Bitcoin Ordinals: Purposeful or Unworkable?

Previously there was Segwit, Lightning, and Taproot; producing a consensus of being productive for the Bitcoin network. The Bitcoin ecosystem is not a stagnant dumb rock, it is perpetually evolving and innovating, the most recent development being “Ordinals”. Ordinals has sparked both excitement and skepticism as with most other network propositions. Here are the basics and what you should know:

Previously there was Segwit, Lightning, and Taproot; producing a consensus of being productive for the Bitcoin network. The Bitcoin ecosystem is not a stagnant dumb rock, it is perpetually evolving and innovating, the most recent development being “Ordinals”. Ordinals has sparked both excitement and skepticism as with most other network propositions. Here are the basics and what you should know:

What is an Ordinal?

Ordinals, introduced in early 2023, represent a novel utilization of Bitcoin’s blockchain. They allow users to inscribe data onto the smallest unit of bitcoin (a satoshi), effectively intertwining this data with Bitcoin’s decentralized and globally verified ledger. This innovation has been likened to the creation of Non-Fungible Tokens (NFTs), marking a significant variation from Bitcoin’s traditional use case.

An easy way to understand this is if you use Venmo. When you send your friend a payment, you typically must inscribe the transaction with a “memo” or emoji in most cases. This attaches data to the transaction. It could be text, image, or a gif. This uniquely identifies the record of the transaction (although Venmo doesn’t enforce as non-fungible). Now this is a trivial representation, but a similar concept.

The name ‘Ordinal’ is derived from the method of their creation. It is similar to ordinal number in set theory in the sense of being a unique number in a series. Each bitcoin can be subdivided into 100 million smaller units, known as satoshis/sats. Ordinals are essentially a way of distinguishing these sats with a unique twist: they carry attached data that is directly embedded onto the blockchain. Each inscription assigns a specific ordinal number based on the order in which the sat was mined. This numbering system, known as ordinal theory, allows for precise tracking and individual verification of each sat.The process to uniquely classify a sat is not terribly complex and resembles a similar convention to video games. The rare aspect of the sat depends on the combination of its origins.

Common: Nothing special sat

Uncommon: First sat from a transaction block

Rare: First sat after difficulty adjustments

Epic: First sat after halving

Legendary: The first sat of each cycle

Mythic: The very first sat ever minedThe buzz around Ordinals primarily stems from “Bitcoin Inscriptions,” where digital artifacts are created by inscribing content onto sats. This process utilizes two key Bitcoin soft fork upgrades: SegWit, which expanded the block capacity, and Taproot, which enhanced transaction efficiency. By leveraging a design aspect of Taproot, files (such as images or videos) can be inscribed onto individual sats as part of the blockchain’s witness data, each acquiring a unique identifier.

The concept of digital artifacts brought about by Ordinals is distinct from traditional NFTs. Unlike NFTs, which rely on smart contracts and are often stored off-chain, digital artifacts are directly stored on the Bitcoin base layer. They are immutable, decentralized, and secure, embodying the essence of the Bitcoin blockchain.

The popularity of Ordinals has led to an increase in blockchain activity. Trading platforms like Binance and OKX have reported significant trading volumes. This heightened activity has had a direct impact on Bitcoin’s transaction fees, which saw a significant spike due to the additional block space required by these inscriptions. This is where controversy comes in.

Critics point to the substantial block space consumed by inscriptions and potential network congestion leading to longer transaction confirmation times. This also introduces a transaction fee affordability barrier for those in unbanked regions with heavy reliance on the Bitcoin network. Following Ordinals’ launch, average block sizes and transaction fees notably increased.

Proponents, however, argue that the market demand for Ordinals could benefit the infrastructure, driving demand for block space and elevating transaction fees. These higher fees could provide additional income for miners, potentially bolstering Bitcoin’s security model in the face of halving events. Transactions fees will be the bread and butter for miners come 2140.

The rise of Ordinals has brought to light several issues concerning the efficiency and scalability of the Bitcoin blockchain. The primary concern revolves around the fact that Ordinals require direct on-chain validation, which consumes considerable block space and creates UTXOs (Unspent Transaction Outputs) that are unlikely to be spent as regular currency. This has led to concerns of potential blockchain ‘spamming’, deteriorating the user experience for regular Bitcoin transactions.

