Kamino Finance: Jumping Into The Pool

Providing liquidity can be a great way to support a project while earning rewards.

Cryptocurrency can be risky due to market volatility and lack of regulation. Use reputable platforms, avoid emotional trading, and only invest what you can afford to lose. Be cautious and remember, not your keys, not your crypto.

When it comes to supporting projects you might be passionate about, we’re pretty spoilt for choices in the world of Web 3. While staking is often a common mechanism for achieving this, liquidity farming can also be a lucrative way to get behind your favourite project while earning some extra tokens.

If you’re on Solana, you’re probably already using some of the De-Fi options, but if you haven’t used them already, Kamino Finance is a great choice. With plenty of time spent ensuring the integrity of the platform, as well as plenty of good resources for those at the beginning of their crypto journey it’s one of the best places to access de-fi on Solana. In today’s article, we’re going to be exploring the yields behind one of their Liquidity Pools. Let’s take a look

About Kamino

One of the reasons behind the meteoric recovery in the Solana token price has been the sheer number of projects that have decided to make Solana home. While Solana may end up being the reason that social media ends up with its time to shine, different types of De-Fi platforms have also played a large role in its success. Jupiter, for instance, is a great exchange that’s spent plenty of time developing a supportive community while focusing on giving value back to the community in the form of incentive programs like ASR and airdrops.

