The Bitcoin ETF: The Great Hope That Disappointed?

The legendary Bitcoin Spot ETF; the catalyst that many experts declared would not only send the price of Bitcoin over $100k in short order but would ignite the next bull market.

Just last week the ETF was finally approved and the market was ready for the stampede rush of Wall Street money to enter. However since the ETF began trading, the price of BTC has fallen from $49k down to as low as $40k.

Could the most hyped event to happen in Bitcoin’s recent memory end up being a disappointment?

This is the question that everyone in the crypto market is wondering right now, and let me tell you why this was all expected. When in doubt, zoom out.

Masters of Manipulation

Like it or not, we are no longer alone in this market. The most powerful organizations have entered Bitcoin. Companies such as BlackRock, JP Morgan, and several others. These are the names that secretly control the world behind the scenes. There is nothing they will not do to get ahead or improve companies’ bottom line.

Like it or not, we are no longer alone in this market. The most powerful organizations have entered Bitcoin. Companies such as BlackRock, JP Morgan, and several others. These are the names that secretly control the world behind the scenes. There is nothing they will not do to get ahead or improve companies’ bottom line.

But most of all, they want control.

Bitcoin has often been considered digital gold. This is a great comparison because JP Morgan was accused and convicted of manipulating the gold markets. There is no reason to believe they won’t try to do the same with Bitcoin. It might not be just a coincidence that the price of BTC drops right after trading begins. Dropping just enough to make most people lose interest; allowing Wall Street to take hold of the market.

The market is an all-out battle right now. Walland everyone is fighting for life-changing wealth.

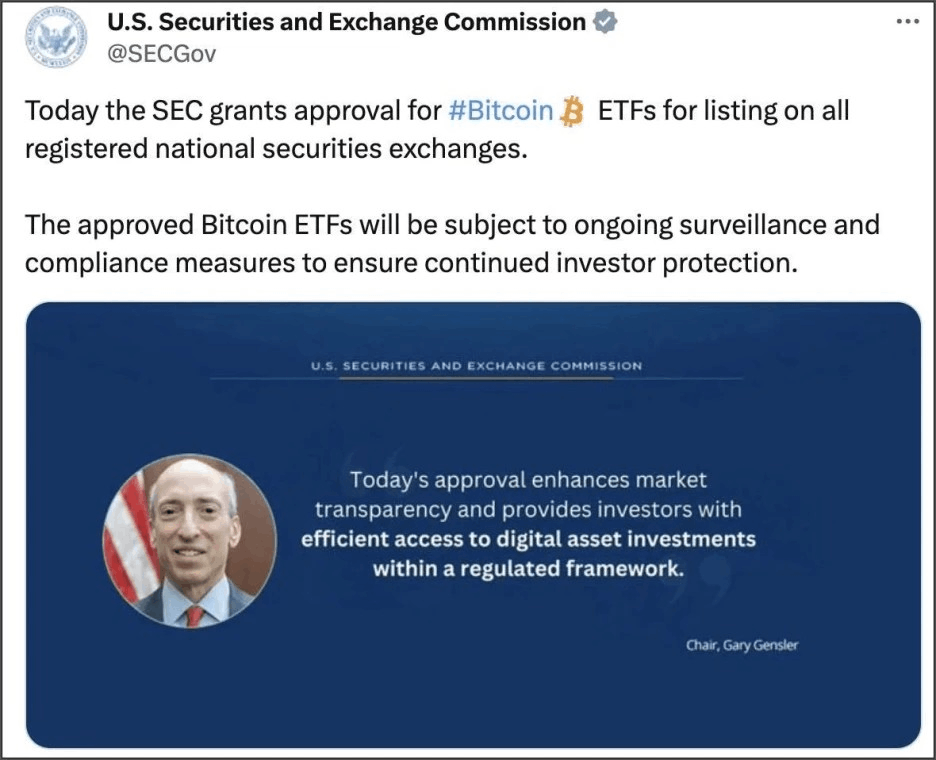

The Fake SEC Approval Took The Wind out of our Momentum

The rumors were everywhere; financial experts were declaring that the Bitcoin ETFs would be approved within the next 24 hours. And then expectedly early, the bombshell was released. The SEC tweeted that they had officially approved the Bitcoin ETF, resulting in the price going parabolic. Rising to $49k in mere minutes, only to have the bubble soon popped after.

The rumors were everywhere; financial experts were declaring that the Bitcoin ETFs would be approved within the next 24 hours. And then expectedly early, the bombshell was released. The SEC tweeted that they had officially approved the Bitcoin ETF, resulting in the price going parabolic. Rising to $49k in mere minutes, only to have the bubble soon popped after.

Around 15 minutes later Gary Gensler tweeted that the SEC X/Twitter account was compromised and that the Bitcoin ETF hadn’t been approved. The price responded accordingly dropping like the rug was pulled out from underneath it.

While the BTC ETF was officially approved the very next day, we were robbed of that “Euphoric” moment that poured into the next day when trading began. Instead, the moment was gone and the wind was taken from our sail.

Perhaps the SEC’s Twitter account was hacked, or maybe it was a saved draft that got posted early. Or perhaps there were darker intentions. One last attempt for large corporations to enter the market at cheaper prices, or even the likes of Elizabeth Warren trying to outright stop Bitcoin in its tracks.

Extreme Selling Pressure From Grayscale Trust Oweners

Grayscale is the unsung hero to this entire onslaught of Bitcoin ETF being approved. A clear result of them suing the SEC and winning.

Grayscale is the unsung hero to this entire onslaught of Bitcoin ETF being approved. A clear result of them suing the SEC and winning.

The SEC was left with no other choice and after a decade was finally forced to approve the Bitcoin ETF.

With that said, once the Grayscale Trust was converted to an ETF, there was always going to be extreme selling pressure.

Just think back over the last few years while the crypto market was deep in the bear market. There were times when GBTC was selling at a 50% discount, and owners were trapped. Now that the conversion has been made, owners finally had a chance to exit recouping their original investment or making large gains on their arbitrage play.

Either way, the result for the Grayscale ETF was always going to be a sprint to the exit.

The ETF Was Always a “Long-term” Play

To make it in Bitcoin you always need to remember, “When in doubt, zoom out.

To make it in Bitcoin you always need to remember, “When in doubt, zoom out.

While every Bitcoiner wanted the Spot ETF to send Bitcoin’s price immediately above $100k. That simply wasn’t going to happen in the short term. It definitely will, but it just takes time.

It’ll take time for hedge fund managers to research Bitcoin and explain it to their clients. It’ll take time for the sale pressure from the Grayscale conversion to wind down.

With the most powerful companies now invested in Bitcoin, there is no doubt that BTC is the future. They will continue to add assets under management while we lead up to the Bitcoin halving, which will cut the issuance of new Bitcoin being mined in half.

What this all means is while Wall Street is finally waking up to Bitcoin, that is when there will be a supply shock due to the halving. It might not be today, tomorrow, next month, or not even until the Fall. But very soon it will become very difficult to buy Bitcoin and prices are about to go parabolic.

Accumulate accordingly.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)