What is FUD in Crypto?

"FUD" is an acronym that stands for “fear, uncertainty and doubt.” In the context of cryptocurrency markets, FUD refers to the spread of negative information or rumours with the intention of creating a sense of fear, uncertainty and doubt among investors and traders. The goal is often to manipulate market sentiment and drive down the prices of particular cryptocurrencies.

FUD can take various forms, including false or exaggerated news, misleading statements and the spreading of unfounded rumours about a particular cryptocurrency or the overall market. It's a tactic that can be employed by individuals or groups to influence market behaviour and cause panic selling.

Crypto traders need to be cautious about the information they encounter, especially on social media platforms and online forums, as FUD can have a significant impact on short-term price movements. You may often hear of “DYOR," which stands for “do your own research” because many times the information you’re receiving might be biased, misleading or simply untrue. It’s therefore important to verify information from reliable sources before making any trading decisions to avoid being swayed by manipulative tactics by unscrupulous market participants.

In this article, i'll answer what is FUD, why it's important that investors have a solid understanding of FUD, and how it can affect crypto markets.

Why Is FUD A Big Deal?

The influence of FUD extends to its ability to prompt hasty decisions among investors, potentially leading them to abandon long-term positions and sell assets at the bottom of the market just before a significant upward trend. This can result in missed opportunities for profit and hinder the growth of individual portfolios.

The detrimental effects of FUD extend beyond individual financial decisions, affecting the broader crypto community. The dismissal of genuine concerns within projects as mere FUD poses a substantial risk to the industry's progress. When legitimate issues are disregarded under the umbrella term of FUD, the cryptocurrency space may fail to address critical challenges that require collective attention. This reluctance to acknowledge and resolve actual problems may impede the development of more secure and robust blockchain technologies and protocols.

In essence, the prevalence of FUD in the crypto world not only influences the financial well-being of individual investors but also has broader implications for the overall integrity and advancement of the entire cryptocurrency ecosystem. Recognizing and distinguishing between unfounded fear, uncertainty and doubt, and genuine issues is crucial for fostering a productive and transparent environment that can contribute to the sustained growth and development of the crypto industry.

How Can FUD Impact The Cryptocurrency Market?

FUD often induces heightened price volatility, as traders react to negative news or uncertainties by selling assets, triggering a market-wide sell-off. FUD influences market sentiment, leading to a lack of confidence and a bearish trend. Regulatory concerns, a common source of FUD, can prompt massive selloffs as investors seek to avoid potential legal issues.

Persistent FUD erodes trust in cryptocurrencies, hindering adoption and slowing down market growth. Media coverage, when sensationalized or misleading, contributes to the spread of FUD and recovering from a FUD-induced downturn can be challenging, as it requires rebuilding investor confidence and overcoming prolonged periods of low trading volumes.

Here are the five key areas you should be thinking about when looking at how FUD can impact the market:

Volatility and Panic Selling

Cryptocurrency markets, characterized by their inherent volatility, are susceptible to abrupt and drastic price fluctuations. Volatility refers to the extent of price variability within a specific period, and in the context of cryptocurrencies, it is a defining feature of the market. When FUD is introduced into this already volatile environment, the impact is often magnified.

The spread of FUD can start panic selling, a phenomenon where a significant number of investors rush to liquidate (sell) their holdings out of fear and apprehension. This panic-driven mass selling creates a cascading effect, leading to a rapid and substantial decline in cryptocurrency prices. Investors, concerned about potential risks or uncertainties, hastily sell in an attempt to mitigate perceived losses or avoid future downturns.

The relationship between volatility and panic selling in the crypto market is symbiotic. The volatile nature of cryptocurrencies can be exploited by the spread of FUD, increasing market reactions and adding to the selling pressure. As prices plummet due to widespread panic, the market experiences heightened turbulence, further amplifying the perception of risk and prompting more investors to sell.

This cycle of panic selling and declining prices can result in a self-fulfilling prophecy, where the fear-driven actions of market participants contribute to the very outcomes they seek to avoid. Moreover, the interconnected and globally accessible nature of cryptocurrency markets, operating 24/7, means that these fluctuations can happen at any time.

