Top AI ETFs: Once In A Lifetime Opportunity?

Diversify your portfolio with these AI-focused funds

Artificial intelligence is shaping up to be one of the most transformative technologies of our generation. As AI continues to advance, it will impact nearly every industry in some way. Many experts predict AI will drive tremendous economic growth over the coming decades. This creates major investment opportunities, but also risks if you bet on the wrong companies.

Rather than trying to pick individual AI stocks, a smarter approach can be to invest in AI exchange-traded funds (ETFs). ETFs allow you to gain exposure to a sector while diversifying across many companies. This helps reduce your risk compared to buying just a few stocks.

In this article, we’ll analyze 5 of the top AI ETFs:

- Global X Robotics & Artificial Intelligence ETF (BOTZ)

- Global X Artificial Intelligence & Technology ETF (AIQ)

- ROBT Robo Global Robotics & Automation ETF (ROBT)

- iShares Robotics and Artificial Intelligence ETF (IRBO)

- WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

Let’s explore each of these ETFs in more detail. As we analyze them, here are some key factors we’ll consider:

- Performance — How has the ETF done over time?

- Holdings — What companies are included and how much of each?

- Fees — What are the expense ratios and other costs?

- Assets — How much money is invested in the ETF?

- Flows — Has the ETF seen consistent inflows over time?

We strongly recommend that you check out our guide on how to take advantage of AI in today’s passive income economy.

Global X Robotics & Artificial Intelligence ETF (BOTZ)

First up is the Global X Robotics & Artificial Intelligence ETF, with the ticker BOTZ. This was one of the first AI-focused ETFs, launching back in 2016.

Strong Returns But Slowing Momentum

Since its inception, BOTZ has delivered stellar returns of over 100%. However, performance has stagnated recently. The ETF is actually down around 15% from its peak in November 2021.

Earlier last year, BOTZ almost tripled in value amidst surging hype around AI stocks. But sentiment has cooled and volatility has picked up in 2022. That said, long-term growth prospects remain very strong.

Top Heavy in Nvidia

Checking BOTZ’s holdings, Nvidia accounts for a massive 14% of the portfolio. The next largest position is Intuitive Surgical at 10%.

Having over 20% concentrated in two stocks increases risk. On the other hand, Nvidia is a AI chip leader, so the big bet makes sense. But it’s something to be aware of.

Strong Inflows Reflect Investor Enthusiasm

Despite slowing returns, BOTZ continues to see strong inflows, taking in over $650 million over the past year. Total assets under management stand at $2.5 billion.

The 3-year cumulative inflow also equals over $600 million. So while hype might be cooling a bit, investors still seem excited about the long-term potential.

Global X Artificial Intelligence & Technology ETF (AIQ)

Next up is AIQ, another Global X AI ETF launched in 2018. This one has also delivered triple digit returns, up 113% since inception.

More Diversified Holdings

Checking AIQ’s holdings, the portfolio seems more diversified. The top position is Intel at just 4.3%. Top 12 holdings all fall between 3–4% of the portfolio.

This spreads out the risk and reward a bit more evenly. Though it possibly dampens the return potential slightly too.

Majority of Inflows Within Past Year

While AIQ manages an impressive $890 million in assets, the flows timing is concerning. Almost 75% of 5-year cumulative inflows have occurred just within the past year.

Chasing performance is rarely a good strategy. There’s a risk investors pile into AIQ after it already experienced huge gains. The ETF may be primed for mean reversion going forward.

ROBT Robo Global Robotics & Automation ETF (ROBT)

Shifting gears, ROBT is focused on the related fields of robotics and automation. The ETF launched in 2018 as well. It hasn’t performed quite as well as the Global X funds, up 55% since inception.

Eclectic Mix of Holdings

ROBT holds a mix of household tech names like Nvidia, plus some more esoteric companies. Top position Upstart is a lesser known fintech startup.

This uniqueness could payoff if the fund managers have identified promising AI players Wall Street has yet to fully appreciate. Or it could speak to lack of focus.

Majority of Inflows Within Past Year

Like AIQ, ROBT has seen the bulk of asset inflows pile in within just the past 12 months. When investors chase performance, it often ends painfully.

ROBT’s rapid ascent could mark a near-term top. That said, the ETF doesn’t seem overvalued yet either.

iShares Robotics and Artificial Intelligence ETF (IRBO)

The iShares’ AI ETF is another appealing option. Launched in mid-2018, IRBO has gained 55% since inception. The expense ratio is just 0.47%, lower than the Global X funds.

