Here are historical snapshots - Part 1

Historical Snapshot - 05 January 2020

Rank Symbol Market Cap Price Circulating Supply

1 BTC $134,469,548,249.08 $7,411.320000 18,143,812 BTC

2 ETH $14,875,569,429.66 $136.280000 109,157,039 ETH

3 XRP $8,474,172,239.53 $0.195500 43,337,903,409 XRP

4 USDT $4,133,500,727.77 $1.006200 4,108,044,456 USDT

5 BCH $4,080,035,773.48 $224.100000 18,206,600 BCH

6 LTC $2,778,396,524.61 $43.550000 63,793,157 LTC

7 EOS $2,559,643,917.93 $2.701600 947,443,787 EOS

8 BNB $2,194,781,442.97 $14.110000 155,536,713 BNB

9 BSV $2,003,156,469.14 $110.870000 18,068,415 BSV

10 XMR $940,587,960.20 $54.100000 17,387,097 XMR

11 XLM $909,657,060.26 $0.045360 20,054,779,554 XLM

12 TRX $908,402,721.81 $0.013620 66,682,072,191 TRX

13 ADA $900,224,705.78 $0.034720 25,927,070,538 ADA

14 XTZ $877,159,746.89 $1.263600 694,191,974 XTZ

16 ATOM $806,970,071.74 $4.231900 190,688,439 ATOM

17 HT $708,925,310.99 $2.938100 241,284,047 HT

18 NEO $639,703,565.89 $9.068800 70,538,831 NEO

20 LINK $632,725,379.19 $1.807800 350,000,000 LINK

21 ETC $570,853,943.07 $4.907900 116,313,299 ETC

23 USDC $518,272,576.97 $1.008500 513,906,091 USDC

26 DASH $476,326,526.07 $51.480000 9,252,790 DASH

29 ONT $351,858,671.02 $0.552100 637,351,170 ONT

30 VET $305,240,316.50 $0.005504 55,454,734,800 VET

31 DOGE $296,989,929.96 $0.002419 122,770,038,083 DOGE

33 BAT $267,401,433.11 $0.188900 1,415,586,562 BAT

34 ZEC $260,715,782.66 $31.020000 8,404,419 ZEC

35 PAX $254,554,712.67 $1.008800 252,336,307 PAX

41 QTUM $157,729,635.29 $1.638100 96,288,788 QTUM

42 TUSD $154,620,833.58 $1.009600 153,152,915 TUSD

47 ALGO $116,782,883.79 $0.231700 504,120,205 ALGO

51 OKB $107,211,336.45 $2.680300 40,000,000 OKB

Data source - Coinmarketcap

Most volatile crypto of January 2020: the top 10 movers

January 2020 was marked by massive growth in the crypto market. Even less-known altcoins raced forward, adding more than 50 per cent to their value. While the bull stampede seems to be over, the market is still in a much better place than it was a month ago. As the dust slowly settles, it's time to check who gained – and lost – most. Note: the list includes only the most volatile cryptocurrencies with a market cap above $5m at press time.

The gainers

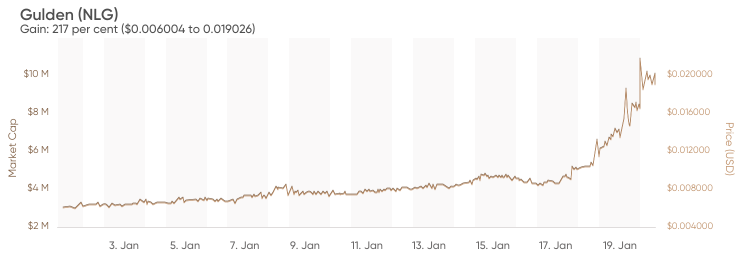

Gulden (NLG)

Gain: 217 per cent ($0.006004 to 0.019026) Credits (here and elsewhere): Coinmarketcap.com

Credits (here and elsewhere): Coinmarketcap.com

Gulden appeared in 2014 as a fork of Litecoin. It uses so-called PoW2 consensus protocol that supposedly reduces energy consumption by miners to just 0.01 per cent of that of Bitcoin. The original idea was that Gulden would become the national cryptocurrency of the Netherlands – but, judging from the current $10m market cap, it still has a long way to go. Nevertheless, in the first three weeks of January GLD grew 3.34 times. This is 26 times lower than its all-time high valuation of $0.499114.