Investors and traders in the crypto space must navigate this volatile landscape with a keen awareness of the potential influence of FUD. Developing a resilient investment strategy, grounded in thorough research and a comprehensive understanding of the market, becomes imperative to withstand the emotional responses triggered by negative information. Additionally, market participants need to cultivate a long-term perspective, do their own research and avoid making impulsive decisions based on short-term fluctuations induced by fear and uncertainty.

Profit Opportunities for manipulators

The cryptocurrency market's susceptibility to manipulation becomes particularly evident when examining the profit-driven motives behind the intentional spread of FUD. In this context, bad actors or market manipulators exploit the psychological vulnerability of market participants to engineer price movements that align with their trading strategies.

These manipulators strategically initiate the spread of negative information or FUD, aiming to create an atmosphere of doubt and apprehension among investors. They may take short positions, essentially betting that the market value of a particular cryptocurrency will decrease. This strategic move positions them to profit from the anticipated decline in prices.

The sequence of events unfolds in a calculated manner. First, the manipulators spread FUD through various channels, such as social media, forums, or news outlets, influencing a large number of market participants. They strategically unleash negative information, whether true or fabricated, to sow seeds of doubt and fear. As fear takes hold and triggers widespread panic selling, the market experiences a sharp decline in asset prices. Subsequently, as the market reacts to the circulated FUD, panic selling and heightened uncertainty often ensue, causing a downward spiral in prices.

The manipulators, having anticipated and orchestrated this downturn, capitalize on their earlier short positions as prices plummet. This enables them to profit handsomely from the discrepancy between their initial short positions and the diminished market value of the assets. In essence, these manipulators exploit the vulnerability of market sentiment, leveraging FUD as a tool to manipulate prices and optimize their trading strategies for financial gain.

24/7 Market Operation

The hallmark of cryptocurrency markets lies in their non-stop, 24/7 nature. This is different to traditional financial markets which have designated trading hours. This constant and relentless nature of cryptocurrency trading has both advantages and challenges, significantly influencing how information, especially FUD, propagates and shapes the market.

The absence of specific trading hours means that cryptocurrency markets are perpetually open, with transactions occurring around the globe at any given moment. This continuous activity fosters an environment where information travels swiftly and market participants are constantly exposed to new developments.

While this dynamic nature contributes to liquidity and accessibility, it also becomes a fertile ground for the rapid dissemination of FUD. FUD can emerge and escalate at any hour, catching investors off guard during periods when traditional financial markets are typically closed. This around-the-clock operation amplifies the challenge for investors to react calmly and rationally to negative information.

Unlike traditional markets, where overnight breaks provide a buffer for reflection and analysis, the cryptocurrency space demands constant vigilance. The real-time nature of cryptocurrency trading increases the impact of FUD, as investors may feel compelled to make split-second decisions in response to rapidly evolving situations. This urgency increases the likelihood of impulsive actions, such as panic selling or hasty investments, driven by emotional reactions rather than a measured evaluation of the available information.

Moreover, the 24/7 trading cycle implies that participants from different time zones are engaged simultaneously, adding an additional layer of complexity. News and events in one part of the world can trigger market reactions that reverberate globally, due to an interconnected ecosystem where the consequences of FUD are felt universally.

We must develop strategies that account for the relentless nature of cryptocurrency trading. Establishing risk management practices, staying informed through reliable sources, and maintaining a disciplined approach become imperative in mitigating the potential adverse effects of FUD in a market that never sleeps.

Lack of Understanding

A significant number of individuals engaging in crypto trading may not possess a thorough grasp of the intricate technological foundations or the nuanced details of the projects they choose to invest in. This knowledge gap becomes a critical factor in shaping market behaviour, especially when confronted with negative news or uncertain developments.

The complexity of blockchain technology, coupled with the rapid evolution of various cryptocurrency projects, can be overwhelming for those unfamiliar with the intricacies of these systems. As a result, when confronted with adverse information or market volatility, individuals lacking a deep understanding of the technology may find it challenging to discern the potential impact on their investments.

This lack of understanding often manifests as susceptibility to panic reactions. In the face of negative news, inexperienced investors may be more prone to emotional decision-making, succumbing to fear or uncertainty rather than relying on a well-informed and rational assessment of the situation. The fear of potential losses or the unknown can trigger impulsive actions, such as hastily selling off assets or making uninformed investment choices.