However, this development has also been immensely profitable for Bitcoin miners. The increased transaction fees associated with Ordinals have become a significant source of income, especially in light of the upcoming Bitcoin halving, which will see mining rewards cut in half. The profitability of these transaction fees has provided a cushion for miners against the expected decrease in earnings post-halving.While some view this as a natural progression of Bitcoin’s capabilities, others see it as a deviation from Bitcoin’s core principles. Innovations like Ordinals could detract from Bitcoin’s primary function as a decentralized peer-to-peer payment transfer mechanism.

Bitcoin developer Luke Dashjr has even registered a method that allows Ordinal inscriptions as a code vulnerability, citing concerns over the bypassing of datacarrier size limits. This action has been met with resistance from other developers, producing a divided agreement for the future direction of Bitcoin’s development.

Despite these controversies, Bitcoin’s network has demonstrated remarkable resilience and adaptability — traits often described as ‘antifragility.’ The network has shown an ability to absorb shocks and stresses, such as those introduced by Ordinals, and emerge stronger.

As the debate continues, the future of Ordinals and their role in Bitcoin’s ecosystem remains uncertain. While they represent a significant innovation, bringing versatility and new functionalities to Bitcoin, they also challenge the networks efficiency and scalability. The ongoing discourse is not merely about Ordinals but reflects a broader conversation about the direction and purpose of Bitcoin as it continues to mature and evolve.

Ordinals represent a significant moment in Bitcoin’s history, highlighting its potential as a foundational layer for a wide range of applications. While the long-term implications are yet to be fully realized, Ordinals have undoubtedly reignited conversations about Bitcoin’s fundamentals. While Ordinals don’t require a hard fork, they do bring potential challenges that could affect the usage of the network. Whether Ordinals will be widely adopted and deemed useful will largely depend on how these challenges are addressed and managed by the community and developers. Nonetheless, Bitcoin will continue to adapt and iterate in the fashion of hard immutable cyber energy.

Sources:

Bitcoin Ordinals: Inscriptions, bitcoin NFTs

Dive into Bitcoin ordinals: inscriptions linking satoshis to NFTs through ordinal theory on the Bitcoin blockchain…

trustmachines.co

Bitcoin Developer Luke Dashjr Registers Ordinal Inscriptions Workaround as a Vulnerability …

Luke Dashjr registered the method that allows Ordinals to embed data directly on top of the Bitcoin blockchain as a…

news.bitcoin.com

If you enjoyed this read be sure to check out my socials:

https://www.linkedin.com/in/williamboonejr/

https://twitter.com/BillyBoone32

5

Bitcoin

Bitcoin Mining

Economics

Finance

Investing

5

Follow

Follow

Written by William Boone

0 Followers

·

Writer for

Coinmonks

Bitcoin | Economics | Stewardship | Bitcoin Education == Inevitable Allocation | Proverbs 16:9

More from William Boone and Coinmonks

William Boone

William Boone

How and Why You Should Be Using RSS in 2024

In 2024, amidst the tech landscape dominated by surveillance and algorithm-driven content, RSS (Really Simple Syndication) emerges as a…

2 min read

·

5 days ago

Shantanu Gupta

Shantanu Gupta

in

Coinmonks

Which Crypto Will Explode in 2024? Here Are Some Of MyTop Picks.

As we approach the end of the year, investors worldwide are gearing up for the anticipated bull run in the crypto market, eyeing the next…

4 min read

·

Dec 19, 2023

668

2

Velvet.Capital

Velvet.Capital

in

Coinmonks

🚨Velvet.Capital Token Distribution (Airdrop)🚨

🚨 Airdrop Alert🚨: DeFi Asset Management Done right! Everything you need to know for Velvet.Capital’s Token Distribution & Airdrop!

4 min read

·

Dec 30, 2022

38K

1016

William Boone

William Boone

Redefine Wealth: Making $100k salary is easy!