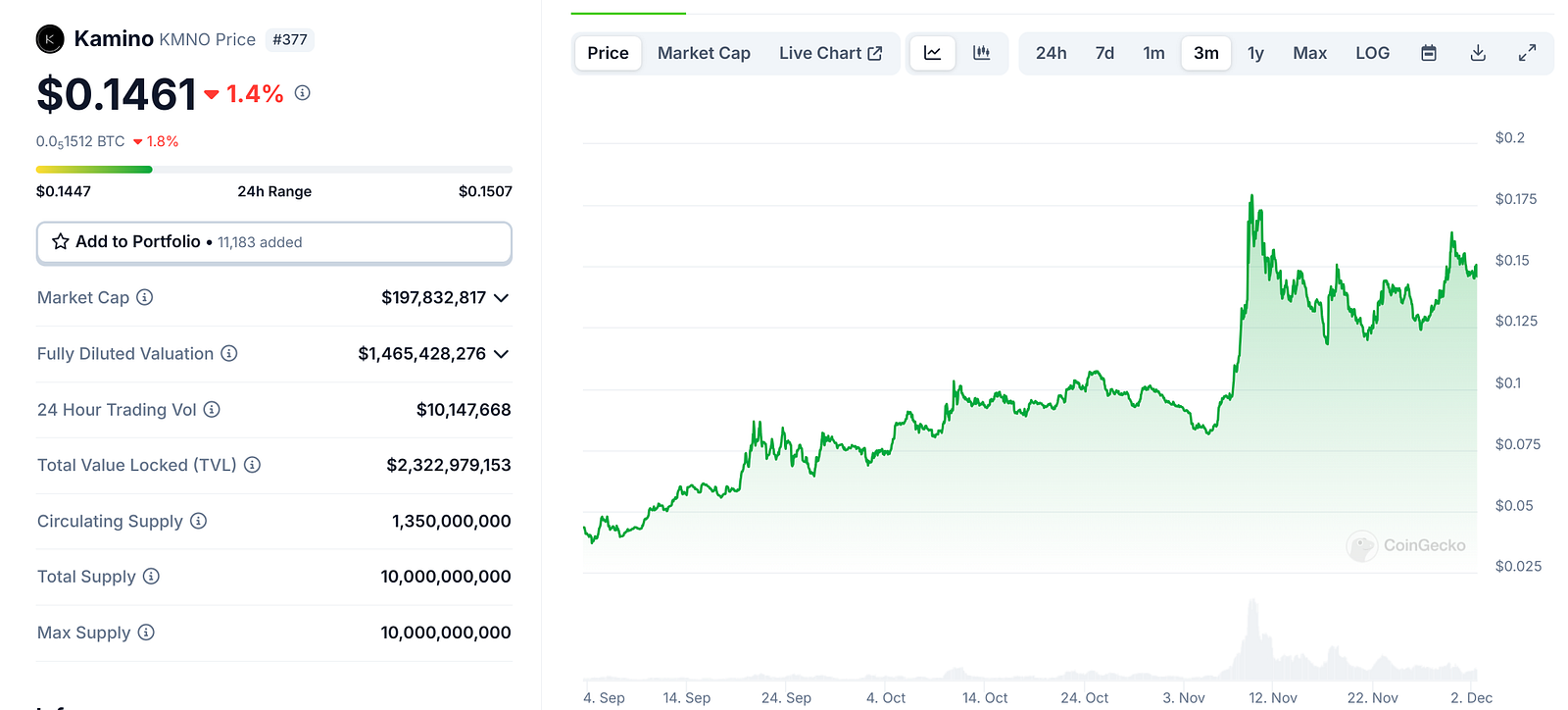

Kamino has been no different in this regard. With their KMNO token already launched, its relatively stable price, large staking numbers and potential for growth mean that there’s plenty of support for Kamino and their products.  A large reason for much of this success comes from the effort that the Kamino team has put into developing trust with its users. Kamino isn’t just a Solana De-Fi platform, it also has the reputation of being a safe platform that provides its users with as many resources as they can. No longer is de-fi a dark art. Kamino is well on its way to achieving its goal of de-mystifying its de-fi services via community-led education.

A large reason for much of this success comes from the effort that the Kamino team has put into developing trust with its users. Kamino isn’t just a Solana De-Fi platform, it also has the reputation of being a safe platform that provides its users with as many resources as they can. No longer is de-fi a dark art. Kamino is well on its way to achieving its goal of de-mystifying its de-fi services via community-led education.

