Solana Price Prediction as SOL Blasts Above $100 – $1,000 SOL Incoming?

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Solana Price Prediction is a hot topic as SOL soars past the $100 mark, with the latest figures showing a trading price of $109.56. This modest 24-hour increase of nearly 15% underscores the burgeoning interest and confidence in Solana, currently ranked 5th in market valuation.With a formidable market cap of roughly $47.9 billion and 437 million SOL coins in circulation, Solana’s trajectory seems poised for further ascension.

Solana Price Prediction is a hot topic as SOL soars past the $100 mark, with the latest figures showing a trading price of $109.56. This modest 24-hour increase of nearly 15% underscores the burgeoning interest and confidence in Solana, currently ranked 5th in market valuation.With a formidable market cap of roughly $47.9 billion and 437 million SOL coins in circulation, Solana’s trajectory seems poised for further ascension.

As enthusiasts and investors closely watch this space, the possibility of SOL reaching $1,000 becomes a subject of intense speculation and analysis.

Amidst this optimistic outlook for Solana, it’s also worth noting the emergence of Smog as a potential alternative, offering intriguing prospects for those diversifying their cryptocurrency portfolio.

Solana Price Prediction

Examining the 4-hour chart, we identify a pivot point at $107.14. Solana is encountering immediate resistance at $110.83, with further potential barriers at $114.74 and $118.21.

On the downside, support is found at $102.36, with additional floors at $98.67 and $93.03. The Relative Strength Index (RSI) sits at a healthy 66, not yet reaching the overbought threshold, which suggests there is room for upward movement before the market might consider it overextended.

The Relative Strength Index (RSI) sits at a healthy 66, not yet reaching the overbought threshold, which suggests there is room for upward movement before the market might consider it overextended. Solana Price Prediction – Source: TradingView

Solana Price Prediction – Source: TradingView

The 50-Day Exponential Moving Average (EMA) is positioned at $100.54, supporting the current price trend above this moving average, indicating sustained bullish sentiment.

Chart patterns reveal an upward channel formation, which traditionally supports a buying trend, particularly as Solana sustains above the $107.14 level.

A breakout above $110.83 could further solidify this trend, targeting the next resistance at $114.74.

In conclusion, the technical outlook for Solana is bullish, especially if prices hold above the $107.14 support zone.

Should Solana surpass the immediate resistance, there is an opportunity for acceleration towards higher levels, affirming the current buying trend.

Unveiling $SMOG: The Gateway to the Largest Airdrop in History

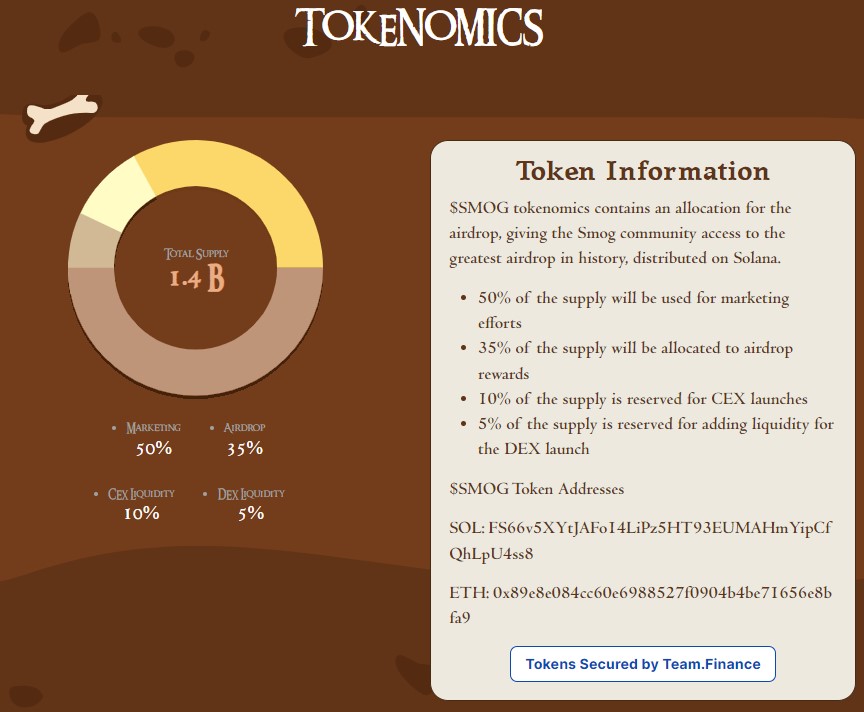

$SMOG tokenomics is setting the stage for what’s being hailed as the most monumental airdrop ever, uniquely distributed on the Solana blockchain. With 50% of its supply earmarked for marketing initiatives and 35% dedicated to rewarding its community through an unprecedented airdrop, $SMOG is generating palpable excitement.