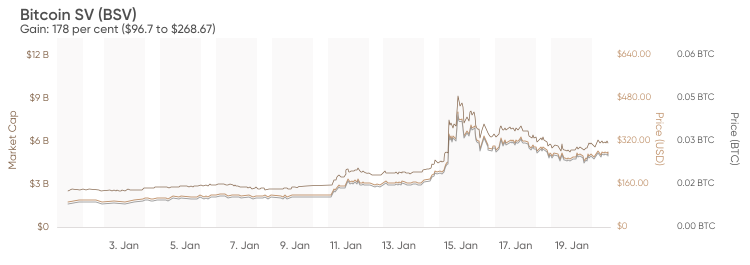

Bitcoin SV (BSV)

Gain: 178 per cent ($96.7 to $268.67) The pump of Bitcoin Satoshi's Vision became one of the most discussed crypto events of January 2020. It looked even more impressive at its peak, when the price rose to $422, making it the single most volatile crypto of January. It definitely looks like a pump, though on a very large scale – but who orchestrated it? Some point to Canadian gambling billionaire Calvin Ayre. According to an insightful Twitter user, he combined BCH mining with BSV washtrading – a genius scheme that catapulted BSV into the top five coins by market cap in just a few days.

The pump of Bitcoin Satoshi's Vision became one of the most discussed crypto events of January 2020. It looked even more impressive at its peak, when the price rose to $422, making it the single most volatile crypto of January. It definitely looks like a pump, though on a very large scale – but who orchestrated it? Some point to Canadian gambling billionaire Calvin Ayre. According to an insightful Twitter user, he combined BCH mining with BSV washtrading – a genius scheme that catapulted BSV into the top five coins by market cap in just a few days.

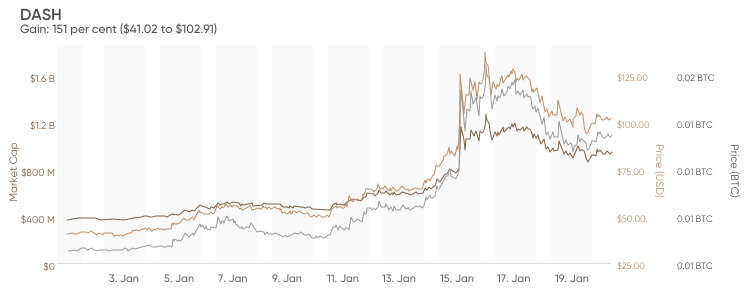

DASH

Gain: 151 per cent ($41.02 to $102.91) Among the top 20 coins, DASH was the biggest winner in the rally – when all was said and done, it outdid even the dubious BSV. On Jan 15, DASH gained 40 per cent in one day, all the way to $148.2 – though it has lost most of those gains since. One of the factors driving up the price of DASH could be the ongoing economic and political crisis in Venezuela, where people are using crypto to hedge against hyperinflation. In Venezuela, DASH is the most popular crypto after Bitcoin.

Among the top 20 coins, DASH was the biggest winner in the rally – when all was said and done, it outdid even the dubious BSV. On Jan 15, DASH gained 40 per cent in one day, all the way to $148.2 – though it has lost most of those gains since. One of the factors driving up the price of DASH could be the ongoing economic and political crisis in Venezuela, where people are using crypto to hedge against hyperinflation. In Venezuela, DASH is the most popular crypto after Bitcoin.

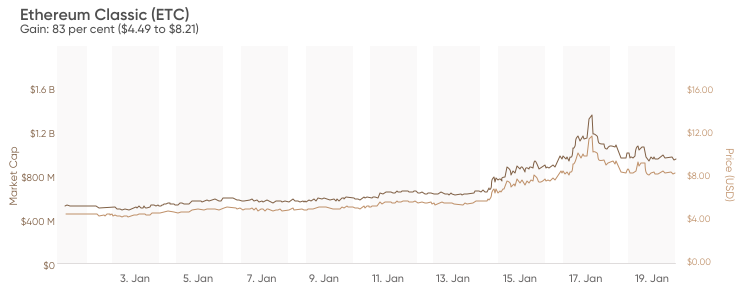

Ethereum Classic (ETC)

Gain: 83 per cent ($4.49 to $8.21) ETC partly owes its recent success to the general bull run, but there are two other reasons. First, Binance listed ETC futures, prompting a rally to $11.57. The price fell by almost 30 per cent since then, and ETC is now back in the second dozen of coins by market cap. Second, the project recently activated its Agartha hard fork, which is supposed to improve the interoperability between Ethereum Classic and Ethereum.

ETC partly owes its recent success to the general bull run, but there are two other reasons. First, Binance listed ETC futures, prompting a rally to $11.57. The price fell by almost 30 per cent since then, and ETC is now back in the second dozen of coins by market cap. Second, the project recently activated its Agartha hard fork, which is supposed to improve the interoperability between Ethereum Classic and Ethereum.