Liquidity & KMNO-JITSOL

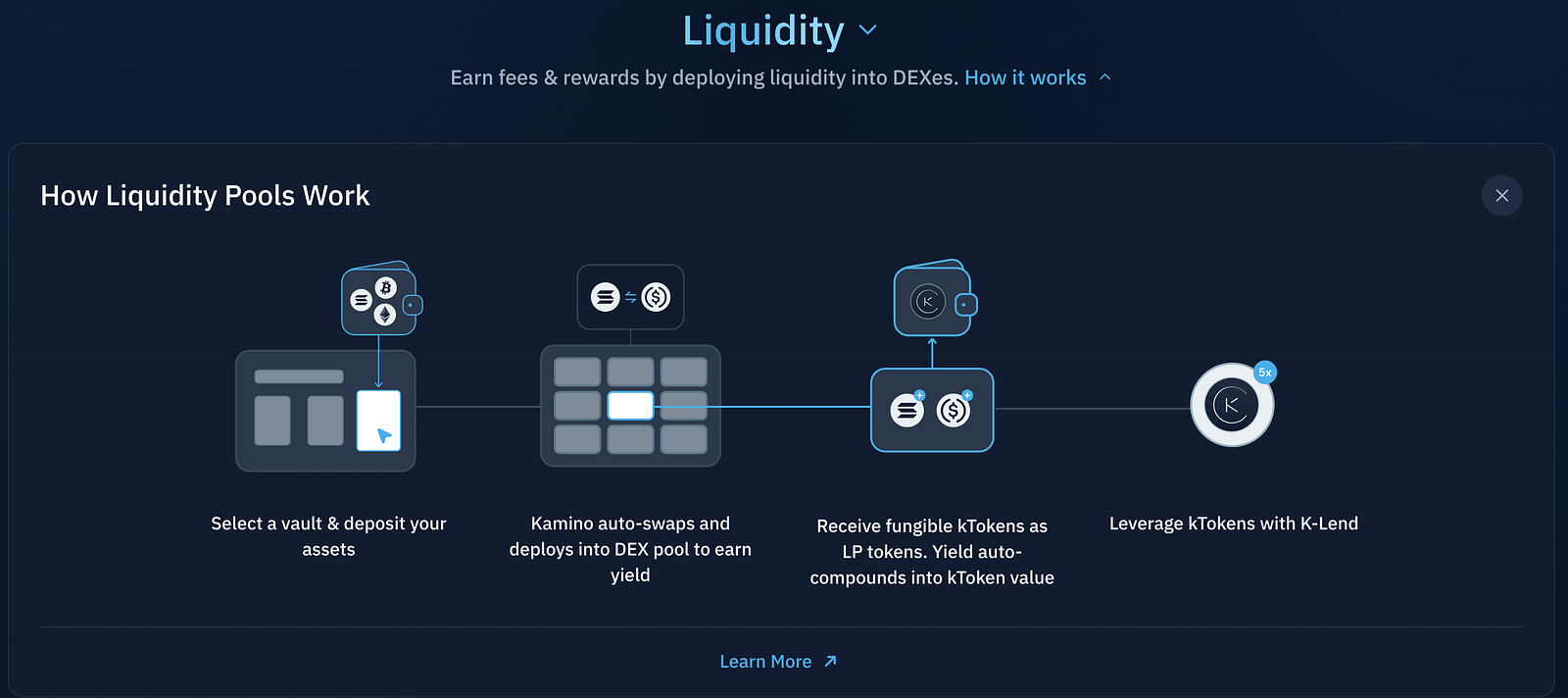

Liquidity pools work on a simple concept. Essentially, providing liquidity allows Kamino to deploy this liquidity into the pools to earn yield. Once earnt, this yield is returned to the community in the form of rewards. Given that liquidity tends to works best over a longer timeframe, yield rewards are auto-compounding. Kamino has a great dashboard available to it’s users which means you can quickly track your metrics and figure out where your position is at.  Shortly after the launch of the KMNO token, we put a small amount of liquidity in the KMNO-JITOSOL pool. Let’s take a look at the results and see how things have performed recently.

Shortly after the launch of the KMNO token, we put a small amount of liquidity in the KMNO-JITOSOL pool. Let’s take a look at the results and see how things have performed recently.  As we’d expect to see the value will fluctuate according to the current market position. Overall though, the pool has been a pretty good performer with some interesting returns.

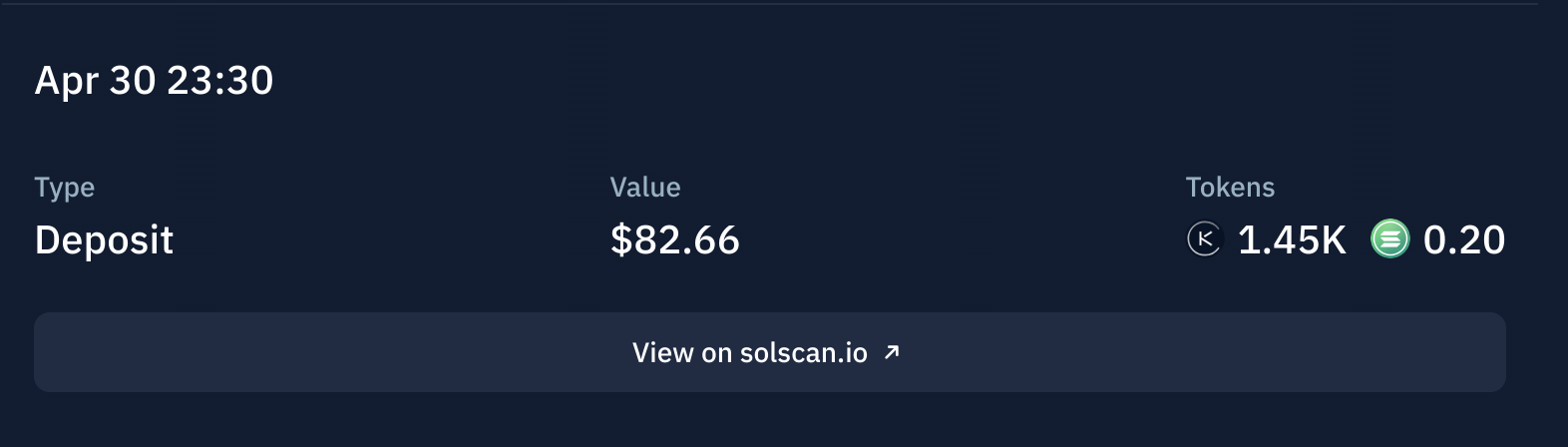

As we’d expect to see the value will fluctuate according to the current market position. Overall though, the pool has been a pretty good performer with some interesting returns.  Starting with the remainder of the KMNO airdrop which was 1.45k and .2 JitoSOL the deposit was worth $82.00 at the start point. This was back in April though, and it’s fair to say the market looks very different now.

