ETF (BITO), launched in October 2021, marked a significant milestone.

Since then, the market has seen a proliferation of Bitcoin ETFs, with various funds offering different strategies, such as futures-based ETFs and spot ETFs.

The growth of Bitcoin ETFs reflects the increasing acceptance and integration of cryptocurrency into mainstream financial markets.

The Influence of Bitcoin ETFs on BTC Price

Mechanisms of Influence

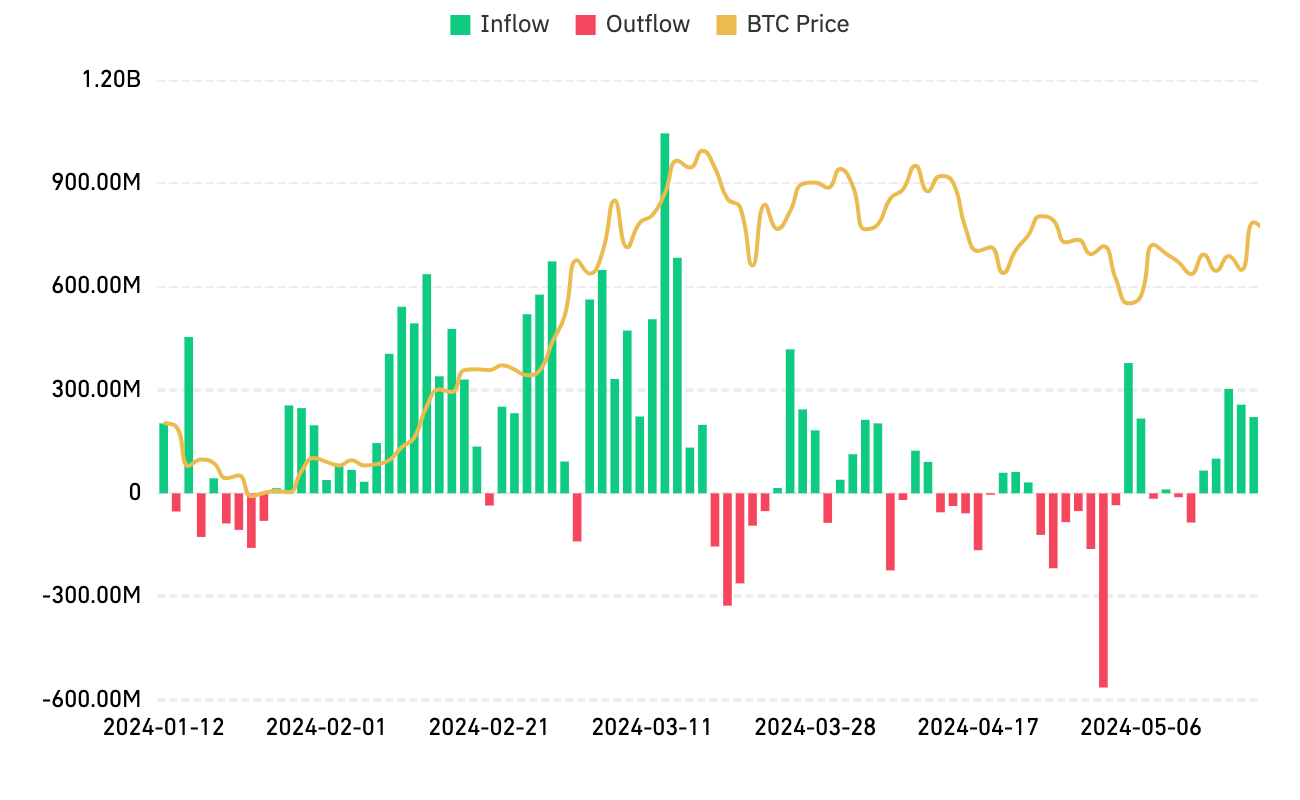

Bitcoin ETFs influence BTC prices through their buying and selling activities. When investors buy shares of a Bitcoin ETF, the fund manager typically purchases an equivalent amount of Bitcoin to back the shares, increasing demand and driving up the price.

Conversely, when investors sell ETF shares, the fund may need to sell Bitcoin, increasing supply and potentially lowering the price.