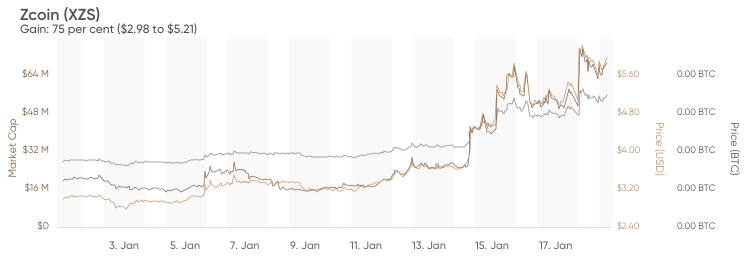

Zcoin (XZS)

Gain: 75 per cent ($2.98 to $5.21) Zcoin is a privacy-focused currency founded in 2016. In December, Zcoin launched a crowdfunding system that is almost identical to the one used by Monero. In early February, the project will become the first privacy coin to introduce so-called RAP addresses into its wallet – an implementation of the well-known Reusable Payment Codes (BIP47) idea. This gives XZS good grounds for growth, though 2020 can also bring a new crackdown on privacy cryptocurrencies.

Zcoin is a privacy-focused currency founded in 2016. In December, Zcoin launched a crowdfunding system that is almost identical to the one used by Monero. In early February, the project will become the first privacy coin to introduce so-called RAP addresses into its wallet – an implementation of the well-known Reusable Payment Codes (BIP47) idea. This gives XZS good grounds for growth, though 2020 can also bring a new crackdown on privacy cryptocurrencies.

The losers

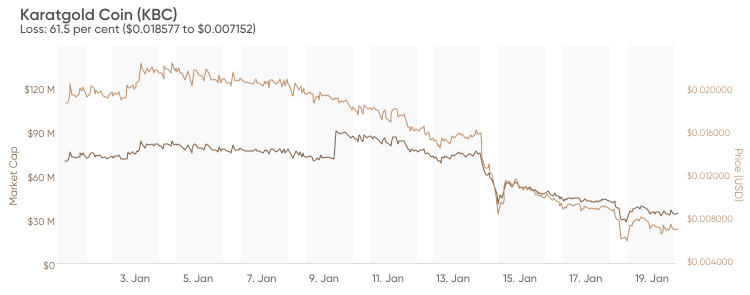

Karatgold Coin (KBC)

Loss: 61.5 per cent ($0.018577 to $0.007152) Karatgold was one of several projects in 2019 offering “tokenized physical gold”. The company behind it – German Karatbars – claimed to have a “crypto bank” in Miami, though it didn't provide any proof. Problems began in October 2019, when Florida began an investigation into Karatbars due to its lack of licensing. In November, Karatbar was ordered to cease its activity by the German regulator BaFin. All negative events KBC at the head of our negative top-five of the most volatile cryptocurrencies of January.

Karatgold was one of several projects in 2019 offering “tokenized physical gold”. The company behind it – German Karatbars – claimed to have a “crypto bank” in Miami, though it didn't provide any proof. Problems began in October 2019, when Florida began an investigation into Karatbars due to its lack of licensing. In November, Karatbar was ordered to cease its activity by the German regulator BaFin. All negative events KBC at the head of our negative top-five of the most volatile cryptocurrencies of January.

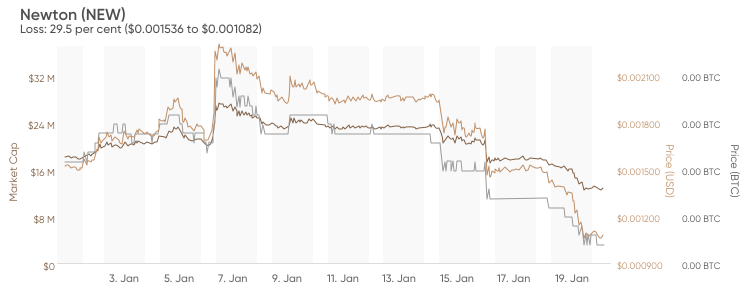

Newton (NEW)

Loss: 29.5 per cent ($0.001536 to $0.001082) Newton peaked a week earlier than other alts (January 7) at $0.002304 and then began its gradual descent. NEW's all-time high ($0.016538) was reached in April 2019 – just three days after its IEO on Huobi. Since then, this highly volatile cryptocurrency lost 94 per cent of its value. This can serve as a cautionary tale to projects that pay for costly IEOs on leading exchanges. Selling out tokens in a few minutes at an IEO isn't the same as long-term success.