Starting with the remainder of the KMNO airdrop which was 1.45k and .2 JitoSOL the deposit was worth $82.00 at the start point. This was back in April though, and it’s fair to say the market looks very different now.  So different in fact, that the pool is currently worth nearly $300 at the time of publishing. It’s worth mentioning here that the Kamino team put a lot of effort into ensuring that regardless of market fluctuations, the platform stays stable and liquidations are kept to a minimum. It doesn't mean that this type of thing comes without risk, but it does mean that the team actively works towards mitigating it wherever possible. There’s no denying that de-fi can get confusing however, the Kamino team have done a great job at keeping the platform user-friendly.

So different in fact, that the pool is currently worth nearly $300 at the time of publishing. It’s worth mentioning here that the Kamino team put a lot of effort into ensuring that regardless of market fluctuations, the platform stays stable and liquidations are kept to a minimum. It doesn't mean that this type of thing comes without risk, but it does mean that the team actively works towards mitigating it wherever possible. There’s no denying that de-fi can get confusing however, the Kamino team have done a great job at keeping the platform user-friendly.

Things To Note

While we’re on the topic of risk, there are a few additional considerations. Like many things in life, crypto has no free lunch. Because of this, it’s important to realise that while liquidity farming is often pretty lucrative, it can also leave you behind in certain instances. Rather than trading via an exchange, Pools offer a way to perform “unofficial” trades where users can cash out one token over another depending on the current market value.