Holdings Spread Extremely Thin

IRBO takes diversification to the extreme, holding over 120 positions. Top positions are just ~1% each. Such diversity makes it very difficult for a handful of winners to move the needle.

On the plus side, IRBO reduces single company risk. But the holdings are so diluted it likely mutes overall return potential.

Stable Assets Under Management

On the positive side, IRBO hasn’t seen massive influxes of capital chasing performance. Assets under management grew from $200 million at inception to a steady $587 million today.

This shows investors believe in the long-term AI opportunity. But IRBO hasn’t surged in popularity like some other AI ETFs recently.

WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

Finally, we have WTAI. This is the newest AI ETF, launched in December 2021. Performance is understandably limited so far, with WTAI down around 15% since inception.

Newest Entrant, Unproven Track Record

Being the newest ETF, WTAI lacks a long-term track record to judge performance by. The fund could certainly bounce back and excel going forward. But other options have a clearer history to evaluate.

WTAI’s strategy could certainly prove itself over time. But the other ETFs seem “safer” options for now based on their longer histories.

Relatively Low Assets Under Management

Reflecting its newness, WTAI has just $200 million under management so far. That’s 5x less than the largest ETF BOTZ. The lower assets likely also contribute to lower liquidity in WTAI.

Key Takeaways: Choose Your AI Exposure Wisely

In closing, AI ETFs can be excellent investment vehicles to gain diversified exposure to this high-growth sector. That being said, return potential and risk profiles can vary greatly depending on how the ETFs are constructed.

BOTZ offers concentrated exposure to AI leaders like Nvidia, while IRBO diversifies across over 100 holdings. ROBT holds more obscure AI players, while WTAI lacks performance history being the newest fund.

Rather than chasing hype, consider starting with a proven ETF like BOTZ or AIQ. Focus on long-term secular growth trends in AI, not short-term overreactions. Monitor fund inflows as well, to avoid piling in at peaks.

AI will transform industries and economies over the next decade. Gain exposure through ETFs, but choose your fund wisely. Diversify across 2–3 ETFs potentially, and aim to hold for the long-term. We strongly recommend that you check out our guide on how to take advantage of AI in today’s passive income economy.

We strongly recommend that you check out our guide on how to take advantage of AI in today’s passive income economy.

9

AI

Etf

Money

Artificial Intelligence

Opportunity

9 Follow

Follow

Written by Money Tent

3.1K Followers

Money Tent offers cutting-edge online money-making strategies for beginners to leverage before they lose their appeal. 🤑 https://highticketaisystem.gr8.com/

More from Money Tent

Money Tent

Money Tent

12 Amazing AI Tools That Are Surprisingly FREE!

Navigating the Sea of AI Tools with Future Tools

4 min read

·

Dec 15, 2023

966

14

Money Tent

Money Tent

Top 5 AI Tools That Are BETTER Than ChatGPT, But Nobody is Using Them

Exploring Lesser-Known Alternatives Transforming the Tech Landscape

4 min read

·

Dec 24, 2023

871

11

Money Tent

Money Tent

Quick $65/Hour Simple AI Side Hustle For Beginners to Make Money Online In 2024

How I Make $50-$65 Per Hour Online Without Selling Anything

5 min read

·

Jan 4

965

20

Money Tent

Money Tent

8 Best AI Tools for Research in 2024

Navigating the Cutting Edge of Research with AI Assistants

5 min read

·

Dec 8, 2023

325

6

Recommended from Medium

The PyCoach

The PyCoach

in

Artificial Corner

OpenAI Just Released The GPT Store. Here’s How To Use It And Make Money With Your GPT

Learn how to publish your GPT to the store and monetize it.

·

5 min read

·

4 days ago

1K

10

Financeable

Financeable

12 Side Hustles You Can Do From Your Phone ($600+ Per Day)

Let’s be honest, if you’re reading this article, you probably have a phone or a laptop. And with this thing, you can make as much as $600…

13 min read

·

Dec 25, 2023

5.2K

89

Lists

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

619

saves

AI Regulation6 stories

AI Regulation6 stories

·

277

saves

What is ChatGPT?9 stories

What is ChatGPT?9 stories

·

273

saves

ChatGPT prompts34 stories

ChatGPT prompts34 stories

·

972

saves

Hasan Aboul Hasan

Hasan Aboul Hasan

How To Create AI Tools in Minutes!

A simple script. You just need to copy, tweak a little bit, and then you can build almost any AI tool you want!