Furthermore, the cryptocurrency market's reputation for volatility, leverage and the fast-paced nature of developments can exacerbate the challenges associated with this lack of understanding. Cryptocurrencies operate at the intersection of technology, finance, and innovation, making them a unique asset class that demands a certain level of technical acumen for effective navigation.

Addressing this knowledge gap is crucial for fostering a more informed and resilient investor base. Education initiatives, transparent communication from cryptocurrency projects, and increased awareness about the fundamental principles of blockchain technology can empower participants to make more informed decisions. As the crypto ecosystem matures, efforts to bridge the understanding gap will likely contribute to a more stable and rational market environment.

Reputational Concerns

The cryptocurrency market, despite its potential for innovation and financial growth, grapples with persistent reputational challenges that stem from various sources, including regulatory scrutiny, security vulnerabilities, and high-profile incidents such as those witnessed with platforms like FTX, BlockFi, and Celsius. These issues collectively cast a shadow over the entire industry, fostering an environment where investors become markedly sensitive to any negative news and are more prone to emotional reactions.

The regulatory landscape surrounding cryptocurrencies is continually evolving, and the lack of a standardized framework across jurisdictions contributes to an air of uncertainty. Regulatory bodies worldwide are scrutinizing the industry for compliance with existing financial laws, raising concerns about potential legal implications for market participants. Instances of regulatory crackdowns (such as Coinbase vs. SEC) or proposed regulations can trigger anxiety among investors, as uncertainty about the future regulatory landscape can impact the viability and acceptance of cryptocurrencies.

Whether it's bankruptcy issues, regulatory penalties, or controversies surrounding business practices, these incidents garner substantial attention and become focal points of negative sentiment. Investors, having witnessed the repercussions of such incidents, become more cautious and responsive to any negative news that might hint at similar problems in other parts of the market.

An example of this would be, the USDC stablecoin by Circle which depegged overnight, falling to as low as $0.88 following the collapse of Silicon Valley Bank. In the absence of clarity from Circle, investors scrambled to exit their USDC holdings, swapping into alternative stablecoins like Tether’s USDT or exiting the crypto market entirely into fiat. USDC witnessed its biggest depeg since it launched in 2018. Its market cap dropped below $40 billion — a 15% decline within 24 hours as $2.34 billion worth of USDC was burned, suggesting redemption for dollars.

The cumulative effect of these reputational concerns is the creation of an environment where investors are predisposed to react emotionally to any adverse information. The cryptocurrency market, already characterized by volatility, becomes even more susceptible to sharp price swings and panic-driven decisions as participants grapple with concerns about the industry's stability, credibility, and regulatory future.

To mitigate the impact of FUD, it's essential for investors to conduct thorough research, stay informed about market developments, and adopt a rational and long-term approach to their investments. Additionally, regulatory measures and increased transparency within the crypto space can help build trust and reduce the susceptibility of the market to manipulation through FUD.

Why Is It Important To Understand FUD?

The extremely short answer to this question is to simply become a better investor.

It’s no secret that some of the best ways to make profits in crypto are by deploying less than fancy strategies such as dollar cost averaging, simply buying crypto from the spot market and staying away from any form of leverage. Holding (or HODL’ing) these positions for long periods of time is a great strategy to make money, but it can be very psychologically demanding. Make no mistake, the market will do everything in its power to siphon those monetary gains from you. This is the nature of the cryptocurrency market, a hyper-volatile competitive market with pitfalls around every corner.

If you’re going to HODL through the dips in order to sell the absolute top, you’re going to need to practice stoicism and understand how the market works. Understanding how FUD works is a great milestone in an investment journey, so let’s dive in.

Understanding FUD in the cryptocurrency space is crucial for several reasons:

Navigating the Dynamic Landscape of Cryptocurrency

The ability to differentiate between legitimate concerns rooted in factual developments and unfounded rumours is a skill that can significantly impact your investment decisions. You can find yourself at the crossroads of a constant influx of information, ranging from genuine news about technological advancements, regulatory shifts, and market trends to speculative narratives driven by emotions and unsubstantiated claims.

