FTX to Start Paying Debt to Users in Early 2025

After More Than Two Years of Restructuring, FTX Will Repay Creditors and Customers in Early 2025, in Partnership with Kraken and BitGo

More than two years after the crypto market crash, cryptocurrency exchange FTX has officially announced its plan to repay its customers and creditors in early 2025.

The FTX Debtors today announced that the effective date for its Plan of Reorganization has been set for January 3, 2025, which is also the initial distribution record date for holders of allowed claims in the Plan’s Convenience Classes. Read more here: https://t.co/7Hggm5cTlS

— FTX (@FTX_Official) December 16, 2024

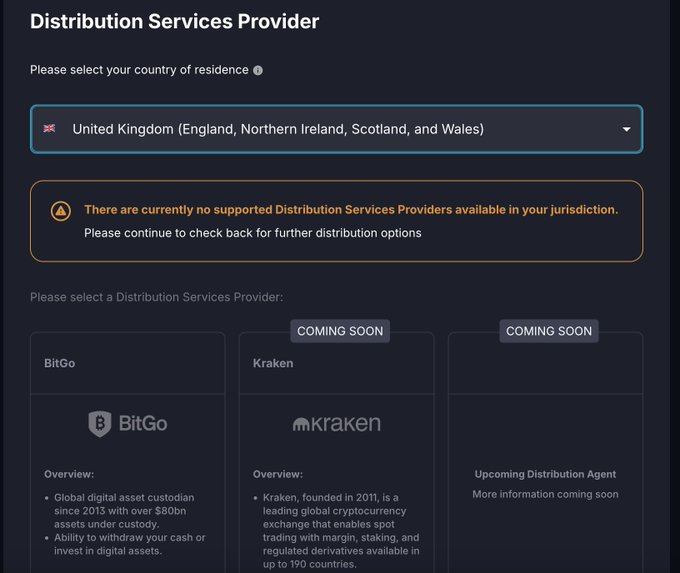

Specifically, the first repayments will be deployed within 60 days from January 3, 2025, 2 months earlier than previously announced. FTX will cooperate with two "big guys" in the industry, Kraken and BitGo, to ensure the distribution process is smooth and transparent. In addition, FTX will also soon announce a third partner participating in this debt repayment process.

FTX Claims: Distribution

FTX has uploaded two distribution partners -

Bitgo and Kraken with a third coming soon

to the FTX Claims Portal pic.twitter.com/x48fogTQZE

— Sunil (FTX Creditor Champion) (@sunil_trades) December 16, 2024

To be eligible for the refund, FTX users will need to complete a number of important procedures, including: identity verification (KYC), tax declaration, and account registration on Kraken or BitGo. These steps must be completed before the refund plan officially goes into effect.

The first refund will prioritize creditors with claims under $50,000, accounting for more than 90% of all creditors, and the distribution plan for the remaining creditors will be announced in the near future.

The compensation that creditors receive will be equivalent to the value of the crypto assets they held on FTX at the time of the exchange's bankruptcy. According to statistics as of May 2024, FTX has recovered up to 16.3 billion USD in assets. However, investors still suffered losses because the value of the assets being compensated was calculated in USD at the time of FTX's bankruptcy in November 2022, instead of calculated according to the actual crypto price, which has grown many times over the past 2 years.

FTX Debtors CEO John J. Ray III shared:

"Over the past two years, our team of experts has worked tirelessly and effectively to recover billions of dollars. The start of the compensation distribution process in January 2025 represents a great success in our asset recovery efforts."

In addition, Kraken also cleverly took advantage of this opportunity to "score points" in the eyes of users, cleverly recalling the experience of distributing Bitcoin and Bitcoin Cash to Mt Gox creditors as an affirmation that the exchange has enough capacity and reputation to ensure the smooth refund to FTX customers.

We've entered into an agreement w/ FTX Trading Ltd. & its affiliated debtors to assist in distributing recoveries to retail customers in supported jurisdictions in accordance with the US bankruptcy court-approved Chapter 11 Plan of Reorganization

Info👇 https://t.co/fQtzUIrHob

— Kraken Exchange (@krakenfx) December 16, 2024

Not only Kraken, BitGo CEO Mike Belshe also spoke out to express his pride in supporting FTX in compensating creditors. He shared:

"BitGo is proud to support FTX. With a reputation as the industry's top choice, we strive to provide services from the institutional level to individual customers, ensuring users can safely grow their assets with peace of mind."

BitGo has been selected as an official FTX Creditor Distributor.

We are fully committed to ensuring a secure and efficient process for distributing assets to creditors.

Our goal is to make this process as simple as possible so creditors can trade, stake, withdraw, or custody… pic.twitter.com/HtoV9x6D5W

— BitGo (@BitGo) December 16, 2024

It can be seen that FTX has recently taken continuous legal actions to "not miss a single penny" to repay customers. After settling the lawsuit with Bybit for $228 million, the bankrupt entity that took over the exchange continued to sue KuCoin, individuals and organizations that had relationships with FTX in the past, and most notably, Binance and former CEO Changpeng Zhao for up to $1.76 billion.

The collapse of FTX also brought a series of legal consequences for the exchange's senior leadership. Former CEO Sam Bankman-Fried received the heaviest sentence of 25 years in prison. Next was former FTX Digital Markets Director Ryan Salame with 7.5 years in prison and former Alameda Research CEO Caroline Ellison received a 2-year sentence.

The former CTOs of FTX seem to be 'luckier' than other senior leaders. Both Nishad Singh and Gary Wang, despite being convicted, did not have to serve time in prison. Gary Wang, the last member of the "FTX team" to appear in court, was only sentenced to 3 years of probation.

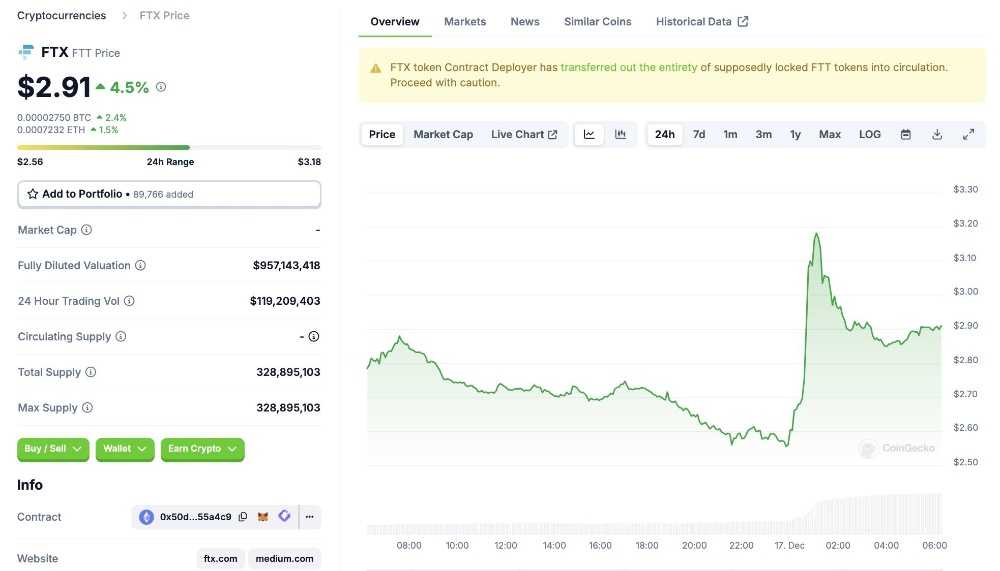

Immediately following this news, the price of FTT spiked nearly 30% to $3.18 and is currently hovering around $2.9."

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)