Newton peaked a week earlier than other alts (January 7) at $0.002304 and then began its gradual descent. NEW's all-time high ($0.016538) was reached in April 2019 – just three days after its IEO on Huobi. Since then, this highly volatile cryptocurrency lost 94 per cent of its value. This can serve as a cautionary tale to projects that pay for costly IEOs on leading exchanges. Selling out tokens in a few minutes at an IEO isn't the same as long-term success.

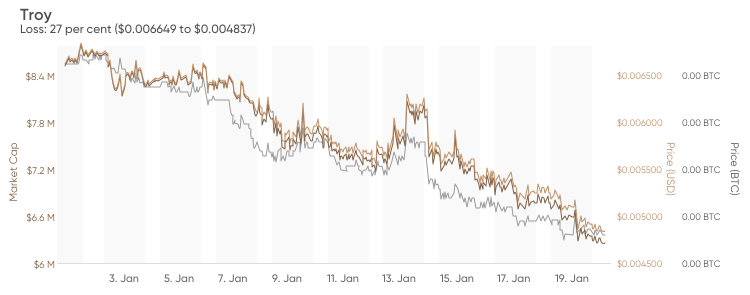

Troy

Loss: 27 per cent ($0.006649 to $0.004837) Troy is an international crypto broker based in Hong Kong, offering trading and asset management services. It focuses on professional traders and money managers. On December 3, 2019, Troy Trade held an IEO on Binance Launchpad. TROY reached its all-time high of $0.010834 on the first trading day (Dec 6) and slowly started to go down. At this point, it has lost 65 per cent of its value.

Troy is an international crypto broker based in Hong Kong, offering trading and asset management services. It focuses on professional traders and money managers. On December 3, 2019, Troy Trade held an IEO on Binance Launchpad. TROY reached its all-time high of $0.010834 on the first trading day (Dec 6) and slowly started to go down. At this point, it has lost 65 per cent of its value.

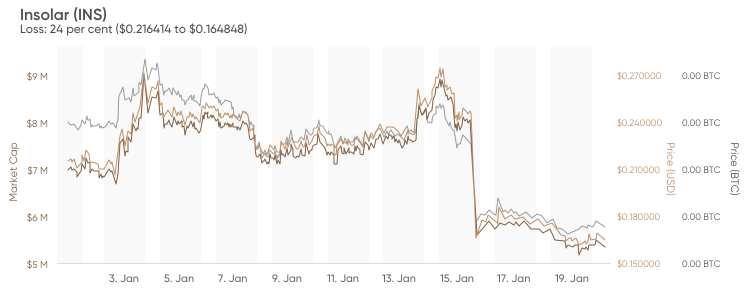

Insolar (INS)

Loss: 24 per cent ($0.216414 to $0.164848) Insolar is an infrastructure project proposing to combine public and private ledgers and bring “unlimited scalability”. The team apparently comprises 70 people, which is quite high for a blockchain start-up with a market cap of just $5.3m. In October, Insolar announced partnerships with Microsoft and Oracle ahead of the mainnet launch. However, the launch was rescheduled for January – and so far hasn't materialised.

Insolar is an infrastructure project proposing to combine public and private ledgers and bring “unlimited scalability”. The team apparently comprises 70 people, which is quite high for a blockchain start-up with a market cap of just $5.3m. In October, Insolar announced partnerships with Microsoft and Oracle ahead of the mainnet launch. However, the launch was rescheduled for January – and so far hasn't materialised.

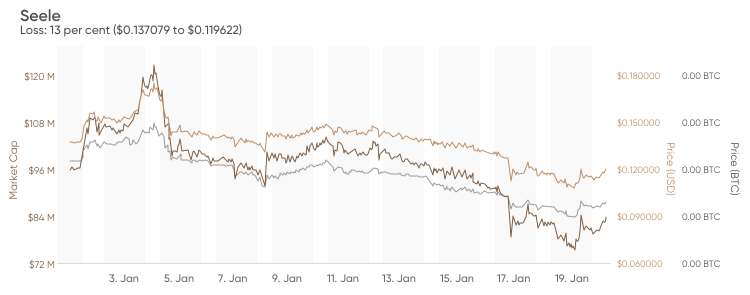

Seele

Loss: 13 per cent ($0.137079 to $0.119622)

Seele advertises a processing capacity of 2000 tps thanks to its Matrix Proof-of-Work algorithm (MPoW). It also claims to be fully compatible with the Ethereum Virtual Machine (EVM). Though the project seems to have a strong team and the Github page is regularly updated, it hasn't published any news in the media lately.

As we've seen, even during a general bull run there are some standout winners – and some unexpected losers.

So BTW it is not an investment advice

Look back for opportunities for the future

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - WEN ALT Season?](https://cdn.bulbapp.io/frontend/images/5e881bda-7f7a-42c8-9a03-01263004c332/1)