Critical thinking emerges as a powerful tool in this scenario, and you must scrutinize information with a discerning eye. Thorough research, due diligence, and a comprehensive understanding of the underlying factors influencing the cryptocurrency market are essential prerequisites for making well-informed decisions. Rushed and impulsive actions driven by misinformation can have profound consequences, potentially leading to financial losses and missed opportunities.

Moreover, the role of media and social platforms in disseminating information cannot be understated. While these channels serve as vital sources of news, some outlets or moon bois are also breeding grounds for sensationalism and exaggerated claims. As such, investors are encouraged to DYOR, cross-verify information from multiple reliable sources, and stay vigilant against the amplification of FUD that may be strategically employed to manipulate market sentiment and ultimately, you.

Understanding Motivations and Incentives

In delving into the details of motivations and incentives within the cryptocurrency ecosystem, it becomes evident that various stakeholders hold diverse interests, which significantly influence their perspectives and actions. Figuring out these motivations is pivotal for gaining a comprehensive grasp of the context surrounding the FUD that you might be hearing about.

A good example of this lies in the clash between traditional financial institutions and the growing decentralized finance (DeFi) sector. Traditional financial entities may find themselves compelled to spread FUD regarding DeFi platforms due to the threat these decentralized systems pose to their established “middleman” roles and the subsequent revenue streams that they receive from the associated fees they charge. The fear of becoming obsolete in a rapidly evolving financial landscape fuels their scepticism and prompts the propagation of negative narratives.

Understanding these built-in biases can give you useful insights into what's really pushing certain stories in the cryptocurrency world. It's important to see that these motivations go beyond just guessing or being nervous; most of the time, there are bigger worries related to money. Whether it's big institutions or regular folks, everyone's decisions are shaped by a mix of money matters, rules and regulations, and competition, all affecting how they see things and what info they decide to spread around.

Biases in the Information Ecosystem

The inherent biases of individuals play a significant role in shaping how information is presented and interpreted, thereby influencing our overall understanding of various subjects. In cryptocurrency, it is essential to recognize and evaluate biases originating from individuals, media outlets, or institutional entities. Such awareness empowers you to navigate information more effectively, enabling you to make decisions based on a more objectively informed comprehension of market dynamics.

Controversies within the Cryptocurrency Discourse

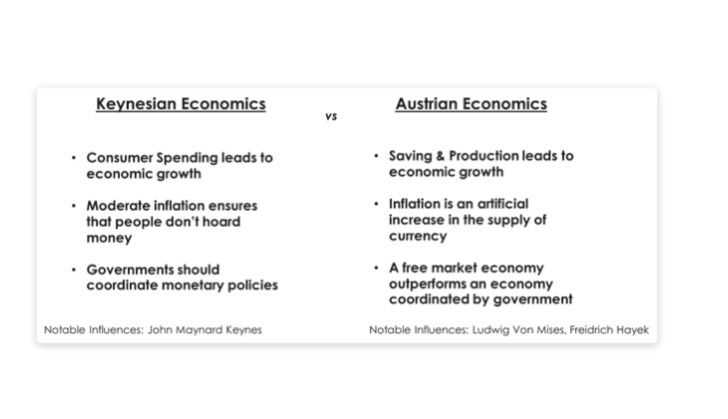

The cryptocurrency landscape is not immune to controversy, with debates spanning diverse economic ideologies. One noteworthy contention involves the clash in the Bitcoin academia between proponents of Austrian economics and proponents of Keynesian economics. Most of the traditional finance believes in Keynesian economics, whereas Bitcoiners prefer Austrian economics. The contentious nature of these debates raises the stakes, as educators who specialize in Keynesian economics may find themselves in a delicate position.

For example, publicly expressing agreement that Keynesian economics could be flawed or ineffective could potentially jeopardize their professional standing. Such an admission might imply that the systems they teach and advocate for are, in fact, not viable. Essentially, embracing alternative economic perspectives could inadvertently position them where they are either challenging their own field or aligning themselves with a narrative that contradicts their expertise.

This dilemma poses a unique challenge within the academic realm, where individuals may be reluctant to question prevailing economic ideologies due to potential repercussions on their careers. The clash of economic theories within the cryptocurrency discourse intensifies this challenge. It becomes not only a matter of personal beliefs but also a professional dilemma, as admitting to the limitations of certain economic frameworks could mean questioning the very foundation of their own expertise. Ultimately it’s important for you to recognize these biases in the cryptocurrency space, whether from individuals, media outlets, or institutional players. You should try to filter FUD more effectively and make decisions based on a more objective understanding of the market dynamics.

