Bitcoin Spot ETF sets second highest inflow record in history - Bitcoin "jumps"

More than $887 million flowed into US Bitcoin Spot ETF products during yesterday's trading session.

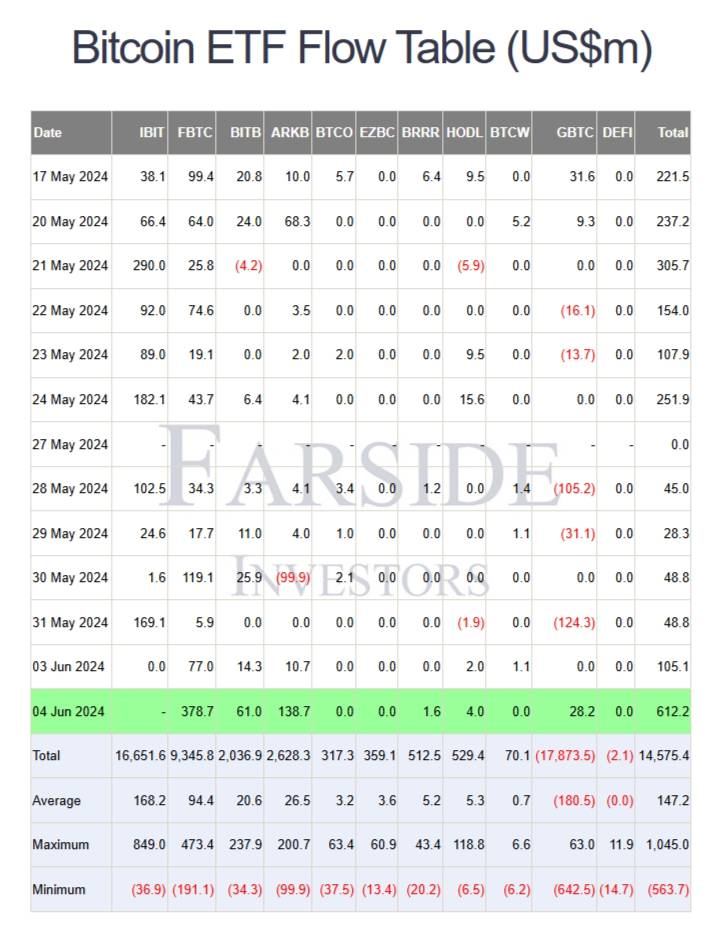

The Bitcoin Spot ETF in the United States was well received on June 4, collecting the highest inflow in the past two months and setting a second record since its inception.

image

The latest trading session recorded more than 887 million USD poured into funds, especially no funds sold. As follows:

- Fidelity (FBTC): Buy 378.7 million USD

- BlackRock (IBIT): Buy 274.9 million USD

- Ark & 21Shares (ARKB): Buy 138.7 million USD

- Bitwise (BITB): Buy 61 million USD

- Grayscale (GBTC): Buy 28.2 million USD

- Valkyrie (BRRR): Buy 1.6 million USD

- VanEck (HODL): Buy 4 million USD

- Galaxy Digital (BTCO): 0

- Franklin(EZBC): 0

- WisdomTree (BTCW): 0

- Hashdex (DEFI): 0

Cash flow of Bitcoin spot ETF products, IBIT data has not been updated. Source: Farside Investors (June 5, 2024)

Positive cash inflow from the Bitcoin Spot ETF continuously for 15 trading days is a significant achievement, especially after a period of sideways and then negative cash flow.

In the past month alone, spot ETFs have accumulated another $2.4 billion in assets, according to data from Bloomberg Intelligence. This is the third largest net capital inflow in the entire ETF market, bringing the total inflow from the beginning of the year to approximately 15 billion USD.

Commenting on the above milestone, Bloomberg ETF expert Balchunas wrote on X:

"The ability to rebound strongly after several harsh sell-offs is rare for hot sauce strategies. This shows a lasting power."

*In this context, "hot sauce" can be understood as a high-risk investment strategy that can bring large profits but is also susceptible to strong fluctuations.

Net inflows have averaged $140 million per day, according to data from Farside Investors. Since May 16, IBIT alone has collected 1.1 billion USD, continuing to maintain its achievement as the strongest ETF in the market. As of yesterday, IBIT owned 291,563 Bitcoin - equivalent to 20.15 billion USD.

Corresponding to the above huge cash flow, it is not surprising to see Bitcoin price accelerating to 71,275 USD, up more than 2% in the past 24 hours.