6 min read

·

5 days ago

1K

12

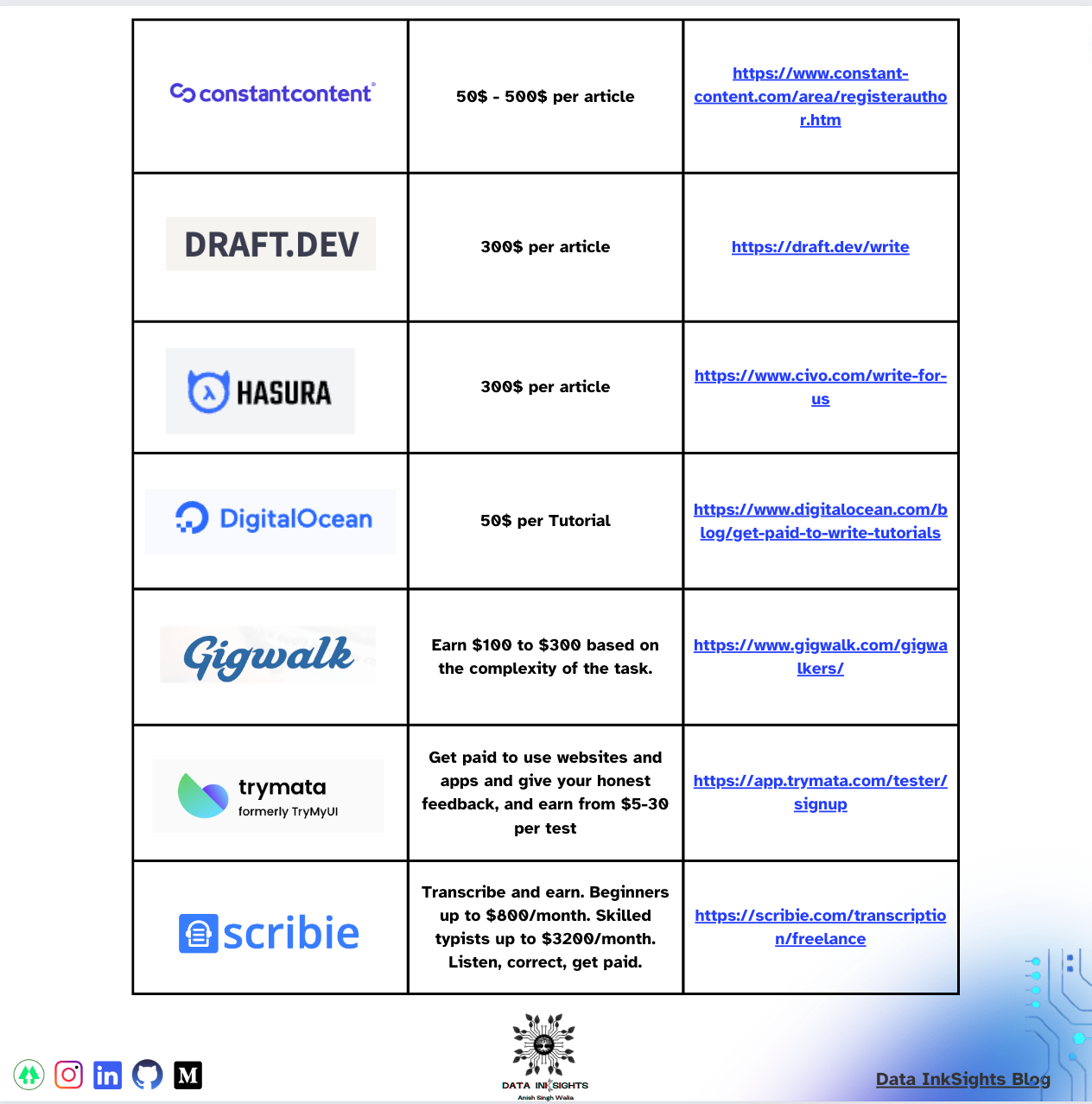

Anish Singh Walia

Anish Singh Walia

in

𝐀𝐈 𝐦𝐨𝐧𝐤𝐬.𝐢𝐨

7 Secret Websites That Pay You to Work from Anywhere in 2024 — Part 1

Looking for websites that pay you to work from anywhere? Check out these 7 secret websites that offer remote work opportunities in 2024.

7 min read

·

5 days ago

414

9

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8K

109

Leon Zucchini

Leon Zucchini

in

Curiosity

Top Apps in 2023: Best-of-the-best from Product Hunt

Explore the apps that captured hearts and screens alike in 2023 and join the buzz of tech innovation.

14 min read

·

Jan 8

706

8