Comparative Analysis with Miners

Traditionally, Bitcoin miners have played a crucial role in influencing BTC prices. By controlling the rate of new Bitcoin entering the market, miners can affect supply dynamics. However, Bitwise's research indicates that Bitcoin ETFs now wield greater influence.

The study found that ETFs impact Bitcoin prices up to 4.8 times more than miners, primarily due to the substantial capital inflows into these funds and their frequent trading volumes.

Case Studies and Examples

To illustrate, consider the launch of the first Bitcoin ETF, BITO. In its debut week, BITO saw over $1 billion in trading volume, significantly impacting Bitcoin's price.

The anticipation and subsequent approval of Bitcoin ETFs often lead to price surges, as seen with the increase in Bitcoin's price following announcements of ETF filings by major financial institutions.

The Implications for the Cryptocurrency Market

Market Volatility

The growing influence of Bitcoin ETFs contributes to increased market volatility. The ease with which investors can buy and sell ETF shares translates to more frequent and substantial price movements in Bitcoin.

This volatility can be both an opportunity and a risk for investors, requiring careful consideration and strategy.

Institutional Adoption

The rise of Bitcoin ETFs signifies a broader trend of institutional adoption. Major financial entities, including banks and asset management firms, are increasingly incorporating Bitcoin into their portfolios through ETFs.

This institutional involvement lends credibility to Bitcoin, potentially attracting more traditional investors and fostering long-term stability.

Regulatory Landscape

Bitcoin ETFs operate within a regulated framework, which contrasts with the largely unregulated nature of direct cryptocurrency trading.

This regulatory oversight can enhance investor confidence but also poses challenges, such as stringent approval processes and compliance requirements.

The ongoing dialogue between regulators and the cryptocurrency industry will shape the future landscape of Bitcoin ETFs.

Impact on Mining Industry

The shifting influence from miners to ETFs does not diminish the importance of mining. Miners continue to play a critical role in securing the Bitcoin network and processing transactions.

However, the reduced price influence highlights a changing dynamic where financial instruments like ETFs are becoming key players in the cryptocurrency ecosystem.

Future Trends and Considerations

Evolution of Bitcoin ETFs

As the market for Bitcoin ETFs matures, we can expect further innovation and diversification. New types of ETFs, such as those incorporating environmental, social, and governance (ESG) criteria, may emerge.

Additionally, global expansion and the introduction of Bitcoin ETFs in new markets will broaden their impact.

Investor Strategies

Investors need to adapt their strategies in light of the growing influence of Bitcoin ETFs. Diversification across different types of ETFs, understanding the underlying assets, and staying informed about regulatory changes are crucial.

Investors should also consider the interplay between ETFs and direct Bitcoin investments to optimize their portfolios.

Long-Term Impact on Bitcoin

The long-term impact of Bitcoin ETFs on BTC prices and the broader cryptocurrency market is still unfolding.

While ETFs provide liquidity and accessibility, they also introduce complexities such as regulatory scrutiny and market manipulation risks. Balancing these factors will be essential for sustaining the positive momentum of Bitcoin ETFs.

Summary

The advent of Bitcoin ETFs marks a significant evolution in the cryptocurrency market. Their ability to influence Bitcoin prices more profoundly than miners underscores a shifting dynamic, where financial instruments are gaining prominence.

Understanding the mechanisms, implications, and future trends of Bitcoin ETFs is crucial for investors, regulators, and the broader financial community.

As Bitcoin continues to integrate into mainstream finance, the role of ETFs will undoubtedly shape its trajectory, offering new opportunities and challenges in the ever-evolving landscape of digital assets.

Sources

- Cointelegraph - Bitcoin ETFs

- Bitwise - Research on Bitcoin ETFs

- ProShares - BITO ETF

- SEC - Bitcoin ETF Approvals

- CNBC - Bitcoin ETF Launch

- Bloomberg - Bitcoin ETF Market Impact

- Nasdaq - Bitcoin ETF Analysis

- Investopedia - Bitcoin ETFs Explained

- Reuters - Institutional Adoption of Bitcoin ETFs

- Forbes - Future of Bitcoin ETFs

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)