Let’s also consider the debt factor. If only Americans understood the principles of a balance sheet! What is even more scarce than a…

5 min read

·

Sep 6, 2023

52

Recommended from Medium

Johnwege

Johnwege

in

Coinmonks

The Greatest Crypto Bull Market You’ve Ever Seen

Throughout your life there will be a handful of decisions that you make that will change your life financially forever. For the better, or…

·

5 min read

·

5 days ago

247

2

Andrey Plat

Andrey Plat

Bitcoin Ordinals under the hood. How Inscriptions and BRC20 workIntroduction.

One of the most talked about narratives in recent weeks is tokens on the Bitcoin blockchain. It is so popular simply because it has already…

12 min read

·

Dec 25, 2023

153

2

Lists

Self-Improvement 10120 stories

Self-Improvement 10120 stories

·

1217

saves Leadership41 stories

Leadership41 stories

·

199

saves

Business 10125 stories

Business 10125 stories

·

640

saves

Work 10126 stories

Work 10126 stories

·

87

saves

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.7K

119 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

423

10

Crypto Rookies

Crypto Rookies

Bitcoin versus Gold ETF

Abstract

8 min read

·

6 days ago

64

Shawn Forno

Shawn Forno

in

The Startup

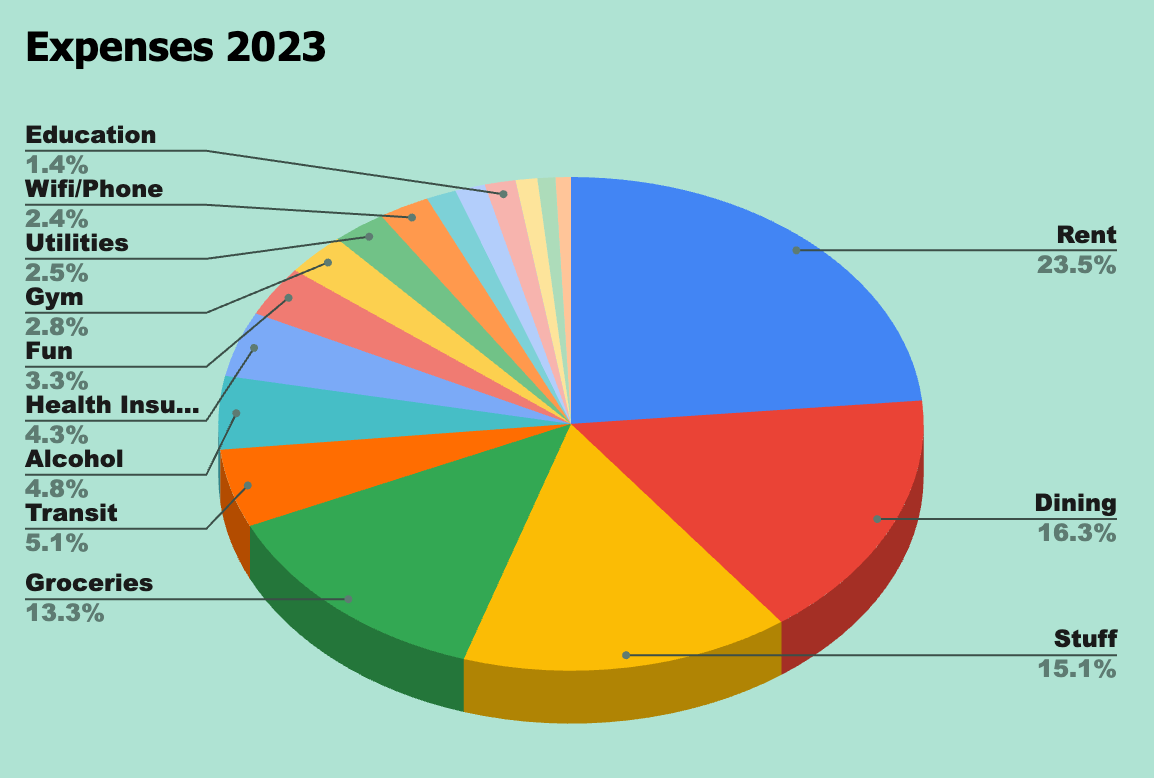

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.6K

49

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)