Bitcoin Reaches $75k ATH, Reflecting U.S. Election Impact

In a significant development for cryptocurrency markets, Bitcoin recently surged past the $75,000 threshold, establishing a new all-time high (ATH). This achievement follows days of fluctuation around the $70,000 mark, driven largely by investor responses to ongoing U.S. political developments and electoral dynamics. With the U.S. presidential election in full swing, the leading cryptocurrency broke through resistance levels, highlighting its resilience and appeal as a potential store of value amid broader economic uncertainty.

Bitcoin, with its market cap now reaching $1.48 trillion, has seen an impressive rally, positioning it as the premier asset in the digital currency space. Market data shows Bitcoin up by 9.2% over the past 24 hours, with its price reaching $74,550 at the time of writing.

Notably, Bitcoin dominance a measure of its market share relative to the broader cryptocurrency market has climbed to 59.4%, reinforcing its stronghold over the sector. With these gains, Bitcoin has pulled the entire crypto market upward, contributing to an impressive 6.2% rise in the total crypto market capitalization.

Election Tensions Fuel Bitcoin Rally

The ongoing U.S. election is widely viewed as a primary driver behind Bitcoin’s recent upward trajectory. As vote counts and predictive data increasingly favor Republican candidate Donald Trump, market sentiment has shifted in response. Data from the decentralized predictions platform Polymarket highlights this trend, with Trump’s odds of victory currently at 96.5%. In contrast, Vice President Kamala Harris, the Democrat runner, now sees her chances down to a mere 3.4%.

This dramatic swing in election projections has triggered widespread investor activity, with Bitcoin serving as a perceived safe haven asset amid possible shifts in economic and regulatory policy under a potential Trump-led administration.

As investors react to the potential implications of a new administration, many view Bitcoin as a hedge against economic uncertainty. The cryptocurrency has historically surged during times of political and economic tension, and recent developments continue to support this pattern. Market analysts have pointed out that the prospect of a Republican victory, potentially favoring deregulation and tax-friendly policies, could pave the way for a favorable climate toward cryptocurrency growth, driving further adoption of digital assets.

With increased election-related trading volume, Bitcoin’s heightened activity signals investor confidence in its ability to withstand broader market fluctuations. Market commentators suggest this trend highlights Bitcoin’s evolving role as a safe-haven asset similar to gold, with both institutional and retail investors flocking to it amid the geopolitical storm. By setting a new ATH in the current climate, Bitcoin reinforces its growing reputation as a hedge against uncertainty, likely adding more momentum to its demand.