A strategic allocation sees 10% reserved for Centralized Exchange (CEX) launches and the remaining 5% for bolstering liquidity in anticipation of its Decentralized Exchange (DEX) debut.

The roadmap delineates a captivating journey, starting with foundational steps like website development and token deployment, to ambitious goals like achieving social dominance and crowning itself as the SOL King. Each phase is meticulously crafted to enhance community engagement and expand $SMOG’s footprint across the digital landscape.

How to Engage with $SMOG:

- DEX Purchase: Navigate to Birdeye, link your Phantom or other Solana wallets, and swap your digital assets for $SMOG tokens. Holding these tokens not only secures your stake in the airdrop but also integrates you into the $SMOG community’s evolving narrative.

- OTC Buy and Stake: For Ethereum users, $SMOG offers a seamless OTC widget for purchases, with a staking pool on the horizon promising attractive APY returns. Whether you opt to hold or stake, you’ll be in line for the airdrop rewards.

- Airdrop Sign-up: Amplify your engagement by joining the Smog community on Zealy. Completing tasks earns you points towards the airdrop, with updates to follow post-launch.

Don’t miss out, buy or stake $SMOG, and prepare to embark on a journey that promises not just rewards but a chance to be at the forefront of cryptocurrency innovation.

CoinList to Acquire FTX’s Digital Custody Subsidiary in Cut-Price Deal

Source: Adobe / Александр Поташев

Source: Adobe / Александр Поташев

The FTX Debtors estate, under the leadership of CEO John Ray III, has initiated the process of selling Digital Custody Inc. (DCI) to CoinList.

FTX had previously acquired the subsidiary in two separate transactions, one in December 2021 and the other in August 2022, for a total of $10 million.

However, CoinList will now acquire DCI for a significantly reduced price of $500,000.

The financing for the deal will be provided by Terence J. Culver, the original CEO and seller of Digital Custody.

Digital Custody Never Integrated to FTX Ecosystem

According to FTX’s lawyers, the acquisition of DCI was intended to offer custodial services for FTX.US and LedgerX.

Unfortunately, due to former CEO Sam Bankman-Fried’s bankruptcy filing in November 2022, the integration of DCI into the FTX ecosystem never materialized, rendering the subsidiary essentially worthless to the FTX estate. Despite its limited value to FTX, Digital Custody still holds a license from the South Dakota Division of Banking, allowing it to provide custodial services.

Despite its limited value to FTX, Digital Custody still holds a license from the South Dakota Division of Banking, allowing it to provide custodial services.

After receiving offers from three interested parties, including Culver, the Debtors selected CoinList as the preferred purchaser based on their superior offer, ability to complete the transaction quickly, and their existing relationship with Culver.

FTX file motion to sell Digital Custody for $500k which FTX bought for $10m to Terrence Culver (person who sold DCI to FTX for $10m)

A&M (UCC/Ad hoc agrees) says this reflects a fair price for the valuable license from South Dakota that allows it to provide custody pic.twitter.com/QZ8XGVoHQ8

— Sunil (FTX Creditor Champion) (@sunil_trades) February 10, 2024

The Debtors believe that CoinList’s association with Culver will be advantageous in expediting regulatory approval for the sale.

FTX’s lawyers have disclosed that both the Committee and the Ad Hoc Committee of Non-US Customers of FTX.com have approved the transaction.

However, as part of the agreement, FTX retains the right to consider more favorable offers for DCI up until three days before the closing of the deal.

A reverse-termination fee of $50,000 will be imposed if the purchaser fails to finalize the transaction.

FTX to Sell AI Startup Anthropic

Last week, FTX sought approval to sell its 8% stake in AI startup Anthropic Holdings.

In a motion filed by FTX’s current CEO, the exchange requested permission to sell the stake and proposes two possible procedures, including an auction or a private sale.

FTX also requested a shortened period for objections to be raised, with a court hearing scheduled for February 22 to expedite the deliberation process.

The precise price sought for the Anthropic shares has been redacted from the filing, as FTX’s legal team believes public disclosure could hinder the potential to obtain higher offers for the stake.

Anthropic Holdings achieved a reported valuation of up to $18 billion in December 2023, indicating that FTX’s 7.84% stake could be worth approximately $1.4 billion.

This value has sparked hope among victims of the FTX collapse, as FTX anticipates having sufficient funds to fully repay all customer and creditor claims.

Earlier this month, FTX also filed a motion in a Delaware court to sell its $175 million claim against bankrupt digital financial services firm Genesis Global Capital.

Currently, claims against Genesis are selling for 65% of their face value, significantly higher than the 38% that Alameda Research claims are fetching.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)