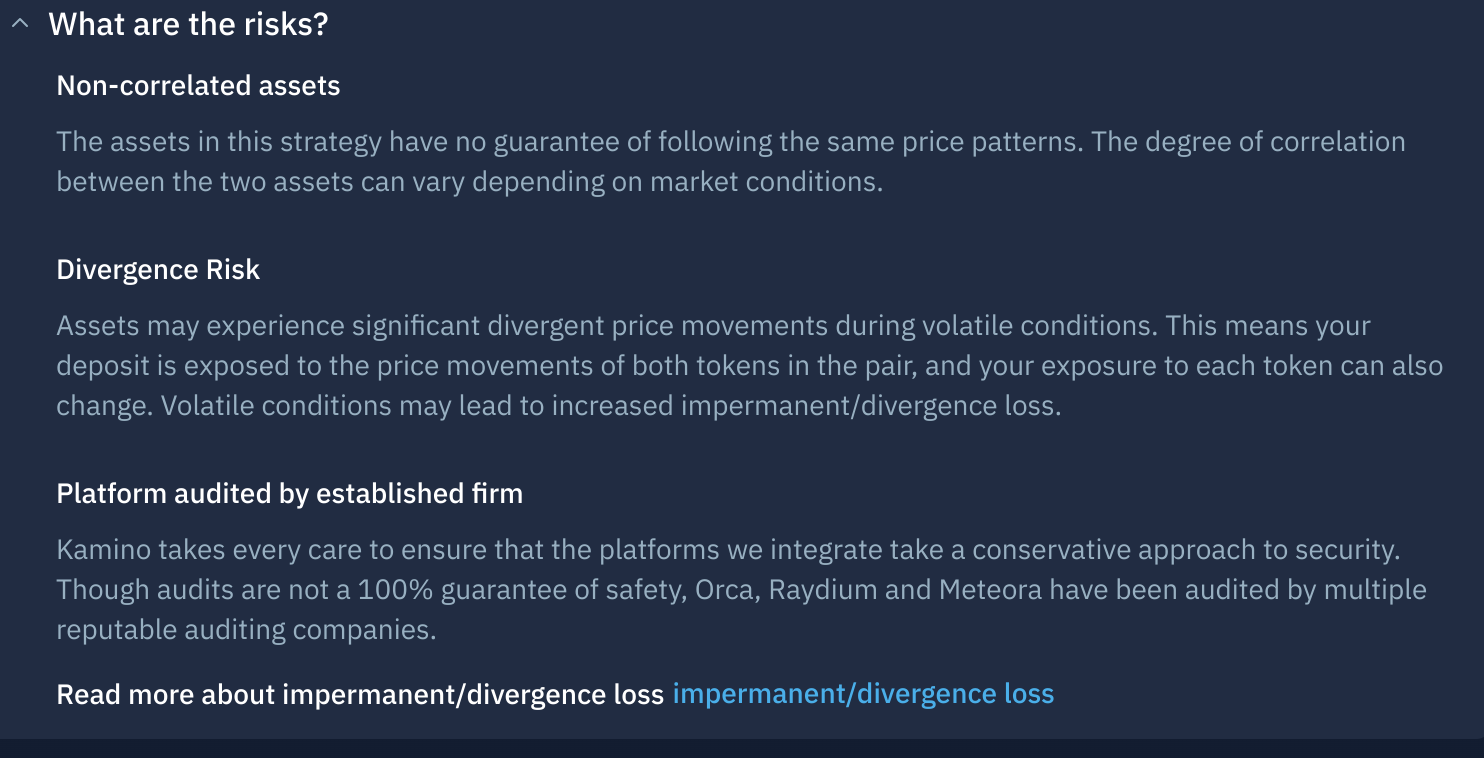

So, the choice of pool you decide to use can often dictate the level of risk you are exposed to regarding this. Stable token pairs are often a good choice to help mitigate this risk and thanks to the concept of Liquid Staking Tokens (LSTs) like JitoSOL users now have plenty of options.  The concept of smart contract exploits may also leave users wary as it wouldn’t be the first time a de-fi provider has been exploited via a vulnerable contract. So, if this is a concern you can rest a little easier knowing that the platform has been fully audited for vulnerabilities. While it doesn’t negate the smart contract risk entirely, it’s another clear step showing that transparency and trust are an integral part of the platform.

The concept of smart contract exploits may also leave users wary as it wouldn’t be the first time a de-fi provider has been exploited via a vulnerable contract. So, if this is a concern you can rest a little easier knowing that the platform has been fully audited for vulnerabilities. While it doesn’t negate the smart contract risk entirely, it’s another clear step showing that transparency and trust are an integral part of the platform.

Get Your Points Game On

In case you haven’t figured it out yet, supporting projects like Kamino has been a huge part of the crypto journey to date. It’s a key part of helping develop the technology that should allow it to be used on a larger scale.

While the KMNO token has already been launched, the team has an ongoing points program that allows you to earn points which may later be converted to KMNO rewards. So if you missed out on stage 1 or 2 of the earlier airdrop, it’s still not too late to earn some points and possibly turn them into KMNO tokens later on.  A great way of doing this is by providing liquidity into an LST pool and staking an allocation of tokens via the platform. Since the start, Kamino has looked for real engaging users that help add a voice to the community and it’s these users that have been rewarded for their engagement.

A great way of doing this is by providing liquidity into an LST pool and staking an allocation of tokens via the platform. Since the start, Kamino has looked for real engaging users that help add a voice to the community and it’s these users that have been rewarded for their engagement.  If you are starting late, be sure to look for the pools that give you an additional multiplier or incentive for use, as well as points boosters. You can identify these pretty easily. The lightning bolt that you’ll find in the details covers incentives and the star represents points multipliers. Using these pools will give you the best return on your dollar.

If you are starting late, be sure to look for the pools that give you an additional multiplier or incentive for use, as well as points boosters. You can identify these pretty easily. The lightning bolt that you’ll find in the details covers incentives and the star represents points multipliers. Using these pools will give you the best return on your dollar.

Do you use Kamino Finance? What did you do with your KMNO airdrop allocation?

If you found this article insightful, informative, or entertaining, we kindly encourage you to show your support. Clapping for this article not only lets the author know that their work is appreciated but also helps boost its visibility to others who might benefit from it.

🌟 Enjoyed this article? Join the community! 🌟

📢 Join our OSINT Telegram channel for exclusive updates or

📢 Follow our crypto Telegram for the latest giveaways

🐦 Follow us on Twitter and

🟦 We’re now on Bluesky!

🔗 Articles we think you’ll like:

- What The Tech?! Rocket Engines

- OSINT Investigators Guide to Self Care & Resilience

✉️ Want more content like this? Sign up for email updates