Ultimately it’s important for you to recognize these biases in the cryptocurrency space, whether from individuals, media outlets, or institutional players. You should try to filter FUD more effectively and make decisions based on a more objective understanding of the market dynamics.

An Example of Crypto FUD

Our all-time favourite villain is Jamie Dimon, the CEO of American megabank JPMorgan . Jamie is a good example of someone who spreads FUD, whilst actually secretly enjoying the technology that blockchains have to offer and investing plenty of time and money into the sector.

In the past, Jamie Dimon has made statements calling Bitcoin a "fraud" and expressing his lack of enthusiasm for cryptocurrencies. For example, in September 2017, Jamie Dimon referred to Bitcoin as a "fraud" and said that he would fire any JPMorgan trader involved in trading Bitcoin for being "stupid." His comments at that time had an impact on the cryptocurrency market, creating FUD and causing a temporary drop in Bitcoin prices.

While Dimon's remarks may not be considered FUD in the strictest sense, they did contribute to creating fear and uncertainty in the cryptocurrency space.

Despite Jamie's remarks, JPMorgan has shown interest in blockchain technology and digital currencies. For example:

- In 2019, JPMorgan Chase announced the development of its own digital currency called "JPM Coin." JPM Coin is designed to facilitate instantaneous payment transfers between institutional clients on the JPMorgan Chase network. It is a stablecoin, meaning its value is pegged to the US dollar. The primary purpose of JPM Coin is to streamline and improve the efficiency of the bank's internal payment processes.

- JPMorgan has been actively exploring and investing in blockchain technology beyond the development of its digital currency. The bank has participated in various blockchain and distributed ledger technology (DLT) initiatives. These efforts aim to leverage the benefits of blockchain, such as improved transparency, security, and efficiency in financial transactions.

- JPMorgan Securities is listed as an “authorized participant” for BlackRock's spot bitcoin exchange-traded fund (ETF).

The above is a good example of the phrase "do not listen to what they say, watch what they do," which essentially means that actions speak louder than words. Instead of relying solely on what someone tells you, pay attention to their behaviours and actions to get a more accurate understanding of their true intentions.

People may say one thing, but their actions can reveal their true beliefs and priorities. By observing their actions, you can discern whether their words, in this case, the FUD aligns with their actual behaviour (buying BlackRock's ETF).

Closing Thoughts

When you're in the crypto space, you need to watch out for FUD. It's a wave of negative info and rumours that can mess with people's heads and make the market go crazy and irrational. FUD usually comes from wrong info, people playing with the market, or outside forces.

So, when you come across FUD, remember:

- Selective Attention to FUD: Not all FUD should be dismissed outright. Some instances are essential for critiquing and addressing underlying issues within crypto projects or blockchains. Distinguishing between constructive criticism and baseless FUD is crucial for the growth and improvement of the cryptocurrency ecosystem.

- Maintain Calm Amidst Uncertainty: In the face of FUD, it is imperative to keep a level head and avoid succumbing to panic. Emotional decision-making can lead to hasty actions that may not align with the long-term goals of investors or the cryptocurrency project in question.

- Source Scrutiny: Always question the source of information and consider the motives or incentives behind it. Understanding where the FUD originates can provide valuable insights into the credibility of the claims. Thoroughly researching and verifying information helps in making informed decisions and avoiding knee-jerk reactions.

- Avoid Overreactions: Reacting impulsively to FUD can result in unnecessary turbulence in the market. Taking the time to analyze and assess the situation objectively prevents overreactions, fostering a more stable and rational market environment.

- Embrace Long-Term Thinking: Cryptocurrency investments are often best approached with a long-term perspective. Focusing on the overarching goals and fundamentals of a project rather than short-term fluctuations can help investors weather the storm of FUD and benefit from the potential growth over time.

- Practice Stoicism: Adopting a stoic mindset involves acknowledging external factors without letting them control emotions or decisions. Cultivating emotional resilience in the face of FUD ensures that investors can navigate the volatile crypto space with composure, making strategic choices based on reason rather than reacting impulsively to market fluctuations.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)