Introducing Mantle WETH Vault

The WETH Mantle Leveraged Staking is now live on Solv!

The WETH Mantle Leveraged Staking is now live on Solv!

This innovative vault is strategically designed for WETH holders on the Mantle network. Its primary goal? To capture and enhance Ethereum liquid staking rewards from mETH by leveraging Lendle, a DeFi lending protocol. Through this process, mETH is staked, and WETH is borrowed, creating a dynamic strategy for maximizing returns.

But that’s not all! As a special bonus, investors get the chance to be a part of a thrilling opportunity — sharing in a whopping $70,000 worth of LEND incentives.

Now, let’s explore some key aspects to consider when investing in the WETH Mantle Leveraged Staking Vault.

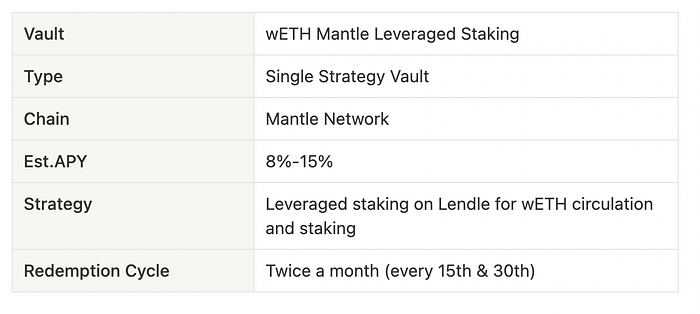

Basic Info of the Vault

Investors can join the vault at any time, based on the Net Asset Value (NAV) of the vault on the day of subscription.

Strategy Deep Dive

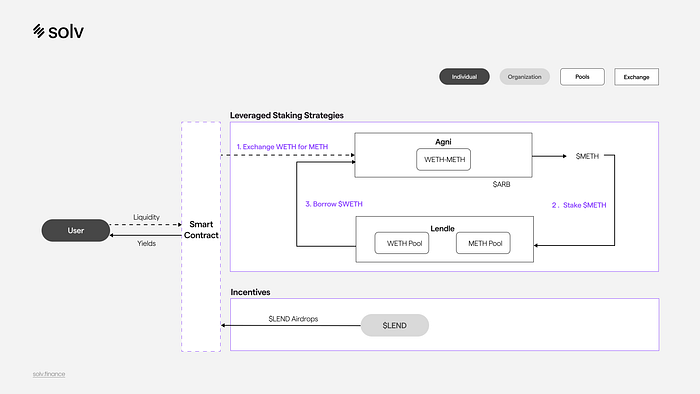

The strategy comprises of two components:

- WETH-mETH Trading: swap WETH for mETH at Agni, a DEX on Mantle.

- Leveraged Staking: In this step, mETH is deposited into Lendle, while simultaneously borrowing WETH to capture the interest rate differential.

These trading, staking and borrowing actions are carried out in repetition, continuously enhancing the vault’s performance.

These trading, staking and borrowing actions are carried out in repetition, continuously enhancing the vault’s performance.

The yield of this vault is derived from three sources:

- Ethereum Staking Rewards from mETH.

- Interest Rate Differential. The difference between staking rewards earned from deposited mETH and the interest paid for borrowing WETH.

- $LEND Incentive:

A total of $70,000 worth of LEND will be distributed to Solv users over 12 months. The amount distributed each month will be determined at the beginning of that month based on the price at that time. The LEND tokens will be airdropped to users’ addresses at the beginning of the following month.

Risk Management

- Solv employs a robust asset management system, ensuring a trustless and non-custodial solution to minimize counterparty risks. All operations are conducted exclusively through a multi-signature wallet, providing an additional layer of security. The Solv Vault Guardian is implemented to enforce strict permissions, adding an extra layer of protection to the entire system.

- Solv, in collaboration with the fund manager, will closely monitor lending and interest ratios in real-time. This proactive approach optimizes returns while prioritizing safety and stability. For more details on Lendle’s interest rate model, please refer to their documentation.

About Solv

Solv offers native yield solutions for diverse assets like stablecoins, Bitcoin (BTC), Ethereum (ETH), and other recognized tokens. We stand out by using strategy-based vaults and robust safety measures, ensuring optimized returns and secure decentralized asset management.

Join our community

Join our community to follow up on upcoming updates for documentation, dapp, and tutorials.