The Surge of Dormant Wallet Activity

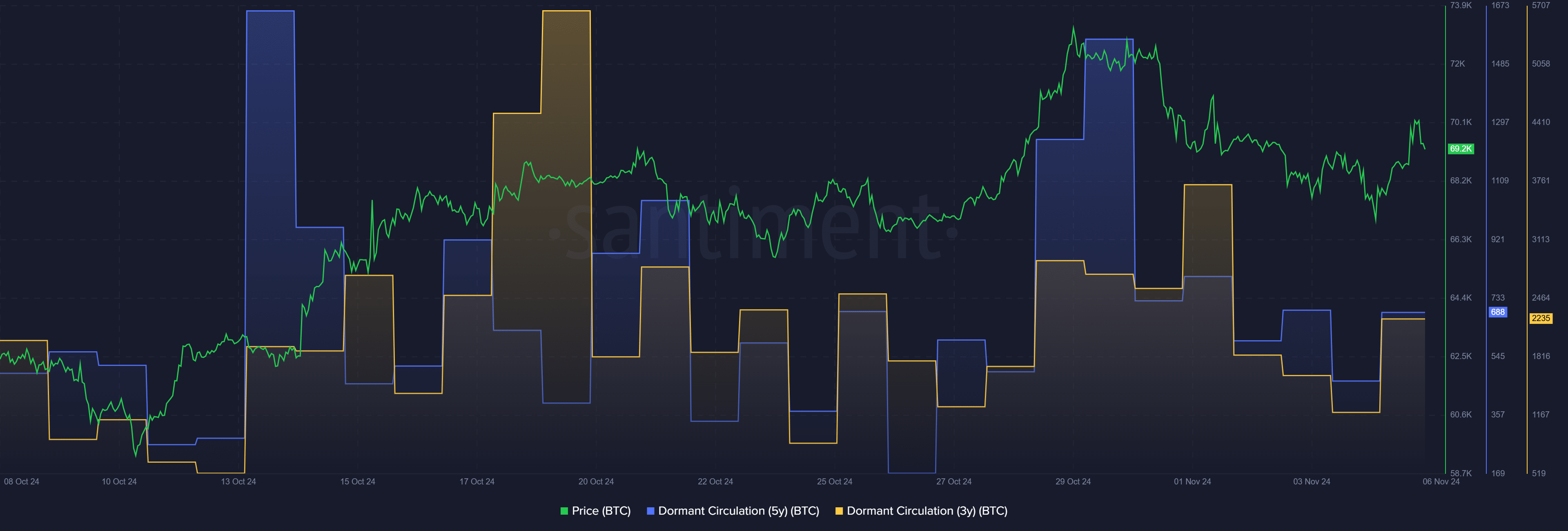

Blockchain data from Santiment provides additional insight into Bitcoin’s rally, showing heightened activity in dormant wallets. Specifically, the five-year dormant circulation of BTC increased from 467 to 688 BTC in the past 24 hours. This surge in activity among long-term Bitcoin holders is notable, as it indicates potential profit-taking and renewed interest in Bitcoin from those who have held their assets for years.

Furthermore, wallets that have held Bitcoin for over three years also recorded a marked increase, with their balance rising from 1,199 BTC to 2,235 BTC. This uptick in movement among seasoned holders may point to a trend of profit-taking, as it is common for long-term investors to liquidate portions of their holdings when an asset hits an all-time high. Analysts suggest this renewed activity among dormant wallets aligns with Bitcoin’s recent ATH, as long-term investors look to capitalize on gains made over the years.

However, while increased activity in older wallets may signal profit-taking, it does not necessarily indicate a sell-off. Given Bitcoin’s strong market performance, many investors remain optimistic about the asset’s long-term prospects. The recent price surge may encourage long-term holders to reposition or redistribute their holdings, potentially fueling further price fluctuations and adding liquidity to the market.

Broader Implications for the Crypto Market

Bitcoin’s latest ATH has had a ripple effect across the entire cryptocurrency ecosystem, sparking a market-wide rally. CoinGecko data reveals that the global cryptocurrency market capitalization swelled by 6.2% within the last 24 hours, reaching $2.57 trillion. This figure underscores the growing investor confidence in the sector as a whole, with $193 billion pouring into the market amidst heightened election-driven activity. Analysts suggest that Bitcoin’s price surge could inspire a renewed interest in alternative cryptocurrencies (altcoins), as investor enthusiasm spreads across the digital asset market.

Market observers anticipate that the election’s outcome could shape the regulatory landscape for digital assets. Should a Trump-led administration assume office, many speculate it may take a less stringent stance on cryptocurrency regulation. This perceived regulatory leniency could open doors for greater institutional investment and possibly even prompt the approval of a Bitcoin spot exchange-traded fund (ETF) in the U.S., a development that has long been a point of interest for the crypto community. Conversely, if policies lean toward increased regulation, this could introduce new challenges for Bitcoin and the broader market.

Regardless of the election outcome, Bitcoin’s resilience and its sustained dominance over the market speak to its position as the leading cryptocurrency. Its performance amid the political and economic turbulence highlights its appeal as an inflation-resistant asset. As inflationary pressures and economic uncertainties persist, Bitcoin’s status as a “digital gold” becomes increasingly relevant, especially among institutional investors seeking diversification from traditional asset classes.

Investor Sentiment and Future Projections

As Bitcoin reaches new price heights, market sentiment remains overwhelmingly bullish, with many predicting continued upward momentum. Analysts argue that while short-term corrections are inevitable—especially as profit-taking increases—the cryptocurrency remains on a long-term upward trajectory. Bitcoin’s recent performance has only strengthened its standing among institutional investors and hedge funds, whose involvement continues to lend credibility and stability to the market.

However, some analysts caution that Bitcoin’s extreme price fluctuations mean the asset still carries a degree of risk. They point out that while Bitcoin has proven resilient to macroeconomic shocks, its price remains influenced by external factors, including regulatory shifts, market speculation, and geopolitical events. As the U.S. election reaches its final stages, Bitcoin’s price could experience further volatility depending on the election’s outcome and its impact on the broader financial markets.

For now, Bitcoin’s unprecedented ATH of $75,000 has set a new benchmark, capturing the attention of both seasoned and new investors. With its market cap exceeding $1.48 trillion and dominance at nearly 60%, Bitcoin remains a central force in the digital asset space, paving the way for potential market growth and further adoption of decentralized finance solutions.

Conclusion

Bitcoin’s achievement of a $75,000 ATH amid the volatile U.S. election environment underscores its standing as a preferred asset during periods of economic and political uncertainty.

This development has sparked a market-wide rally, bringing new attention to the cryptocurrency sector and driving increased investment. Bitcoin’s resilience in the face of election-driven market volatility and its growing appeal as a hedge against traditional economic uncertainties continue to attract both institutional and retail investors. As the crypto market evolves, Bitcoin’s latest milestone further solidifies its role as a foundational asset in the digital economy.

References

- Crypto News Original Article on Bitcoin ATH and U.S. Election

- https://crypto.news/bitcoin-reaches-75k-marking-new-ath-on-the-heels-of-us-election/

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)